- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 10/17/19 at 7:36 am to DeathAndTaxes

quote:

Unless the government decides to start assessing income taxes on Roth distributions, the advantage of the Roth will remain.

Those are very solidly done and helpful.

But they are inaccurate in that they assume the entirety of the sum is dropped at the same time. A Trad 401k will have a considerably higher value because you are putting 20% more in a year to increase in value. So every year in the market you’ll have a 1.4% increase in value of the Trad over Roth considering 7% increase in value. You have 20% more money increasing at 7% a year.

I don’t feel like actually calculating this, but over 10 years that’s not a lot. But over 30 years, that could be in the neighborhood of 20-30% more money. Which is going to make any tax savings from the Roth moot. Furthermore, you are only taxed on the distributions. So long term, the additional money in the Trad would become worth considerably more after taxes then a Roth.

Posted on 10/17/19 at 8:19 am to lsu13lsu

quote:

My position is that most people I deal with live off less income than they do during working years so they are in lower bracket.

The average retired American relies more on social security than retirement savings. If you ask most when they began planning for retirement they'd answer in their 50's.

Most people absolutely live on less, but if anyone starts planning for retirement in their 20's or 30's it's entirely possible to retire with a higher salary especially if you have a few years without raises.

The Roth isn't a no brainer, but it's definitely worth every intelligent investors consideration.

Posted on 10/17/19 at 8:30 am to UpstairsComputer

quote:

UpstairsComputer

Then explain?

If you have 20% more money invested every year, how do you make that up?

Posted on 10/17/19 at 8:35 am to baldona

I’m on my phone, but using your numbers 1.4/7 = 20% It’s the same.

Roth: $10,000 - 20% = $8000

Year 1: 8000 * 7% = 8560

Year 2: 8560 * 7% = 9159.20

Etc

IRA

$10,000 * 7% = 10700

10700 * 7% = 11449

11449 - 2289.80 (20%) = 9159.20

Etc

The only variable is tax rate when you withdraw. That’s it. Everything else is mental games.

Roth: $10,000 - 20% = $8000

Year 1: 8000 * 7% = 8560

Year 2: 8560 * 7% = 9159.20

Etc

IRA

$10,000 * 7% = 10700

10700 * 7% = 11449

11449 - 2289.80 (20%) = 9159.20

Etc

The only variable is tax rate when you withdraw. That’s it. Everything else is mental games.

Posted on 10/17/19 at 8:44 am to baldona

Additionally, don’t forget that Roth Money that’s not used in a trad is take off your highest tax bracket at the time of your transfer while a vast majority would be taxed at the lowest tax bracket in retirement. The difference is 10% right now if not more. 10 freaking percent difference.

Let’s say you make $100,000 now then your Roth contributions were taxed at the $77,000 bracket that’s 22% compared to 12% today right? So 100% of your Roth money was taxed at 22%. But if you take a distribution of $100,000 then 77% of your money is taxed at 12% and only 23% taxed at 22%.

Let’s say you make $100,000 now then your Roth contributions were taxed at the $77,000 bracket that’s 22% compared to 12% today right? So 100% of your Roth money was taxed at 22%. But if you take a distribution of $100,000 then 77% of your money is taxed at 12% and only 23% taxed at 22%.

Posted on 10/17/19 at 8:46 am to CoachMoorGut

quote:

Most people absolutely live on less, but if anyone starts planning for retirement in their 20's or 30's it's entirely possible to retire with a higher salary especially if you have a few years without raises.

The problem with that is that most people who start planning to retire in 20s or 30s are going to be extremely frugal and big time savers. Most of these that I know still live off less in retirement. They hate having to turn 70 and have to withdraw from IRA.

Posted on 10/17/19 at 8:53 am to baldona

I don’t have spreadsheet capabilities right now but it works the same in reverse. If you need 20% more money from the traditional (to account for the taxes) you’ve now moved right back where you started.

ETA. You also have taxes on the extra 20% you had to pull to pay the taxes, before someone checks this math :)

It’s easier to explain using effective tax rates. While you can complicate it by using marginal brackets in the calculations... still the same.

ETA. You also have taxes on the extra 20% you had to pull to pay the taxes, before someone checks this math :)

It’s easier to explain using effective tax rates. While you can complicate it by using marginal brackets in the calculations... still the same.

This post was edited on 10/17/19 at 8:56 am

Posted on 10/17/19 at 8:58 am to ihuntsum1

Health Savings Account

It can only be used to pay for Health Care. But, if you look at what will be needed in retirement for Health Care costs it won't even cover that. So, I max that out for Retirement.

If for some reason you don't need it in retirement for health expenses then you can withdraw like a Traditional IRA and taxed on what you withdraw at 65 years old.

It can only be used to pay for Health Care. But, if you look at what will be needed in retirement for Health Care costs it won't even cover that. So, I max that out for Retirement.

If for some reason you don't need it in retirement for health expenses then you can withdraw like a Traditional IRA and taxed on what you withdraw at 65 years old.

Posted on 10/17/19 at 9:08 am to lsu13lsu

Thank you very much for this information. If one pays taxes upon a non-medical withdrawal, wouldn't that also include taxes on the gains?

Posted on 10/17/19 at 9:13 am to UpstairsComputer

The account owner has to keep track of deposits vs. gains?

Posted on 10/17/19 at 9:21 am to UpstairsComputer

quote:

It’s easier to explain using effective tax rates. While you can complicate it by using marginal brackets in the calculations... still the same.

