- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Akebia Therapeutics (AKBA)- Vadadustat FDA Approved AT LAST!!

Posted on 2/1/21 at 12:56 pm

Posted on 2/1/21 at 12:56 pm

While I realize that it's nice to throw a few hundred or a few grand at the next 200% gainer, that's not really my thing. As some of you know, I've been accumulating shares of AUPH for right at four years now. It's main drug (voclosporin), now marketed as Lupkynis, has shown stellar data from Phase I all the way to a nod from the FDA (22 Jan). Though I'm up more than 300% on my original shares, the stock price is still relatively low, and value is just starting to be realized as sales have just begun.

Inevitably, I will cash out of my Aurinia position at some point, and I think that identifying the next "AUPH" could be the likeliest road to wealth accumulation for me. For whatever reason, I don't mind a good wait, and I've learned a lot from the "games" and manipulation that accompanies the world of clinical trials and small pharmas.

While AUPH is taking a few years to reach full potential, you should be happy to know that AKBA seems to be much further ahead, yet currently one hell of a bargain. Without further delay, here's the DD:

MISSION

To address complications related to chronic kidney disease (CKD), specifically anemia. Approximately 5.7 million Americans alone are affected by anemia as a result of CKD.

DRUGS

Auryxia - This drus is available now, and has two indications.

1. control serum phosphorus levels in patients with CKD that are ON dialysis.

2. treat anemia in patients with CKD who are NOT on dialysis.

Auryxia competes against the injectable SoC from the early 1990s. Auryxia is an oral treatment.

Sales have been modest, but increasing. 55.5 million in 2017, 96 million in 2018, roughly 35 million per quarter in 2020

