- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Treasury, IRS reveal a postcard-size form to file your taxes

Posted on 6/29/18 at 6:56 pm

Posted on 6/29/18 at 6:56 pm

The GOP's long-promised change is an offshoot of a tax overhaul last year that cut corporate rates and winnowed down the number of individual tax brackets.

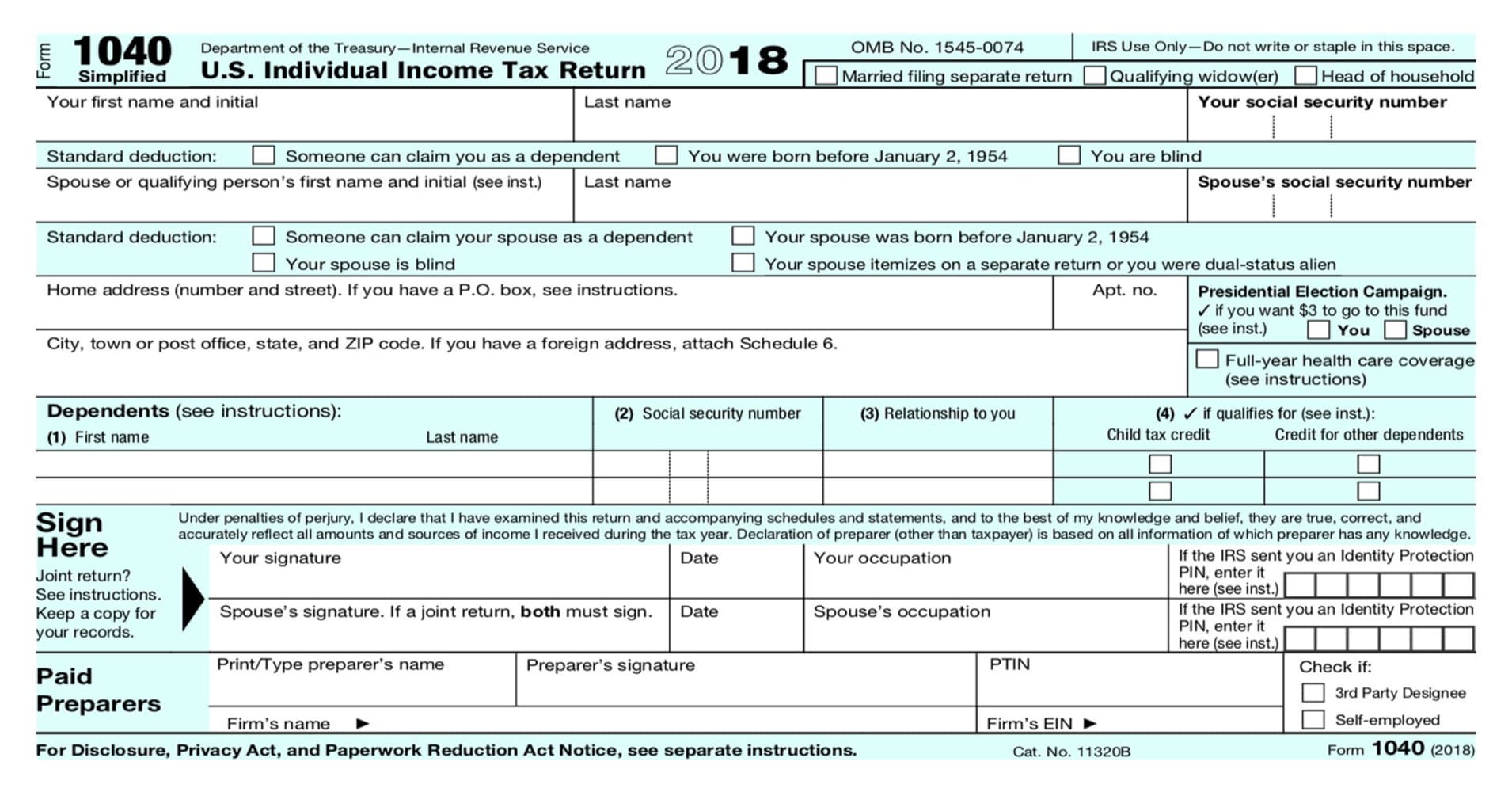

On Friday, the Treasury Department and IRS unveiled the new postcard, which will replace the current forms 1040, 1040A and 1040 EZ.

