- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

BP Slashes Dividend For First Time In Decade

Posted on 8/4/20 at 10:01 am

Posted on 8/4/20 at 10:01 am

quote:

BP Slashes Dividend For First Time In Decade On Dismal Energy Demand

by Tyler Durden Tue, 08/04/2020 - 08:31

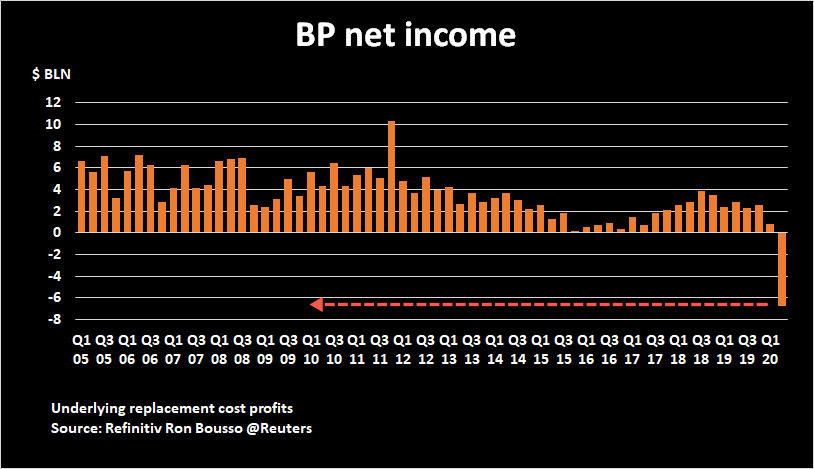

BP halved its dividend on Tuesday after reporting a record $6.7 billion quarterly loss due to the collapse in global demand for energy products.

The dividend cut by BP comes at no surprise. Major oil companies were crushed in the second quarter as coronavirus lockdowns led to a sharp decline in demand for oil and gas products. Royal Dutch Shell is a major oil and gas company that recently announced a cut to its dividend.

BP said the outlook for energy demand and prices remains "challenging and uncertain," warning that the virus-induced global recession could weigh on demand for a "sustained period." As to how long, well, no specific guidance was given.

We noted last month, KPMG estimates 14 million fewer vehicles on US highways due to remote working trends and permanent job loss. Tuesday's halving of the dividend (first cut in a decade) to 5.25 cents per share was much larger than what analysts expected, due primarily to the company needing to get its massive debt load under control while adapting to a new environment, one which demand languishes as the global economic recovery is sluggish.

LINK

This post was edited on 8/4/20 at 10:02 am

Posted on 8/4/20 at 11:06 am to cadillacattack

Anddddddd.... the stock is up.

Posted on 8/4/20 at 11:35 am to skewbs

BP transitioning to a "low carbon" energy company and only cut the divy by 50%.

My only guess on the stock movement today.

My only guess on the stock movement today.

Posted on 8/4/20 at 11:50 am to cadillacattack

Exxon looking pretty good with only $1B loss.

Chevron - $8.3B loss

BP - $16.9M loss

Shell - $18.1B loss

Chevron - $8.3B loss

BP - $16.9M loss

Shell - $18.1B loss

Posted on 8/4/20 at 3:39 pm to Ramblin Wreck

ExxonMobil doesn’t write down assets as aggressively as the others

Posted on 8/4/20 at 7:12 pm to C

My accounting game is rusty. So you write down some capital assets form your balance sheet. What’s the pro/con for doing that?

Tax benefit is what I remember but Acct101 was 15 years ago

Tax benefit is what I remember but Acct101 was 15 years ago

Posted on 8/4/20 at 7:54 pm to TulaneUVA

quote:it lowers your capital base - meaning less working capital, higher ROCE, etc.

So you write down some capital assets form your balance sheet. What’s the pro/con for doing that?

Do it in a crappy year when you are already expecting a bunch of losses and the impact is all lumped in together. Then you take the benefit in subsequent years with a higher net income since your depreciation is lower due to lower asset value.

For the record - I am not an accountant.

Posted on 8/4/20 at 9:08 pm to skewbs

Stocks generally go up when dividends are cut. Look at WFC when they cut their dividend a few weeks back (It's gone lower since but still).

Posted on 8/4/20 at 9:10 pm to C

Posted on 8/5/20 at 8:31 am to cadillacattack

My buddy works at the BR Exxon refinery told me this morning that Exxon will no longer match 401K contributions. Company wide email sent out this morning.

Posted on 8/5/20 at 8:42 am to lsufan1971

That’ll probably save the company about $500million

Posted on 8/5/20 at 8:48 am to C

75K employees with ExxonMobil

Assume average salary is 130K and it is closer to 700M.

Nearly closes the 1B loss gap from 2nd quarter

Assume average salary is 130K and it is closer to 700M.

Nearly closes the 1B loss gap from 2nd quarter

Posted on 8/5/20 at 8:49 am to MAUCKjersey1

quote:

Exxon suspending company match to employee retirement plans starting in October.

I was shocked when I saw that this morning. Could they possibly think of a better to way to express a complete LACK of confidence in the business?

Posted on 8/5/20 at 8:53 am to RedStickBR

They had to reduce costs in some way. Exxon doesn’t pay bonuses to most employees so they didn’t have another lever to pull. I think it’s the smart move. They just need to be sure to turn it back on quickly as the market conditions improve to avoid losing staff.

