- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Tech crash is picking up steam. Nasdaq down over 1,000 points in the last 8 days.

Posted on 4/19/24 at 11:24 am

Posted on 4/19/24 at 11:24 am

Nasdaq partying like it's April 2000.

This post was edited on 4/19/24 at 11:54 am

Posted on 4/19/24 at 11:27 am to Ghandi

You would think Ghandi would have more wisdom

Posted on 4/19/24 at 11:30 am to wutangfinancial

quote:

You would think Ghandi would have more wisdom

Gandhi say "Don't shoot messenger".

This post was edited on 4/19/24 at 12:00 pm

Posted on 4/19/24 at 11:34 am to Ghandi

We'll see. The market may still be full of optimism come Monday morning, it wouldn't be the first time.

Posted on 4/19/24 at 11:37 am to Bard

quote:

We'll see. The market may still be full of optimism come Monday morning, it wouldn't be the first time.

Imagine a lot of people don't want to be in over the weekend with IRAN/ISRAEL drama.

This post was edited on 4/19/24 at 11:47 am

Posted on 4/19/24 at 12:01 pm to Ghandi

quote:So, it hit an all-time high and then back off 6%? The HORROR!

Tech crash is picking up steam. Nasdaq down over 1,000 points in the last 8 days.

Ghandi

Nasdaq partying like it's April 2000.

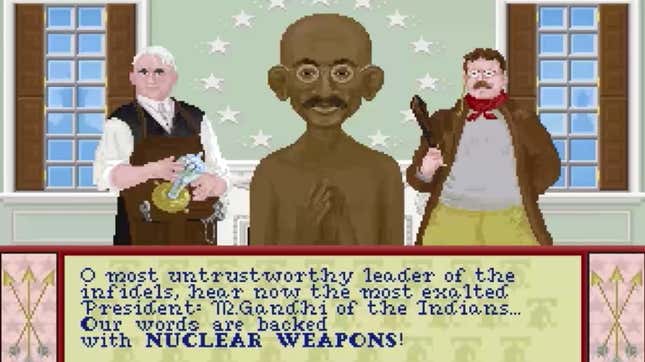

Posted on 4/19/24 at 12:02 pm to Ghandi

quote:

Gandhi say "Don't shoot messenger"

I thought he said this:

Posted on 4/19/24 at 12:10 pm to Big Scrub TX

quote:

So, it hit an all-time high and then back off 6%? The HORROR!

Nasdaq down 1,200 from the High.

7 percent off high.

NVDA & AAPL and many other tech stocks are off over 15 percent from their high.

TSLA off 50 percent from 52 week high.

The Nasdaq isn't 100 percent tech.

Tech has actually dropped more than the Nasdaq.

Strange how people get emotional when you merely present facts/data.

This post was edited on 4/19/24 at 12:23 pm

Posted on 4/19/24 at 12:13 pm to Ghandi

One reason is we're in a duck market. A handful of stocks were skewing the overall indices.

One of the days the S&P set a record, only 78/500 stocks were green.

One of the days the S&P set a record, only 78/500 stocks were green.

Posted on 4/19/24 at 12:33 pm to Ghandi

Obvious alter is obvious.

7% pullback isn’t a crash. It’s hardly a blip on the historical radar.

7% pullback isn’t a crash. It’s hardly a blip on the historical radar.

Posted on 4/19/24 at 12:51 pm to Ghandi

quote:Emotional? lol

Strange how people get emotional when you merely present facts/data.

quote:CRASH!!!

NVDA & AAPL and many other tech stocks are off over 15 percent from their high.

TSLA off 50 percent from 52 week high.

The Nasdaq isn't 100 percent tech.

Tech has actually dropped more than the Nasdaq.

Posted on 4/19/24 at 1:16 pm to Ghandi

Market was frothy. Pullbacks are expected when you hit all time highs. If you are invested for the long term nothing to see here.

Posted on 4/19/24 at 1:45 pm to Ghandi

All my stocks have been getting hammered the past few weeks but I see it as just healthy pullbacks/market over reactions. They will come back stronger with time. Too many instant gratification and panic freaks out there, longs are rewarded if you stick with good companies

Posted on 4/19/24 at 2:53 pm to kaaj24

quote:

If you are invested for the long term nothing to see here.

What is considered long term? 10 years?

Posted on 4/19/24 at 3:33 pm to wmtiger69

quote:

What is considered long term? 10 years?

Until you need the money or you don’t believe in the company anymore

This post was edited on 4/19/24 at 3:36 pm

Posted on 4/19/24 at 3:37 pm to Ghandi

quote:I just hope you keep claiming the market is "melting down" like you did last night.

Tech crash is picking up steam.

My brokerage accounts are up by almost a combined +$30,000 today. And that's not counting the accrued interest on my T-bills (where I park most of my cash) or money market mutual funds. Thank you!

Posted on 4/19/24 at 3:43 pm to wmtiger69

quote:

What is considered long term? 10 years?

Good question. IMO, it’s somewhat age and circumstance dependent. But generally speaking, if one cannot (comfortably) stay with a long position for at least 5 years, it would be better to either not take the position or consider it more of a “tradeable”. But your mileage may vary.

Posted on 4/19/24 at 5:17 pm to Ghandi

Nasdaq is up 17.7% in last 6 month.

Posted on 4/19/24 at 6:04 pm to slackster

quote:In case you missed his thread on the Poli Board last night after the Israel/Iran action: LINK

Obvious alter is obvious.

7% pullback isn’t a crash. It’s hardly a blip on the historical radar.

quote:

Oil Prices jump 3 percent after hours. Stock Futures Melting Down.

Posted on 4/18/24 at 9:54 pm

Oil Prices Jump 3 percent after hours on Israel strike on Iran

Stock Futures Melting Down

To which I replied:

quote:

So you think a 1% decline in stock futures = “melting down”?

He replied:

quote:

Sold everything and went 100 percent cash today.

Gonna sleep like a baby !

However, he edited that post this morning at 8:55 AM and deleted his statement about selling everything and going "100 percent cash." You can see what he deleted in Bestbank Tiger's quote of Ghandi's post in a reply.

Apparently he knew he would look stupid after seeing that the futures this morning were flat to slightly UP and all three indices were UP after the market opened.

So he doubled down today in this Money Talk Board thread about a "Tech crash" when the NASDAQ pulled back.

He's really, really desperate to impress everyone with his investing acumen.

Popular

Back to top

10

10