- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Trump promoting a 50 year mortgage. Dave Ramsey will lose his mind. Terrible idea - imo

Posted on 11/9/25 at 7:19 am to Ricardo

Posted on 11/9/25 at 7:19 am to Ricardo

quote:

The USA should be for Americans. Not foreign interests and not mega corporations l

Talking about "mega corporations" make you sound leftist as hell

Posted on 11/9/25 at 7:21 am to frogtown

quote:

The problem with this analysis is a 50 yr and 30 yr will have different interest rates. You can go ahead and assume a 50 year will be 50 basis points higher.

There’s too many people on here who don’t realize this and also aren’t factoring in things like property taxes and insurance etc. The math just doesn’t make any sense. The same clown on here calling 30 year mortgages a scam is advocating for 50 year mortgages all because it’s Trumps idea

Too many poors on here desperately wanting fed rate cuts and mortgage rates to go down to cover for or hide their failures. 15 year mortgages should be maximum allowed it would immediately solve all the issues people on here are whining and crying about and it wouldn’t make Americans slaves to debt more than they already are which is what a 50 year term does. Same for the 72 and 84 month car loans. It’s fricking stupidity to the nth degree.

Posted on 11/9/25 at 7:22 am to SDVTiger

No links. More deflection.

Again, I don’t read your posts that aren’t addressed to me. Anyone taking your advice is likely stupid. I have no idea what you are wrong about this time. I don’t argue with fools anyway. My guess is people have already stated how you are wrong based on your downvotes. People clearly see your idiocy and binary thinking. I don’t need to add anything. Have a great Sunday.

Again, I don’t read your posts that aren’t addressed to me. Anyone taking your advice is likely stupid. I have no idea what you are wrong about this time. I don’t argue with fools anyway. My guess is people have already stated how you are wrong based on your downvotes. People clearly see your idiocy and binary thinking. I don’t need to add anything. Have a great Sunday.

Posted on 11/9/25 at 7:26 am to roadGator

You need me to link where you said the issue with a 50yr mortgage is that it will cause more demand and what happens with more demand?

Its in the post where you lied about owning multiple homes

You lie so much you cant even keep up with it. Then you lash out like a female

If you actually owned a property you would be celebrating this

Its in the post where you lied about owning multiple homes

You lie so much you cant even keep up with it. Then you lash out like a female

If you actually owned a property you would be celebrating this

Posted on 11/9/25 at 7:29 am to SlowFlowPro

quote:So, in your analysis, Boomer deaths will lead to a housing supply surge which will lead to price collapse?

We also have the Boomer demographic problem, which will 100% be realized over the next 50 years. When the boomers start to die and those homes hit the market the prices of RE will not be able to be propped up by government anymore. Policy now to artificially prop up prices to avoid market forces just make that bubble bigger.

Aside from that being a monocausal prediction in a multivariate system and ignoring countervailing demand, absorption mechanisms, policy adaptation, regional market segmentation, and structural supply shortages, I guess you have a point.

Posted on 11/9/25 at 7:29 am to AncientTiger

To enslave people financially and permanently.

Posted on 11/9/25 at 7:32 am to NC_Tigah

quote:

Aside from that being a monocausal prediction

Did you not read the rest of my post?

It's on variable in larger scenario of decades of government-backed policies meant to warp the free market and , more importantly, skew free market forces.

That single variable will overcome the "supply" argument that tries to pretend that our housing inflation and the insane prices (that don't reflect the actual market prices) are a supply issue only. That's why I specifically said that the impact will be so great that the government will not have a bullet big enough to fire at that problem at that time.

Real estate is a bubble built upon a bubble built upon a bubble and this 50-year mortgage is another government-created bubble that will pop. Instead of addressing the actual problem. We are making the ultimate solution worse

Posted on 11/9/25 at 7:34 am to NC_Tigah

Boomers dying off is leading to The Great Wealth Transfer it’s a very real thing estimated trillions of dollars in assets from older generations, primarily Baby Boomers, to younger generations like Gen X, Millennials, and Gen Z will be handed down. Many will inherit paid off homes or cash to buy a new home or both.

Posted on 11/9/25 at 7:45 am to SDVTiger

Only dummies such as yourself take 30 year mortgages.

The 20 is the way to go. It really is.

The 20 is the way to go. It really is.

Posted on 11/9/25 at 7:46 am to ronricks

quote:No.

Same for the 72 and 84 month car loans. It’s fricking stupidity to the nth degree.

It's not the same. 72-84 month loans on depreciating assets are very different than loans at any term on appreciating assets.

quote:Choice in financial instruments has nothing to do with "the poors." In fact, quite the opposite. Assertions to the contrary speak for themselves. E.g., I've had unique financing opportunities at disposal which most here simply wouldn't. Some I've engaged, others I've passed on.

