- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Any household that consistently runs a deficit goes bankrupt

Posted on 5/27/23 at 10:30 am

Posted on 5/27/23 at 10:30 am

But the government is some exception to that? We can just run a deficit to infinity? Sure they can borrow more money for longer to keep it afloat, but if they use the eventual "print more money to cover the deficit" trick everyone goes bankrupt. What am I missing?

Posted on 5/27/23 at 10:35 am to Thundercles

While a simple comparison, a HH and government are very different.

Posted on 5/27/23 at 10:39 am to Thundercles

Macroeconomics is completely different than household Financials, you're missing that for one. You don't have a currency exchange with your nextdoor neighbors.

If I run up a million dollars of debt and my neighbor runs up 2 million, it doesn't change the value of my debt in dollars in household financials. In macro, it does.

Not saying a deficit is good, but this is not a great comp.

If I run up a million dollars of debt and my neighbor runs up 2 million, it doesn't change the value of my debt in dollars in household financials. In macro, it does.

Not saying a deficit is good, but this is not a great comp.

Posted on 5/27/23 at 10:41 am to lynxcat

So the government can borrow into infinity and it will never matter?

Posted on 5/27/23 at 11:38 am to Thundercles

quote:Possibly, yes.

So the government can borrow into infinity and it will never matter?

Posted on 5/27/23 at 11:47 am to Thundercles

quote:Yes.

Any household that consistently runs a deficit goes bankrupt

But the government is some exception to that?

Does your household have:

the ability to print its own currency that the entire world clamors to accept as the standard?

the capacity to borrow consistently - at decent rates - despite never actually net paying down existing debt?

the right to collect income (in the form of taxes) on denominators that are measured in nominal dollars that more or less increase by definition along with the growth of the economy?

I'm guessing not.

Let's look at Japan - by far the most indebted "western" nation. The majority of their debt is held internally by their own citizens. To answer your question - no, it's possibly not sustainable. I'm guessing at some point they might just ask their citizens to take a 30% haircut on what they're owed and be done with it. Debt is just accounting, so they'll do it.

Posted on 5/27/23 at 2:04 pm to Big Scrub TX

If the government prints its way out of debt, we experience hyperinflation and the dollar becomes worthless and the world abandons it for another standard currency-- this is already happening by the way.

If the government doesn't print its way out and continues to borrow, at some point interest on that debt will consume most of if not all of tax revenues.

So what's the workable outcome if they're apparently unwilling to spend dramatically less?

If the government doesn't print its way out and continues to borrow, at some point interest on that debt will consume most of if not all of tax revenues.

So what's the workable outcome if they're apparently unwilling to spend dramatically less?

Posted on 5/27/23 at 2:15 pm to Big Scrub TX

quote:

So the government can borrow into infinity and it will never matter?

Possibly, yes.

Correct but if the average Joe borrows to infinity that person is called dumb and undisciplined with money.

Posted on 5/27/23 at 2:33 pm to Thundercles

quote:

So the government can borrow into infinity and it will never matter?

Didn't work out so well for Greece

Posted on 5/27/23 at 2:42 pm to Thundercles

quote:That's not really right, at least not necessarily. People skyscreamed about this for years after the GFC, but what they missed was demand was so slack. We went well more than a decade of QE with the primary worry still being DEflation.

If the government prints its way out of debt, we experience hyperinflation and the dollar becomes worthless and the world abandons it for another standard currency-- this is already happening by the way.

The stupid covid stimulus stuff is what caused the majority of the current inflation. And that was not monetary policy - not fiscal policy.

