- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 8/5/21 at 8:54 pm to CecilShortsHisPants

Posted on 8/5/21 at 8:54 pm to CecilShortsHisPants

quote:

riendly PSA:

Plenty of us have made a lot of money from our discussions on this thread, but we need to be careful to not explicitly ask for, or offer “financial advice”. Its a gray area, but remember, this is a public forum.

Anyway... carry on, love this stock!

True. I'm not a financial expert or certified financial advisor. I've given some opinions which are worth about zero. Thanks for the reminder.

Posted on 8/5/21 at 8:59 pm to Shamoan

quote:

Why is there such a focus in southern Arkansas? The smackover formation runs straight through the gut of Mississippi along with other states, but there has been little development in this regard. Is it more/easier to get to in Arkansas? Curious because I have mineral rights in central MS.

The brine wells and bromine production already in place. Tetra's abandoned site. Lowest cost, easiest to get going. Mintak has mentioned that the Smackover formation holds enough lithium to supply the world. Some one told me that people around Texarkana were getting calls or maybe they saw where some land was leased for lithium extraction. Not sure if they were referring to the Galvanic leases or something else. I keep meaning to search for other lithium projects in the Smackover formation. It would take billions to duplicate what is already in place and paid for at Lanxess and Tetra. Plus rail access, cheap electricity, permits in place, trained workforce etc. Cost/benefit.

Posted on 8/5/21 at 9:03 pm to SmackoverHawg

Good info. Thanks. Mississippi has great soil, but in terms of valuable natural resources, it’s got the shite end of the stick. Would be great for us and our fellow less financially endowed neighbor states to be sitting on a proverbial gold mine of the future.

Posted on 8/5/21 at 9:05 pm to GeneralLee

quote:

No stop losses here. My main debate is do I sell covered calls at $20 strike when options open up here....

Me either. Haven't decided when I'll start taking profit. Have some other things working that will make the decision easier. I make take some starting at $20-25, but if things go half way in my favor, I'll hold a bit longer pending how things are looking and will be more comfortable sitting on a large number of shares long term.

But like we've said, a big irrational spike will likely lead to me taking profit and buying back in at a more reasonable price. If I hadn't forgot my damn phone that one day, I probably would've flipped about 25-30k shares.

Posted on 8/5/21 at 9:05 pm to SmackoverHawg

This.

They are focused on areas that are already being mined.

SLi has the technology to get the lithium out of brine.

They do not have the upstream capability to get the brine. Extracting the brine is no small task.

They are focused on areas that are already being mined.

SLi has the technology to get the lithium out of brine.

They do not have the upstream capability to get the brine. Extracting the brine is no small task.

Posted on 8/5/21 at 9:06 pm to SmackoverHawg

Can you imagine Robert Mintak reading through this thread and chuckling at some of our hypotheses?

Before COVID, I was all about Vanguard index funds and basically didn't own any individual stocks. Then COVID happened and it was like shooting fish in a barrel with any tech stock getting massive returns so I ditched the index funds. In January I was up about 300 grand over if I had just kept everything in index funds. Then February-March happened and at one point I was only up 30 grand over the index fund alternative, and I seriously considered liquidating all my individual stocks and getting back to index funds at that point. Now, largely powered by SLI (with some additional boosts by NVVE and TELL), I'm up over 800 grand over what I'd have if I had kept everything in index funds. I'd be sooooo pissed at myself if I had gone back to index funds in March/April only to watch this stock moon like this.

Before COVID, I was all about Vanguard index funds and basically didn't own any individual stocks. Then COVID happened and it was like shooting fish in a barrel with any tech stock getting massive returns so I ditched the index funds. In January I was up about 300 grand over if I had just kept everything in index funds. Then February-March happened and at one point I was only up 30 grand over the index fund alternative, and I seriously considered liquidating all my individual stocks and getting back to index funds at that point. Now, largely powered by SLI (with some additional boosts by NVVE and TELL), I'm up over 800 grand over what I'd have if I had kept everything in index funds. I'd be sooooo pissed at myself if I had gone back to index funds in March/April only to watch this stock moon like this.

This post was edited on 8/5/21 at 9:13 pm

Posted on 8/5/21 at 9:26 pm to GeneralLee

Holy crap... just looked at Fidelity Fully Paid Lending and they might pay up to 7.75% annualized interest rate to lend out my SLI shares. $5,500/month....

Posted on 8/5/21 at 9:29 pm to GeneralLee

Gonna buy more SLI shares?

Posted on 8/5/21 at 9:31 pm to eng08

Nope... I wish but this is sitting at 50% of my investment assets at the moment and it will be 80%+ once it hits $20/share. I'm happy with my last purchase being at $4.75....

Going to load the boat on NSH and AHAC once they dip hard post SPAC mergers....

Going to load the boat on NSH and AHAC once they dip hard post SPAC mergers....

