- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

State Income Tax: Florida vs. Louisiana

Posted on 11/19/25 at 1:51 pm

Posted on 11/19/25 at 1:51 pm

If 4.5 million enough of a reason to choose Florida over LSU if the reported contract from both is 10 years at 15 million?

State Income Tax Comparison for $15 Million Annual Income (2025 Rates)Based on 2025 tax rules, Florida has no state income tax, so you'd pay $0 in state taxes each year, or $0 total over 10 years.Louisiana switched to a flat 3% state income tax rate on all taxable income starting January 1, 2025. For $15 million in annual income:Annual state tax: 3% × $15,000,000 = $450,000

Total over 10 years: $450,000 × 10 = $4,500,000

This assumes the full income is subject to state tax (e.g., no major deductions or credits factored in) and you're a resident of the state. Actual taxes could vary based on filing status, other income sources, or federal interactions—consult a tax professional for your specifics. These figures exclude federal income tax, which would be the same in both locations.

State Income Tax Comparison for $15 Million Annual Income (2025 Rates)Based on 2025 tax rules, Florida has no state income tax, so you'd pay $0 in state taxes each year, or $0 total over 10 years.Louisiana switched to a flat 3% state income tax rate on all taxable income starting January 1, 2025. For $15 million in annual income:Annual state tax: 3% × $15,000,000 = $450,000

Total over 10 years: $450,000 × 10 = $4,500,000

This assumes the full income is subject to state tax (e.g., no major deductions or credits factored in) and you're a resident of the state. Actual taxes could vary based on filing status, other income sources, or federal interactions—consult a tax professional for your specifics. These figures exclude federal income tax, which would be the same in both locations.

This post was edited on 11/19/25 at 1:54 pm

Posted on 11/19/25 at 1:53 pm to broadhead

He don’t care about the money he cares about the nil funding

Posted on 11/19/25 at 1:54 pm to broadhead

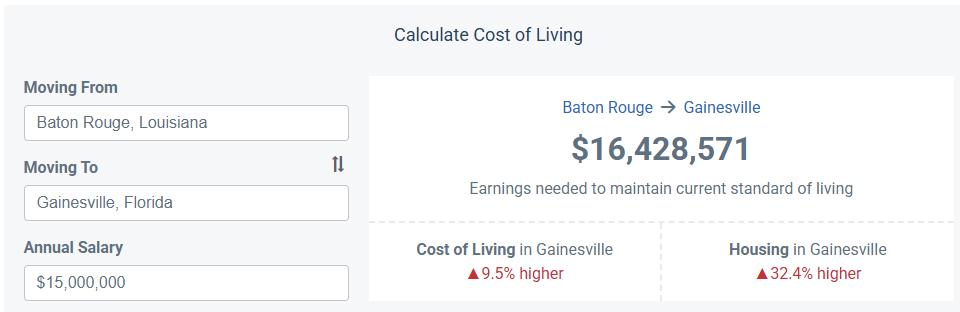

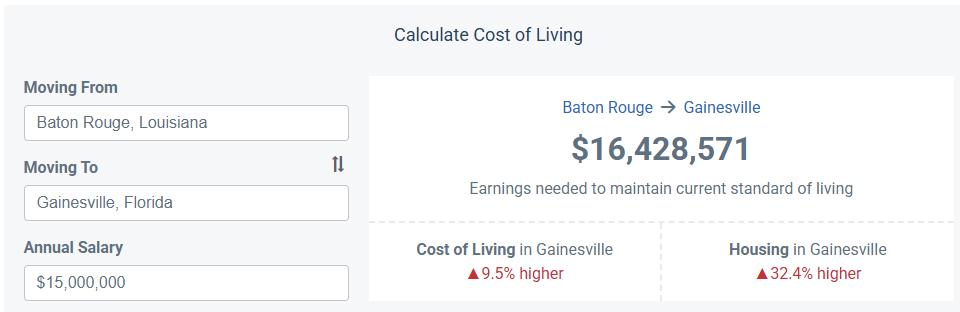

What about the land tax?

What about the cost of living?

What about the cost of living?

Posted on 11/19/25 at 1:55 pm to Islandboy777

Cost of living in Fla is very very high. Compared to Louisiana.

Posted on 11/19/25 at 1:56 pm to broadhead

Lane will make a decision based on where he wants to coach in hopes of winning a national championship. All of the rest is secondary.

Posted on 11/19/25 at 1:57 pm to broadhead

Now do property tax comparisons!

Posted on 11/19/25 at 2:00 pm to safetyman

Back in 2016 I rented a 2edroom apartment for 3200 month outside of Tampa

Posted on 11/19/25 at 2:14 pm to broadhead

quote:

State Income Tax Comparison for $15 Million Annual Income (2025 Rates)Based on 2025 tax rules, Florida has no state income tax, so you'd pay $0 in state taxes each year, or $0 total over 10 years. Louisiana switched to a flat 3% state income tax rate on all taxable income starting January 1, 2025. For $15 million in annual income: Annual state tax: 3% × $15,000,000 = $450,000

Total over 10 years: $450,000 × 10 = $4,500,000

So increase his salary by 450K over what Florida offers him yearly.

Problem solved.

Posted on 11/19/25 at 2:15 pm to broadhead

When you got that kind of money there are always ways to play the tax game

Posted on 11/19/25 at 2:15 pm to broadhead

Now do property tax on Florida higher cost of homes.

Posted on 11/19/25 at 2:17 pm to broadhead

Don't forget he'll more than make up for that lost money in sponsorships from businesses like Canes

Posted on 11/19/25 at 2:18 pm to broadhead

I guarantee you that because of tax codes LSU will be paying more than Florida accordingly.

Posted on 11/19/25 at 2:19 pm to WhyAreWeHere

quote:

Now do property tax comparisons!

They aren’t that different

Posted on 11/19/25 at 2:32 pm to broadhead

Check out Florida’s property tax

Posted on 11/19/25 at 2:35 pm to Commander Rabb

quote:

Check out Florida’s property tax

Floridas property taxes (in Gainesville especially) are a lot less than the delta of Louisiana’s income tax and property taxes. And let’s not even start with sales tax and other excise taxes

At least the third idiot in this thread

Posted on 11/19/25 at 3:29 pm to broadhead

Let's just use a cost of living calculator to see how this plays out.

https://www.payscale.com/cost-of-living-calculator/Florida-Gainesville

>

>

Looks like if UF and LSU are offering the same amount, UF is actually offering less.

https://www.payscale.com/cost-of-living-calculator/Florida-Gainesville

>

> Looks like if UF and LSU are offering the same amount, UF is actually offering less.

Posted on 11/19/25 at 3:30 pm to broadhead

LSU will give incentive to offset this. They're not dumb.

Posted on 11/19/25 at 3:30 pm to broadhead

He would 100% be able to get out of his Louisiana income taxes just like every other millionaire here does

Popular

Back to top

15

15