- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Will 30 year mortgage rates ever see 4.5% again?

Posted on 7/18/24 at 2:41 am

Posted on 7/18/24 at 2:41 am

In February 2022, my wife and I decided to build our forever home. Rates were low and the time was right to start our build, but there were a lot of uncertainties. Lumber costs at the time were high due to Covid and storm we had in August. As luck would have it, our windows were late and things were always delayed and cost us valuable time because homes that were being built within 10 months were now taking 12-13 months. Because we didn’t lock in a rate when we did the construction loan,(our bank didn’t allow this) it hurt us. We finally locked in at 6.75%. Any chance we see it drop to the mid 4% range?

Posted on 7/18/24 at 4:52 am to shoelessjoe

I think so but that might take 2-3 years

Posted on 7/18/24 at 6:12 am to shoelessjoe

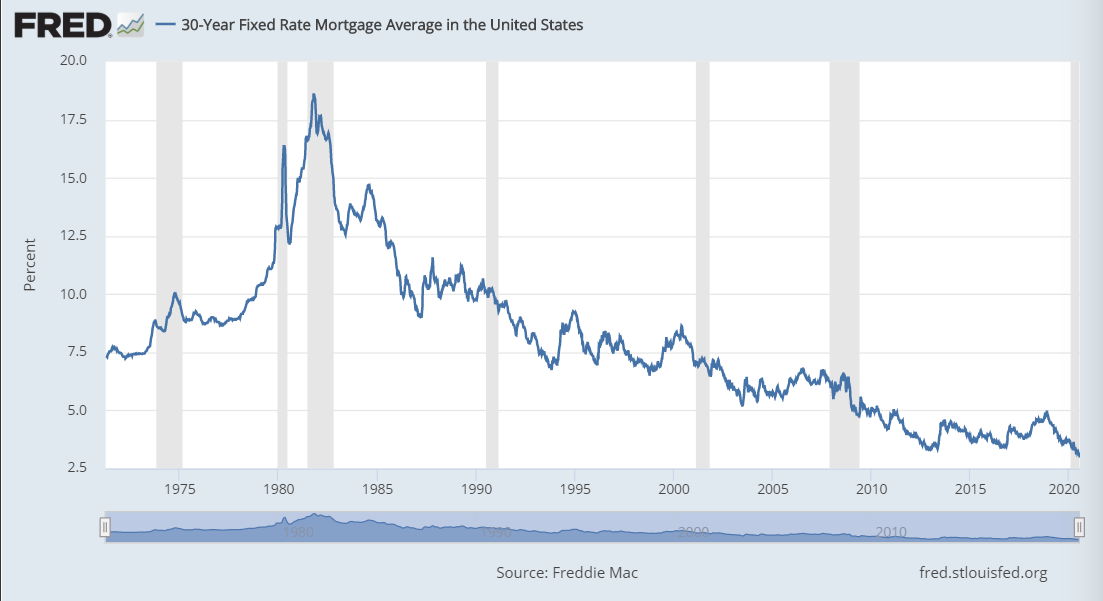

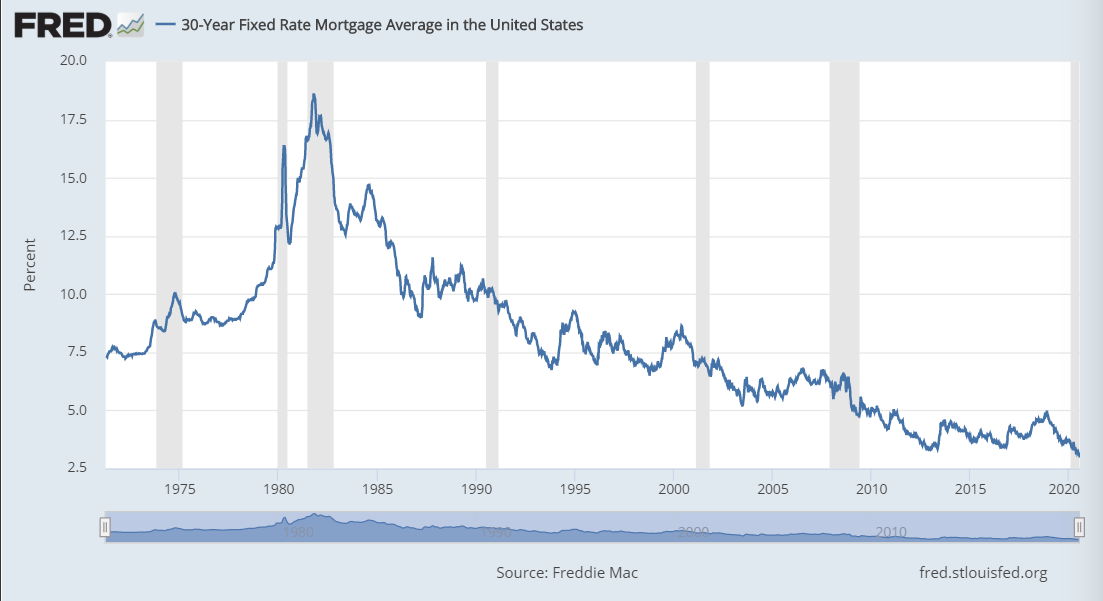

The Feds are hinting at a drop. But Trump is calling for them to stay the same or else inflation will spring back. There is more than one financial guru suggesting the next 10 years will have high interest rates. Hell, my first house loan in '79 was at 10.95--a special rate at the time. Rates were as high as 18% before they started heading down. It took about 15 years to drop to 7%. Face it for you, it might be as good as it gets for a while. Check this out, we might be in a repeat cycle. Mortgage rates over the years chart

Posted on 7/18/24 at 7:03 am to Enadious

My interest rate on my first home was 6.2% and I thought that was pretty good at the time. My macro level take is that the fed used QE to combat the GFC. Then they didn’t take their foot off the gas and we got 3% rates. I think 5-6% is more likely the norm and <4% and >9% are the exceptions.

Just my humble opinion.

Just my humble opinion.

Posted on 7/18/24 at 7:05 am to shoelessjoe

