- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

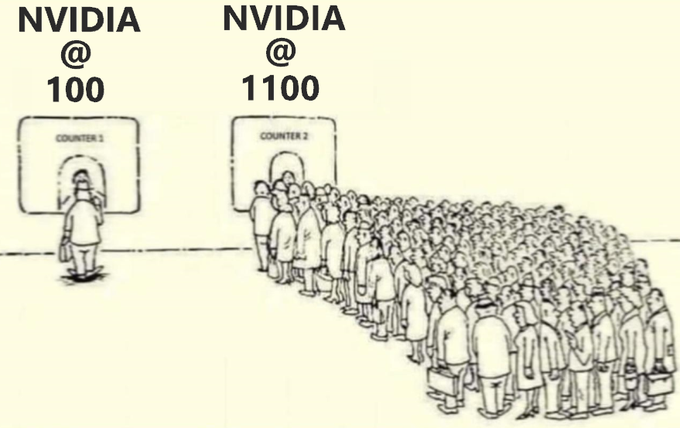

re: How High Do you think Nvidia stock can go?

Posted on 5/29/24 at 2:37 pm to thesabanizer

Posted on 5/29/24 at 2:37 pm to thesabanizer

quote:

see you at $10T

I hope so. Not sure what that would mean for the rank and file of this country, but I’m along for the ride.

Posted on 5/29/24 at 4:04 pm to slackster

Selling my shares at $135 back in September of 2022 doesn’t seem like the best strategy looking back at it in retrospect

Posted on 5/29/24 at 5:10 pm to BigPerm30

quote:

Selling my shares at $135 back in September of 2022 doesn’t seem like the best strategy looking back at it in retrospect

I got in at 313 and 446 wish i would of bought at $125 at that time

Posted on 5/30/24 at 12:55 pm to Granola

Like Broadcom, they are like at $1300.

Posted on 5/31/24 at 8:21 am to Geauxldilocks

quote:

That said currently the risk is to the downside. Elliot Wave chart not hitting $1,100 on the recent recovery afree April lows indicates below $700 more likely than $1100 after earnings next week.

No offense, but I’ve never found Elliot Wave theory to be an overly useful indicator when a stock has strong fundamentals, strong money flow and a strong earnings outlook. Those factors pushed the stock well above $1100 after earnings. It may consolidate from where it is now ($1105), but it would have taken something of a black swan event (in the AI world) to have knocked it down below the 700s (a roughly 30% drop from when this thread started).

And to note: I’ve traded options on this ticker several times, but have not (yet) been long shares.

Posted on 6/1/24 at 2:54 pm to Granola

Probably to the moon since I don’t own any shares or call options.

Posted on 6/3/24 at 8:21 am to Venus Flytrap

Cathy wood sold almost 1mm shares when it was at 150. She lost out on @1.2 billion dollar return.

This post was edited on 6/3/24 at 8:24 am

Posted on 6/3/24 at 8:28 am to SlidellCajun

She’s just good like that.

Posted on 6/3/24 at 8:50 am to Jag_Warrior

Up over 3% in trading today.

Posted on 6/3/24 at 9:07 am to Granola

Jensen spoke at a conference this weekend. A lot of AI future discussions.

I’m bullish on this stock as believe AI is going to revolutionize our world.

I’m bullish on this stock as believe AI is going to revolutionize our world.

Posted on 6/3/24 at 9:18 am to kaaj24

quote:

Jensen spoke at a conference this weekend. A lot of AI future discussions.

I’m bullish on this stock as believe AI is going to revolutionize our world.

Or companies could discover that they aren't getting the Bang for the Buck that they expected from their AI spending, in which case look out below.

But it will take time for that possible scenario to play out.

This post was edited on 6/3/24 at 9:19 am

Posted on 6/3/24 at 9:29 am to slackster

quote:

NVDA within spitting distance of Apple market cap. $2.8T to $2.9T respectively

So total newb questions - nvdas PE is 66, and apples is 30. What is nvdas upmovement based on...solely their lack of competition and being the first, and how long is it sustainable? Idk who their nearest solid competitor is so may be long based on there not being one. Just seems like a major unseen coordinated dump for something new will leave many holding the bag.

Also, is nvdas doing a 10-1 split soon, and when if so? What's the boards mindset on when to buy it before or after? Apple progress slowed down after their last split.

Just wondering. TIA.

Posted on 6/3/24 at 9:35 am to Venus Flytrap

I guess that is possible.

I’m sure a lot of companies are talking about AI so they don’t seem far behind.

However, I’m not in that camp.

I work with accountants and lawyers and seeing the potential of what AI can do. I may have about 10 years or so until I’m obsolete for the most part.

I’m sure a lot of companies are talking about AI so they don’t seem far behind.

However, I’m not in that camp.

I work with accountants and lawyers and seeing the potential of what AI can do. I may have about 10 years or so until I’m obsolete for the most part.

Posted on 6/5/24 at 7:06 am to kaaj24

NVDA does a 10 for 1 stock split on June 7th if some of yall want to create a position if you are not currently in. I would highly recommend.

Posted on 6/5/24 at 7:18 am to FreddieMac

quote:

Like Broadcom, they are like at $1300.

I don't have any Broadcom shares. Should I jump in. Looks like a great company? Please advise

Posted on 6/5/24 at 7:21 am to HagaDaga

quote:

What's the boards mindset on when to buy it before or after?

Curious on this as well...

Posted on 6/5/24 at 7:26 am to Ziggy

I would buy directly after the split. It will be at around 109 dollars per share.

This post was edited on 6/5/24 at 7:29 am

Posted on 6/5/24 at 7:29 am to Ziggy

quote:

What's the boards mindset on when to buy it before or after? Curious on this as well...

Historically speaking stocks that split will go up on avg 25% in the following 12 months.

From a standpoint of buying pre or post split, it really doesn’t matter.

Personally, if I don’t have a position in a stock that is about to split already then I wait until post split with the following caveat. I wait for a little pull back post split. Stocks that are on fire on the ramp up pre split should pull back a post split then go on its march upward.

Now specifically as it relates to Nvda. Throw all that out the window and just buy because I don’t see the fervor of this beast dying down anytime soon.

Read one article the other day that predicted at least a $10 TRILLION valuation by 2030.

I can’t even wrap my head around that but whatever.

Posted on 6/5/24 at 7:35 am to Venus Flytrap

I think the stock is going up now because it’s going up. Like bitcoin, a lot of the run is fomo.

It’s momentum more than fundamentals.

I struggle to hold it while trying to figure out if I have the stomach to hold it when it sells off - which it will eventually.

The revenue and earnings are legit. It’s just gotten over bought on a fundamental basis.

It’s momentum more than fundamentals.

I struggle to hold it while trying to figure out if I have the stomach to hold it when it sells off - which it will eventually.

The revenue and earnings are legit. It’s just gotten over bought on a fundamental basis.

Popular

Back to top

1

1