- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: For those saying $3MM net worth at age 45 would not be nearly enough to retire...

Posted on 3/28/25 at 9:41 am to TX_Tiger23

Posted on 3/28/25 at 9:41 am to TX_Tiger23

quote:

That’s an outdated rule

You could have stopped there. It's just outdated period.

Posted on 3/28/25 at 10:30 am to PNW_TigerSaint

quote:

retiring at 45 yo with $3MM in net worth would be "bold."

Retiring at 45 with 3M in invested assets is actually my goal.

I'll probably work some bullshite part time job to mitigate risk but that likely won't be necessary. I also don't have expensive aspirations so that obviously helps a lot.

Posted on 3/28/25 at 12:18 pm to VABuckeye

quote:

Even is you invest conservatively and make and draw 4% a year you are drawing $120k a year without touching your principle.

Well, exactly. That’s not enough if you have a family, even in a LCOL area. My burn is around $150 per year w two kids, 3% mortgage, no car note, limited travel. Shits expensive these days. Only getting worse, too, at least for the next 5-10 years.

Posted on 3/28/25 at 12:20 pm to TxTiger82

I think 4-6MM would do it, but that’s assuming a level of economic stability that simply doesn’t exist right now. Can’t go FIRE’ing when we are reconfiguring the global economy. Too risky unless you’re well over 10MM and diversified into hard assets.

Posted on 3/28/25 at 12:28 pm to notsince98

quote:

$3MM in my retirement accounts is a different discussion. I'd probably feel just fine giving it a go if I had that in my retirement accounts.

How would you retire at 45 with that in retirement accounts?

At that age wouldn't the taxes and penalty be prohibitive from actually withdrawing and retiring?

Posted on 3/28/25 at 12:36 pm to RoyalWe

quote:

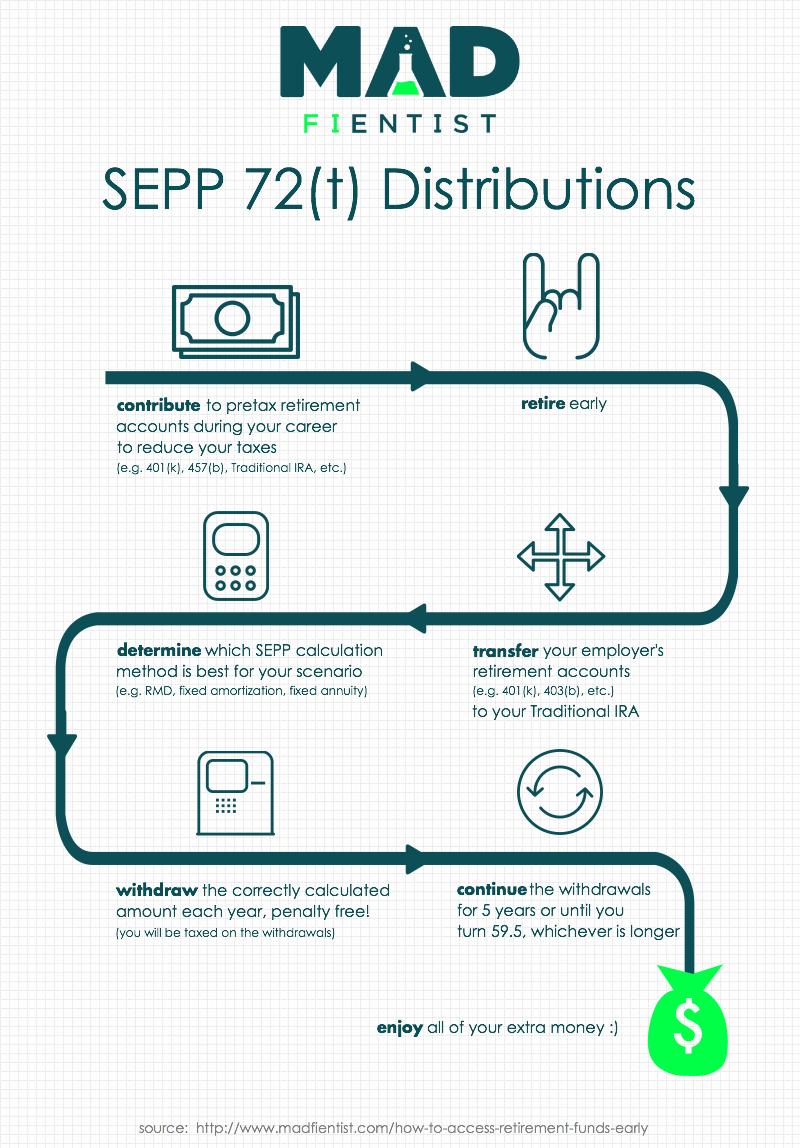

SEPP plan doesn't provide enough income for my lifestyle

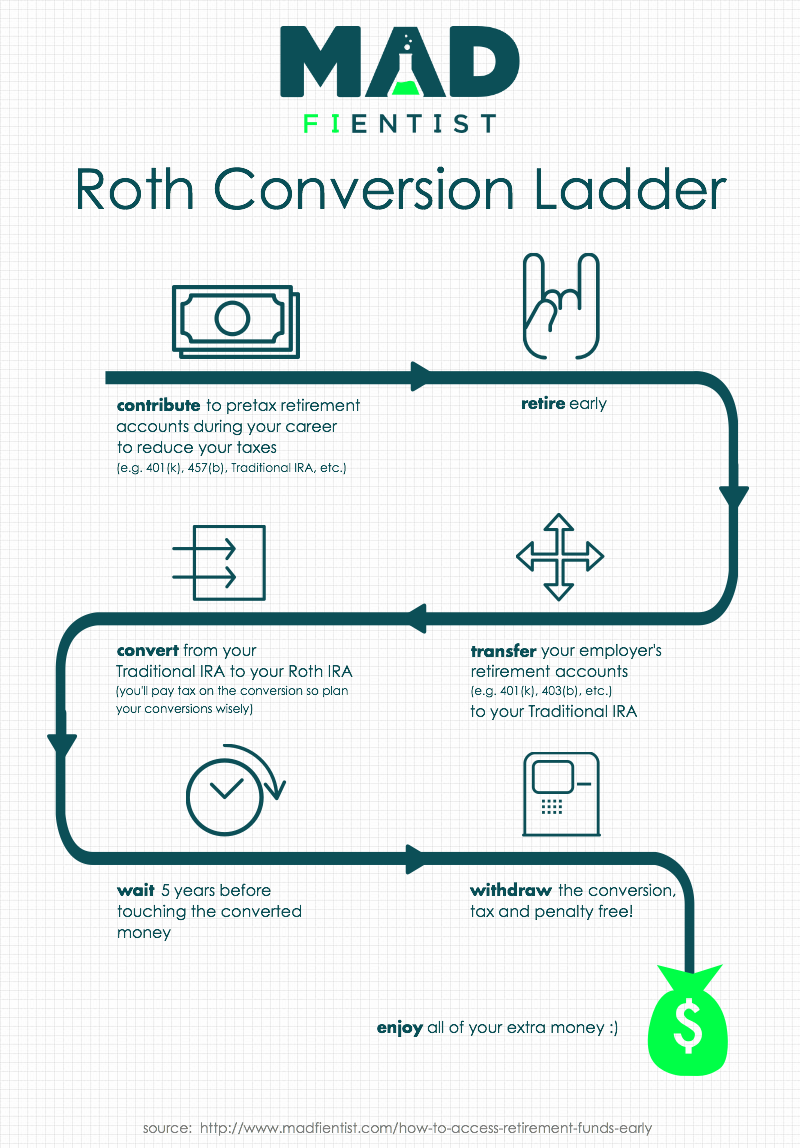

What rate are you withdrawing at and what will the SEPP allow? (The calculation was made less conservative last couple yrs or so if I recall) You dont have non retirement account funds to make up the difference or bridge the gap? I'd deplete other assets aggressively before taking 10% penalty. Did you consider a Roth conversion ladder?

Posted on 3/28/25 at 12:48 pm to whodatigahbait

quote:

How would you retire at 45 with that in retirement accounts?

Avoid penalties using one of these or Rule of 55.

You're gonna pay income tax on traditional withdrawals even if you wait (perhaps at higher rate w large RMDs, tax on SS benefits, and IRMAA later)

Read more about early withdrawal strategies here MADFIENTIST

This post was edited on 3/28/25 at 12:51 pm

Posted on 3/28/25 at 1:02 pm to TorchtheFlyingTiger

I use an aggressive income strategy that I won't go into the details of here. I haven't reviewed SEPP calculations recently, but if I recall a $5M SEPP gets you about $280K a year. As someone recently pointed out, I could do a partial SEPP to pay partial penalties instead of the full amount. I may consider it.

I do not have non-retirement account funds to bridge the gap. This is one of my largest regrets, but I did not expect to retire at 52 either.

I do not have a 401k with significant enough funds to allow me to use the Rule of 55 when I turn 55 to bridge the gap. Also, my income remains extremely high and Roth conversions would be especially expensive for me to execute.

I considered a Roth conversion ladder and I might get two years of not paying penalties as you can't touch the money for 5 years.

I do not have non-retirement account funds to bridge the gap. This is one of my largest regrets, but I did not expect to retire at 52 either.

I do not have a 401k with significant enough funds to allow me to use the Rule of 55 when I turn 55 to bridge the gap. Also, my income remains extremely high and Roth conversions would be especially expensive for me to execute.

I considered a Roth conversion ladder and I might get two years of not paying penalties as you can't touch the money for 5 years.

This post was edited on 3/28/25 at 1:04 pm

Posted on 3/28/25 at 1:16 pm to PNW_TigerSaint

quote:

I get that $10K per month in 20 years won't be worth nearly as much, but are you spending that much now?

Yes, maybe a bit more.

Posted on 3/28/25 at 2:47 pm to TDTOM

I think that the key for this is lifestyle and the disconnect between net worth and liquid assets.

If you are a disciplined individual and frugal in the years leading up to that point, then it is possible to hit this target and be comfortable in retirement.

If you are a consistent high wage earner then you will expand your expenses and it becomes tougher to reverse course and shut things down.

If you are a disciplined individual and frugal in the years leading up to that point, then it is possible to hit this target and be comfortable in retirement.

If you are a consistent high wage earner then you will expand your expenses and it becomes tougher to reverse course and shut things down.

Posted on 3/28/25 at 3:03 pm to whodatigahbait

My retirement accounts would be a mix of traditional, Roth and brokerage accounts.

Popular

Back to top

0

0