- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: roth 401k vs regular 401k

Posted on 10/17/19 at 3:23 pm to DeathAndTaxes

Posted on 10/17/19 at 3:23 pm to DeathAndTaxes

quote:

Let's say someone retired January 1 of this year, and they need $98,350 a year to live on (I chose this number because it is the amount that brings them to the very top of the 12% bracket.)

If they need $98,000 to live off of. What was the effective tax rate of their Roth contributions? That puts them in at least the 22% category.

Because you just showed the effective rate of their Trad to be 11.61%.

Posted on 10/17/19 at 4:31 pm to baldona

quote:

If they need $98,000 to live off of. What was the effective tax rate of their Roth contributions? That puts them in at least the 22% category.

Because you just showed the effective rate of their Trad to be 11.61%.

Funny you should ask that, because I was just whipping that up.

Let's say our guy made $400,000 a year (spouse didn't work). That means he was firmly in the 32% tax marginal tax bracket. He just happened to make that same amount for the last 30 years of his career (worst case scenario for the Roth, higher income the whole time), and because he didn't read TD, he did't start contributing to his 401k until his last 30 years of work. He contributed $19,000 a year.

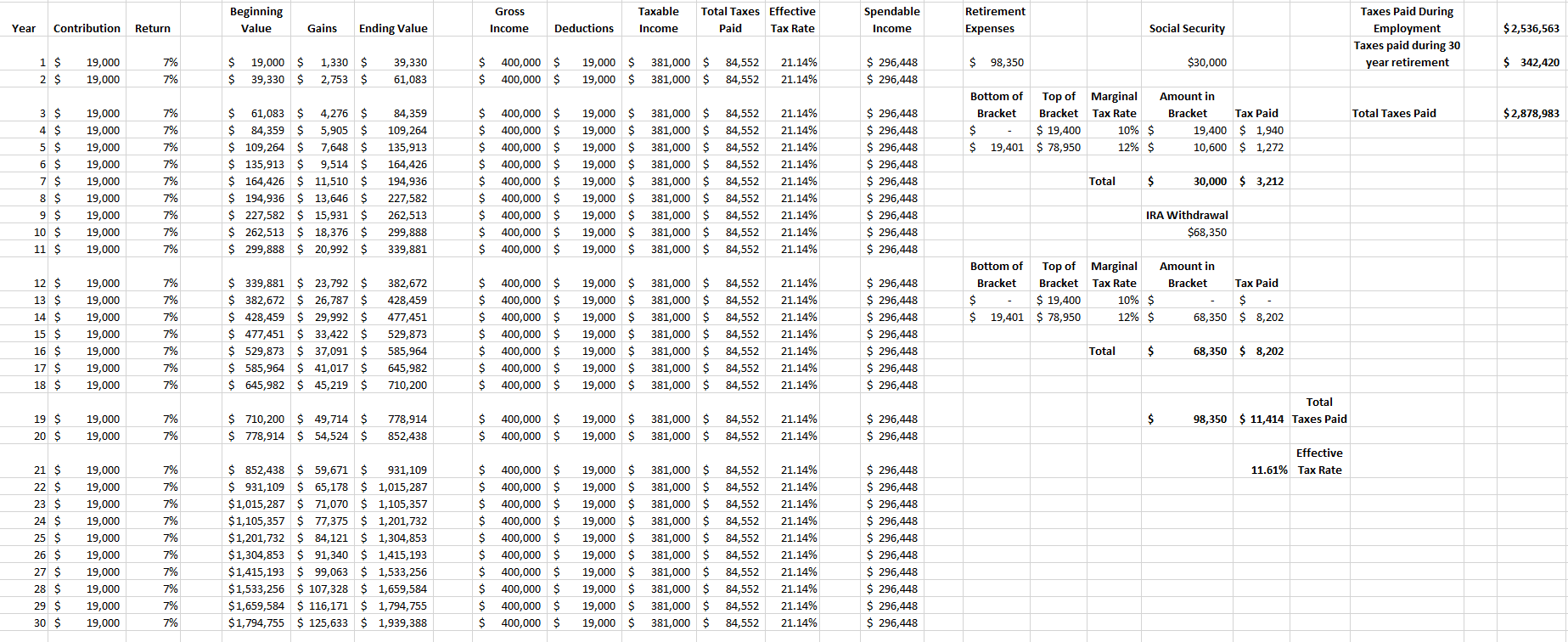

So 30 years of Traditional 401k contributions. Then a 30 year retirement. Lets see how that works out:

I modeled it out how it would actually happen, meaning I put $19,000 in the 401k, and then lowered his taxable income for each year of work by $19,000, and showed the resulting taxes and spendable income. As you can see, he paid $84,552 in taxes every year of work (effective tax rate of 21.14%), which sums to $2,536,563 over 30 years.

If his retirement expenses remained the same for 30 years, and he withdrew the same $68,350 every year, he would pay $342,420 in taxes over the course of his retirement ($11,414 x 30 years).

His total taxes paid over the 60 years of work and retirement would be $2,878,983

But what if our guy actually went and sat down with someone who knew what they were doing and could give him some advice 30 years ago when he started saving?

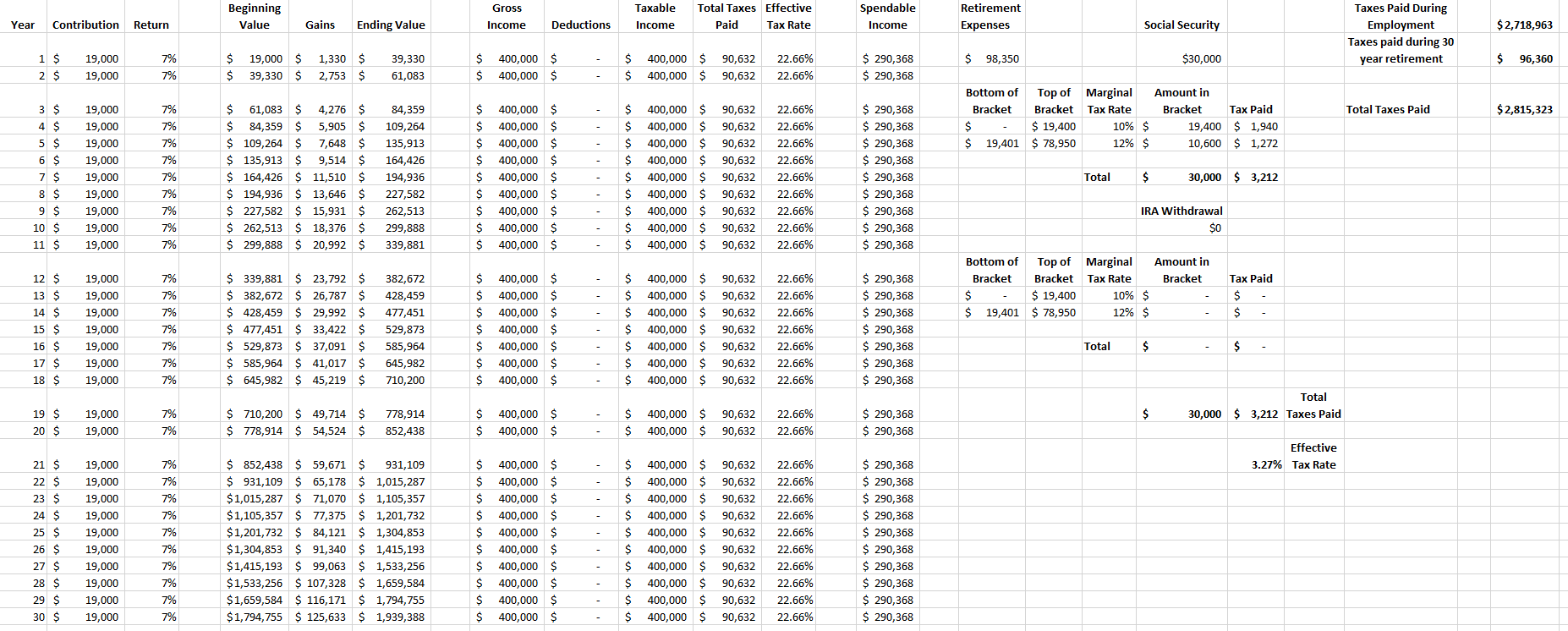

This time, he made Roth 401k contributions instead. I put $19,000 every year into the 401k, but those contributions didn't lower his taxable income. He paid taxes on all $400,000, resulting in $90,632 paid in taxes each year (effective rate of 22.66%), totaling $2,718,963 over his 30 year career.

