- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Tomorrow's CPI. Lower than expected?

Posted on 9/12/22 at 2:30 pm

Posted on 9/12/22 at 2:30 pm

Would a lower than expected CPI lead to fed only hiking rates 50 basis pts v 75 triggering a stock rally leading up to the election?

Posted on 9/12/22 at 2:34 pm to SmackoverHawg

I think 75 is locked in. That may not be a bad thing for the market.

Posted on 9/12/22 at 3:11 pm to SmackoverHawg

75 is a lock, maybe 50 at the next meeting.

I still think JP has no balls, if the market starts to collapse, he'll take his foot off the gas.

I still think JP has no balls, if the market starts to collapse, he'll take his foot off the gas.

Posted on 9/12/22 at 3:40 pm to SmackoverHawg

I would think they set up for it to be high so when it comes back “lower”, it’s better than expected for the market.

Posted on 9/12/22 at 3:44 pm to SmackoverHawg

I predict the administration will be pushing Core CPI hard. Energy and food have continued to rise and that doesn't look to change anytime soon.

If they were really wanting to influence the election, they would hit another .75 increase at the end of this month and make lots of noise about another .75 for November but then only go with .5 or even .25 (their meeting is just under a week from election day).

If they were really wanting to influence the election, they would hit another .75 increase at the end of this month and make lots of noise about another .75 for November but then only go with .5 or even .25 (their meeting is just under a week from election day).

Posted on 9/12/22 at 4:15 pm to Bard

Energy has gone down pretty significantly here lately.

Posted on 9/12/22 at 5:00 pm to Shepherd88

quote:

Energy has gone down pretty significantly here lately.

That was my thought. Home prices down as well, not sure how rents are doing. Oil prices will run again once Biden's release of the strategic reserves is done, but we won't really see the effects until after mid-terms.

Posted on 9/12/22 at 5:17 pm to j1897

quote:

I still think JP has no balls, if the market starts to collapse, he'll take his foot off the gas.

It's a paradox. The longer unemployment stays low, the harder they will hike which will cause the crash to be worse. They are basically 1 year behind the curve CUTTING rates just like they were 1 year behind raising them. Without cuts energy investment won't happen therefore CPI remains elevated/volatile. It's kind of hilarious watching them make the problem they are trying to fix worse.

Posted on 9/12/22 at 5:19 pm to SmackoverHawg

quote:

Home prices down as well

That's why I think the Fed has no idea what they're doing. They are using a backwards looking measurement where owner's equivalent rent, which takes multiple years to price in rent increases fully, is 1/3 of it.

Posted on 9/12/22 at 8:49 pm to Shepherd88

quote:

Energy has gone down pretty significantly here lately.

I think you may be thinking of gasoline. That's energy, but its not the entirety of the category.