It will but likely to take a few years. It won’t happen fast.

You can always refinance and do an adjustable loan btw.

You can always refinance and do an adjustable loan btw.

Posted on 7/18/24 at 7:07 am to shoelessjoe

I haven’t had a mortgage in years so hoping they drop back. Usually that means prices will increase which is all that matters to me.

Last time interest rates were 3-4% I sold my house for double what I paid. Wash and repeat.

Last time interest rates were 3-4% I sold my house for double what I paid. Wash and repeat.

Posted on 7/18/24 at 7:32 am to Enadious

quote:

The Feds are hinting at a drop. But Trump is calling for them to stay the same or else inflation will spring back.

Source? The only thing I've seen is Trump saying they shouldn't lower rates before the election. I haven't seen anything that would alter his previous positions that he would want rates lowered once he was president. Have I missed something?

Posted on 7/18/24 at 7:42 am to Joshjrn

quote:

The only thing I've seen is Trump saying they shouldn't lower rates before the election.

Well, I said Trump said they shouldn't lower rates. You agree.

Posted on 7/18/24 at 8:36 am to Enadious

quote:

Mortgage rates over the years chart

I would love to see housing costs as a percentage of income overlaid on that chart. I'm not accusing you of saying this, but most Boomers saying "You kids have it easy. I had a 14% rate on my first house" ignore that the cost of housing as a percent of income has dramatically increased in most markets. A $100k house in 1982, if only adjusted for inflation, should only be $325k, but those houses are realistically going for way more in most healthy metro areas. I really feel for first-time home-buyers in the market right now. I'm an older millenial, and I got lucky. I had enough time to recover after 2008 and get a decently priced house before the market went nuts. Refi'd from 4.25% down to 2.875% a few years ago.

