- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 11/13/23 at 10:36 am to Joshjrn

quote:

It’s genuinely going to be interesting to see whether that combination of houses hitting the market will be able to markedly outpace any pent up demand.

I have to imagine that keeping rates high is, in part, specifically designed to do what stout is posting about in the RE context.

These rates are targeting commercial RE holders directly in order to increase consumer supply, ultimately.

Posted on 11/13/23 at 10:37 am to Cosmo

quote:

Id actually like rates to go up another couple clicks

I agree and they should.

If people cannot control themselves hopefully the rates control them a little better.

I dont know what kind of parents raise their kids with literally no education involving finance but it seems like 95% of people dont know what the frick they are doing. Even college graduates.

Posted on 11/13/23 at 10:37 am to SDVTiger

quote:

And in your opinion whats the correct mesage for Agents right now?

Sorry, I can't help you because I'm too busy counting money from an artificially-created boom

Posted on 11/13/23 at 10:38 am to Thib-a-doe Tiger

If you have been saving cash, a grinding halt and fall in prices are very welcomed across the board.

Posted on 11/13/23 at 10:38 am to Joshjrn

quote:

It’s genuinely going to be interesting to see whether that combination of houses hitting the market will be able to markedly outpace any pent up demand.

The other factor to account for is that there is an uptick in delinquencies and that is expected to increase

Mortgage Delinquency Rate Increases Across YoY, Quarterly Time Frames

quote:

With the labor market having shown recent signs of weakening, and the unemployment rate rising to 3.9% in October, the Mortgage Bankers Association’s (MBA) latest National Delinquency Survey has found that the delinquency rate for mortgage loans on one-to-four-unit residential properties increased to a seasonally adjusted rate of 3.62% of all loans outstanding at the end of the third quarter of 2023.

quote:

MBA forecasts slower hiring and rising unemployment, with the unemployment rate rising to 5% by the end of 2024.

“The increase in unemployment will likely mean further increases in mortgage delinquencies, particularly for FHA borrowers,” said Walsh.

If foreclosures tick up that will solve some of the issues for buyers but creates more renters

As you said, interesting times for sure.

Posted on 11/13/23 at 10:39 am to SlowFlowPro

quote:

Sorry, I can't help you because I'm too busy counting money from an artificially-created boom

You realize all the houses are sold by like 10% of all realtors

I mean nothing said by this person is wrong

Posted on 11/13/23 at 10:40 am to stout

I was talking to a buddy about this yesterday. My issue right now isnt the rates as much as the stupid over evaluation of home prices. Houses that shouldnt be going for more than 150 tops are being listed for 220/230. Paying 7.1 on something that artificially inflated seems like a bad investment to me.

Posted on 11/13/23 at 10:40 am to SDVTiger

quote:

How am I expecting rate cuts? Lol

You've been saying all year rates cuts were coming by the EOY this year. They aren't.

quote:

And in your opinion whats the correct mesage for Agents right now?

Just be honest and say rates might not come down soon. Also, be honest and say prices may continue to drop if rates stay high so there is a possibility you may have negative equity and not get to refi anytime soon.

It's better than screwing someone over. I couldn't sleep at night without being honest with people. If they make the decision to proceed then that is on them but my conscience would be clear.

This post was edited on 11/13/23 at 10:41 am

Posted on 11/13/23 at 10:41 am to Deactived

quote:

Talked to the real estate agent the other day and she told me the biggest problem she is having right now is getting people approved with the bank. People are trying to buy and the prices are going down but the bank is being strict with loans.

Good they shouldve been doin this 15 years ago.

Posted on 11/13/23 at 10:42 am to Thib-a-doe Tiger

quote:

I don't believe this for a second. It also came from a woman, so probably not hyperbolic at all

These people have debt of some sort.