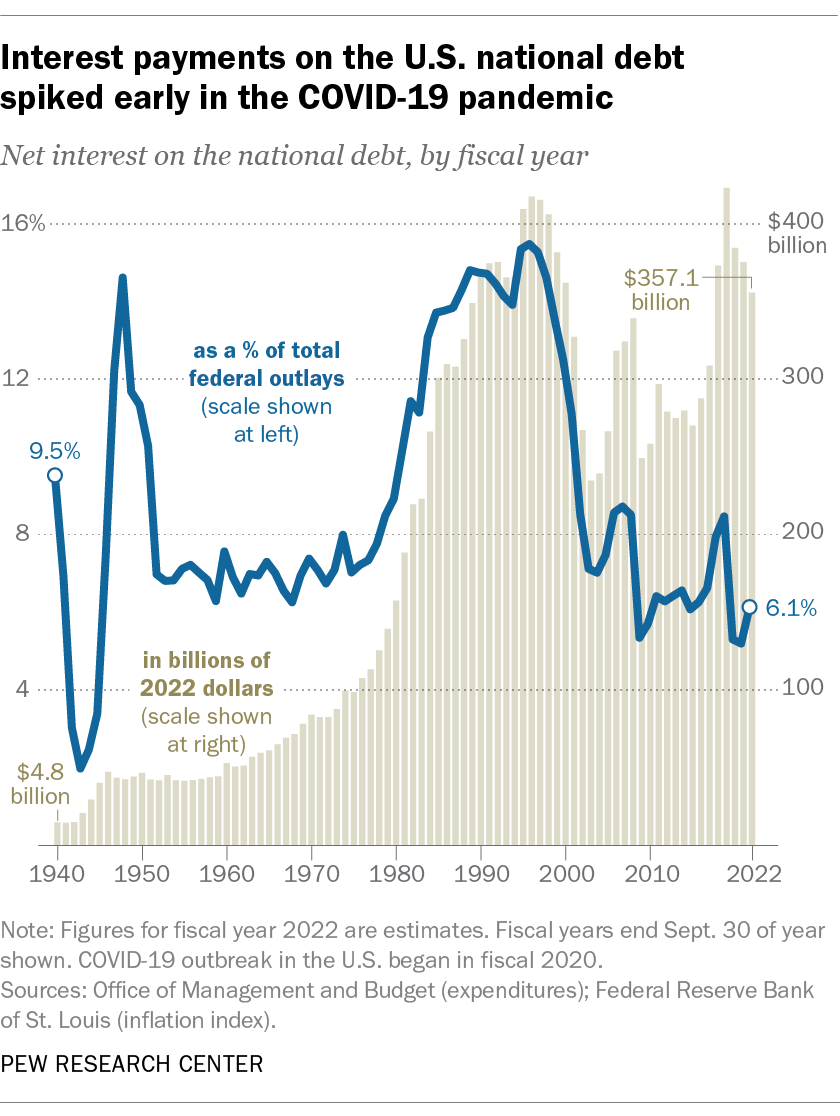

quote:Yes, agreed. You could argue Japan is already there. Something like 50% of their budget is spent on debt service. For comparison, the US is like 6-10%. As you can see, that's a lot lower than it was even just in the 90s:

If the government doesn't print its way out and continues to borrow, at some point interest on that debt will consume most of if not all of tax revenues.

quote:I guess we'll see where rates go. I'd say many decades more can go like this before we have to think too hard about it - especially if rates don't go much higher. If the $ stays the reserve currency and the US maintains dominance (which I think is very likely), this just won't matter very much.

So what's the workable outcome if they're apparently unwilling to spend dramatically less?

Posted on 5/27/23 at 4:43 pm to Thundercles

quote:

Any household that consistently runs a deficit goes bankrupt

Apples and oranges, not sure why this is such a talking point. It is in the best interest of everyone for the government to leverage.

quote:

If General Motors, AT&T, and individual households had been required to balance their budgets in the manner being applied to the Federal government, there would be no corporate bonds, no mortgages, no bank loans, and many fewer automobiles, telephones, and houses.

William Vickery

This post was edited on 5/27/23 at 4:45 pm

Posted on 5/27/23 at 6:32 pm to UltimaParadox

quote:

Apples and oranges, not sure why this is such a talking point. It is in the best interest of everyone for the government to leverage.

By leverage do you mean eternal global conflict?

Everyone you say?

Also, I disagree apples to oranges because math is math. That is why no currency, ever, as beaten math. Some make it longer, but math always wins.

It is really just how long the USA can push the can. At some point, it falls apart. Always does.

This post was edited on 5/27/23 at 6:38 pm

Posted on 5/27/23 at 6:59 pm to JayDeerTay84

quote:

leverage do you mean eternal global conflict?

Not even sure how you came to that conclusion.

Posted on 5/27/23 at 8:04 pm to JayDeerTay84

quote:Leverage in this case literally means borrowing money.

By leverage do you mean eternal global conflict?

Posted on 5/27/23 at 8:44 pm to Big Scrub TX

quote:

Let's look at Japan - by far the most indebted "western" nation. The majority of their debt is held internally by their own citizens.

Most of that debt will be held by older Japanese. I could see their government passing a law that when that person dies, so does the debt.

Posted on 5/27/23 at 9:17 pm to Thundercles

The dollar will eventually lose its reserve currency status and it will get ugly. Or we'll get to a point where we can't afford to service the interest on our debt.

This post was edited on 5/27/23 at 9:18 pm

Posted on 5/28/23 at 12:34 am to Big Scrub TX

If the government can borrow infinite money to cover its expenses and there is no repercussion, why bother collecting tax revenue? Why not just borrow 100 trillion dollars and then print the money to cover it?

Posted on 5/28/23 at 1:09 am to Thundercles

quote:Well, for one thing, the government and the fed are not the same thing exactly.

If the government can borrow infinite money to cover its expenses and there is no repercussion, why bother collecting tax revenue? Why not just borrow 100 trillion dollars and then print the money to cover it?

But of course in the extreme limit, you are theoretically correct. I'm just saying it could be a REALLY long time before it's actually acute - like 100+ years or something. A lot can happen to change assumptions in the interim.

Posted on 5/28/23 at 1:13 am to fallguy_1978

quote:Who exactly is your nominee to replace it?

The dollar will eventually lose its reserve currency status and it will get ugly

quote:Maybe. Look at the chart. We're still spending WAY less of our budget on debt service than Japan - and do they seem teetering to you? Certainly if rates go A LOT higher than here, you could be right. Or they could stabilize and even go lower, in which case, this is "affordable" for much longer than you can live.

Or we'll get to a point where we can't afford to service the interest on our debt.

I'm not defending any of this. I'm merely hoping to help some of you understand the folly of making your investments as bets against the US. Betting against Japanese currency and rates has long been called "the widowmaker" because so many fund managers have been carried out betting on the same macro thesis of this thread. And the US is WAY better than Japan.

Posted on 5/28/23 at 1:29 am to Big Scrub TX

So basically the government can just borrow and print until people stop buying their securities due to lack of consumer trust (would need extreme circumstances) or until the US experiences true hyperinflation, but those are in some future state.

So the likely outcome in the meantime is that they'll collect tax revenue, spend 150% of what they collect, the deficit will continue to increase, they'll pay for it with fabricated money, and one day we'll have a deficit so obscene that the entire system falls out from under us (or our descendants).

So the likely outcome in the meantime is that they'll collect tax revenue, spend 150% of what they collect, the deficit will continue to increase, they'll pay for it with fabricated money, and one day we'll have a deficit so obscene that the entire system falls out from under us (or our descendants).

Popular

Back to top

5

5