Front:

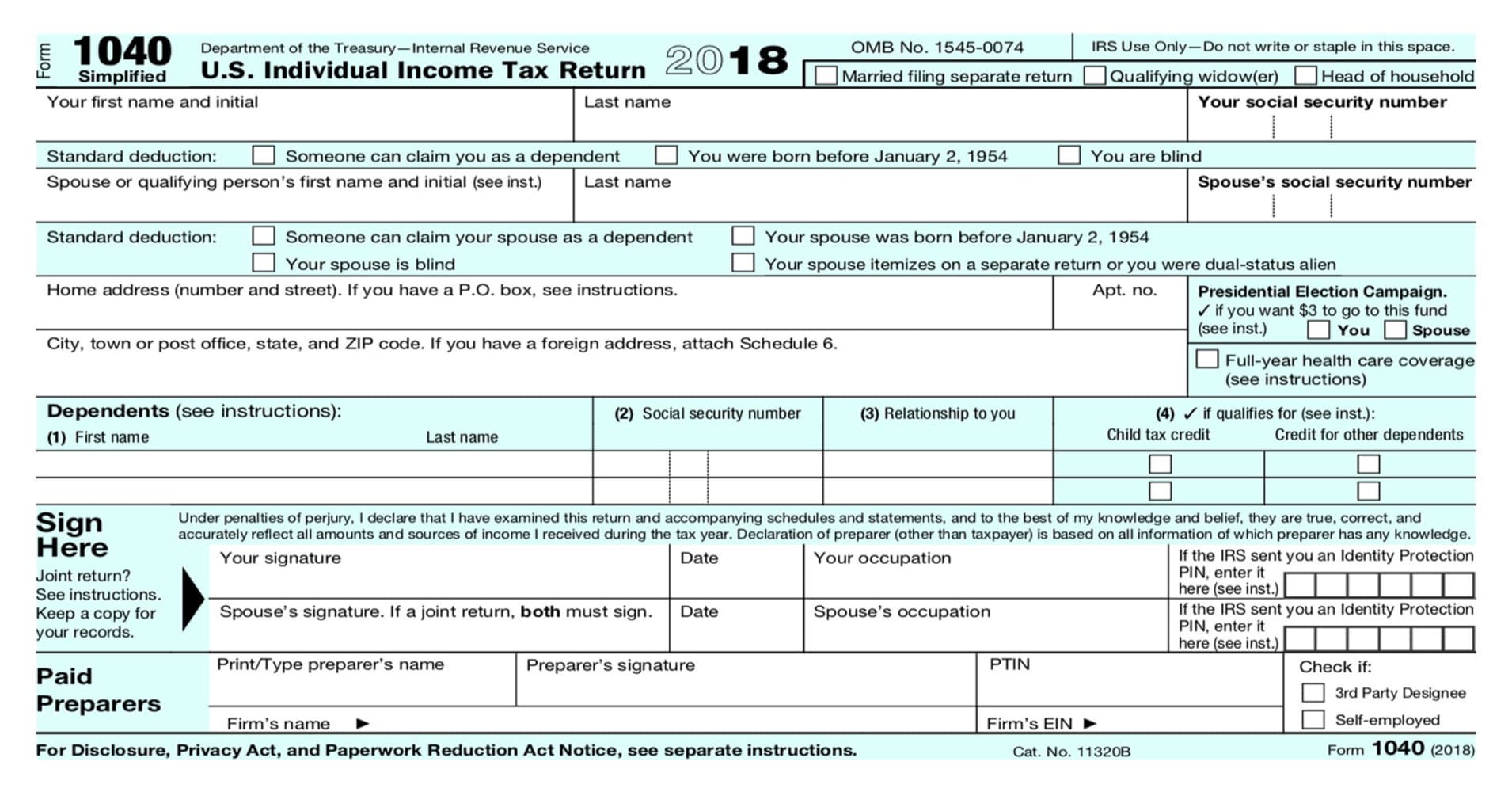

Back:

Next year, Americans will be able to file their individual tax returns on a postcard.

The GOP's long-promised change is an offshoot of a tax overhaul last year that cut corporate rates and changed individual tax brackets. On Friday, the Treasury Department and IRS unveiled the new postcard, which will replace the current forms 1040, 1040A and 1040 EZ.

Treasury Secretary Steven T. Mnuchin said in a statement, "The new, postcard-size Form 1040 is designed to simplify and expedite filing tax returns, providing much-needed relief to hardworking taxpayers.”

More than 90 percent of individuals file their tax returns electronically, something the IRS has encouraged in recent years as a safer, faster and easier way to submit their information.

The tax overhaul was designed to make it so simple 9 out of 10 people would be able to use the postcard to file, according to Republican Rep. Kevin Brady, in comments last year around the time the tax bill was introduced. It was ultimately passed and signed by President Donald Trump, who had campaigned heavily on tax reform

LINK

On Friday, the Treasury Department and IRS unveiled the new postcard, which will replace the current forms 1040, 1040A and 1040 EZ.

Front:

Back:

Next year, Americans will be able to file their individual tax returns on a postcard.

The GOP's long-promised change is an offshoot of a tax overhaul last year that cut corporate rates and changed individual tax brackets. On Friday, the Treasury Department and IRS unveiled the new postcard, which will replace the current forms 1040, 1040A and 1040 EZ.

Treasury Secretary Steven T. Mnuchin said in a statement, "The new, postcard-size Form 1040 is designed to simplify and expedite filing tax returns, providing much-needed relief to hardworking taxpayers.”