Vadadustat

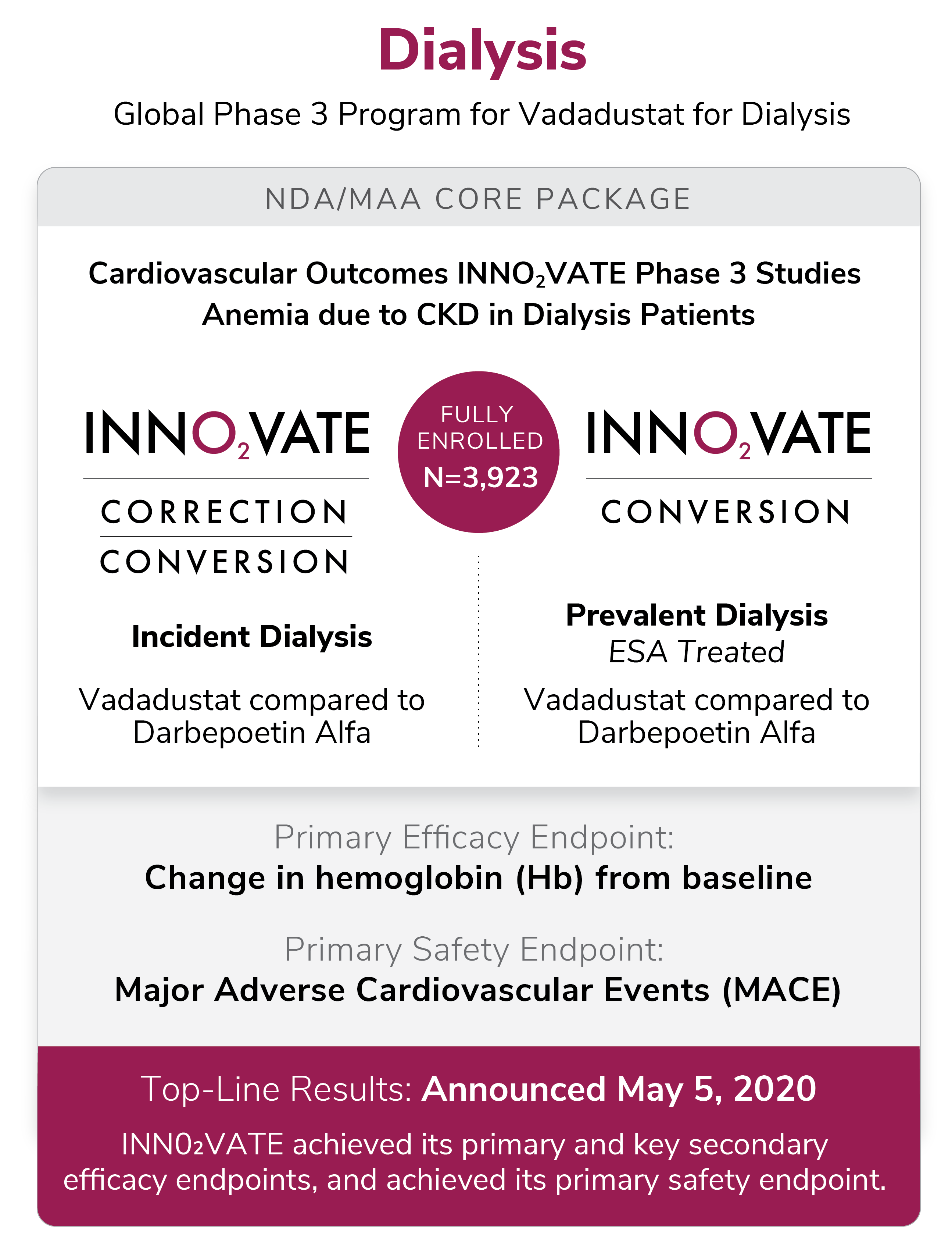

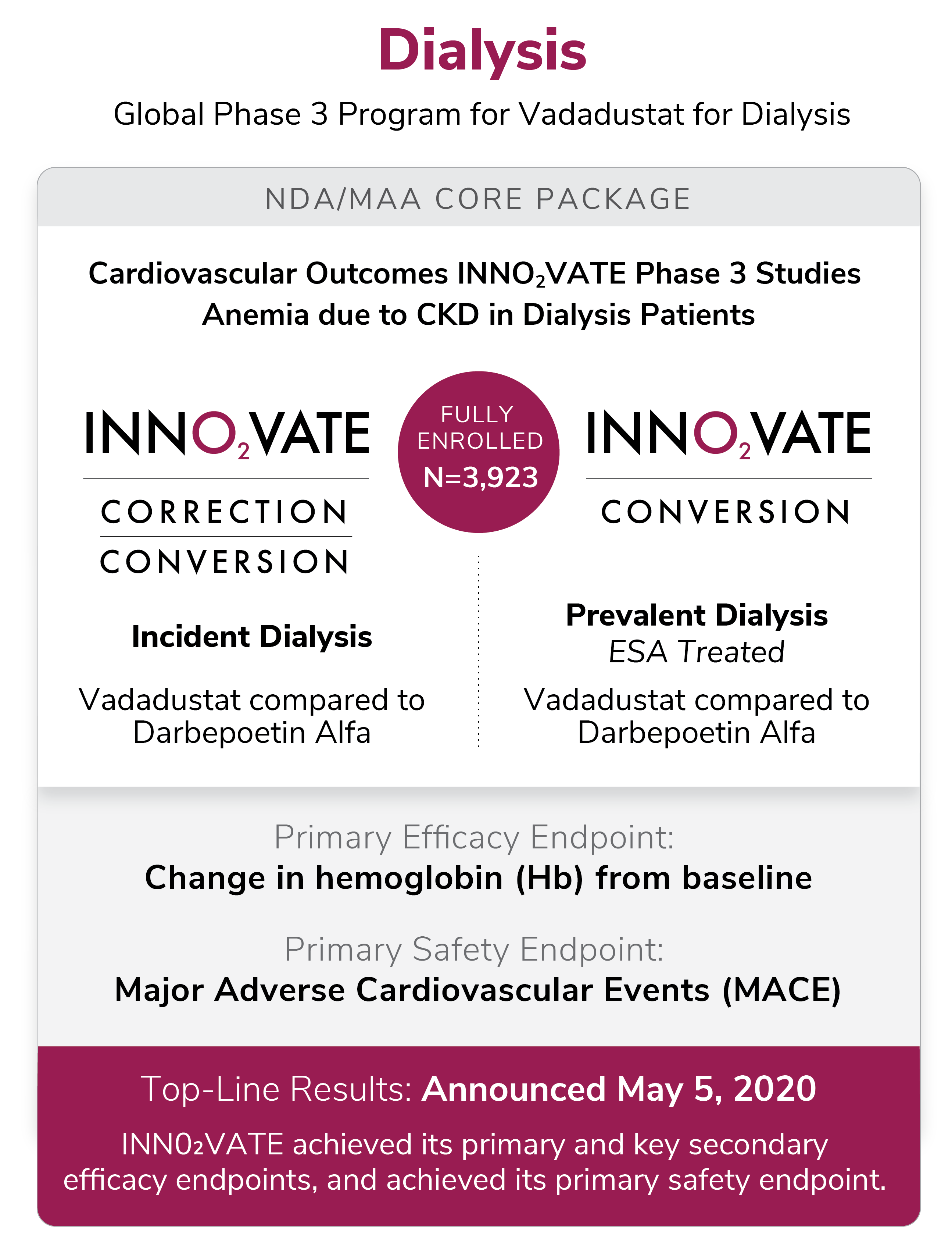

While Auryxia is making money, it seems like the company is much more excited about Vadadustat. Two separate clinical trails concluded in 2020--one for treating anemia due to CKD for people ON dialysis (Innovate) and the other for those NOT on dialysis (Protect).

"Protect" failed on safety.

The measure was MACE (Major Adverse Cardiovascular Events). This failure sent the stock from over $20 to $3 immediately.

And here's where the uncertainty lies... Akebia is expecting to file a singular NDA for both studies at any moment now.

They are confident that the stellar efficacy from Innovate (for dialysis), which met its safety endpoint plus the efficacy of Protect (no dialysis) will be enough...

These graphics are helpful:

>

>

>

>

Failed safety withstanding, I think this company is worth a look for three reasons.

1. Auryxia alone is producing 1/4 of the company's current market cap in revenue, and continues to show consistent growth since 2017. Vadadustat would be complimentary to Auryxia as the two drugs treat different aspects of anemia due to CKD.

2. Vadadustat is already approved in Japan and has begun earning royalties thanks to a partnership with Mitsubishi Tanabe. Akebia also has a working relationship with Otsuka, which has paid up front cash, reimbursements for R&D, and future royalties (Otsuka has a similar deal with AUPH in Europe and Asia).

The following quote is from 2017: "Akebia has established three significant collaborations for vadadustat in a little over a year, which together total more than $2.2 billion in potential value and include $573 million or more in upfront payments and committed development funding. In addition to this agreement and the U.S. collaboration with Otsuka, Akebia has established a collaboration with Mitsubishi Tanabe Pharma Corporation for the development and commercialization of vadadustat in Japan, Taiwan, South Korea, Indonesia, India and select other countries in Asia."

