- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: 4Chan breaks the "Gamestop Crisis" down for you, as only they can

Posted on 1/28/21 at 9:39 am to SlowFlowPro

Posted on 1/28/21 at 9:39 am to SlowFlowPro

I haven’t traded one share of anything since well before this started, as all my positions are long.

I just find the whole turn of events with the hedge funds getting fricked to be goddamn hilarious considering the quality of individuals involved, such as ones who bragged about a previous run on Tesla.

I just find the whole turn of events with the hedge funds getting fricked to be goddamn hilarious considering the quality of individuals involved, such as ones who bragged about a previous run on Tesla.

Posted on 1/28/21 at 9:39 am to JohnnyKilroy

quote:

Are all short squeezes illegal?

no there is one more important part:

quote:

for the purpose of inducing the purchase or sale of such security by others.

that was the collaboration i was talking about

the people who initially sold this idea literally did it to create a wave of people buying. that inducement is the key

Posted on 1/28/21 at 9:41 am to SlowFlowPro

78i(a)(2) Specifically says that you cannot act alone to induce someone else to buy a share at a higher price.

This makes all short squeezes illegal.

This makes all short squeezes illegal.

Posted on 1/28/21 at 9:41 am to SlowFlowPro

quote:

it's not the activity in an individual vacuum as much as the collaboration

That's BS.

It's a public message board, lol. Literally, anyone with an internet connection can read it without joining, and make their own decisions.

You're going to have a hard time convincing anyone that this was anything other than a legit short squeeze. The short players overgambled and they're getting fricked. Too fricking bad.

The same could also be argued against any investment writer who discloses they own underlying shares of the equity they're writing about. It amazes me you don't understand how worthless that specific section of law is.

quote:

like if you just bought GME, you're not going to be in any danger

if you were promoting this on reddit? i'd have a tight butthole

remember, they arrested a guy for posting MEMES yesterday, 4 years after posting it

Yeah, I don't have a reddit account, but can still read the forum. Also, the platform I use for a brokerage has a social media component where I can post that I just bought a share, and discloses how much it is up. That would fall under your same lame argument. If they were to be consistent, they'd need to go after more people than those on Reddit.

This post was edited on 1/28/21 at 9:43 am

Posted on 1/28/21 at 9:42 am to JohnnyKilroy

quote:

This makes all short squeezes illegal

There an actual section in the Series 7 about short squeezes

Posted on 1/28/21 at 9:43 am to SlowFlowPro

quote:

(2)To effect, alone ..., a series of transactions in any security ...., for the purpose of inducing the purchase or sale of such security by others.

Posted on 1/28/21 at 9:45 am to JohnnyKilroy

And wouldn’t this be exactly what the hedge funds did through their run in an attempt to depress the stock price solely to purchase it to fulfill their shorts?

If they go after WSB and not the girls involved, it won’t be pretty.

If they go after WSB and not the girls involved, it won’t be pretty.

Posted on 1/28/21 at 9:46 am to JohnnyKilroy

I found this SEC case

i can look for more if you want. that's one guy who made selective purchases/sales and they allege violations of 78i(a)(2)

i can look for more if you want. that's one guy who made selective purchases/sales and they allege violations of 78i(a)(2)

Posted on 1/28/21 at 9:52 am to SlowFlowPro

So I will admit not understanding what shorting a stock was until yesterday, my question is this:

