- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Chinese to meet with U.S. despite possible rise in tariffs

Posted on 5/7/19 at 10:30 am to Palmetto08

Posted on 5/7/19 at 10:30 am to Palmetto08

quote:

A dollar more? Are you buying a $4 jacket from Amazon?

Maybe. And it looks just like the kind i saw at Saks the other day too. it's gonna be a pimpin steal.

Posted on 5/7/19 at 10:40 am to cahoots

quote:

If these things take time then why have you guys been prematurely ejaculating for the past year and half?

Ignorant comment. So like your side doing the same over "collusion". Ha.

The fact that Trump told us this is what he is going to look into doing is great news. No one thought it was going to happen right away. Stop trolling like people were.

Posted on 5/7/19 at 10:53 am to Homesick Tiger

quote:But the problem is that reality does not really conform to this theory.

Less imports from China and more production at home which creates more jobs here thus having more people paying into our tax base which theoretically helps with the debt and/or other government supported programs.

1. There is a strong correlation between changes in the trade deficit and changes in GDP. In other words, when the trade deficit grows GDP also grows.

2. In a global economy, merely decreasing the products and materials imported from one nation, does not mean they will return back here. It may just go to another foreign nation, that is still cheaper than the US, but will be more expensive than it was before, on top of the costs of that move.

3. As it pertains to addressing trade through tariffs, there is the obvious increase in prices on imports as a function of the tax. But the problem is that this also creates upward price pressure on the domestic products too as a result of increased demand PLUS companies now use that competitive tariff margin to increase their prices.In other words, if imports have a 25% tariff, a domestic company could increase price by say 10% and still have an price advantage. But now the consumer pays more for both.

Furthermore, because of this, there is no guarantee that companies will even increase their labor and/or production. They can increase their profit margin without adding any more costs and adding any supply, and adding even more upward pressure. At the very least, it minimizes the incentive to increase the costs that they can't already scale (e.g., once they reach their current labor and production capacity), especially since there is no guarantee those tariffs will be there far enough into the future, to justify the risk.

4. Even if jobs are added in the sector benefiting from the tariffs, this unfortunately creates a biased perception of reality of the aggregate impact.

Specifically the job gains from that particular industry is usually easy to quantify and usually represents a fairly sizable portion of that sample; however, the jobs that are lost due to the negative impact of increased costs are more spread out across sectors and regions and represents a smaller portion but of a much larger aggregate sample.

So say we add 150,000 or so jobs in the steal industry, because of the tariffs. That would be easy to see that major benefit for that industry since that would be roughly the double the current job totals. However, that increase would represent only about 0.1% of the total non-farm workforce. So it would take 1 out of every 1006 or so people to lose their job as a result of increased prices across the rest of the job market to completely offset those gains.

Posted on 5/7/19 at 10:55 am to Homesick Tiger

quote:

Less imports from China and more production at home

would you be ok with less imports of strictly consumer goods, since imports of raw materials & capital/intermediate goods directly support our production at home?

Posted on 5/7/19 at 11:12 am to Homesick Tiger

quote:

Less imports from China and more production at home which creates more jobs here thus having more people paying into our tax base which theoretically helps with the debt and/or other government supported programs.

US producers are becoming more and more automated so you’re not going to get a big job creation.

Another way to look at it:

Less imports from China = less stuff to sell = less money to be made = less employees to pay = less paying into tax base creating more debt.

Less global competition = higher priced US made products

US Company A buys a widget from China for $5. Their sales teams sells these widgets to US company B for $15. Then company B sells these widgets to Company C for $30. Company C sells these widgets to Company D for $50. Everyone is working and selling. With tariff in place, Company A, B, C and D are forced to buy higher priced same quality widget from US company. Unfortunately US company cannot produce enough of this widget so company B, C and D are SOL. Employees of B, C and D let go and company loses money.

This post was edited on 5/7/19 at 12:02 pm

Posted on 5/7/19 at 11:24 am to TOSOV

quote:But let says it increases costs for the average citizen by $2 per week. The typical person would hardly even notice that impact, if at all. They may just have to forgo eating out as a few times a year, or buying a little less during the holiday season, or maybe going an extra couple weeks between haircuts.

But but but my knock off jacket, with the zipper on the wrong side, from amazon is going to be a dollar more

The problem is that $2 dollars every week for every person adds up to over $34 billion in extra costs, which is no longer going all of the other companies (probably places where they spend their disposable income).