While retired, he still needs $98,350 a year, but because he is able to withdraw from his Roth assets tax-free, he would only pay taxes on his social security of $30,000 a year. His total taxes each year would be $3,212 (effective tax rate of 3.27%.) He would pay $96,360 in taxes over his retirement ($3,212 x 30 years.)

His total taxes paid over 60 years of work and retirement would be $2,815,323.

Jesus tap dancing Christ! He would pay $63,660 LESS with the Roth? Even with his marginal tax rate going down 20%? What kind of black magic frickery is this?!

The difference in tax rates while working (21.14% for the Traditional, 22.66% for the Roth), is far less impactful than 30 years of the difference in in tax rates while retired (11.61% for the Traditional, 3.27% for the Roth).

Mind you, his spendable income (Gross Income - Deduction - Taxes paid) over his 30 years of work would have been reduced by $182,403 with the Roth. Netted out, over the course of 60 years the Traditional IRA would have given him $118,743 extra dollars. Less than $2,000 a year.

And this is in this very specific scenario, where he was in a high bracket his entire working career, and he cut his spending from $296,448 a year to $98,350. Not very likely. If instead, he needed 75% of his previous spending in retirement, that would be $222,336 a year, meaning he would need to withdraw $192,336 a year from his IRA, resulting in taxes of $44,786 a year, while the Roth would remain at $3,212 a year.

Now we are talking about a difference of $1,064,790 in taxes paid over the course of 60 years. In favor of the Roth.

Come at me bro.

This post was edited on 10/17/19 at 5:08 pm

Posted on 10/17/19 at 5:59 pm to DeathAndTaxes

quote:

Mind you, his spendable income (Gross Income - Deduction - Taxes paid) over his 30 years of work would have been reduced by $182,403 with the Roth. Netted out, over the course of 60 years the Traditional IRA would have given him $118,743 extra dollars. Less than $2,000 a year.

First off well done.

I will have to take a closer look at it certainly.

But, as far as the above. Why does total taxes matter? Who gives a shite about taxes? I care about net income. If my income is higher with one, that is absolutely the preference.

Posted on 10/17/19 at 7:10 pm to baldona

I originally included just the tax difference, but realized that I was inadvertently not telling the whole story, and edited the comment. The additional commentary was to point out that in even in this situation where the marginal tax rate difference at taxation is 20%, an unlikely real life scenario, the difference in net income was small.

Using the more reasonable scenario that I included at the end, the net income difference is $946,044 in favor of the Roth.

Using the more reasonable scenario that I included at the end, the net income difference is $946,044 in favor of the Roth.

Posted on 10/17/19 at 7:12 pm to EFHogman

Do both. The cpa will say all reg401k because they are seeking immediate benefit, financial planner will lean towards Roth because they seek future benefit. But the younger you are the more you should contribute to the Roth. For example, you’re under 30 yo with 30+ years to go, you could prob assume you’ll only make more going forward. And then depending on the situation, as you make more $ you reduce Roth and increase regular. Ideally you want 3 buckets in retirement: Pretax, post tax, and a taxable brokerage account. That way you can spread your tax liability across Ordinary income tax, ordinary income tax,,0% on Roth, and capital gains on brokerage.

Posted on 10/17/19 at 7:36 pm to DeathAndTaxes

quote:

DeathAndTaxes

Woah woah woah. You took $19,000 contributions in the Roth and compared that to $19,000 Trad? Come on. Tell me that’s not so and please tell me you know that’s not how this works?

