- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Home sales tanked in May

Posted on 6/25/25 at 10:44 am

Posted on 6/25/25 at 10:44 am

quote:CNBC

Sales of new single-family homes dropped 13.7% in May compared with April to 623,000 units on a seasonally-adjusted, annualized basis, according to the U.S. Census.

That sales total was 6.3% lower than May 2024 and well below both the 6-month average of 671,000 and the one-year average of 676,000. It also lags the pre-pandemic average in 2019 of 685,000 units sold.

Wall Street analysts were expecting May new home sales of 695,000, according to estimates from Dow Jones.

This count is based on signed contracts, so people out shopping in May, when mortgage rates remained stubbornly high.

The average rate on the 30-year fixed mortgage started May at 6.83%, rose steadily to just over 7% and then settled back at 6.95% by the end of the month, according to Mortgage News Daily.

At some point you'd think prices would start dropping sharply.

This post was edited on 6/25/25 at 1:36 pm

Posted on 6/25/25 at 10:45 am to bigjoe1

Yet, I feel half the people I know are realtors.

Posted on 6/25/25 at 10:46 am to bigjoe1

quote:

At some point you'd think prices would start dropping sharply.

It's simply amazing to me they haven't, although locally (we're in one of the worst markets by % I think) I have seen it.

Posted on 6/25/25 at 10:50 am to SlowFlowPro

I'm in Huntsville/Madison, Al. and builders are throwing up homes and multifamily properties like there is no tomorrow. I do know some new apt. complexes are way behind on their occupancy projections.

Posted on 6/25/25 at 11:06 am to rpg37

quote:

Yet, I feel half the people I know are realtors.

3% of those numbers is about $10B

Posted on 6/25/25 at 11:41 am to bigjoe1

quote:

Home sales tanked i May

Good

quote:

At some point you'd think prices would start dropping sharply.

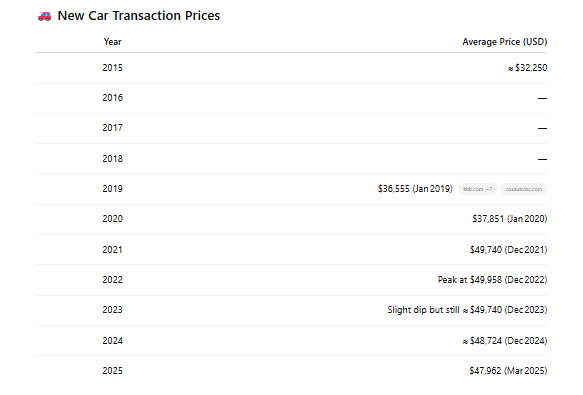

This is why

The car market has started to correct (slightly), time for housing

Posted on 6/25/25 at 11:41 am to bigjoe1

quote:

builders are throwing up homes and multifamily properties like there is no tomorrow

Same here in South FL. They are offering all kinds of incentives and discounts, now. Inventory of new homes is shooting up, as opposed to a couple of years ago, when there were bidding wars and a 2 year wait for a new build in some areas.

I sold my house last fall and have been renting. Will buy when we get the right opportunity.

Posted on 6/25/25 at 12:12 pm to bigjoe1

quote:

I'm in Huntsville/Madison, Al. and builders are throwing up homes and multifamily properties like there is no tomorrow. I do know some new apt. complexes are way behind on their occupancy projections.

Same area. Neighbor’s house sat on the market for over a year. Finally sold in May. A lot of people were hoping mortgage rates would fall.

Posted on 6/25/25 at 12:17 pm to bigjoe1

I bought a new home and relocated to South Florida about 5 years ago and the area I live in never slowed down. Until now. We are seeing the slow down and rise in new home inventory that the rest of the country has been seeing now.

Posted on 6/25/25 at 12:39 pm to LanierSpots

quote:

I'm in Huntsville/Madison, Al. and builders are throwing up homes and multifamily properties like there is no tomorrow. .

Ditto for Lee County

Posted on 6/25/25 at 1:06 pm to SlowFlowPro

quote:

It's simply amazing to me they haven't

As much as demand has dropped off, so has supply.

Like 80% of homeowners have a 4% or less interest rate on their mortgage and more homeowners than ever (about 40%) have no mortgage at all.

Home price appreciation so far outpaced rate increases that even a very substantial drop in housing prices would still result in a significantly higher note for prospective home buyers vs their current situation.

There aren't many buyers at these prices, but there aren't that many sellers who want a sell their house and get into a new mortgage at 2025 rates.

The only people who are buying and selling right now are people who are being forced to (job related or divorce etc). That's a relatively small subset of the residential buyer/seller pool.

