- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Fed Panics: Announces First Repo Operation In A Decade To Halt Funding Panic

Posted on 9/17/19 at 8:59 am

Posted on 9/17/19 at 8:59 am

quote:

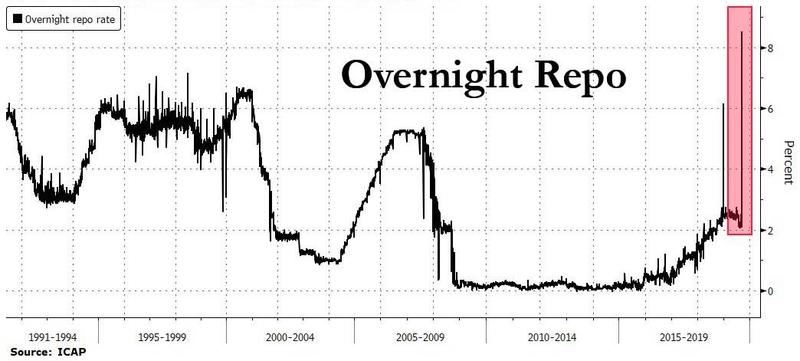

Not long after we hinted that today's action in the US repo market is similar to what took place in 2013 China, when an explosion in funding rates nearly destroyed the local banking system before the PBOC intervened, the Fed has done just that, and as everyone - finally - began to realize this morning that something was very broken in the short-term liquidity markets, as overnight general collateral repo exploded to 10%...

quote:

This is precisely what we said last Friday would be the Fed's first line of defense, when we laid out what may happen after the dollar funding shortage arrives:

repos, i.e. temporary ad hoc reserve adding open market operations,

Treasury purchases, i.e. permanent open market operations, similar to outright UST QE only without a clear QE mandate (for now), and

standing repo facility (SRF), i.e. a new facility that could "automatically" add reserves to the banking system when GC or fed funds reaches a threshold above IOER.

We are now at 1. If and when repo rates continue to rise even with the Fed's repos in market, the Fed will have no choice but to launch either QE or start a standing repo facility.

Lots more on ZeroHedge

Rates about to go down. QE is here again.

More winning by Trump?

Posted on 9/17/19 at 9:05 am to FrenchToast

Is that the buy rate or the sell rate? (never delved into repo before)

Posted on 9/17/19 at 9:38 am to FrenchToast

quote:

Rates about to go down. QE is here again.

More winning by Trump?

Maybe this is what he was talking about when hammering the Fed for raising rates and acting too slowly....

Posted on 9/17/19 at 9:41 am to SlackMaster

It never ceases to amaze me how complicated economics can be.

All moves are calculated. Trump is up against globalist bankers and the Fed is their weapon.

What does this tell us exactly?

All moves are calculated. Trump is up against globalist bankers and the Fed is their weapon.

What does this tell us exactly?

Posted on 9/17/19 at 10:03 am to FrenchToast

quote:

More winning by Bourre’

I plan to refinance my home with the lower interest rate. Thanks President Trump!

Posted on 9/17/19 at 10:30 am to FrenchToast

This is  .

.

ETA: Look at the calendar.

Yesterday was settlement day for a $78 billion Treasury department bond auction held last week. That means $78 billion flowed out of banks yesterday to pay for the Treasury securitites purchased last week.

Yesterday was also the due date for individuals and corporations to make their quarterly estimated tax payments to the Treasury Department. Because U.S. corporations are enjoying a banner year for profits, their estimated tax payments were bigger than in most years.

The large withdrawals for paying taxes along with the larger than normal bond settlement day both occurring on Monday left some banks a little short on liquidity for part of one day.

So banks used some of their Treasury securities in their investment portfolio as collateral to borrow funds from the Federal Reserve either overnight, or 3 days, or 7 days or 30 days. The banks will pay off their short-term loans on the due date and the Fed will release their Treasury bonds collateral back to them. That's the "repurchase" part which gives the process the shortened name "repo."

This operation has been part of the banking funding mechanism for decades. Only ZeroHedge could make it sound like Armageddon is upon us.

And the "10% repo rate" the Chicken Littles at ZeroHedge claimed was really 5.0%. I have no idea where they came up with the 10% rate claim. The repo rate was actually higher back in January, around 6.25%. So again, the "decade" time frame ZH claims is bogus.

Overnight rates are already back down within the Fed's fed funds range of 2-2.25%.

For those of you who want the Fed abolished, this liquidity infusion by the Fed last night and this morning is exactly what is meant by "lender of last resort." The system worked just as it is supposed to work.

ETA: Look at the calendar.

Yesterday was settlement day for a $78 billion Treasury department bond auction held last week. That means $78 billion flowed out of banks yesterday to pay for the Treasury securitites purchased last week.

Yesterday was also the due date for individuals and corporations to make their quarterly estimated tax payments to the Treasury Department. Because U.S. corporations are enjoying a banner year for profits, their estimated tax payments were bigger than in most years.

The large withdrawals for paying taxes along with the larger than normal bond settlement day both occurring on Monday left some banks a little short on liquidity for part of one day.

So banks used some of their Treasury securities in their investment portfolio as collateral to borrow funds from the Federal Reserve either overnight, or 3 days, or 7 days or 30 days. The banks will pay off their short-term loans on the due date and the Fed will release their Treasury bonds collateral back to them. That's the "repurchase" part which gives the process the shortened name "repo."

This operation has been part of the banking funding mechanism for decades. Only ZeroHedge could make it sound like Armageddon is upon us.

And the "10% repo rate" the Chicken Littles at ZeroHedge claimed was really 5.0%. I have no idea where they came up with the 10% rate claim. The repo rate was actually higher back in January, around 6.25%. So again, the "decade" time frame ZH claims is bogus.

Overnight rates are already back down within the Fed's fed funds range of 2-2.25%.

For those of you who want the Fed abolished, this liquidity infusion by the Fed last night and this morning is exactly what is meant by "lender of last resort." The system worked just as it is supposed to work.

This post was edited on 9/17/19 at 11:40 am

Posted on 9/17/19 at 11:16 am to LSURussian

Excellent Summary, Russian.

Always enjoy reading your posts on economics, etc.

Always enjoy reading your posts on economics, etc.

Posted on 9/17/19 at 11:21 am to LSURussian

quote:

The system worked just as it is supposed to work.

So, can I reopen the door to my bunker? A simple "yes" or "no" will suffice...

j/k thanks for the summary...

Posted on 9/17/19 at 12:00 pm to LSURussian

You sound like you know wtf you're talking about.

Posted on 9/18/19 at 10:17 am to LSURussian

An Update on ZH

Thanks for the explanation, LSURussian.

What does this development meant today? They say an increased liquidity shortage. Also that the measures yesterday failed for some unknown technical reason?

Thanks for the explanation, LSURussian.

What does this development meant today? They say an increased liquidity shortage. Also that the measures yesterday failed for some unknown technical reason?

Posted on 9/18/19 at 10:28 am to LSURussian

Thanks Russian. I was just about to post the same thing. .

Popular

Back to top

4

4