Posted on 11/13/23 at 10:44 am to stout

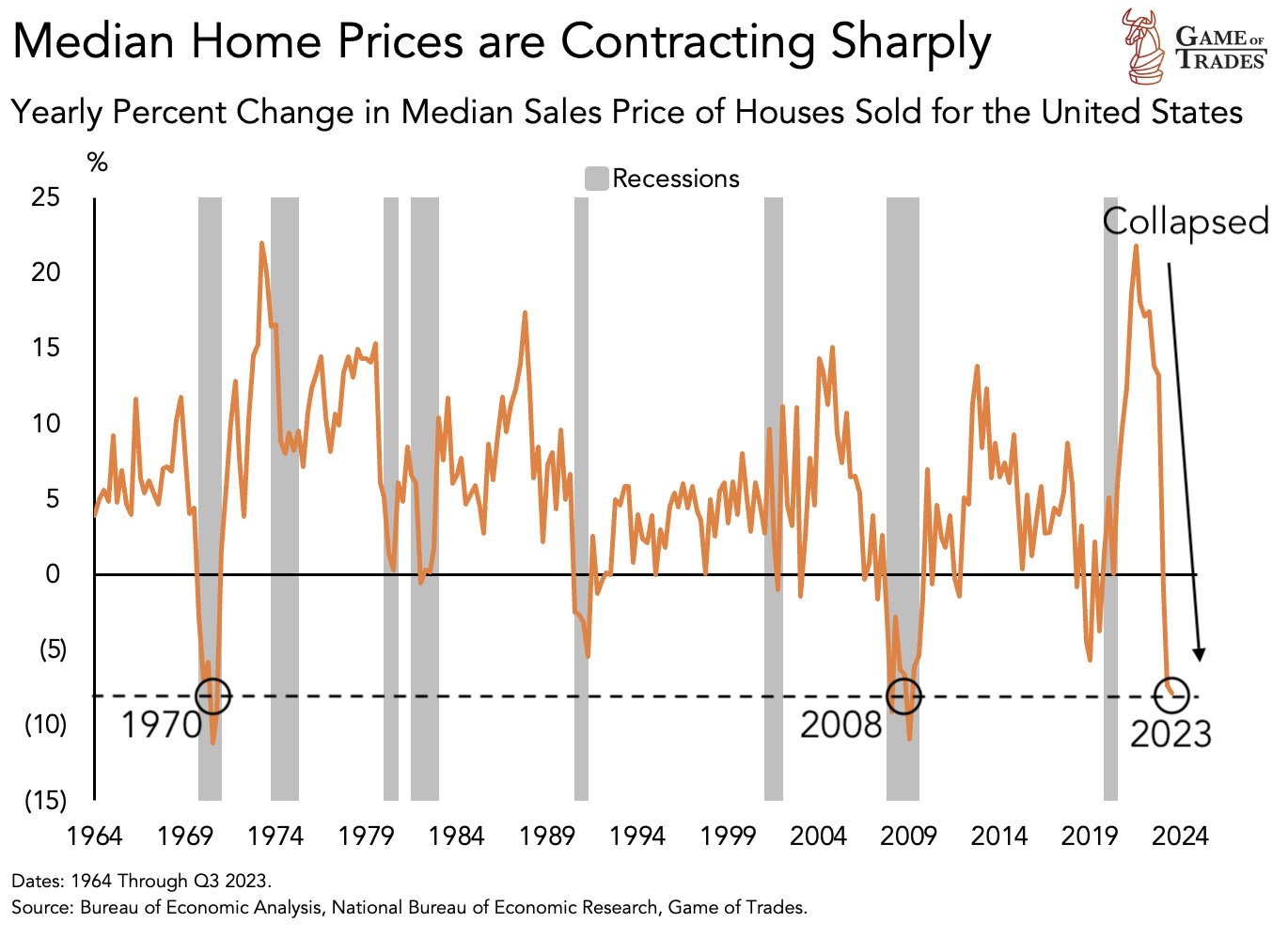

Just missing the grey recession line now.....

Posted on 11/13/23 at 10:45 am to stout

You guys all act like real life isn't continuing to happen all around us. People get married, people die, people get divorced. The "buying frenzy" from 2022 is over but the housing market is still strong because of short supply. And before you say it, yes, this is highly dependent on location. Some markets are starting to slow down while other really haven't and probably really won't.