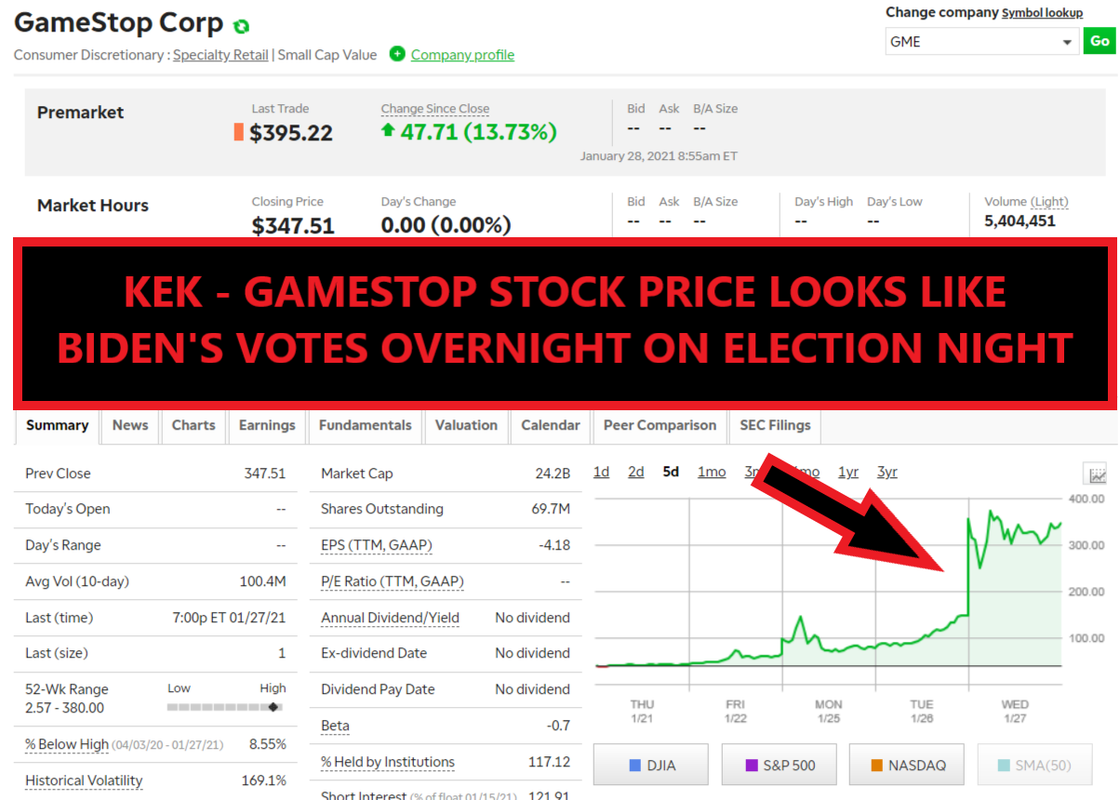

Since the stock is now obviously overpriced more than ever, why wouldn’t the hedges short it again? They’d stand to make way more money than originally planned, and make up even more than their original losses . The company is obviously going down soon and is only artificially being propped up by small time investors playing games. How long do these shorts typically last before they have to sell/buy them back?

Also if seems to me only the first people to sell will make the big money, before it comes crashing all the way down.

Since the stock is now obviously overpriced more than ever, why wouldn’t the hedges short it again? They’d stand to make way more money than originally planned, and make up even more than their original losses . The company is obviously going down soon and is only artificially being propped up by small time investors playing games. How long do these shorts typically last before they have to sell/buy them back?

Also if seems to me only the first people to sell will make the big money, before it comes crashing all the way down.

This post was edited on 1/29/21 at 8:07 am

Posted on 1/28/21 at 9:56 am to EvrybodysAllAmerican

quote:

Since the stock is now obviously overpriced, why wouldn’t the hedges short it again?

I don't disagree, but they are out of credit.

Posted on 1/28/21 at 9:57 am to TrueTiger

Out of credit, out of cash, and unless I am mistaken, they have been dumping their other stocks to save their asses on GameStop.

Posted on 1/28/21 at 9:57 am to EvrybodysAllAmerican

quote:

Since the stock is now obviously overpriced, why wouldn’t the hedges short it again?

like with anything in investing, timing is the key

shorting WILL make a ton of money if you time it correct. the problem is that shorting CAN lose you a ton of money if you time it poorly. shorting isn't like buying, where you have a maximum investment that you can lose. you can lose 100x your investment with shorts (as many of these funds found out)

an idiom has developed. basically, "we can hold out longer than you can". not only are the potential losses for each individual capped (since they've bought), the movement has a lot of minor exposure for millions of individuals. losing $300 is worth it for the lulz

hence this meme:

*ETA: my comments above were general. the funds in danger are overextended, as other posters have pointed out. they don't have the money to buy shorts

This post was edited on 1/28/21 at 9:59 am

Posted on 1/28/21 at 9:59 am to SlowFlowPro

I think it was closer to “Our stupidity can outlast your liquidity.”

Posted on 1/28/21 at 10:00 am to teke184

i didn't want to drop an r-word, since that's apparently why WSB was banned form discord

This post was edited on 1/28/21 at 10:01 am

Posted on 1/28/21 at 10:00 am to teke184

I believe the quote was "we can stay retarded longer than you can stay solvent."

Posted on 1/28/21 at 10:05 am to Bunk Moreland

Close enough.

Point is that a bunch of people willing to park money in the stock indefinitely can outlast a group paying interest by the day on their position looking at hard losses.

Point is that a bunch of people willing to park money in the stock indefinitely can outlast a group paying interest by the day on their position looking at hard losses.

Posted on 1/28/21 at 10:08 am to SlowFlowPro

quote:

In light of current market volatility, we are restricting transactions for certain securities to position closing only, including $AMC and $GME. Read more here.

https://twitter.com/stoolpresidente/status/1354814026325188616

I have a question. Do the companies like GME and AMC benefit from the shorts?

In light of current market volatility, we are restricting transactions for certain securities to position closing only, including $AMC and $GME. Read more here.

https://twitter.com/stoolpresidente/status/1354814026325188616

I have a question. Do the companies like GME and AMC benefit from the shorts?

This post was edited on 1/28/21 at 10:12 am

Posted on 1/28/21 at 10:10 am to SlowFlowPro

quote:

I found this SEC case

i can look for more if you want. that's one guy who made selective purchases/sales and they allege violations of 78i(a)(2)

Not an on point case.

Troll harder.

Posted on 1/28/21 at 10:11 am to Ailsa

Nope. A short is basically a bet that the stock is worth too much, indicating problems that should cause it to re-valuation downward.

A buy is basically a vote of confidence in the company and its prospects.

A buy is basically a vote of confidence in the company and its prospects.

Popular

Back to top

0

0