This post was edited on 10/17/19 at 7:36 pm

Posted on 10/17/19 at 7:47 pm to baldona

Why? The way reality actually works is people make a 401k election, max being $19,000 this year, which is withheld from their paycheck and deposited in their account. If it is a Traditional pre-tax contribution, their taxable income is reduced by the amount of the contribution, if it is a Roth election, their taxable income is not reduced.

That is how it works.

That is how it works.

This post was edited on 10/17/19 at 7:49 pm

Posted on 10/17/19 at 8:02 pm to DeathAndTaxes

quote:

That is how it works.

Wut? So that’s the advice you give to your clients? Any tax savings you tell them just to spend it and not invest?

Interesting

Posted on 10/17/19 at 8:07 pm to baldona

Perhaps your suggestion is that the taxed amount that was “saved” amount each year by choosing the Traditional over the Roth, $6,080 in this case ($19,000 x 32%), was not invested elsewhere.

First of all, most folks simply don’t do that. They make whatever contribution they can to their 401k (very few max out), and certainly pay no mind to investing the tax difference.

Second, the amount that is “missing” are the gains only, because the principal was accounted for in the net income calculation, and depending on income level, those would be taxed at 15% at distribution. I don’t have my spreadsheet here at home, but I assure you it wouldn’t make up a $944,000 difference.

First of all, most folks simply don’t do that. They make whatever contribution they can to their 401k (very few max out), and certainly pay no mind to investing the tax difference.

Second, the amount that is “missing” are the gains only, because the principal was accounted for in the net income calculation, and depending on income level, those would be taxed at 15% at distribution. I don’t have my spreadsheet here at home, but I assure you it wouldn’t make up a $944,000 difference.

Posted on 10/17/19 at 8:19 pm to baldona

I would think you would have gotten tired of people showing how you are talking out your arse, but ok.

The only instance where that would be a consideration is if the client is maxing out their 401k election, has capitalized on a backdoor Roth if they can, and still want to save additional funds. Which would be the case in either election scenario for the example person.

People with an actual financial plan target a certain amount of savings for the year, calculated by a need in the future, add in a margin of error, and then save that amount. And then they enjoy the rest of their money.

“Save what you can” or “Save whatever is left” are not plans. Those are reactions.

The only instance where that would be a consideration is if the client is maxing out their 401k election, has capitalized on a backdoor Roth if they can, and still want to save additional funds. Which would be the case in either election scenario for the example person.

People with an actual financial plan target a certain amount of savings for the year, calculated by a need in the future, add in a margin of error, and then save that amount. And then they enjoy the rest of their money.

“Save what you can” or “Save whatever is left” are not plans. Those are reactions.

This post was edited on 10/17/19 at 8:22 pm

Posted on 10/17/19 at 8:34 pm to DeathAndTaxes

Lol, ok man. Mr. Professional here telling us how we should do it. Yet you don't tell your people to reinvest their tax savings from a Trad 401k over a Roth? Give me a break.

This is exactly why people with money have a good lawyer, good accountant, and good financial adviser. Because their financial adviser doesn't know their taxes like they think they do and their accountant doesn't know their investing like they think they do.

Any comparison X to X with a Roth and Trad is obviously going to come out better for the Roth. That's a ludicrous argument.

If you save money on taxes by investing in a Trad 401k, you should absolutely invest your savings in either a Roth IRA or taxed account.

This is exactly why people with money have a good lawyer, good accountant, and good financial adviser. Because their financial adviser doesn't know their taxes like they think they do and their accountant doesn't know their investing like they think they do.

Any comparison X to X with a Roth and Trad is obviously going to come out better for the Roth. That's a ludicrous argument.

If you save money on taxes by investing in a Trad 401k, you should absolutely invest your savings in either a Roth IRA or taxed account.

Posted on 10/18/19 at 8:59 am to UpstairsComputer

quote:

So I’d pay my tax in a lower tax environment depending on your circumstances.

I don't disagree with the logical, but I think too often people don't consider the very real possibility of the tax law changing...

Just look at the history of the taxability of Social Security benefits if you need proof that income you thought wouldn't be taxable can become taxable. One of the best professors I had in college (who taught Tax Seminar) always told his students that he'd take the tax break NOW if given the choice.

