- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 7/29/22 at 10:40 pm to Morpheus

quote:Well the basic demand side of the equation is Money Supply * Velocity (how much money moves through the economy), so more money and/or higher velocity pure upward pressures in demand. Now that increase can lead to economic growth and/or inflation, and the extent to which it leads to inflation is based on the extent to which supply keeps up with demand.

I'm just trying to figure out in my tiny little brain how taking money out of circulation helps lower the Inflation problem.

And while there appear to be somewhat different mechanisms in which the supply can increase/decrease, and some can increase it more than others (more velocity), in general more money that can circulate, the more likely it will increase demand.

I think an extreme example is best to illustrate it. So say for an example, everyone gets $1 million dollar stimulus check on Monday. What are people going to do with it? Sure some will be saved, some will be invested, and some will be used to pay down debt, but undoubtedly a lot of it will be spent and demand would sky rocket as a result. I know I would probably be buying a new vehicle (and my wife as well), and I would he doing it quickly because I know others would be too, and then this creates even more demand pressure and inflation would spiral.

Now conversely, if they took a bunch of money out of everyone’s accounts, now all of a sudden people don’t have money to spend, especially on anything but bare necessities and demand would crater for lots of things. Of course, that would likely cause a severe recession, not to mention it’s flat out theft (but I guess could be achieved similarly by raising taxes, but not spending), so they use other means to achieve it. But the general premise is the same.

Posted on 7/30/22 at 2:50 am to buckeye_vol

This is a good thread for education and explanation purposes.

Posted on 7/30/22 at 6:33 am to FinleyStreet

quote:

Every American adult should watch "How the Economic Machine Works" by Ray Dalio, who runs Bridgewater.

It's 30 minutes, but it's entirely worth it. A high school kid could understand this video; it explains how the economy works in simple terms.

Ray is a very smart odd man. I interviewed for his family office and it was the weirdest interview and experience in my life.

Posted on 7/30/22 at 10:26 am to buckeye_vol

quote:

So say for an example, everyone gets $1 million dollar stimulus check on Monday. What are people going to do with it? Sure some will be saved, some will be invested, and some will be used to pay down debt, but undoubtedly a lot of it will be spent and demand would sky rocket as a result. I know I would probably be buying a new vehicle (and my wife as well), and I would he doing it quickly because I know others would be too, and then this creates even more demand pressure and inflation would spiral.

Another aspect to this is productivity, or lack thereof.

We saw with the stimmy checks how lower-end workers simply stopped showing up for work for a while once they get their $1,200. Imagine that times (roughly) 1,000. Many of your lower-end workers (convenience store clerks, wait staff, cooks, construction workers, yard people, etc) and even some mid-range workers (factory workers, for example, cops, teachers, etc) would simply quit their jobs, thinking they are set for life.

Suddenly nothing is being made. Think the toilet paper shortage at the beginning of COVID was annoying? The empty deli sections at supermarkets when the stimmy checks came out was ridiculous? Those are just mild examples of the economic collapse we would see along many lines if everyone was just given $1,000,000.

How valuable is $1,000,000 if everyone has it and there's very limited goods to buy with it?

This is a bit of the mistake pro-UBI people make. Not coincidentally, you no longer hear proponents of UBI since the failure of the stimmy checks, at least not as prominently as we heard them prior to all that.

Posted on 7/30/22 at 11:00 am to slackster

quote:

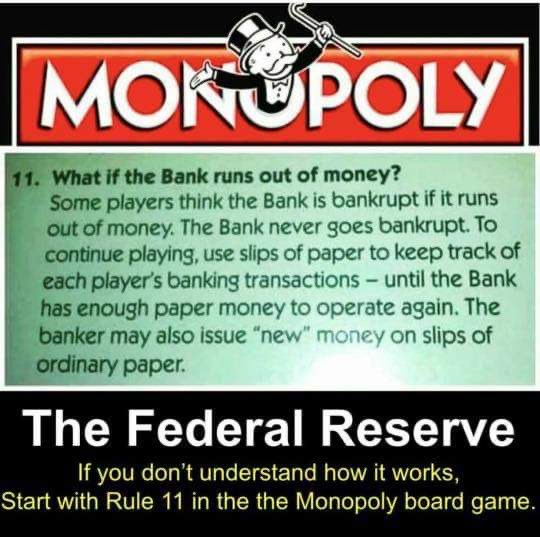

Fed funds rate is the rate banks make on deposits held at the fed reserve.

So when people say its the overnight rate at which banks borrow or lend to each other, what does that mean? Who pays the interest? The Federal Reserve, or the banks to each other?

Posted on 7/30/22 at 11:53 am to Morpheus

quote:

Yes, and I understand that goal by the Fed. I'm just trying to figure out in my tiny little brain how taking money out of circulation helps lower the Inflation problem.

Less money chasing the same amount of goods.

Posted on 7/30/22 at 12:11 pm to Street Hawk

quote:

So when people say its the overnight rate at which banks borrow or lend to each other, what does that mean? Who pays the interest?

The bank doing the borrowing.

This is a VERY generalized analogy, but it's enough to give you the basic idea.

In this example, I'm the Fed and you're the Bank of Street Hawk.

Let's say I loan you $100 with a 2% interest rate. You then loan that out at 5%. When the loan is due, the person you loaned the money to pays you $105, you then pay me $102. Off of that $100, I made $2 while you made $3.

Now you may be wondering "well how does that work if it's an 'overnight' rate?" That's where it gets more complicated because banks are always making loans and getting payments in. It's an ongoing balancing act.

Posted on 7/30/22 at 1:08 pm to GhostofJackson

Can't really say as the first step is signing an NDA.

Posted on 7/30/22 at 3:50 pm to Morpheus

It slows down the economy. Incomes and credit shrink. Spending goes down. Less money chasing things to buy. Prices go down as a result. That lowers the inflation rate Everything boils down to supply and demand.

Posted on 7/30/22 at 3:54 pm to MSTiger33

quote:

Ray is a very smart odd man. I interviewed for his family office and it was the weirdest interview and experience in my life.

Go on...

Popular

Back to top

0

0