3. The potential renal caused anemia market represents a 2B dollar in the US alone. 3.5 billion globally. Therefore, with a market cap of less than 500 million, Akebia is severely undervalued. The company has 269 million in cash equivalents and 143 million shares outstanding.

As a bonus, take a look at institutional ownership. It's above 80% with Wellington and Blackrock owning 12 and 8 percent respectively. Buyout???

$3.17 at time of posting.

Inevitably, I will cash out of my Aurinia position at some point, and I think that identifying the next "AUPH" could be the likeliest road to wealth accumulation for me. For whatever reason, I don't mind a good wait, and I've learned a lot from the "games" and manipulation that accompanies the world of clinical trials and small pharmas.

While AUPH is taking a few years to reach full potential, you should be happy to know that AKBA seems to be much further ahead, yet currently one hell of a bargain. Without further delay, here's the DD:

MISSION

To address complications related to chronic kidney disease (CKD), specifically anemia. Approximately 5.7 million Americans alone are affected by anemia as a result of CKD.

DRUGS

Auryxia - This drus is available now, and has two indications.

1. control serum phosphorus levels in patients with CKD that are ON dialysis.

2. treat anemia in patients with CKD who are NOT on dialysis.

Auryxia competes against the injectable SoC from the early 1990s. Auryxia is an oral treatment.

Sales have been modest, but increasing. 55.5 million in 2017, 96 million in 2018, roughly 35 million per quarter in 2020

Vadadustat

While Auryxia is making money, it seems like the company is much more excited about Vadadustat. Two separate clinical trails concluded in 2020--one for treating anemia due to CKD for people ON dialysis (Innovate) and the other for those NOT on dialysis (Protect).

"Protect" failed on safety.

The measure was MACE (Major Adverse Cardiovascular Events). This failure sent the stock from over $20 to $3 immediately.

And here's where the uncertainty lies... Akebia is expecting to file a singular NDA for both studies at any moment now.

