- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Whats the next event that could send the markets back down to the 3500 level or lower??

Posted on 11/30/22 at 7:29 pm to FLObserver

Posted on 11/30/22 at 7:29 pm to FLObserver

quote:

Big selloff today . For Sure

Nothing fundamentally has changed, but that was a huge intraday rally from Powell's statement that was already known information. Really incredible actually.

We'll see how much carry through happens with every trader eyeing S&P's long-term resistance lines coming up between 4080-4010, which the index is essentially at after it blew its load today.

Fundamentals are on the back burner until further notice.

Posted on 11/30/22 at 7:35 pm to Pendulum

quote:

Powell is playing this kind of brilliant. CPI comes in light, he can go dove and say I was prepared to go further but data is guiding us. If CPI comes in higher than expected, he basically just stays on the same course and says "I was telling you guys ALL ALONG". And they managed to not break anything.

Exactly, he can change his tone at any point.

We don't know if anything will break, but he's driving us towards stagflation.

Posted on 11/30/22 at 7:54 pm to FLObserver

quote:

Whats the next event that could send the markets back down to the 3500 level or lower??

The answer to the question is when the SPR is empty and OPEC cuts production. Oil will moon to 130+ and inflation ramps back up

Posted on 11/30/22 at 8:04 pm to My2ndFavCivilNgineer

quote:

The answer to the question is when the SPR is empty and OPEC cuts production. Oil will moon to 130+ and inflation ramps back up

Maybe, but this board said the SPR releases wouldn’t do anything and oil was going to $200, and it’s sitting at $80. I too would have been wrong on this big of a drop, but oil has defied the odds for 6+ months now.

Posted on 12/1/22 at 7:53 am to JimMorrison

I'm just buying good stocks on so so earnings. Problem with that is they drop 20 bucks after earning but they up 50 for the month.

Posted on 12/1/22 at 8:00 am to tenderfoot tigah

Biden becomes totally incapacitated and we’re stuck with Heels Up.

Posted on 12/1/22 at 9:21 am to FLObserver

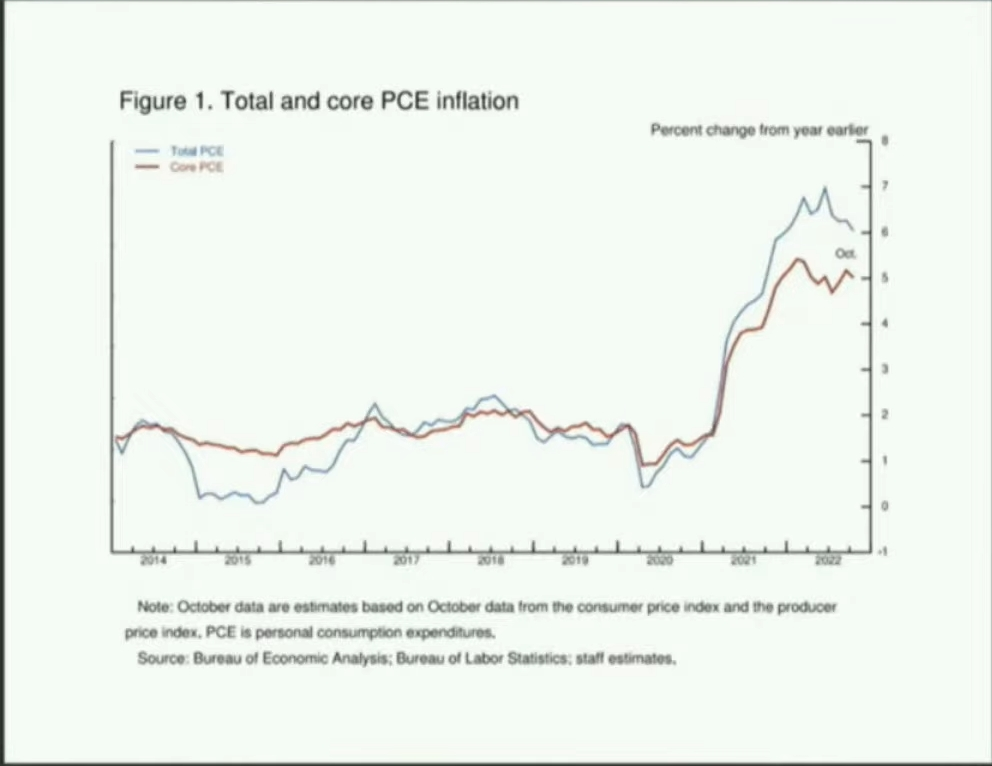

Core PCE came in still high and not showing any significant dropoff.