Its not the same though. This is an oversight. 100% of Roth Contributions are at your highest marginal tax bracket. That's a fact. Because if you instead contribute the money to a Trad that's at 0% tax. You are pulling your money from the top.

BUT, when you retire you are taking distributions starting from the bottom of your tax bracket.

So for most people today, a majority of their Trad distributions will be at 12% while their contributions to their ROTH will be at 22%. That is significant.

This post was edited on 10/17/19 at 9:22 am

Posted on 10/17/19 at 9:22 am to ihuntsum1

After 65, you are taxed on your non-health withdrawals just like a traditional IRA/401K. You get a tax deduction for deposits so not double taxed (no need to track deposits).

This post was edited on 10/17/19 at 11:48 am

Posted on 10/17/19 at 9:55 am to baldona

You're going to need to show your work if you're trying to convince me.

You're ignoring that if you draft the 77k, as per your example, now you'll have to pay the higher marginal tax rate on the next dollar here too. If you do the work, you'll see.

Your better argument, if we're trying to convince people traditional is better, is in retirement you won't have to draft the money you spent saving. In our previous examples, $100,000 - $10,000 = $90,000 needed in retirement. That $10,000 you don't have to pull is the actual difference in taxes - but only effectively, not marginally.

I still hold firm on my expectations that taxes will be going up dramatically (more than 3% effectively and marginally) in the future so I think that $10,000 is a non-issue in the grand scheme.

You're ignoring that if you draft the 77k, as per your example, now you'll have to pay the higher marginal tax rate on the next dollar here too. If you do the work, you'll see.

Your better argument, if we're trying to convince people traditional is better, is in retirement you won't have to draft the money you spent saving. In our previous examples, $100,000 - $10,000 = $90,000 needed in retirement. That $10,000 you don't have to pull is the actual difference in taxes - but only effectively, not marginally.

I still hold firm on my expectations that taxes will be going up dramatically (more than 3% effectively and marginally) in the future so I think that $10,000 is a non-issue in the grand scheme.

Posted on 10/17/19 at 11:36 am to EFHogman

One feature of the Roth that hasn’t been mentioned is that you do not have to take required minimum distributions when you become 70 ½ years of age. This probably isn’t a factor for most workers because the average worker has little invested in a traditional or a Roth. However, if you begin to fund your retirement at an early age and are able to max out every year it can be a consideration. I have long advocated for both to give you flexibility in managing your marginal tax bracket in retirement.

Posted on 10/17/19 at 2:49 pm to baldona

quote:

I don’t have spreadsheet capabilities right now but it works the same in reverse. If you need 20% more money from the traditional (to account for the taxes) you’ve now moved right back where you started.

ETA. You also have taxes on the extra 20% you had to pull to pay the taxes, before someone checks this math :)

It’s easier to explain using effective tax rates. While you can complicate it by using marginal brackets in the calculations... still the same.

Don't worry, I got you dawg.

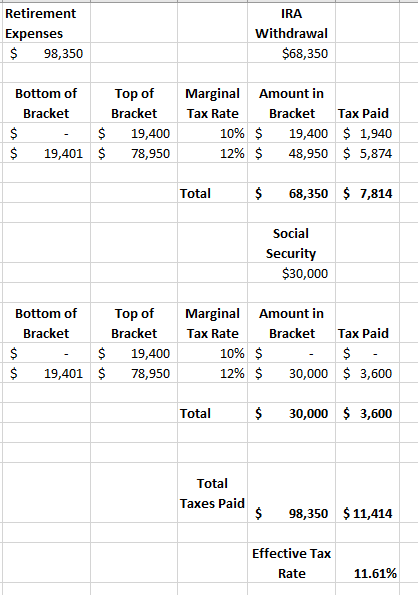

Let's say someone retired January 1 of this year, and they need $98,350 a year to live on (I chose this number because it is the amount that brings them to the very top of the 12% bracket.)

They are married, and most couples receive some sort of Social Security benefit, so thankfully they don't need to draw all $100,000 from their Traditional IRA that they just created from a rollover from their 401k. For ease, let's say they receive $30,000 in Social Security. So they will have to pull $68,350 from their Traditional IRA.

Lets say you are right, and Traditional IRA assets come out first, at the 10% bracket:

This results in $11,414 in taxes paid for the year, an effective tax rate of 11.61%

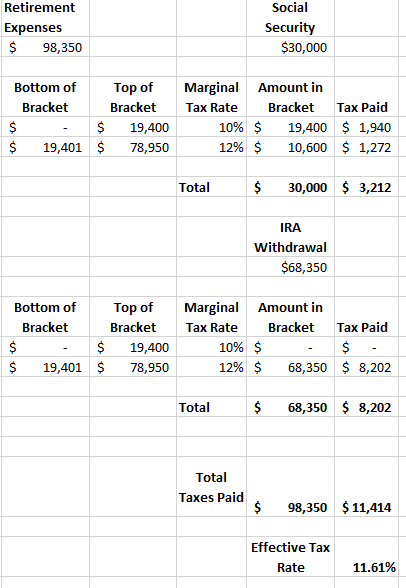

Now, just for fun, let's say you are wrong, and IRA withdrawals are added on top of other income like Social Security:

This scenario results in $11,414 in taxes paid for the year, an effective tax rate of 11.61%

Holy shite they are the SAME?!

As previously stated, multiple times, by people who do this for a living, the only thing that matters is the difference between tax rate at contribution and distribution.

This post was edited on 10/17/19 at 2:51 pm

Popular

Back to top

0

0