- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: 89% of SVBs $175 billion in deposits was not FDIC insured at the end of 2022

Posted on 3/11/23 at 12:12 am to Cosmo

Posted on 3/11/23 at 12:12 am to Cosmo

quote:

How could anybody not make sure their money is under the 250k limit?

I rotate my money around in 100k-200k short term CDs in different banks to make sure Im protected.

Most of its customers are other business, not individuals. I've got a client that had nearly 650 million with SVB. WTF do you want them to do? open 2,500 bank accounts?

Posted on 3/11/23 at 12:22 am to stout

quote:Trying it on every board, huh? Just hoping for the worst, right?

Reports of a lot of companies struggling just to cover payroll today.

This post was edited on 3/11/23 at 12:27 am

Posted on 3/11/23 at 12:24 am to Cosmo

quote:It's multi-million/billion dollar businesses. They need deposit services too. I mean, I have always thought SVB was an insane enterprise, but we're not talking retail there.

How could anybody not make sure their money is under the 250k limit?

Posted on 3/11/23 at 4:43 am to Big Scrub TX

quote:

It's multi-million/billion dollar businesses. They need deposit services too.

Then they should have created them or been smart enough to figure out how to safeguard their money, aren't these supposed to be the smartest people in the world?

Posted on 3/11/23 at 4:50 am to stout

The downside of high risk high reward

Posted on 3/11/23 at 6:04 am to Bass Tiger

I can’t believe ultra rich people made a bad business decision. And who are we to question?

This post was edited on 3/11/23 at 6:13 am

Posted on 3/11/23 at 6:07 am to LSUFanHouston

quote:for context

If 160 billion goes poof it’s going to impact a lot of companies.,

quote:

Lehman Brothers International held close to 40 billion dollars of clients assets when it filed for Chapter 11 Bankruptcy.

Posted on 3/11/23 at 6:09 am to POTUS2024

quote:

aren't these supposed to be the smartest people in the world?

I deal with engineers with advanced degrees all the time, many are quite stupid concerning everything outside of a very limited sphere of knowledge.

Posted on 3/11/23 at 6:11 am to ImaObserver

quote:

So Vanguard, SSgA Funds and Black Rock among others are going to see the benefit of a bail out from the FDIC.

How much is SVB's ESG score worth now?

Posted on 3/11/23 at 6:30 am to Bass Tiger

quote:

Sadly, a lot of SVB investments were 10-30 year treasuries paying less than 1% yield. What could go wrong when the Fed goes from ZIRP to nearly a 4.5 Fed funds rate?

How many more banks are sitting on bonds that they bought yielding 1% or less that are now worth 40% less than what they paid for them?

Posted on 3/11/23 at 6:41 am to BeYou

quote:

I've got a client that had nearly 650 million with SVB. WTF do you want them to do? open 2,500 bank accounts?

That is a lot of money in one account. It is probably larger than the balance sheet of some smaller community banks.

There are some options to protect deposits over FDIC limits. Some banks may offer private insurance cover larger amounts than FDIC limits like the Deposit Insurance Fund. DIF only has a list of smaller community banks in Massachusetts, and has only 500 million in assets which is less than what your client has.

Just think of the person that won the 2 billion powerball jackpot. He collected just short of a billion. Where do you put it all?

In today’s market, you may have to load up on physical assets like property or gold since the stock market is so unpredictable. And if there is a coming banking crisis, you may have to load up on cash and a safe at the house, or a money bin for the Powerball winner, see below.

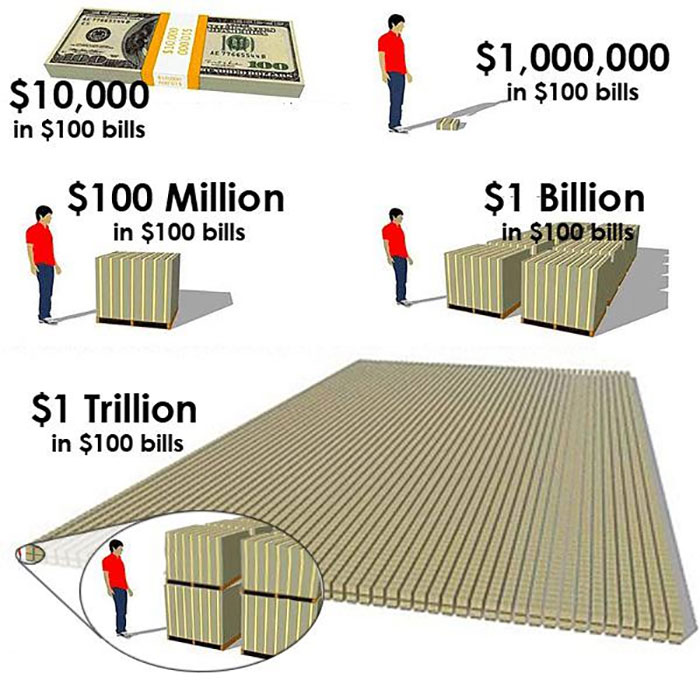

For visual reference here how that much money can look like:

Posted on 3/11/23 at 6:52 am to KillTheGophers

quote:

Then their CFO, CEO, internal audit and external audit should be fired. Half billion deposited at one institution is simply failing with the fiscal responsibility granted them

It was 26% of their cash.

Posted on 3/11/23 at 6:56 am to Bass Tiger

quote:Yep.

Sadly, a lot of SVB investments were 10-30 year treasuries paying less than 1% yield. What could go wrong when the Fed goes from ZIRP to nearly a 4.5 Fed funds rate?

Management at SVB was atrocious.

In addition to the inexplicably stupid LTFI holdings, they held nondiversified partnerships in intended IPOs with no IPO market to unload them them. Meanwhile, the SVB CEO was cashing out of his stock options.

Posted on 3/11/23 at 6:59 am to BeYou

quote:

Most of its customers are other business, not individuals. I've got a client that had nearly 650 million with SVB. WTF do you want them to do? open 2,500 bank accounts?

Risk Management. I want them to do risk management, especially to understand the FDIC insurance rules.

If you have $650 million in ONE bank, you damn well have enough funds to have an effective risk management department.

Even a junior bank regulator could tell this company it had an issues.

Posted on 3/11/23 at 7:01 am to NC_Tigah

Now let’s see if the Feds have any questions for Mr. Becker.

Posted on 3/11/23 at 7:09 am to Cosmo

quote:

How could anybody not make sure their money is under the 250k limit?

Posted on 3/11/23 at 8:05 am to Alltheway Tigers!

quote:

Risk Management. I want them to do risk management, especially to understand the FDIC insurance rules.

If you have $650 million in ONE bank, you damn well have enough funds to have an effective risk management department.

Man. That sounds like a cost. And you don't win at the game of Beat The Number by having a lot of costs.

Nah, we cut risk management costs and understand that the feds will bail us out.

Whether you are running a billion dollar operating company, a billion dollar bank, or own a house in hurricane alley.

Underinsure, and take the bailout. That's how we roll in America!

Privitize the profits, socialize the losses.

Posted on 3/11/23 at 8:07 am to Jcorye1

quote:

even huge companies need a place to stash operating cash. If I'm buying something for 30 million, I can't exactly send 120 wires

Or use 100 different banks for payroll.

Posted on 3/11/23 at 8:20 am to stout

Let em fail. Their investors have plenty of money. frick all those elite frickers

Back to top

4

4