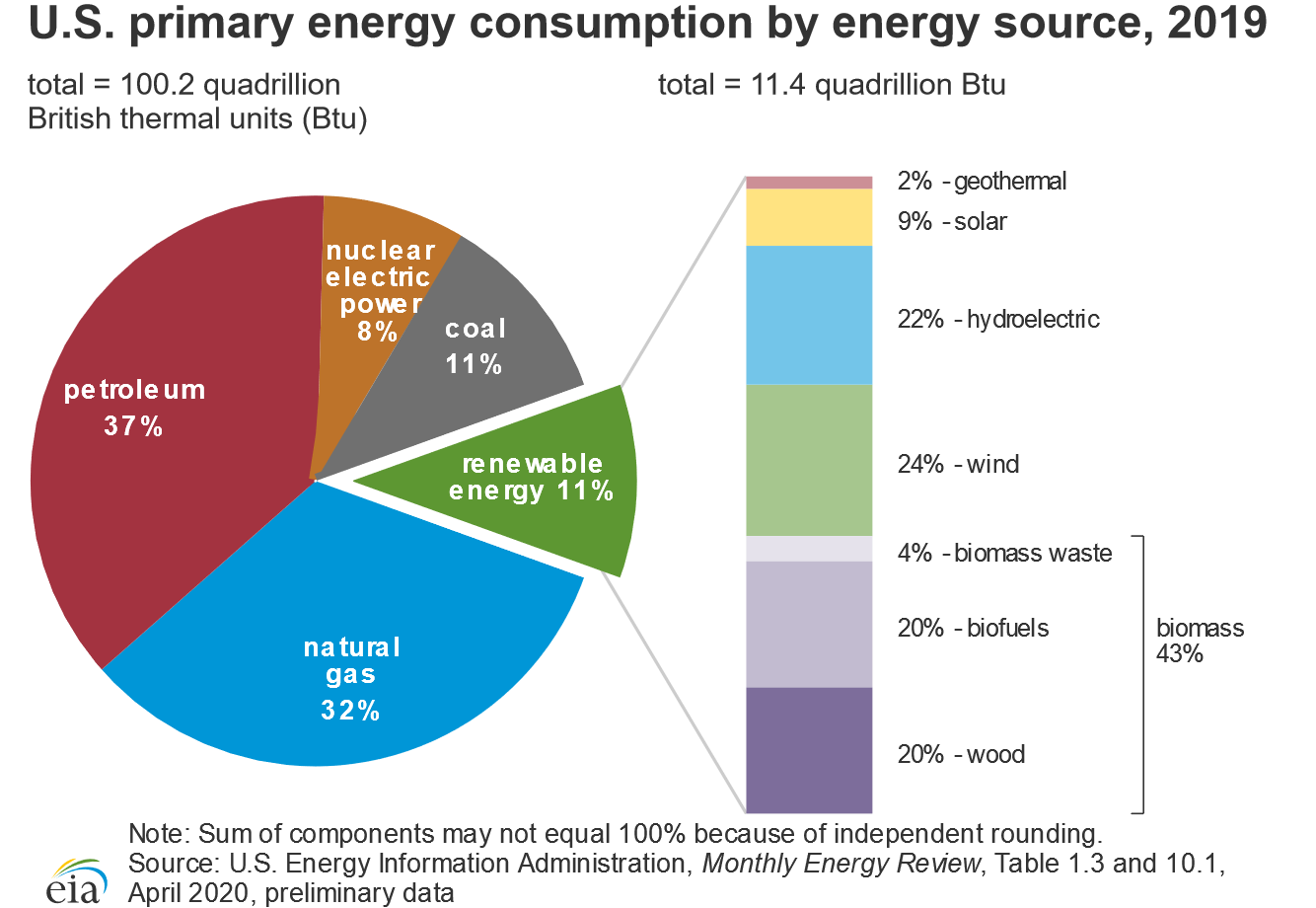

For this discussion, I'm talking about electricity production (which is generally everything else).

I'm not sure where you live, but here in La we have Entergy running commercials bragging about how their employees have donated "millions" to help Entergy customers afford rising bills.

Average US electricity price, 12-month change

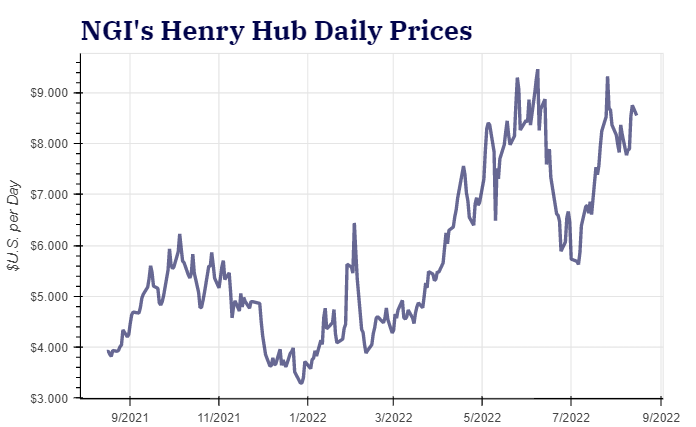

Natural gas has more than doubled in price since December of 2021 and it's the primary source of electricity generation in the country, by far.

While the EPA has been doing a solid job of killing coal, it's still used quite a bit. Coal has also more than doubled (nearly tripled) in price since December 2021.

Unless peace suddenly breaks out in Ukraine and Putin returns energy to Europe because his heart grew three sizes, there's absolutely no reason to expect our energy prices won't continue their upward trends through the end of the year.

Posted on 9/12/22 at 8:55 pm to wutangfinancial

quote:

That's why I think the Fed has no idea what they're doing. They are using a backwards looking measurement where owner's equivalent rent, which takes multiple years to price in rent increases fully, is 1/3 of it.

No idea what the rationale for the two downvotes on this could be.

OER is indeed the thing BLS uses to determine home prices in CPI.

Posted on 9/13/22 at 7:34 am to SmackoverHawg

Was easy to expect Inflation rate still high even with gas prices dropping. Just take a walk thru any grocery store and Food is still going up every week it seems.

Posted on 9/13/22 at 7:39 am to FLObserver

quote:Nope.

Lower than expected?

CPI is up. Inflation 8.3% vs 8.0% est.

Posted on 9/13/22 at 7:41 am to NC_Tigah

going to be an interesting day in the markets.

Posted on 9/13/22 at 7:41 am to NC_Tigah

Futures dropped like 700 points in a few minutes, lol. Glad to be sitting on lots of cash.... come to daddy!

Posted on 9/13/22 at 7:41 am to FLObserver

Figured they’d play with the numbers even more with us getting this close to the elections.

Posted on 9/13/22 at 7:43 am to NC_Tigah

Fed rate outlook now at 4.2% for Apr 2023. 80% chance of 75 bpts, but now w/ 20% chance of 100bpts increase this month.

Posted on 9/13/22 at 7:43 am to SmackoverHawg

Remember when Biden said inflation was 0

Posted on 9/13/22 at 7:47 am to GeneralLee

quote:

Futures dropped like 700 points in a few minutes, lol. Glad to be sitting on lots of cash.... come to daddy!

Have plenty of cash as well but will be interested to see if this sends markets down to retest lows from June over the next few weeks. It is Sept after all.

Until i see food prices stop going up every week at the grocery store i'm going to assume Inflation is nowhere near getting under control. Lower Oil prices is a start but there are more factors than that.

Posted on 9/13/22 at 7:49 am to FLObserver

The food price increases are honestly staggering to me. Everything at the grocery store has increased 30-40% on the things I typically buy. We have started planning our meals around sale items

Popular

Back to top

5

5