There’s too many people on here who don’t realize this and also aren’t factoring in things like property taxes and insurance etc. The math just doesn’t make any sense. ...

Too many poors on here desperately wanting fed rate cuts

The interest in sticking your nose in others' financial affairs by insisting their choices in financial instruments be limited feels anticapitalistic as hell.

Posted on 11/9/25 at 7:51 am to NC_Tigah

quote:

No.

It's not the same. 72-84 month loans on depreciating assets are very different than loans at any term on appreciating assets.

Ronricks

Posted on 11/9/25 at 7:58 am to SDVTiger

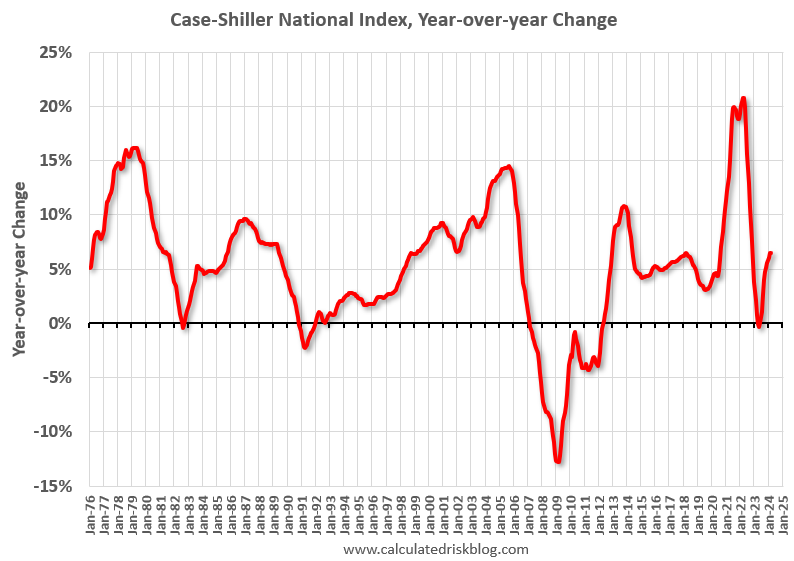

The question is what happens when houses aren't appreciating assets anymore (for a sizeable amount of time, not in perpetuity obviously)

Pretending RE is always appreciating is literally why the 2009 crash occurred.

Pretending RE is always appreciating is literally why the 2009 crash occurred.

Posted on 11/9/25 at 8:00 am to SlowFlowPro

quote:

Pretending RE is always appreciating

We dont need to pretend cause they have

Posted on 11/9/25 at 8:01 am to SDVTiger

quote:

We dont need to pretend cause they have

Posted on 11/9/25 at 8:02 am to ronricks

quote:Yes, but

Boomers dying off is leading to The Great Wealth Transfer it’s a very real thing estimated trillions of dollars in assets from older generations, primarily Baby Boomers, to younger generations like Gen X, Millennials, and Gen Z will be handed down. Many will inherit paid off homes or cash to buy a new home or both.

the Great Wealth Transfer

runs 180° antithetical to SFP's premise.

In some ways, so does this,

Boomers are subsidizing Gen Z and millennial spending habits, ‘Oracle of Wall Street’ says.

Posted on 11/9/25 at 8:03 am to SlowFlowPro

The last 100yr they have risen 93 out of 100

You can post all the charts you want

You can post all the charts you want

Posted on 11/9/25 at 8:05 am to NC_Tigah

quote:

the Great Wealth Transfer

runs 180° antithetical to SFP's premise.

Not at all

You're going to have a lot of RE hit the market with a smaller population. The supply is going to increase dramatically

quote:

In some ways, so does this,

That is a sign of an unhealthy economy and a period of extreme asset inflation.

Posted on 11/9/25 at 8:09 am to SlowFlowPro

Never go full Diana Olynick bro. Which is what you are doing

Posted on 11/9/25 at 8:13 am to AncientTiger

He should be promoting 50 year treasuries at sub 1% rates to help the deficit and finance long term growth. LOL

This post was edited on 11/9/25 at 8:14 am

Posted on 11/9/25 at 8:18 am to SlowFlowPro

quote:The same thing that happens to investors in any down market, moreso for leveraged investors. The ones who cannot ride it out get smacked. Those who can ride it out are largely unaffected. Those on the sideline get a second swing at investing.

The question is what happens when houses aren't appreciating assets anymore (for a sizeable amount of time, not in perpetuity obviously)

quote:"Literally" no one is doing that.

Pretending RE is always appreciating

Popular

Back to top

0

0