And if they can still somehow manage to only lose 1 job for every $100,000 decrease in revenue, that still results in a loss of 340,000 jobs. But as their loss of income adds up, then there is even less available revenue for places. And suddenly this becomes somewhat of a recurring feedback loop, so the jobs gains and income gains that benefited from this better offset that difference.

Posted on 5/7/19 at 11:33 am to GeeOH

quote:

Youve just shown me uou are one of the dumber posters on this board.

I know it's fun to say stuff like that, but none of you can ever actually explain why trade deficits are bad. I've tried getting an explanation but it's always weak.

Posted on 5/7/19 at 11:35 am to Sweet daddy

quote:

They consider Trump to be an idiot and the Republicans bigger idiots for following an idiot.

Are these the same folks who eat bugs and bean sprouts? Yep, we need to pay attention to what they think.

This post was edited on 5/7/19 at 11:35 am

Posted on 5/7/19 at 12:41 pm to GeeOH

quote:He's right though. The trade balance (or imbalance) in and of itself is neither negative or positive. This is a pretty universally accepted reality in capitalism, although socialists like Bernie may agree with you and may find it stupid.

Youve just shown me uou are one of the dumber posters on this board.

Furthermore, the true inflows and outflows of capital is not exclusive to trade. What do people do when they have excess capital? They invest it. And where do foreign investors like to invest their money? In the US market.

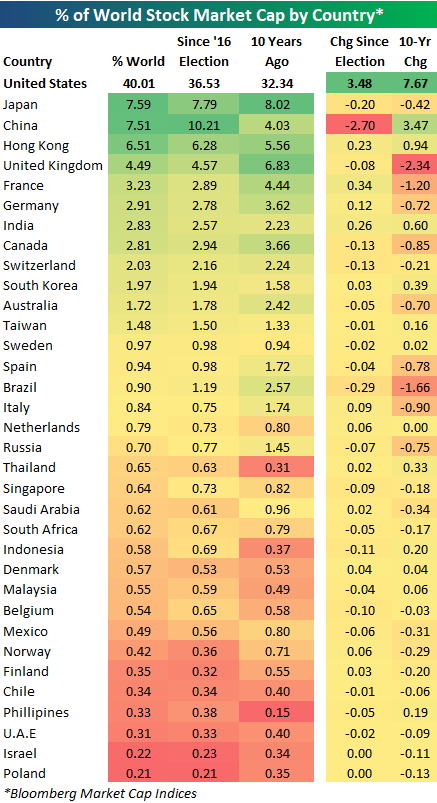

And despite our increasing trade deficit, the US stock market has increased its share of the overall market capitalization from 32.34% in 2008 to 40.01% as of August 2018. And our market has added almost $19 trillion in that time despite running a trade deficit of over $5 trillion.

Posted on 5/7/19 at 12:46 pm to randybobandy

Everybody in here looking at the short term when the long term is where the focus needs to be.

China is in some deep waters financially right now and has a credit bubble growing like crazy to keep the economy afloat.

We put pressure on them, their economy gets weaker, they have banks give our more loans, bubble gets bigger. 856 Billion in loans went out Q1. That’s an increase of 20%.

Eventually that bubble will burst as Xi continues to drag his people back to the cultural revolution. People will rise up against the government as things get really tough after 40 years of prosperity.

Losing a few jobs or paying a few bucks extra to help facilitate the collapse of a communist dictatorship is fine by me.

People think China is some real economic threat but visit the country a few times and you’ll see that fear was built on unsustainable debt.

China is in some deep waters financially right now and has a credit bubble growing like crazy to keep the economy afloat.

We put pressure on them, their economy gets weaker, they have banks give our more loans, bubble gets bigger. 856 Billion in loans went out Q1. That’s an increase of 20%.

Eventually that bubble will burst as Xi continues to drag his people back to the cultural revolution. People will rise up against the government as things get really tough after 40 years of prosperity.

Losing a few jobs or paying a few bucks extra to help facilitate the collapse of a communist dictatorship is fine by me.

People think China is some real economic threat but visit the country a few times and you’ll see that fear was built on unsustainable debt.

Posted on 5/7/19 at 12:51 pm to buckeye_vol

quote:

although socialists like Bernie may agree with you and may find it stupid

nice

Posted on 5/7/19 at 1:18 pm to cahoots

quote:

If these things take time then why have you guys been prematurely ejaculating for the past year and half?

Because win, lose, or draw it is nice that a President finally stood up to China on trade. Hopefully, someone will do it on pollution next.

Popular

Back to top

0

0