The biggest problem facing the overall market is that you've got a lot of houses out there that are financed at some really really attractive rates. I'm personally at 2.65% and will stay on the sidelines for a long time due to this fact. This creates problems for people trying to enter the market because you have a much smaller portion of the the potential pool willing to sell. This creates higher prices and in turn puts more pressure on the market.

It's a vicious cycle. We got addicted to really low rates + the covid money printers going brrrrrrr. Both of those put us in this tough market.

I do agree that as rates start to trickle back down the intensity of the market will start to heat back up and we'll start all of this conversation over again.

The biggest problem facing the overall market is that you've got a lot of houses out there that are financed at some really really attractive rates. I'm personally at 2.65% and will stay on the sidelines for a long time due to this fact. This creates problems for people trying to enter the market because you have a much smaller portion of the the potential pool willing to sell. This creates higher prices and in turn puts more pressure on the market.

It's a vicious cycle. We got addicted to really low rates + the covid money printers going brrrrrrr. Both of those put us in this tough market.

I do agree that as rates start to trickle back down the intensity of the market will start to heat back up and we'll start all of this conversation over again.

Posted on 11/13/23 at 10:45 am to stout

quote:

What's crazy is that everyone is so jaded that they think we have to have a full-on 2008 meltdown. That will never happen but there are signs we are in the early stages of a correction and that will only amplify if rates stay high. If rates drop then obviously prices will take off again.

A correction would actually be healthy for the market and will also lead to AirBNB and institutional investors dumping inventory leading to more affordability.

I agree, and primarily because something like 72% of borrowers have a sub 4% interest rate. Unless there is some cataclysmic occurrence, we probably aren't going to see a true "crash" like 2008.

A lot of factors are combining to keep prices high, and as those factors ease, I would not be surprised if we see a long, slow, deflation in home prices that could last a decade or more. Even in the 2008 crash, it took five years to go from peak to trough.

Posted on 11/13/23 at 10:46 am to stout

quote:

You've been saying all year rates cuts were coming by the EOY this year. They aren't.

I never said rate cuts will happen by the end of the year. Mortgage Rates will and are starting to drop

We will see this week with CPI/PPI

quote:

Just be honest and say rates might not come down soon. Also, be honest and say prices may continue to drop if rates stay high so there is a possibility you may have negative equity and not get to refi anytime soon.

Shouldnt the approach be that this is the time to make a deal and offer less get credits do a 3/1 buydown paid for by the sellers?

And this is why you buy FHA right now so if values dip you streamline without worry about value and not have to put 20% in

Posted on 11/13/23 at 10:47 am to Jcorye1

quote:

. I bought fully knowing we could lose some value on the house in the short/medium term

We bought going we are here until we are dead so didn't worry too much about value. The rates were going up as we were in the entire process and the cpa and Morgan Stanley advisor were pushing to just get it done asap. Settled on 3.6%. I think it jumped up to 4 plus the following Monday.

quote:

People also tend to be less concerned about interest when you pay something off in 10 years rather than take all 30.

Yea. I think this agent also deals with a lot of cash buyers so dealing with approvals is out of the norm for her.

This post was edited on 11/13/23 at 11:29 am

Posted on 11/13/23 at 10:47 am to jizzle6609

quote:

If you have been saving cash, a grinding halt and fall in prices are very welcomed across the board.

I don't disagree at all. But as someone who knows how to use and control credit, I don't need them to tighten the screws any more. They have essentially pushed the weak buyers out of the market already between high(er) rates and inflation. Anything additional is just piling on. While still at a discount from recent highs, the drop in the stock market doesn't rival Covid or 2009 drops.

ETA: and I don't see them pausing and then continuing to go up

This post was edited on 11/13/23 at 10:50 am

Posted on 11/13/23 at 10:49 am to stout

quote:

date the rate

Man, realtors really don’t care who will get fricked over as long as they get that commission.

Posted on 11/13/23 at 10:50 am to Deactived

quote:

She said for a 400k home right now you need an income of 200k

This board seriously needs to give up talking about the housing market. It amazes me how much wishcasting gets posted on here as fact.

Posted on 11/13/23 at 10:53 am to ronricks

I was repeating what a realtor said. Everyone has said the number is wrong.

Who is wishcasting?

Who is wishcasting?

Popular

Back to top

0

0