- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Trump promoting a 50 year mortgage. Dave Ramsey will lose his mind. Terrible idea - imo

Posted on 11/9/25 at 8:21 am to SlowFlowPro

Posted on 11/9/25 at 8:21 am to SlowFlowPro

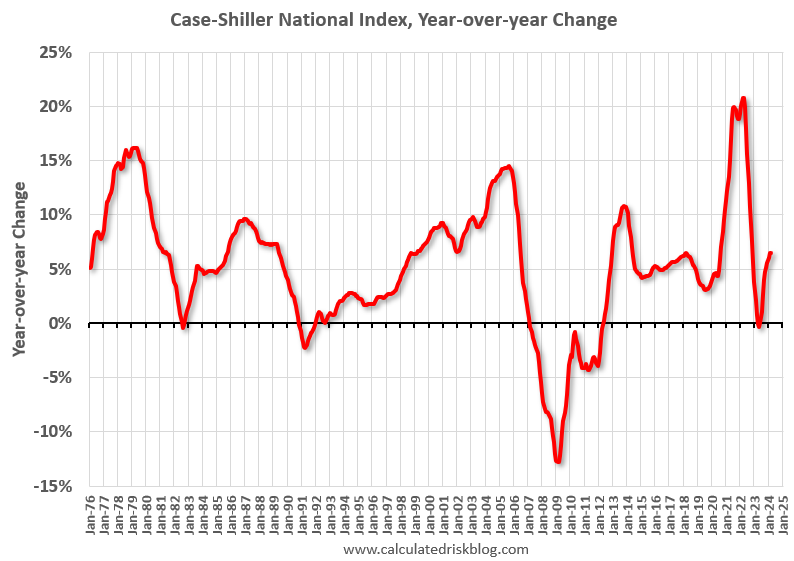

quote:The post you were responding to was an "over time" reference. Your graph supports his assertion.

Posted on 11/9/25 at 8:23 am to Tarps99

quote:

He should be promoting 50 year treasuries at sub 1% rates to help the deficit and finance long term growth.

Posted on 11/9/25 at 8:25 am to NC_Tigah

quote:

The same thing that happens to investors in any down market, moreso for leveraged investors. The ones who cannot ride it out get smacked. Those who can ride it out are largely unaffected. Those on the sideline get a second swing at investing.

Or, what actually happens: government steps in to enact policies to artificially raise prices to avoid the middle sentence and thwart the last sentence.

However, when government can't do that anymore, policy and regulatory vehicles created to stop the deflation of the prices just creates bigger bubbles and larger "smacks". This 50-year mortgage would be incredibly poor for anyone with one of these in a period of declining housing prices.

quote:

"Literally" no one is doing that.

Read the posts of the biggest defender of this policy in this thread

Posted on 11/9/25 at 8:26 am to NC_Tigah

quote:

He should be promoting 50 year treasuries at sub 1% rates to help the deficit and finance long term growth

Lighten up Francis…it was a joke.

Only someone who would buy a timeshare or run a government agency would buy a security with that little of a return.

This post was edited on 11/9/25 at 8:31 am

Posted on 11/9/25 at 8:26 am to NC_Tigah

quote:

The post you were responding to was an "over time" reference. Your graph supports his assertion.

You're forgetting the actual framing, which came from me

quote:

The question is what happens when houses aren't appreciating assets anymore (for a sizeable amount of time, not in perpetuity obviously)

Posted on 11/9/25 at 8:32 am to SlowFlowPro

Your chart doesnt show a sizable amount of time where values didnt go up

Posted on 11/9/25 at 8:55 am to AncientTiger

Yikes

It’s not a novel idea but it’s just sad

Also sad is Trump support of 50 and 100 year US government bonds

It’s not a novel idea but it’s just sad

Also sad is Trump support of 50 and 100 year US government bonds

Posted on 11/9/25 at 8:59 am to SDVTiger

quote:

This is a stable genius move

You are retarded

Posted on 11/9/25 at 10:09 am to NC_Tigah

It’s fricking stupidity. Both of them. You are a god damn idiot if you take out an 84 month car loan or a 50 year mortgage that you are essentially paying nothing but interest on for the first 20 years. shite like this is why most Americans are living paycheck to paycheck don’t have $1,000 for an emergency etc. you are becoming a slave to debt and those of you that think housing prices just keep rising to infinity must be very young.

