- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

roth 401k vs regular 401k

Posted on 10/14/19 at 8:10 pm

Posted on 10/14/19 at 8:10 pm

Hey guys I see alot of advisers steering their clients to the roth 401k over the pretax regular 401k. All things being equal which do ya'll think will generate the best income at the end of the race? Seems like I'm in a high tax bracket now and likely will have my debts paid off by retirement. I would rather the tax break now. Seems like a no brainer, am I wrong?

Posted on 10/14/19 at 8:42 pm to EFHogman

You can invest in both and diversify your potential tax liabilities. The Roth 401k will protect you from increased future tax rates and 401k will protect you from lower future tax rates or things like a VAT.

This post was edited on 10/14/19 at 9:00 pm

Posted on 10/14/19 at 10:23 pm to EFHogman

We don’t have enough information on you, but all else being equal “best income” is the one that isn’t taxed. You’ll have to create more “best income” to cover the taxes in the traditional if that makes sense.

Philosophically, the only way to pay for what’s coming is default, print more, or raise taxes.

We have already printed more (QE and deficits) and that hasn’t stopped the pols from spending more on the blank check. Default obviously can’t happen or we’ve got way bigger problems. When shite hits the fan, they will raise taxes.

You already hear about this with MMT proponents. Name the tax that didn’t go up once it was legal to impose. I’ll wait... When they get in, and they will, these recent cuts will go bye bye and the pendulum will swing back the other way. Eventually we’ll have another crisis and we’ll have to pay for all this crap.

*steps off soapbox*

So I’d pay my tax in a lower tax environment depending on your circumstances. If you need the money now more than later, there’s your answer.

Philosophically, the only way to pay for what’s coming is default, print more, or raise taxes.

We have already printed more (QE and deficits) and that hasn’t stopped the pols from spending more on the blank check. Default obviously can’t happen or we’ve got way bigger problems. When shite hits the fan, they will raise taxes.

You already hear about this with MMT proponents. Name the tax that didn’t go up once it was legal to impose. I’ll wait... When they get in, and they will, these recent cuts will go bye bye and the pendulum will swing back the other way. Eventually we’ll have another crisis and we’ll have to pay for all this crap.

*steps off soapbox*

So I’d pay my tax in a lower tax environment depending on your circumstances. If you need the money now more than later, there’s your answer.

Posted on 10/15/19 at 8:07 am to EFHogman

Everyone's situation is different. Some items to consider:

- Is your income higher now than you expect to have in retirement? (Yes->traditiona, No-> Roth)

- Do you want to retire early? (Yes-> Roth as you can access the principal anytime you want)

- Will taxes go up or down as time goes on? (Up->Roth now, Down->Traditional now)

For some people it can be an easy decision. For others, there is too much uncertainty to feel comfortable with either option and splitting it 50/50 might be a good idea.

- Is your income higher now than you expect to have in retirement? (Yes->traditiona, No-> Roth)

- Do you want to retire early? (Yes-> Roth as you can access the principal anytime you want)

- Will taxes go up or down as time goes on? (Up->Roth now, Down->Traditional now)

For some people it can be an easy decision. For others, there is too much uncertainty to feel comfortable with either option and splitting it 50/50 might be a good idea.

Posted on 10/15/19 at 8:52 am to EFHogman

I would explore maxing out your 401k and then contributing to your Roth IRA either by normal avenues or a backdoor Roth if your income is high enough.

Posted on 10/15/19 at 9:38 am to TheWiz

You would need to provide more info regarding income and tax filing status for a real answer, but UpstairsComputer has the right of it, you are probably better off paying the taxes now.

If you are working towards putting away $25,000 for the year, as in you aren't positive you will be able to set aside that much, and a ROTH is something you want to pursue, a more logical strategy would be to contribute up to the max matching amount in the 401(k), then max the ROTH, then go back to the 401(k). This way you gain the advantages of the IRA (flexibility in investment options, ability to withdraw contributions without penalty, etc.) without losing anything on the 401(k) side.

quote:

I would explore maxing out your 401k and then contributing to your Roth IRA either by normal avenues or a backdoor Roth if your income is high enough.

