- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

30 Trillion - Hidden Fed Data - 10 year Wait FOIA Request

Posted on 1/31/22 at 12:29 pm

Posted on 1/31/22 at 12:29 pm

Ummmmm.....wtf? Is this real? Someone with financial knowledge know if this is even possible. 30 trillion given to banks and foreign countries during the big bank bail out of 2008?

Then loaned out 1 trillion per week? Up to 90 TRILLION dollars. SOOOoooo thats like 120 trillion to fricking banks?

YouTub - Glenn Beck - Hidden data from the Fed

Can someone explain how you digitize federal money and just give it out in the TRILLIONS without anyone knowing...

If true, time to call in collections. I don't get to fricking default on my payments to daddy government, and it ain't fricking trillions.

Then loaned out 1 trillion per week? Up to 90 TRILLION dollars. SOOOoooo thats like 120 trillion to fricking banks?

YouTub - Glenn Beck - Hidden data from the Fed

Can someone explain how you digitize federal money and just give it out in the TRILLIONS without anyone knowing...

If true, time to call in collections. I don't get to fricking default on my payments to daddy government, and it ain't fricking trillions.

Posted on 1/31/22 at 12:31 pm to geauxturbo

Everyone keeps looking over this massive news. Our fate is sealed if this is true. We are done. The unraveling has already started

Posted on 1/31/22 at 12:31 pm to geauxturbo

Because it’s bank reserves not legal tender. They’re essentially giving the banks optionality to create new money via lending by expanding their balance sheet capacity.

Posted on 1/31/22 at 12:33 pm to wutangfinancial

Would you say that the banks are diversifying their portfolios?

Posted on 1/31/22 at 1:02 pm to geauxturbo

Not too alarming in reality. Banks have about 30 trillion in outstanding loans just on houses in the USA. So I guess indirectly the Fed owns all of our houses (or those of us still with mortgage payments anyway).

Add in worldwide investments for US banks and I'm sure it's equal to whatever the outstanding balance sheet as someone else already said.

Add in worldwide investments for US banks and I'm sure it's equal to whatever the outstanding balance sheet as someone else already said.

Posted on 1/31/22 at 1:05 pm to wutangfinancial

quote:

Because it’s bank reserves not legal tender. They’re essentially giving the banks optionality to create new money via lending by expanding their balance sheet capacity.

This is what I have no knowledge of. I'm guessing most people don't and its why its not big news. Its hard to screem in fury over that which you don't understand.

Like me explaining to a 2 year old how an internal combustion engine works. Just a blank stare back.

So, they are lending out money they don't have with the Fed's backing by the fed printing some digital and some real currency? Sorry, I'm the 2 year old in this. Or vice versa, the bank lends out money even though they don't have it and report it to the fed as part of the "loan"? Or, something way more complex than that and I am not even in the ballpark?

Posted on 1/31/22 at 1:07 pm to geauxturbo

Sad but true & they had to. If the big 16 on Wall Street crash, we all crash.

Posted on 1/31/22 at 1:11 pm to geauxturbo

quote:

So, they are lending out money they don't have with the Fed's backing by the fed printing some digital and some real currency?

There is probably only about 1 trillion of actual money in circulation at any given time.

Posted on 1/31/22 at 1:19 pm to geauxturbo

The central bank does an asset swap with bonds that are already on their balance sheet. So it’s an accounting entry that doesn’t really mean anything in reality. The banks can’t lend without the expansion of bank reserves because of post GFC banking regulation limiting balance sheet expansion without quality collateral. The Fed is effectively giving them the ability to lend more money but they are choosing not to. We know this is true because rates are and have been at and below 0 for almost a decade signaling the tightest lending environment in modern history.

Posted on 1/31/22 at 1:43 pm to geauxturbo

Notice how all the banks started building nice new palace office buildings all over the country that are now being vacated?

The corruption is massive and well beyond our wildest imaginations.

The corruption is massive and well beyond our wildest imaginations.