Powell shared this slide yesterday and admitted the rate hikes haven't changed inflation's course. It's been sideways all year. Let's get ready to welcome stagflation next year.

Sorry for the quality. It was a screen grab from video.

Looking more into what happened yesterday, the market started rallying before Powell even spoke a word

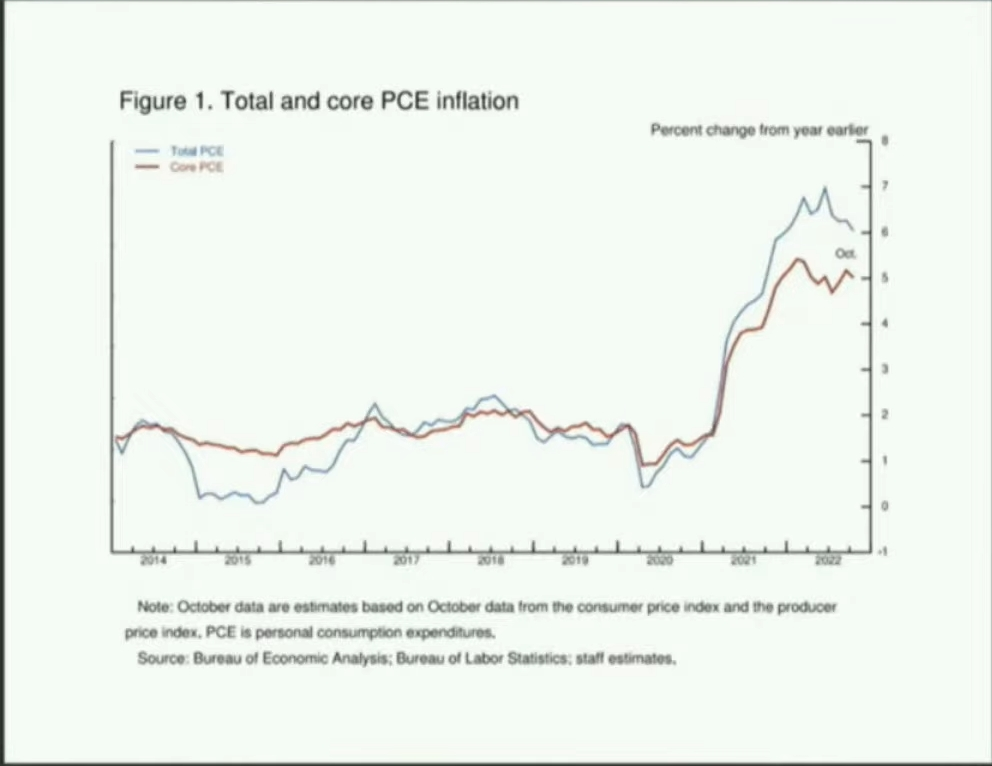

Powell shared this slide yesterday and admitted the rate hikes haven't changed inflation's course. It's been sideways all year. Let's get ready to welcome stagflation next year.

Sorry for the quality. It was a screen grab from video.

Looking more into what happened yesterday, the market started rallying before Powell even spoke a word

Posted on 12/1/22 at 11:02 am to JimMorrison

quote:

Powell shared this slide yesterday and admitted the rate hikes haven't changed inflation's course. It's been sideways all year. Let's get ready to welcome stagflation next year.

I’m not sure how much change you can really expect when the effective FFR was 1.6% 125 days ago. It’s only been restrictive for two months, and our data that tracks the economy is at least 1-month behind that.