If you are working towards putting away $25,000 for the year, as in you aren't positive you will be able to set aside that much, and a ROTH is something you want to pursue, a more logical strategy would be to contribute up to the max matching amount in the 401(k), then max the ROTH, then go back to the 401(k). This way you gain the advantages of the IRA (flexibility in investment options, ability to withdraw contributions without penalty, etc.) without losing anything on the 401(k) side.

Posted on 10/15/19 at 9:40 am to EFHogman

If you actually invest your tax savings then the difference won't be much at the end. But, most people won't invest the tax savings from Traditional so Roth ends up being better.

Posted on 10/15/19 at 9:42 am to UpstairsComputer

quote:

Philosophically, the only way to pay for what’s coming is default, print more, or raise taxes.

I have a feeling when these Roths start hitting tax revenues in the future they will raise taxes via a National Sales Tax or something like a VAT. So Roths get hit too (in a way).

Posted on 10/15/19 at 12:03 pm to lsu13lsu

quote:

I have a feeling when these Roths start hitting tax revenues in the future they will raise taxes via a National Sales Tax or something like a VAT. So Roths get hit too (in a way).

In which case the tax advantage of Roth vs Traditional remains the same. The only way the advantage is eroded is if they begin taking income taxes from Roth distributions, which is highly unlikely.

Posted on 10/15/19 at 12:47 pm to DeathAndTaxes

quote:

In which case the tax advantage of Roth vs Traditional remains the same. The only way the advantage is eroded is if they begin taking income taxes from Roth distributions, which is highly unlikely.

I think what the previous poster was saying if you pay taxes on your income now, put it in a roth, and then a national sales tax gets implemented to replace income tax.....you will end up essentially paying income tax twice. In this scenario, traditional would only pay the tax once either way.

Unless I am missing something, in this specific situation, traditional clearly comes out ahead.

Posted on 10/15/19 at 12:54 pm to notsince98

He suggests that the government may "raise taxes via a National Sales Tax or something like a VAT. So Roths get hit too (in a way)". That would be in addition to Federal income taxes, which would remain in place on the Traditional IRA.

Income taxes aren't going away, something could be added to the tax scheme though.

Income taxes aren't going away, something could be added to the tax scheme though.

Posted on 10/15/19 at 1:38 pm to DeathAndTaxes

My point is that if you are betting on Roth because Taxes will have to go up then you may not get any benefit in that area because the taxes may go up via National Sales tax or something similar.

I have a feeling when the government sees these big Roth balances in the future they won't be able to help themselves.

I hear so much "taxes gotta go up". Well yeah, I agree but I think they will do it in a way which hits Roths.

I have a feeling when the government sees these big Roth balances in the future they won't be able to help themselves.

I hear so much "taxes gotta go up". Well yeah, I agree but I think they will do it in a way which hits Roths.

Posted on 10/15/19 at 2:15 pm to lsu13lsu

government likes their money now... not deferred. I don't see ROTHs going anywhere.

If you do an IRA now and then there is a VAT like you mention they aren't going to forget about the lost income from distributions of IRAs, 403bs, 401ks and any other tax deffered accounts. They will tax them at an accelerated VAT rate or some other manner on the backend. The assumption that the government isn't gonna get their tax money from an IRA is absurd.

If you do an IRA now and then there is a VAT like you mention they aren't going to forget about the lost income from distributions of IRAs, 403bs, 401ks and any other tax deffered accounts. They will tax them at an accelerated VAT rate or some other manner on the backend. The assumption that the government isn't gonna get their tax money from an IRA is absurd.

This post was edited on 10/15/19 at 2:16 pm

Posted on 10/15/19 at 2:28 pm to lsu13lsu

And my point is your premise is incorrect. Unless the government decides to start assessing income taxes on Roth distributions, the advantage of the Roth will remain.

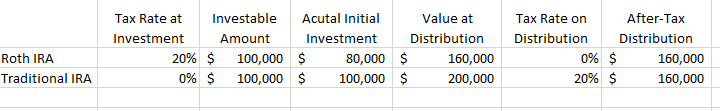

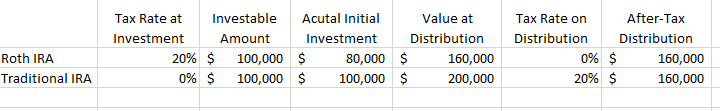

Scenario 1.)