Posted on 6/25/25 at 1:25 pm to bigjoe1

Just sold my higher end Huntsville home in 30 days. Might have been a bit of luck, but It’s still a decent market. Apartment construction however is insane.

Posted on 6/25/25 at 2:00 pm to JohnnyKilroy

quote:

It's simply amazing to me they haven't As much as demand has dropped off, so has supply. Like 80% of homeowners have a 4% or less interest rate on their mortgage and more homeowners than ever (about 40%) have no mortgage at all.

This is the simple reality. Barring life events, the majority of people have two decades remaining on their low interest mortgages, and they’ll wait out the buyers looking for discount.

All the millennials that changed their minds about preferring memories and mobility over mortgages isn’t helping the supply side either.

Posted on 6/25/25 at 2:03 pm to bigjoe1

There are a lot of houses not selling in my market because they are overpriced. I think prices will come down.

Posted on 6/25/25 at 2:24 pm to Auburn80

Lot of people denying reality. The price cuts are coming.

I know a lot of people who are selling but have unrealistic expectations for prices. Once their homes sit longer they'll start realizing they need to sell at a loss.

I know a lot of people who are selling but have unrealistic expectations for prices. Once their homes sit longer they'll start realizing they need to sell at a loss.

Posted on 6/25/25 at 2:25 pm to Auburn80

Mortgage rates hovering near 7% will dampen the thirst. People aren’t “trading up” because they are sitting on 3% mortgages in their current home. Math gets in the way of making the upgrade.

Posted on 6/25/25 at 2:28 pm to ynlvr

quote:

Mortgage rates hovering near 7% will dampen the thirst. People aren’t “trading up” because they are sitting on 3% mortgages in their current home. Math gets in the way of making the upgrade.

And common sense gets in the way of sellers realizing the market has turned. A lot of "But I bought it for $650k I should be able to sell it for at least that."

Posted on 6/25/25 at 2:50 pm to JohnnyKilroy

quote:

The only people who are buying and selling right now are people who are being forced to (job related or divorce etc). That's a relatively small subset of the residential buyer/seller pool.

Living in a South Florida town that has a high percentage of retirees, I see that the reality of the situation is that there are many that are being forced to sell - either the owner has died or can no longer take care of their house.

In addition, there are a lot of folks who are switching houses, but paying cash. Either they want a bigger or smaller house. Either way, the interest rates don't affect them.

In addition, according to the Federal Reserve Economic Data, there were 343 houses for sale in Indian River County when I moved down here in Jan of 2022. Today, there are over ten times that number (as of April). The reality is that inventory is going up rapidly and it's going to take some time to bring it down.

The other statistic that shocked me is that the average initial asking price in Indian River County is $430K and the average sales price is $365k. that means the average discount is $65K, and I believe it. As one realtor said, "It's about time for buyers to start insulting the sellers", meaning the buyers need to not worry that their offer will insult the seller. If the house has been on the market for 6 months and not getting any showings, an insulting offer may not be so bad...

I'm seeing similar houses in the same neighborhood go for drastically different prices. We went to two open houses in the same neighborhood 3-4 months ago, both were pool homes of similar size and condition, but one sold for $130k less than the other one did. Not sure if there were underlying factors, but probably the difference was a motivated seller vs a patient one.

Posted on 6/25/25 at 5:11 pm to Florida_Man1981

quote:

And common sense gets in the way of sellers realizing the market has turned. A lot of "But I bought it for $650k I should be able to sell it for at least that."

That’s also irrelevant. That 650k@3.0% was $2,700/mo.

If those people simply want to move to an equivalent house it’s now $4,100/mo @6.5%

To keep the same mortgage payment, they now need to find an equally motivated seller that will discount their $650k home to $400k, and they need to eat every dollar less than they originally paid.

In ‘09 people could just walk alway from their mortgages and rent an apartment to get back on their feet. Good luck walking away from a mortgage today and expecting to find an apartment that doesn’t cost more than your mortgage.

Posted on 6/25/25 at 5:37 pm to Jax-Tiger

I've got neighbors that bought about 2.5-3 years ago but stretched to make it work. Now they are trying to sell because didn't get raise/promotion as they'd hoped and expenses are mounting. I suspect they may have took out an ARM to make payment work and hoped to refi but rate is up. Their plan is to move to a slightly cheaper hood and rent. All that to say they have had to lower price and asking less than purchase price. 3 years ago this hood was going above ask w bidding wars. Zoned for good schools in a county consistently ranked top 3 in FL (#1 by some counts) Still zero offers after 2-3 months during peak moving season for families.

This post was edited on 6/25/25 at 5:39 pm

Popular

Back to top

10

10