Posted on 1/31/22 at 1:51 pm to geauxturbo

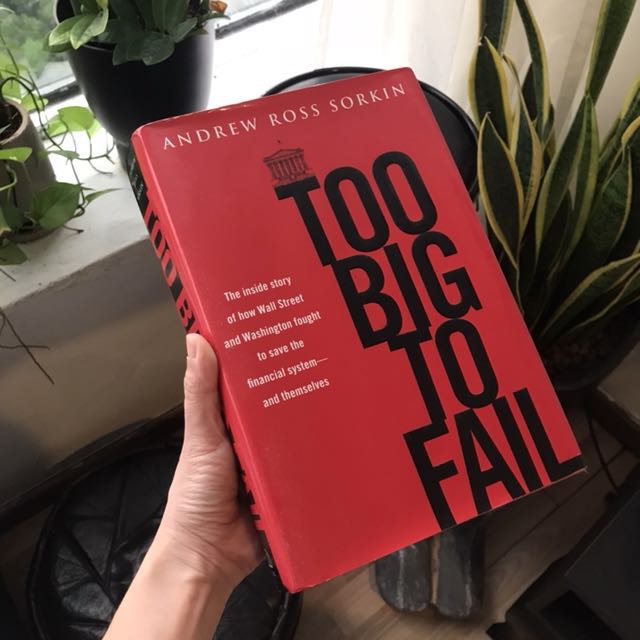

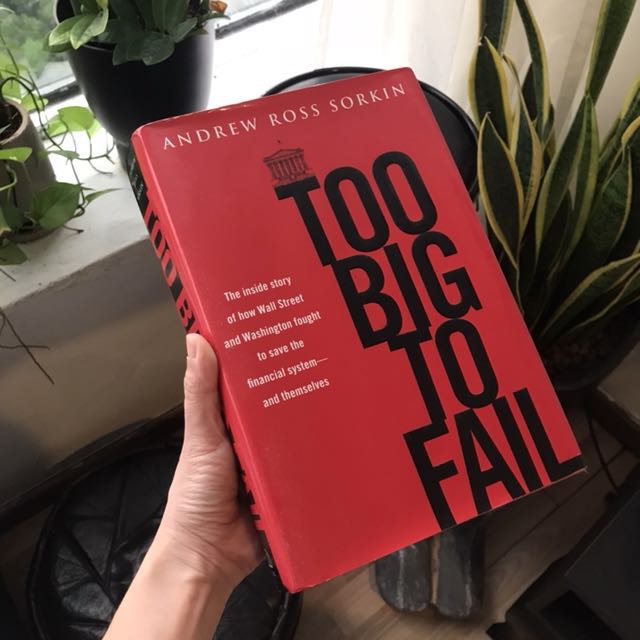

Everyone should read this book, money flowing like the Mississippi River.

Posted on 1/31/22 at 2:15 pm to geauxturbo

quote:

Ummmmm.....wtf? Is this real? Someone with financial knowledge know if this is even possible. 30 trillion given to banks and foreign countries during the big bank bail out of 2008? Then loaned out 1 trillion per week? Up to 90 TRILLION dollars. SOOOoooo thats like 120 trillion to fricking banks?

This is the kind of shite that would make sense of the RESET absurdity that is just a given among the elites.

In other words we are already bankrupt. It just hasn’t been acknowledged. Everything is a house of cards. And this is all a contest to figure out who survives after the inevitable happens.

Posted on 1/31/22 at 2:20 pm to moneyg

It's a shame we all don't have access to the fed discount window but that's reserved for the banksters

Posted on 1/31/22 at 2:21 pm to geauxturbo

quote:

Can someone explain how you digitize federal money and just give it out in the TRILLIONS without anyone knowing...

If true, time to call in collections. I don't get to fricking default on my payments to daddy government, and it ain't fricking trillions.

Actually, this ^^^ was discussed pretty heavily during the Occupy Wall Street movement during the financial meltdown of 2008/2009. Our Federal Reserve is the top of the Global Banking Cabal totem pole and that’s why we’re able to be so financially irresponsible with magic money.

This ^^^^ is also why the CCP/Russia/Iran/Soros want to destroy the USD as the world’s reserve currency. If we lose the USD as the world’s reserve currency it’s game set match.

Posted on 1/31/22 at 2:53 pm to Bass Tiger

quote:

This ^^^^ is also why the CCP/Russia/Iran/Soros want to destroy the USD as the world’s reserve currency

I actually highly doubt this is true for anybody but Iran

Posted on 1/31/22 at 3:38 pm to wutangfinancial

quote:

This ^^^^ is also why the CCP/Russia/Iran/Soros want to destroy the USD as the world’s reserve currency

I actually highly doubt this is true for anybody but Iran

So you would be caught by surprise if China, Russia and other anti US forces were conspiring to attack the USD? It would definitely be the plan of attack I would use if I were the CCP. If the USD is toppled from world reserve currency status the US is in trouble. So far our superior military and economy has been enough to keep that world reserve currency status for the USD but there’s a lot of uncertainty both abroad and domestically that could work against the USD remaining the preferred world reserve currency.

Posted on 1/31/22 at 5:08 pm to Bass Tiger

I wouldn’t be surprised but the CCP isn’t that stupid. They would crumble under your scenario.

Popular

Back to top

8

8