- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: JPMorgan CEO told wealthy clients the US heading into 'something worse' than a recession

Posted on 8/16/22 at 11:35 am to Klark Kent

Posted on 8/16/22 at 11:35 am to Klark Kent

And you may be right. But I would argue when the right is in control, they don't undo the wrongs when they have every opportunity to do so. That's the game.

Posted on 8/16/22 at 11:35 am to LegendInMyMind

I have found it wise to take Jamie Dimon seriously on financial and economic matters.

Posted on 8/16/22 at 11:37 am to Byron Bojangles III

quote:Like what?

well republicans usually create the shite the democrats step in

Posted on 8/16/22 at 11:38 am to Sao

quote:

they don't undo the wrongs when they have every opportunity to do so.

yup. RINO's who should be voted out at the next opportunity. should be considered the true enemies of conservatives. run on conservative values, win the election, then don't do shite.

Posted on 8/16/22 at 11:39 am to stout

* He was said to have put the chances of a "harder recession" and of "something worse" at 20-30%.

* He called current risks "storm clouds" an apparent downgrade from his June "hurricane warning"

I'll take a few storm clouds over a hurricane any day.

* He called current risks "storm clouds" an apparent downgrade from his June "hurricane warning"

I'll take a few storm clouds over a hurricane any day.

Posted on 8/16/22 at 11:41 am to stout

quote:

stout

The is a CNN level thread topic

Posted on 8/16/22 at 11:41 am to Klark Kent

For the sake of comparison, McConnell is as old and gray as Biden. Yet, they're career cronies. How does that occur

Posted on 8/16/22 at 11:53 am to Sao

term limits. we need them.

something everyone, regardless of the side of the aisle, should be able to agree on.

something everyone, regardless of the side of the aisle, should be able to agree on.

Posted on 8/16/22 at 12:03 pm to Klark Kent

quote:

term limits. we need them.

something everyone, regardless of the side of the aisle, should be able to agree on.

I'm not a total supporter of term limits (in theory) because I don't like choices being taken away from voters, but I do recognize the rigged nature of the game.

Posted on 8/16/22 at 12:04 pm to stout

I can confirm this. Got an email last month

Posted on 8/16/22 at 12:27 pm to Klark Kent

quote:

term limits. we need them.

Well, yeah. It's the most prolific argument why DC is what it is. When self-preservation is up to the person on the ballot, you'll get scare tactics and red meat to ensure they return.

Do you straight ticket vote by chance?

Posted on 8/16/22 at 12:28 pm to Byron Bojangles III

quote:

well republicans usually create the shite the democrats step in.

Posted on 8/16/22 at 12:30 pm to TBoy

quote:

A doom and gloom prediction right now is likely a marketing ploy aimed at a certain kind of investor who is wishcasting doom and gloom.

There's no wishcasting involved if you actually look at economic indicators. As such, I think we're starting to see glimmers of the real downturn.

Homebuilders say U.S. is in a ‘housing recession’ as sentiment turns negative

quote:

The National Association of Home Builders/Wells Fargo Housing Market Index dropped 6 points to 49 this month, its eighth straight monthly decline. Anything above 50 is considered positive. The index has not been in negative territory since a very brief plunge at the start of the Covid pandemic. Before that, it hadn’t been negative since June 2014.

“Tighter monetary policy from the Federal Reserve and persistently elevated construction costs have brought on a housing recession,” said NAHB Chief Economist Robert Dietz.

Of the index’s three components, current sales conditions dropped 7 points to 57, sales expectations in the next six months fell 2 points to 47 and buyer traffic fell 5 points to 32.

quote:

The biggest hurdle for buyers right now is affordability. Home prices have been climbing since the start of the pandemic, and the average rate on the 30-year fixed mortgage, which had hit historic lows in the first part of the pandemic, is nearly twice what it was at the start of this year. Home price growth has cooled somewhat in recent weeks, while mortgage rates have come down from highs.

“The total volume of single-family starts will post a decline in 2022, the first such decrease since 2011. However, as signs grow that the rate of inflation is near peaking, long-term interest rates have stabilized, which will provide some stability for the demand-side of the market in the coming months,” Dietz said.

To add to this a little: New Home Starts

quote:

Housing starts in the US dropped 2% month-over-month to an annualized rate of 1.559 million units in June of 2022, the lowest since September last year. Figures were also lower than forecasts of 1.58 million but follow an upwardly revised 1.591 million rate in May. The housing sector has been cooling amid soaring prices and mortgage rates. Single-family housing starts sank 8.1% to 982,000 while starts for units in buildings with five units or more was 568,000. Starts were lower in the South (-4.8% to 825,000) and the Midwest (-7.7% to 215,000) but rose in the Northeast (10.6% to 156,000) and the West (3.7% to 363,000)

New home starts have been plummeting since April, expect July to be even lower.