They are confident that the stellar efficacy from Innovate (for dialysis), which met its safety endpoint plus the efficacy of Protect (no dialysis) will be enough...

These graphics are helpful:

>

>  >

> Failed safety withstanding, I think this company is worth a look for three reasons.

1. Auryxia alone is producing 1/4 of the company's current market cap in revenue, and continues to show consistent growth since 2017. Vadadustat would be complimentary to Auryxia as the two drugs treat different aspects of anemia due to CKD.

2. Vadadustat is already approved in Japan and has begun earning royalties thanks to a partnership with Mitsubishi Tanabe. Akebia also has a working relationship with Otsuka, which has paid up front cash, reimbursements for R&D, and future royalties (Otsuka has a similar deal with AUPH in Europe and Asia).

The following quote is from 2017: "Akebia has established three significant collaborations for vadadustat in a little over a year, which together total more than $2.2 billion in potential value and include $573 million or more in upfront payments and committed development funding. In addition to this agreement and the U.S. collaboration with Otsuka, Akebia has established a collaboration with Mitsubishi Tanabe Pharma Corporation for the development and commercialization of vadadustat in Japan, Taiwan, South Korea, Indonesia, India and select other countries in Asia."

3. The potential renal caused anemia market represents a 2B dollar in the US alone. 3.5 billion globally. Therefore, with a market cap of less than 500 million, Akebia is severely undervalued. The company has 269 million in cash equivalents and 143 million shares outstanding.

As a bonus, take a look at institutional ownership. It's above 80% with Wellington and Blackrock owning 12 and 8 percent respectively. Buyout???

$3.17 at time of posting.

This post was edited on 3/27/24 at 8:15 pm

Posted on 2/1/21 at 1:11 pm to bayoubengals88

What happened in September to cause that plunge in stock value?

Posted on 2/1/21 at 1:12 pm to jrodLSUke

Safety issues with a phase 3 trial on vadadustat. Efficacy was good though.

I’m in for 1000 shares. Low entry point with significant upside.

I’m in for 1000 shares. Low entry point with significant upside.

This post was edited on 2/1/21 at 1:26 pm

Posted on 2/1/21 at 4:51 pm to bayoubengals88

I do like the low entry point. It’s similar to AUPH in February of 2017.

Posted on 2/1/21 at 5:12 pm to bayoubengals88

Just what I needed another auph style play

Posted on 2/1/21 at 5:20 pm to Paul Allen

quote:Precisely!

low entry point. It’s similar to AUPH in February of 2017.

Posted on 2/1/21 at 8:05 pm to bayoubengals88

Updated research included

Posted on 2/1/21 at 8:38 pm to bayoubengals88

I like it. Putting 1k into it to start and will probably put in for a recurring weekly buy of 100.

Posted on 2/1/21 at 10:36 pm to bayoubengals88

Nice DD. What kind of timeframe are you looking at? Multi-year type of play?

Posted on 2/1/21 at 11:10 pm to bayoubengals88

quote:

bayoubengals88

Thanks for the detailed and thoughtful post.

Posted on 2/2/21 at 1:28 am to bayoubengals88

Did some dd. Analyst have a $10 price target? That's like 5x.

Posted on 2/2/21 at 1:18 pm to bayoubengals88

As usual great stuff BB. By chance do have any info , like what you have isn’t enough, the institutional put/call ratio?

TIA... I think I’m gonna ride with you again

TIA... I think I’m gonna ride with you again

Posted on 2/2/21 at 2:00 pm to cuyahoga tiger

quote:

I think I’m gonna ride with you again

quote:

institutional put/call ratio?

Posted on 2/3/21 at 10:27 am to bayoubengals88

Don’t know much about stocktwits, but it seems to have WSB type rhetoric. Anyway, people there are anticipating an NDA on vadadustat imminently. Anyone here have information on that? Only thing I see is a several months old statement saying they hope to have an NDA early this year.

Posted on 2/3/21 at 10:31 am to WDE24

quote:That's the only thing you'll find.

Only thing I see is a several months old statement saying they hope to have an NDA early this year.

The last conference call stated "as early as we can in 2021"

Posted on 2/3/21 at 7:05 pm to WDE24

None.

Yeah, I made this post at like 3.24

I only have 70 shares!!

Yeah, I made this post at like 3.24

I only have 70 shares!!

Popular

Back to top

20

20