If your income tax rate stayed the same, and there is no additional tax introduced (such as a VAT):

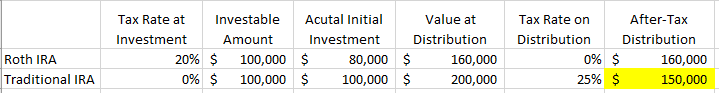

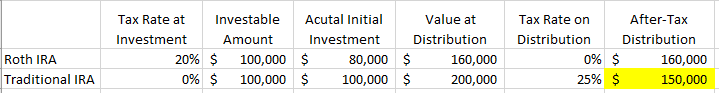

Scenario 2:

If your income tax rate increased, and there is no additional tax introduced (such as a VAT):

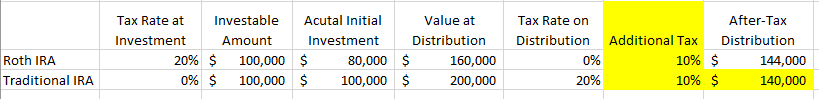

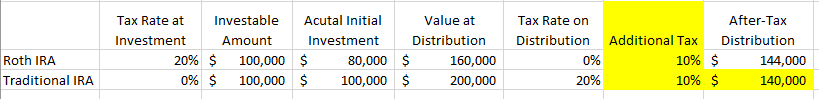

Scenario 3:

If your income tax rate stayed the same, and they introduce an additional tax:

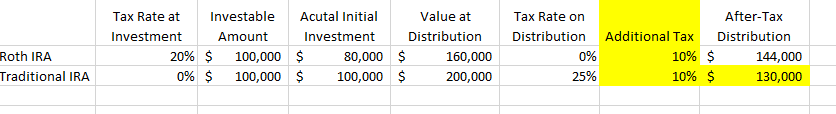

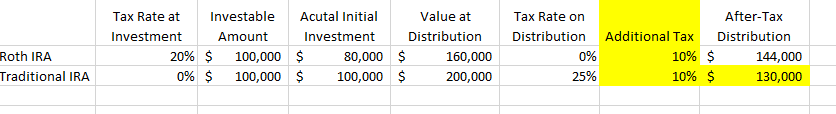

Scenario 4:

If your income tax rate increased, and they introduce an additional tax:

As you can see, the Roth is advantageous even in the scenario where your income tax rate remain the same and an additional type of tax is introduced because they are being assessed on a larger sum of money. Even if that tax is not assessed directly on the distribution (which it most likely wouldn't be), the result would be after-tax neutral.

If your income tax rate increases, the Roth is superior, if your income tax rate falls, the Traditional is superior, just as it is today.

The government is highly unlikely to start assessing income taxes on Roth assets, as that would be double taxation on the contribution amount, something they avoid on individuals currently (exceptions being Social Security benefits and the estate and gift taxes).

Edit: Missed a comma.

Scenario 1.)

If your income tax rate stayed the same, and there is no additional tax introduced (such as a VAT):

Scenario 2:

If your income tax rate increased, and there is no additional tax introduced (such as a VAT):

Scenario 3:

If your income tax rate stayed the same, and they introduce an additional tax:

Scenario 4:

If your income tax rate increased, and they introduce an additional tax:

As you can see, the Roth is advantageous even in the scenario where your income tax rate remain the same and an additional type of tax is introduced because they are being assessed on a larger sum of money. Even if that tax is not assessed directly on the distribution (which it most likely wouldn't be), the result would be after-tax neutral.

If your income tax rate increases, the Roth is superior, if your income tax rate falls, the Traditional is superior, just as it is today.

The government is highly unlikely to start assessing income taxes on Roth assets, as that would be double taxation on the contribution amount, something they avoid on individuals currently (exceptions being Social Security benefits and the estate and gift taxes).

Edit: Missed a comma.

This post was edited on 10/15/19 at 2:32 pm

Posted on 10/15/19 at 3:37 pm to DeathAndTaxes

quote:

if your income tax rate falls, the Traditional is superior, just as it is today.

My entire point is that people think INCOME tax rates will go up because government is incompetent. So Roth is clear winner. I am saying they may raise taxes in some way to hit Roths like a National Sales Tax or something of that nature.