Posted on 10/18/19 at 12:08 pm to OMapologist

quote:

take the tax break NOW if given the choice

And counter-intuitively, paying the taxes is taking the tax break now.

Posted on 10/18/19 at 12:16 pm to DeathAndTaxes

For what it's worth, seeing how frustrations are rising, I don't recommend this either.

While it sounds like a great idea on the surface, the truth is, people do traditional now to *save* money on taxes so they can get a larger paycheck for spending, not so they can save more.

I wrote a script for it if you want to use it:

Advisor: "Mr. & Mrs. Client, I'd like you to up your 401k contributions to the max so we can save $8,000 in taxes per year. Then we'll take that money and invest it too. It'll be great for your future, but it's going to cost you $16,000 extra per year. What do you think?"

Mr. & Mrs. Client: "Hell no."

/scene

While it sounds like a great idea on the surface, the truth is, people do traditional now to *save* money on taxes so they can get a larger paycheck for spending, not so they can save more.

I wrote a script for it if you want to use it:

Advisor: "Mr. & Mrs. Client, I'd like you to up your 401k contributions to the max so we can save $8,000 in taxes per year. Then we'll take that money and invest it too. It'll be great for your future, but it's going to cost you $16,000 extra per year. What do you think?"

Mr. & Mrs. Client: "Hell no."

/scene

Posted on 10/18/19 at 1:21 pm to UpstairsComputer

quote:

For what it's worth, seeing how frustrations are rising, I don't recommend this either.

While it sounds like a great idea on the surface, the truth is, people do traditional now to *save* money on taxes so they can get a larger paycheck for spending, not so they can save more.

I wrote a script for it if you want to use it:

Advisor: "Mr. & Mrs. Client, I'd like you to up your 401k contributions to the max so we can save $8,000 in taxes per year. Then we'll take that money and invest it too. It'll be great for your future, but it's going to cost you $16,000 extra per year. What do you think?"

Mr. & Mrs. Client: "Hell no."

/scene

I'm not sure if you meant to reply to me, or were just seconding my statement, but this exactly what occurs in the real world.

Client's ask me if they should make their election as a Traditional or a Roth, and we .look at the specifics of their situation. Many of them are not maxing out anyway, which is the ONLY case where this question occurs. If someone can part with $10,000 for their 401k election, because expenses exhaust the rest of their income, the ability to invest the "savings" is moot. They are not going to say:

"Well, since I chose the Traditional election (the standard option), I can take that $2,000 I saved (but never saw, because it's not actual cashflow, just a reduction on taxable income, and thus ultimately taxes owed), and invest that money in a taxable account."

Just like they don't say:

"Well, since I chose the Roth election, I better only contribute $8,000 to my 401k, so I can set aside that other $2,000 for the current tax liability of that contribution."

Nope, they just make their election and go about living their life.

Of course for people who have exhausted their 401k election we look for the next best option. That is what contribution planning is, maximizing the utility (After Tax value, Liquidity, creditor protection, etc.) of the next incremental dollar, or "most bang for your buck."

Because I can't stop myself, I did all the math you are requesting and then some Mr. "I don't know how marginal tax brackets (or math) works". I will include it later, because I'm not here "telling people how they should do it", I am showing them, and they can make their own decisions, based on their situation.

Posted on 10/18/19 at 1:48 pm to DeathAndTaxes

The latter, I agree with you. I don't think it was necessarily a bad point in principal by Baldona, but the reality is just as you explain it.

I've never had one person ask what to do with the tax savings.

The script was an attempt at levity, you can use it whenever you'd like.

I've never had one person ask what to do with the tax savings.

The script was an attempt at levity, you can use it whenever you'd like.

Posted on 10/18/19 at 10:34 pm to UpstairsComputer

wow, reading this thread has made me realize there isn't a perfect way to go so i'll just continue to max out HSA (as i think that is the best option ever especially when the money is making 3% an not ever taxed), then go half and half and let the chips (taxes) fall where they may.

thanks for the good read.

thanks for the good read.

Popular

Back to top

1

1