Posted on 11/9/25 at 10:28 am to SlowFlowPro

quote:Even if the premise was true (it isn't), there would be markets (retiree laden, e.g., FL) hit more heavily, and markets nearly completely spared.

You're going to have a lot of RE hit the market with a smaller population.

quote:

That is a sign of an unhealthy economy and a period of extreme asset inflation.

What is the reference?

Market escalation over the past several decades?

GDP growth?

The Schiller graph you posted?

Record personal savings set for transition?

Posted on 11/9/25 at 10:35 am to NC_Tigah

quote:

Even if the premise was true (it isn't),

What?

Boomers are a larger population than Gen Z and younger. The population will be net smaller when they're gone.

Their RE will hit the market.

Both are true.

quote:

What is the reference?

In a healthy economy, parents aren't having to subsidize normal livings costs. It's a sign of low wages and high COL, which means the market is not healthy and likely skewed by government polity to create that unhealthiness.

Posted on 11/9/25 at 10:49 am to blzr

What a great arguement

Please explain your issue with it

Please explain your issue with it

Posted on 11/9/25 at 11:05 am to ronricks

quote:

those of you that think housing prices just keep rising to infinity

You're delving in areas you understand less than you realize.

Leverage (debt) can be good or bad. For most Americans, mortgage loans (leverage) and home sales will yield better net ROI than any financial instrument they'll engage otherwise. Though there are always exceptions to the rule, Americans not in the home ownership game are generally disadvantaged.

It is always an individual situation though. More choices equate to better opportunity. E.g., We carried a low fixed interest (~3.5%) loan on one of our homes for years, up to deductible limits ($1M for a while, then $750K IIRC). At the same time, we leveraged a second home within an investment portfolio with ~ 2% floating rate loan and $0 toward principal with interest written off as capital expense. Later we fixed that rate X 5yrs at 3%. When the 5yr period ended in 2023, the new rates were higher. So we just paid off the note. We could have cashed out both places at any point. But the money we would have tied up in the homes was instead invested with significant annual returns. We sold both places over a two-year span recently, taking advantage of the $500K Section 121 Exclusion X 2 to lower a portion of the tax exposure as we did.

You say "It’s fricking stupidity." I'd counter that your approach, in our case, would be "fricking stupidity."

Posted on 11/9/25 at 11:07 am to NC_Tigah

quote:

For most Americans, mortgage loans (leverage) and home sales will yield better net ROI than any financial instrument they'll engage otherwise. Though there are always exceptions to the rule, Americans not in the home ownership game are generally disadvantaged.

This difference is mostly due to government policy and not market forces. That's why RE price growth has been so astronomical compared to wage growth in the same time period.

Posted on 11/9/25 at 11:13 am to SlowFlowPro

quote:Negative!

Boomers are a larger population than Gen Z and younger.

Statistics are like bikinis ....

"Boomers" are categorized by births over an 18yr span. There are ~76M.

Of those born over the next 18yrs, there are ~79M.

The problem with your comparison is Gen X is demarcated by births over a 15yr period. The same is true of Gens Y & Z.

Posted on 11/9/25 at 11:14 am to SlowFlowPro

quote:

This difference is mostly due to government policy and not market forces.

And monetary policy

Posted on 11/9/25 at 11:36 am to Fuzzy Dunlop

Lololol

This post was edited on 11/9/25 at 11:37 am

Posted on 11/9/25 at 11:42 am to SlowFlowPro

quote:Has it though?

RE price growth has been so astronomical compared to wage growth in the same time period.

When you adjust home pricing for size, accoutrement upgrades, etc?

RE is definitely up (we're probably bubblish at this point) relative to HHI. But astronomical? Nah.

quote:How do you analytically parse those?

This difference is mostly due to government policy and not market forces.

Posted on 11/9/25 at 12:09 pm to SDVTiger

quote:It shouldn’t take fifty years to pay off a double wide trailer.

This is a stable genius move Lets stop pretending anyone pays off a home now with a 30yr fix

Popular

Back to top

1

1