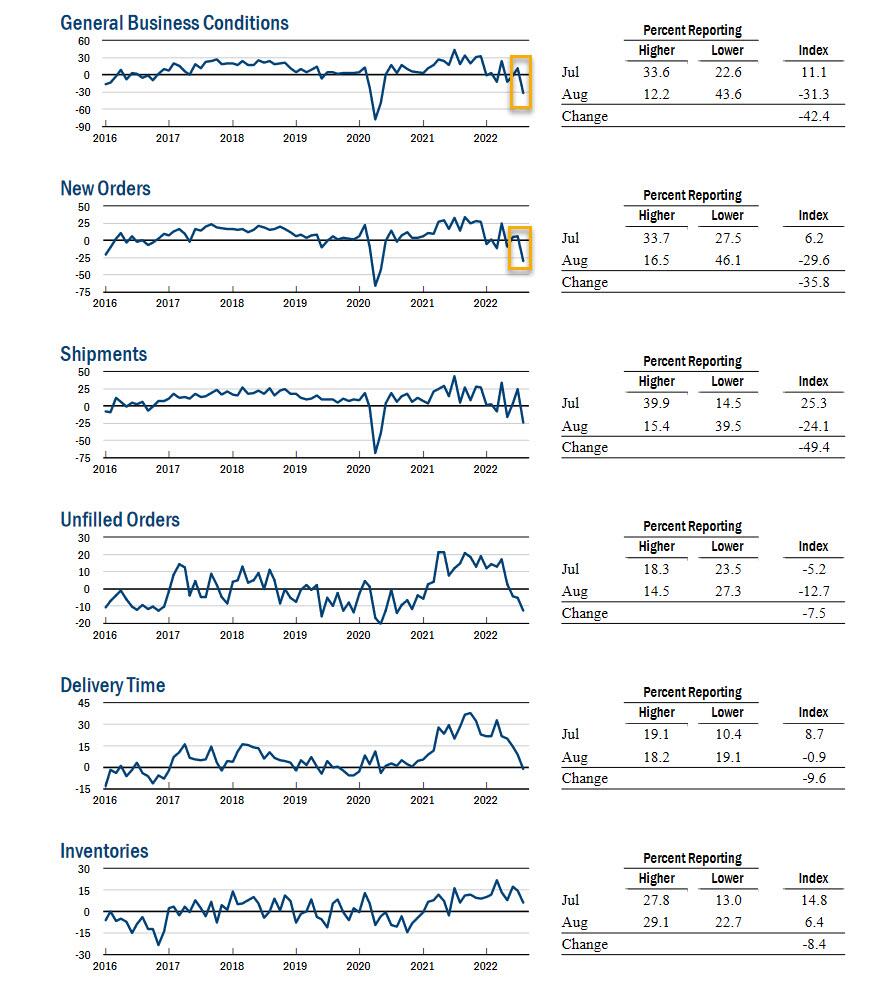

Recession Back On: NY Fed Manufacturing Unexpectedly Craters In 2nd Biggest Drop On Record

quote:

The big miss of the month's first regional manufacturing survey was driven by a decline across all indicators, but especially by a sharp drop in the forward looking New Orders which tanked to -29.6 from +6.2, while the shipments index plummeted nearly fifty points to -24.1, indicating a sharp decline in both orders and shipments, and strongly hinting that a hard-landing recession is inevitable and that, for all the posturing, a Fed rate cut is imminent after all.

We'll likely see a similar trend across most of the country as more numbers come out.

Let's sum this all up:

-High (and increasing) levels of consumer debt

-Sustained high inflation

-Sustained high fuel prices

-Wage growth being constantly far outpaced by inflation

-High (and likely increasing) energy prices (especially with the extra energy costs in the Inflation Reduction Act)

-Declining home sales and new home starts

-Declining manufacturing across the board

-Rising vehicle repossessions

-Rising foreclosure rates

You simply can't have these sorts of numbers if you believe you're moving into a period of economic upswing or even flat economic activity. Our economic winter is coming.

Posted on 8/16/22 at 1:11 pm to stout

quote:

CEO Jamie Dimon talked to some of JPMorgan's wealthy clients on a call Tuesday, Yahoo reported. He was said to have put the chances of a "harder recession" and of "something worse" at 20 to 30%. He called current risks "storm clouds," an apparent downgrade from his June "hurricane" warning.

Sounds like good marketing targeted to ultra high net worth clients.

Popular

Back to top

1

1