OP, no one has a crystal ball. If someone forced me to put money on it, I'd say in 18-24 months it should settle down closer to your range, but that's purely a guess.

Posted on 7/18/24 at 8:49 am to Joshjrn

quote:

Source? The only thing I've seen is Trump saying they shouldn't lower rates before the election. I haven't seen anything that would alter his previous

The sentiment is VERY strong that there will be a rate drop in September. Data backs it up. Cpi, ppi, jobs, and other factors giving solid rationale for a rate drop.

Fed chief talked this week about things looking favorable without saying outright that they would drop.

Posted on 7/18/24 at 8:52 am to BottomlandBrew

HIstorically 5-6% is average. We just got used to low interest rates, but that's not historically normal nor is it historically common what so ever.

Mortgage interest rates are tied to other interest rates, its all a give and take. We are making more money in CD's, Treasuries, Bonds, etc. but Mortgages are higher.

Personally, if you are at 6.75% I'm not sure I'd be overly concerned right now. Its not amazing, but realistically getting under 5% IMO is not likely anytime soon.

ETA: Here's a chart since 1970, soyou can see 5-7.5% is rather normal

Mortgage interest rates are tied to other interest rates, its all a give and take. We are making more money in CD's, Treasuries, Bonds, etc. but Mortgages are higher.

Personally, if you are at 6.75% I'm not sure I'd be overly concerned right now. Its not amazing, but realistically getting under 5% IMO is not likely anytime soon.

ETA: Here's a chart since 1970, soyou can see 5-7.5% is rather normal

This post was edited on 7/18/24 at 8:55 am

Posted on 7/18/24 at 8:55 am to Joshjrn

quote:

Source? The only thing I've seen is Trump saying they shouldn't lower rates before the election. I haven't seen anything that would alter his previous positions that he would want rates lowered once he was president. Have I missed something?

Obviously

quote:

Traders see the odds of a Fed rate cut by September at 100%

PUBLISHED TUE, JUL 16 2024 10:24 AM EDTUPDATED TUE, JUL 16 2024 11:58 AM EDT

And you can listen to what Waller and Williams said yesterday along with Jeromes comments

When they cut rates will get into mid 5s could get some high 4s

But having a 5-6% mortgage rate when looking at it historically is fantastic

Posted on 7/18/24 at 8:58 am to shoelessjoe

Think we see 4.5% in the next few years but don't think we see 2.5 to 3% for a long long time.

Posted on 7/18/24 at 9:05 am to Enadious

quote:

The Feds are hinting at a drop.

I don’t doubt they drop rates, but they’ve been saying that for two years now. It kind of feels like:

Posted on 7/18/24 at 9:19 am to Enadious

quote:

Well, I said Trump said they shouldn't lower rates. You agree.

Saying they shouldn’t lower rates in the next four months != shouldn’t lower rates.

OP was clearly asking a long term question; giving a short term answer to a long term question and then pretending as though what you said is anything other than incomplete at best and misleading at worst begs credulity, in my opinion.

Posted on 7/18/24 at 9:21 am to SDVTiger

quote:

Obviously

That’s responsive to my question of what I missed regarding Trump’s position on rate drops… how?

Posted on 7/18/24 at 9:23 am to shoelessjoe

They'll probably go that low at some point again when we have a recession.

Posted on 7/18/24 at 9:26 am to Joshjrn

quote:

That’s responsive to my question of what I missed regarding Trump’s position on rate drops… how?

Posted on 7/18/24 at 9:29 am to SDVTiger

quote:

SDVTiger

Ah, so it isn’t. Cool. Just wanted to make sure

Posted on 7/18/24 at 9:32 am to shoelessjoe

Maybe. Frankly, 4.5 to 5.5 would be a good range for mortgage rates to sit for the long term. While not that bad, 7 (I once held a mortgage at 7%) starts to hurt. On the other hand, folks were spoiled to ~3 for so long, money was practically free.

Nothing's free - at least not forever.

Nothing's free - at least not forever.

Popular

Back to top

16

16