More than 90 percent of individuals file their tax returns electronically, something the IRS has encouraged in recent years as a safer, faster and easier way to submit their information.

The tax overhaul was designed to make it so simple 9 out of 10 people would be able to use the postcard to file, according to Republican Rep. Kevin Brady, in comments last year around the time the tax bill was introduced. It was ultimately passed and signed by President Donald Trump, who had campaigned heavily on tax reform

LINK

Posted on 6/29/18 at 7:00 pm to dr smartass phd

But many people (myself included) file electronically.

Posted on 6/29/18 at 7:02 pm to dr smartass phd

Yeah but how many will die because of this?

Posted on 6/29/18 at 7:03 pm to Pelican fan99

quote:

Yeah but how many will die because of this?

The 10% that don't file online.

Posted on 6/29/18 at 7:04 pm to dr smartass phd

Obligatory

PoundsignTaxationistheft

PoundsignTaxationistheft

Posted on 6/29/18 at 7:05 pm to Quidam65

quote:

But many people (myself included) file electronically.

Then your tax form will be the size of a computer.

Posted on 6/29/18 at 7:57 pm to dr smartass phd

Doubling the standard deduction is not going to make up for the loss of those personal exemptions for an average family of four.

Posted on 6/29/18 at 8:02 pm to dr smartass phd

Taxes on a postcard. That brings back memories of my arguments with "principled conservatives" who we re all tax experts pre-election.

Pass through tax cuts would never make.

Anyone every get curious why I knew they would?

Taxes n a postcard, and scheduled depreciation where?

Where is Marco Rubio to answer these questions? Ted Cruz? And the "expert" posters on TD?

We have taxes on a post card! Rejoice! The Republic is saved!

Pass through tax cuts would never make.

Anyone every get curious why I knew they would?

Taxes n a postcard, and scheduled depreciation where?

Where is Marco Rubio to answer these questions? Ted Cruz? And the "expert" posters on TD?

We have taxes on a post card! Rejoice! The Republic is saved!

Posted on 6/29/18 at 8:04 pm to BFIV

quote:That's true. Doubling the child tax credit may help some, though.

Doubling the standard deduction is not going to make up for the loss of those personal exemptions for an average family of four.

Posted on 6/29/18 at 8:04 pm to BFIV

Sucks for you. I’m single and always took the standard deduction previously so the doubling of the standard deduction should make a big difference for me.

Posted on 6/29/18 at 8:13 pm to dr smartass phd

It is still a tax on labor which is despicable and immoral!

Posted on 6/29/18 at 8:17 pm to HonoraryCoonass

quote:

Then your tax form will be the size of a computer.

Posted on 6/29/18 at 8:44 pm to 03GeeTee

quote:Where do you see a doubling? It says $12,000 for single person is standard deduction. Was it $6000 last year?

Sucks for you. I’m single and always took the standard deduction previously so the doubling of the standard deduction should make a big difference for me.

Posted on 6/29/18 at 8:50 pm to Quidam65

People can do either.

The idea, though, is still to simplify the form.

You make it easier for people to figure out their taxes and, should they file on paper, it becomes a lot easier to scan.

The idea, though, is still to simplify the form.

You make it easier for people to figure out their taxes and, should they file on paper, it becomes a lot easier to scan.

Posted on 6/29/18 at 8:54 pm to BFIV

quote:

Doubling the standard deduction is not going to make up for the loss of those personal exemptions for an average family of four.

It brings money back into people's wallets though... My church for instance is already 20% behind year over year from donations. It makes me wonder if 20% of the donations coming in last year were for the wrong reasons: these 20%'s (and I would assume way more for a typical nonprofit) are going to have a good bit of money back. They don't have to give a damn cent to anyone to get a fraction of it back anymore, it's huge. They get all of their donations money back, while not having to worry about their taxes either, because more than likely they get more back this year anyways + not having to give to churches / nonprofits

Posted on 6/29/18 at 8:58 pm to teke184

Curious to see how this affects the brick and mortar tax prep firms. They're gonna take a big hit, I believe. It is incredible the number of people who pay exorbitant, in my opinion, fees to have Block, JH, and Liberty prepare a simple 1040 EZ.

Posted on 6/29/18 at 9:06 pm to 03GeeTee

quote:

Sucks for you. I’m single and always took the standard deduction previously so the doubling of the standard deduction should make a big difference for me.

Yeah, it is what it is. In years past, we would itemize and be able to also deduct personal exemptions. We can still itemize, but the MFJ standard deduction is a couple of thousand more and no personal exemptions to add to that total now. Sometimes you're the bug and sometimes you're the windshield. We've always been the windshield. Starting this year, my family is the bug!

Posted on 6/29/18 at 9:09 pm to BFIV

A lot of the people going through those firms are ones looking for short term loans against their potential refund.

You could give those people a form that was signing their name on a piece of paper and they would still go through Block to get an advance.

You could give those people a form that was signing their name on a piece of paper and they would still go through Block to get an advance.

Popular

Back to top

9

9