Posted on 8/5/20 at 9:00 am to C

quote:

They just need to be sure to turn it back on quickly as the market conditions improve to avoid losing staff.

There wil be a lot of rightsizing going on in the industry in the next 12 months, perhaps more than has ever been seen before.

Posted on 8/5/20 at 9:23 am to cave canem

quote:

There wil be a lot of rightsizing going on in the industry in the next 12 months, perhaps more than has ever been seen before.

Frankly, I wouldn't touch the publicly-traded oil and gas sector with a ten-foot pole. That's not because I believe there won't be a (substantial) continued use for fossil fuels well into the future. And it's also not because I believe clean energy is even fractionally as efficient as FF-based energy. Casting all personal beliefs aside, I simply can't help but notice that the entire public market investment apparatus is already more or less moving on from FFs. That means publicly-traded oil and gas companies will continue to be the ugly girl at the dance unless climate concerns prove to be completely overblown. The real money in this sector will be made by the private equity firms who don't have to abide by the same ESG mandates as the funds investing in listed equities.

We've seen this before. In tech, particularly within data storage, we saw the shift from tape storage to disc storage to flash storage. When disc storage became the go-to application for all but the most commoditized use cases, those companies who continued to offer tape storage were actually printing money as their competition moved on to the next technology. As a number of cost-focused bulk storage operations still found tape beneficial, the companies still in that space had substantial pricing power. This allowed them to become cash cows for a while that were generating ridiculous free cash flow yields.

But here's the thing: those yields stayed fat because the stocks never got bid up. Wall Street simply didn't care. No fund manager wanted to talk about tape storage in his/her quarterly letter to investors. The entire apparatus simply moved on to the next technology. That's kind of how I feel about oil and gas stocks. Whether or not you agree with the climate alarmism doesn't change the fact that the environmentalist narrative is winning. You can hardly so much as build a gas plant in much of Europe, Australia, or the East and West Coasts of America anymore. And that's GAS, for crying out loud, which was supposed to be the "clean bridge fuel." This only goes to show that when you give the true believers an inch, they're going to take a mile every time, and hence that "bridge" they intend to make a short as absolutely possible.

Posted on 8/5/20 at 9:47 am to RedStickBR

quote:

That's kind of how I feel about oil and gas stocks.

Well articulated, cogent take. You're spot on and there are many additional reasons why I think this will be true. As someone who works in one of the giants, the feel in the company is that the society AND investors demand progress. They expect that this progress will cost money. They expect that we will be required to take it -- even if that means lower margins and more "philanthropic" investments. The IOC's will be held accountable for the past use of FF and the perceived way they have not pushed society off of them. They are now the sacrificial lambs, each fighting to not be brought to slaughter first.

Meanwhile, smaller, private firms will continue to go after traditional O&G and profit handsomely. That is, until they either face a tail risk (eg. major blowout or natural/economic catastrophe) OR society finally moves on from FF. If you're playing Shell, Total, CVX, etc., the play is long. It's a survival and adaptive game. Not short term profits or growth in the next few decades. You'll see all of the majors use phrases like "resilience" and "adaptation" as they signal their move in this direction.

Posted on 8/5/20 at 10:06 am to o0 ecdysis 0o

quote:

Well articulated, cogent take. You're spot on and there are many additional reasons why I think this will be true. As someone who works in one of the giants, the feel in the company is that the society AND investors demand progress. They expect that this progress will cost money. They expect that we will be required to take it -- even if that means lower margins and more "philanthropic" investments. The IOC's will be held accountable for the past use of FF and the perceived way they have not pushed society off of them. They are now the sacrificial lambs, each fighting to not be brought to slaughter first.

Meanwhile, smaller, private firms will continue to go after traditional O&G and profit handsomely. That is, until they either face a tail risk (eg. major blowout or natural/economic catastrophe) OR society finally moves on from FF. If you're playing Shell, Total, CVX, etc., the play is long. It's a survival and adaptive game. Not short term profits or growth in the next few decades. You'll see all of the majors use phrases like "resilience" and "adaptation" as they signal their move in this direction.

Thanks. Good take by you as well. We appear to be on the exact same page. I thought about taking my post just one step further to add that even if climate concerns prove to be completely overblown, it still couldn't matter for traditional oil and gas companies. Why? Two reasons: the first is that the momentum in the other direction may simply be too strong at that point to reverse. But the other is the phenomena you described in which it is now the oil and gas majors who are helping swing the pendulum in favor of clean energy because they feel as if they have no other choice.

The advantage these companies still have is absolutely massive balance sheets that they can use to establish dominant positions in the renewable power generation and/or retail electricity markets. The companies exploiting that advantage are who I'd be focused on in this space. I thought Shell's purchase of ERM Power in Australia, for instance, was a brilliant move. ERM Power is short generation, which will actually allow them to benefit from the renewable overbuild Australia seems hellbent on. That tailwind and Shell's balance sheet will most likely allow ERM Power to gain substantial market share in Australia. That's the kind of thing I'd be looking for from these companies, as opposed to digging their heels in and expecting the world around them to eventually stop changing.

This post was edited on 8/5/20 at 10:08 am

Posted on 8/5/20 at 11:08 am to jimjackandjose

XOM cutting 401k matching, but still borrowing money to pay out Dividends?????

I’m sure the process/mechanical boot to ground workers are beyond furious right now.

I’m sure the process/mechanical boot to ground workers are beyond furious right now.

Back to top

3

3