Many people will make less money in retirement so they will be in a lower tax rate so it is important to understand the consequences of blindly saying "Income Taxes will always go up." They may or they may not.

I truly believe the government will want their hands on the Roth and will get it via some kind of wealth or national sales tax and not via income tax.

quote:

The government is highly unlikely to start assessing income taxes on Roth assets

Agreed. No where have I ever said Income Tax on Roth.

ETA: In my example, there would be a Scenerio 5 where tax rates go down for the retiree but a national sales tax or VAT would be charged. In that case, the dollars would be same for traditional or roth because it is based on what you spend. In that case Traditional would be better.

This post was edited on 10/15/19 at 3:42 pm

Posted on 10/15/19 at 4:53 pm to lsu13lsu

quote:

when the government sees these big Roth balances in the future they won't be able to help themselves.

I think you're overestimating the percentage of investable assets in Roth IRA's. As someone who "pushes" the Roth IRA as frequently as possible, I'd say the percentage of the assets I manage in Roth vs Traditional (guessing here) is somewhere in the 90/10 range (if this thread is still going I'll look it up tomorrow). Then you have to consider the 90% of the population who never uses an advisor that doesn't know what a Roth is and all their matching dollars are traditional. And all their pension dollars are traditional. I googled it but that's a tough search.

quote:

Many people will make less money in retirement so they will be in a lower tax rate so it is important to understand the consequences of blindly saying "Income Taxes will always go up."

The argument is the marginal tax bracket will go up. So if you make $100k now, you're in the 24% bracket. Maybe you need 75k in retirement, but if the brackets go back up to literally just 3 years ago (25%) you're in a higher bracket making less money (WTF!?) and this is before whatever crisis happens.

quote:

I truly believe the government will want their hands on the Roth and will get it via some kind of wealth ... tax

This is the correct answer to your scenario. And in fact, if you can actually stomach watching the debates, it is exactly what they're talking about now. And this would effect the Roth IRA's. Because that 10% mentioned above, yeah, they're the ones with the money.

Posted on 10/15/19 at 4:54 pm to EFHogman

Im about to have a Roth 401k option at work in November for the first time.

In a Roth 401k can I still take withdrawal from contributions without penalty like a Roth IRA?

And can I max my existing Roth IRA and the Roth 401k at the same time?

I hope my questions make sense.

In a Roth 401k can I still take withdrawal from contributions without penalty like a Roth IRA?

And can I max my existing Roth IRA and the Roth 401k at the same time?

I hope my questions make sense.

Posted on 10/15/19 at 4:59 pm to lsu13lsu

If your position is that the government is going to lower income tax rate, but increase overall taxes with some additional tax, that seems exceptionally unlikely. Liberals are not going to do away with income taxes to install a consumption or wealth tax, they would just bolt it on to the current system. Conservatives have shown resistance to wealth taxes (obviously), but also have balked at installing consumption taxes, because they fear they would be too easy for Liberals to ramp up when they have control. It doesn't appear that income tax rates are going down from here.

If your position is that income tax rates for individuals naturally go down in retirement, and you aren't suggesting the government will lower income tax rates, then the introduction of another type of tax is irrelevant. This is true now, and would remain true.

IRA assets totaled just over $8 trillion ins 2016, with almost 85% of those assets being held in Traditional IRAs. Roth IRA assets made up only 9% of that number. That is not large enough to target specifically.

If your position is that income tax rates for individuals naturally go down in retirement, and you aren't suggesting the government will lower income tax rates, then the introduction of another type of tax is irrelevant. This is true now, and would remain true.

IRA assets totaled just over $8 trillion ins 2016, with almost 85% of those assets being held in Traditional IRAs. Roth IRA assets made up only 9% of that number. That is not large enough to target specifically.

Posted on 10/15/19 at 5:01 pm to deeprig9

Yes, your questions make sense. Q1: You have to wait 5 years IF the company allows it in the first place (double check my work here). Q2: Yes, assuming you don't make too much money.

Posted on 10/15/19 at 5:03 pm to DeathAndTaxes

Dayyyumm I was close...

quote:

IRA assets totaled just over $8 trillion ins 2016, with almost 85% of those assets being held in Traditional IRAs. Roth IRA assets made up only 9% of that number. That is not large enough to target specifically.

Back to top

9

9