Posted on 8/5/21 at 9:36 pm to eng08

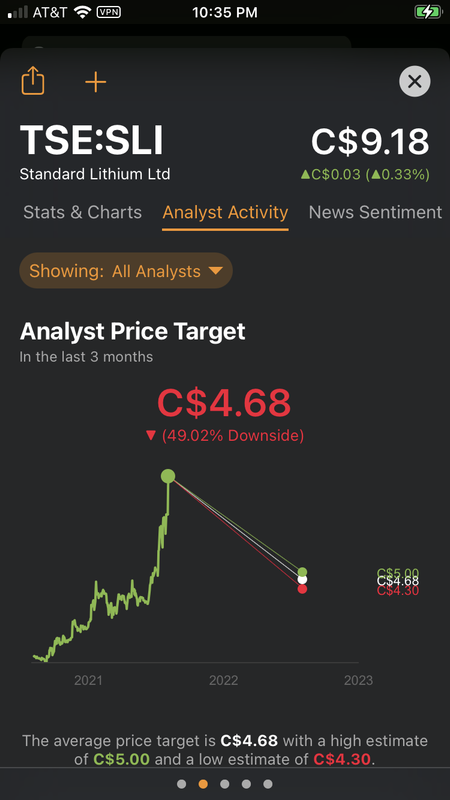

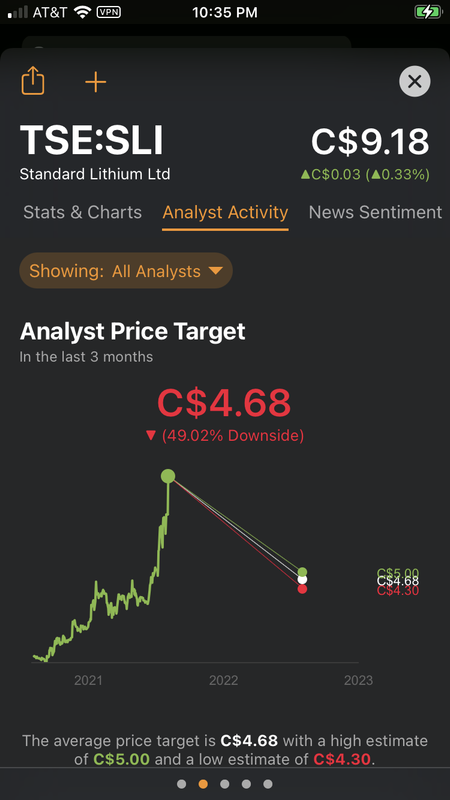

Is this the same SLI you guys are talking about?

Posted on 8/5/21 at 9:37 pm to xxTIMMYxx

Yeah baw... those poor analysts are gonna be revising their targets upward soon...

Posted on 8/5/21 at 9:39 pm to GeneralLee

quote:

Holy crap... just looked at Fidelity Fully Paid Lending and they might pay up to 7.75% annualized interest rate to lend out my SLI shares. $5,500/month....

Say what?

Posted on 8/5/21 at 9:41 pm to SmackoverHawg

Yeah which broker do you use? If an idiot short seller borrows against your shares, you can earn interest on that lending.

This post was edited on 8/5/21 at 10:02 pm

Posted on 8/5/21 at 9:44 pm to GeneralLee

Maybe we can all loan our shares, use the payments to buy more SLI then call all the shares back at the same time and force a squeeze?

We have to have like a few million all together?

We have to have like a few million all together?

Posted on 8/5/21 at 9:57 pm to GeneralLee

quote:

Yeah which broker do you use? If my idiot short seller borrows against your shares, you can earn interest on that lending.

Schwab. Never realized you could get that kind of return on it.

Posted on 8/5/21 at 9:57 pm to CorkRockingham

quote:

Can we get a valuation. Today I set stop loss limits ranging from $6.75 to $6 since this is taking up close to 50% of my portfolio. My cost basis is around $2. I don’t want to regret not taking great profits but I believe in the due diligence.

Smack you got any advice?

PS I only got 8k shares and my retirement portfolio isn’t that large $140k. But I’m young.

Are you saying about 70K of your 401K is in SLI? Does that worry you? Im genuinely curious bc I'm youngish (35) and feel like I'm in the same boat as you. I have about 135K in 401K but when I first started my brokerage account that is tied to my 401K I have been holding true to using only 10% of my 401K for stocks. As much as I want to add more I can't bring myself to do it out of fear.

I tend to be very risk averse as I'm scared to lose a big portion of my retirement gambling on stocks. Plus I have taken some licks and learning many lessons the hard way but thankfully SLI is pulling me back up to even. But I also get sick knowing the $$ I have left on the table bc I am too chicken shite to go in more here when it all sounds like a great bet.

I guess I'm asking how do you get your mind to the place where you just say F it bc you know this is a winner? I don't want to add years before retirement bc I lost money already earned but I really really want to take yours off of retirement bc I made a ton due to believing in this. LOL.

Posted on 8/5/21 at 10:07 pm to JustForThisThread

Probably said it before in this thread somewhere, but we're getting EV's whether we want them or not. Investing in an EV manufacturer is risky, investing in EV "oil" is the sweet spot, and once the greens realize all the old tech lithium/oil companies are frackers...

Posted on 8/5/21 at 10:08 pm to GeneralLee

quote:

my last purchase being at $4.75.

My last was at $5.2 or 5.3, the day before it dropped to $4.75. Shoulda picked up some more for the girls, but I got busy as hell, and greedy hoping for a bit lower, and never did. Still don't have an even number. My dyslexia kicked in or my Covid brain and I transposed the last 3. Had 463 shares and wanted ,000 now it's like ,o46 so I have to buy 954 more.

Posted on 8/5/21 at 10:12 pm to SmackoverHawg

Here's a link regarding Tesla buying batteries from a company called BYD.

LINK

Anyone care to spitball how long it might be for SLI to go commercial with their lithium product?

LINK

Anyone care to spitball how long it might be for SLI to go commercial with their lithium product?

Popular

Back to top

0

0