This seems like the economic equivalent of firing Brian Kelly after the FSU loss.

Posted on 12/2/22 at 5:16 am to slackster

quote:

I’m not sure how much change you can really expect when the effective FFR was 1.6% 125 days ago. It’s only been restrictive for two months, and our data that tracks the economy is at least 1-month behind that.

No, I agree and that's my point on the S&P pricing is way too optimistic again.

It's still unknown the effects the higher rates will have and if the terminal rate will need to be higher than thought due to possibly sticky inflation in the 5-6-7% range meanwhile unemployment increases due to lower corporate earnings.

Wall Street may take stocks a bit higher, but the move is nearly over. Looking forward to the fade and turn lower on the indexes.

Posted on 12/5/22 at 8:41 pm to JimMorrison

A high-level assassination in a top tier nation.

Posted on 12/7/22 at 6:42 am to JimMorrison

quote:

Looking forward to the fade and turn lower on the indexes

Indexes have given up all gains during the fake Powell pump. If you are one to analyze charts, the prices are near breaking support lines from the November CPI print. If it breaks down, there is a big gap to fill from that event.

If indexes become oversold before next week's CPI and FOMC, it may be more probable to pump on next week's news, but it will be short-lived since January is around the corner.

Posted on 12/7/22 at 2:32 pm to Pendulum

OOOOOO boy those TLT calls are finally working.

Posted on 12/7/22 at 7:19 pm to Shankopotomus

quote:

Time

Saw an article today saying that the final capitulation will come mid year 2023. (Panic sell off)

I don’t necessarily agree that we will have a panic sell off but I do think we will hit a new low next year.

Posted on 12/7/22 at 7:57 pm to Guntoter1

Agree I think we go back down under 3500 early '23. There are really no near term catalysts I can think of.

I'm not selling what I'm holding but I'll probably start building up some more cash.

I'm not selling what I'm holding but I'll probably start building up some more cash.

Posted on 12/7/22 at 8:54 pm to Pendulum

quote:

OOOOOO boy those TLT calls are finally working.

I’ve been bearish on longer dated rates but they’ve fallen too far too fast IMO. There is substantial downside risks 2+ year rates IMO. I think we see 4% on the 10y before we see 3%.

Posted on 12/7/22 at 9:13 pm to slackster

For sure too much to fast, but 10yr went from what? 4+% to 3.4% in one month since CPI for October. Dec 13 November CPI; if it were to say, surprise to the downside, 3% doesn't seem that far. If it shows a slower than expected decline, you are definitely right. The markets are in the process of blowing it's load realizing 9% inflation is over; the markets haven't yet realized that getting from 4-5% to 2% will require unemployment to go up unless we magically bring back productivity and that is not happening. I'm playing for a light CPI and I'm going to unload alot of these calls if that happens.

This post was edited on 12/7/22 at 9:16 pm

Posted on 12/7/22 at 9:25 pm to Pendulum

10y went from 4.3% to 3.4% in a month.

I think most of the money on those calls has been made, but good luck.

I think most of the money on those calls has been made, but good luck.

Posted on 12/8/22 at 8:56 am to slackster

I have 4 TLT call positions, the ones I bought in sept are up like 6% and 5% now after being down huge, had me sweating. The ones I bought last week are up 70% and 20% so yea, I feel uneasy with this much green these days, you're probably right. Shoulda took some profits yesterday, will probably be how I feel a week from now.

Altho jobless claims today

The beginning of cracks starting to show.

Dec 13, CPI next.

Altho jobless claims today

quote:

Continuing US Jobless Claims Rise to Highest Since February

Three-week jump in continuing claims is most since May 2020

California, New York posted biggest rise in initial claims

The beginning of cracks starting to show.

Dec 13, CPI next.

This post was edited on 12/8/22 at 8:58 am

Posted on 12/8/22 at 9:22 am to Pendulum

quote:

Dec 13, CPI next.

PPI Tomorrow

Popular

Back to top

1

1