- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Do experts on the money board agree with what the feds did today?

Posted on 3/29/24 at 12:20 pm to Big Scrub TX

Posted on 3/29/24 at 12:20 pm to Big Scrub TX

No sir, I would not want to be importing food and energy. But here’s why Japan is important to our position. When food/energy inflation reaches a certain level they are forced to sell treasuries to buy oil. Yields go up domestically and the Fed and Treasury have to react. Janet can go back to the short end on new issuance and they can make USTs permanently exempt from SLR requirements. The banks sent a letter to the Feds a few weeks ago begging for it. That will postpone yield curve control but won’t ultimately prevent. That’s where we’re headed eventually.

Posted on 3/29/24 at 1:58 pm to Big Scrub TX

quote:

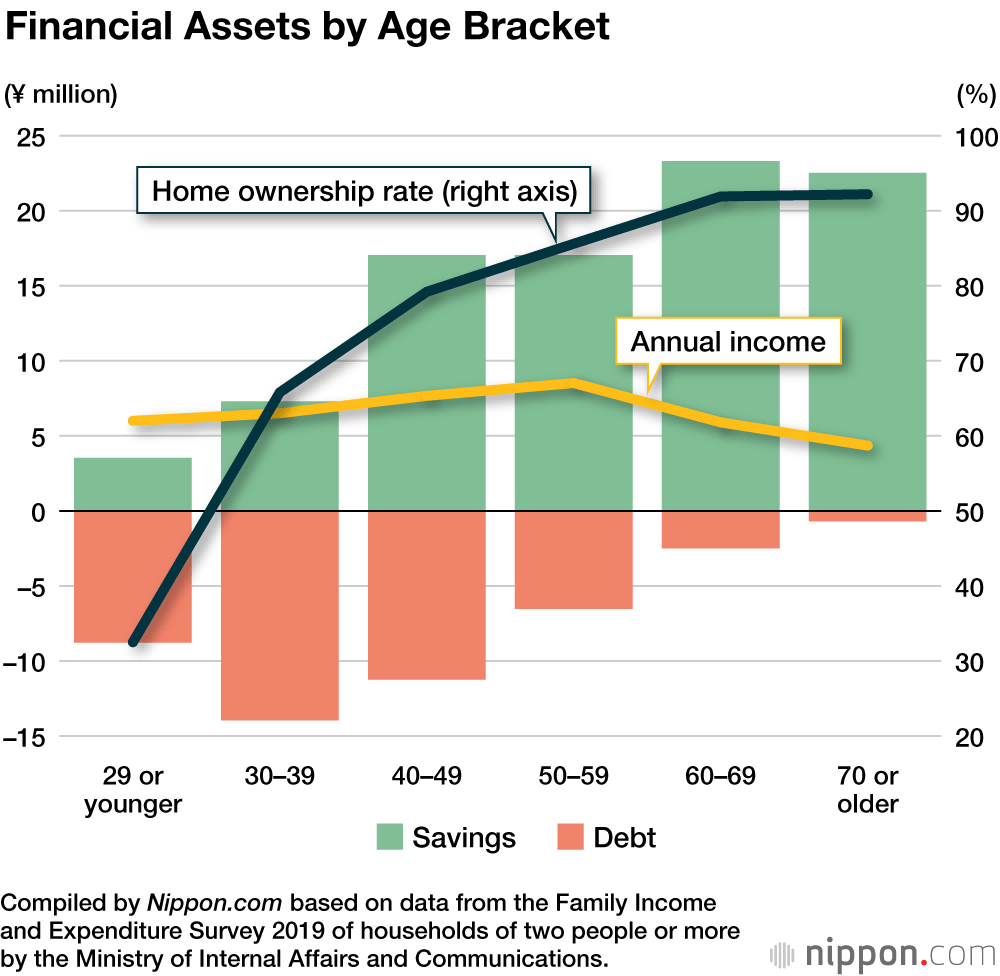

Does this include retirement savings.

Sort of. Japan has a mandatory pension system and the cost of living is ~32% lower than in the US. Again, their society's views on consumerism are different enough that it makes comparing the two apples v oranges. The majority of retirees in Japan have little to no worries about day-to-day spending.

quote:

Although income decreases as people reach retirement age, many seem to have secured a stable retirement by building up their assets in the meantime.

By age group, the amount of savings and the percentage of home ownership increase with the age group, while the amount of debt peaks among those in their thirties and begins to decrease thereafter. The basic pattern is to take out a mortgage in one’s thirties and then steadily pay back that loan.

Net savings, or savings minus debt, increase the higher the age group of the head of the household. The jump in savings in a person’s sixties is thought to be due to the lump retirement payment received by company employees. Households headed by those in their sixties and seventies who have paid off a mortgage by retirement age have larger net savings than other age brackets.

quote:

I think it just did.

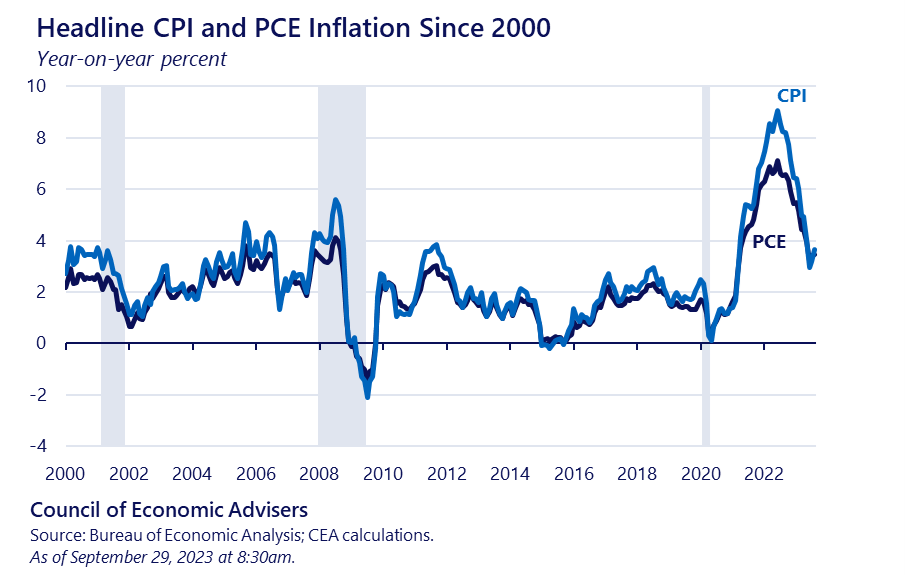

It depends on what you're using. I go with CPI because CPI sources from consumers, PCE sources from consumers and businesses. Since discussions of inflation are usually consumer-centric, I stick with CPI and then look at PPI for business. While CPI has bigger swings, it usually leads PCE (because of the business sourcing).

As such, CPI hasn't been below 3% since March 2021.

quote:

Sure there is. Rates could go back down a lot - especially short rates given we are tilted (stupidly) towards bills and not long bonds.

Rates aren't going down until inflation is tamed. Inflation isn't going to be tamed until debt-creation is tamed. Debt-creation isn't going to be tamed unless we hit a recession. That said, the only certainty of a recession is that it will curb debt-creation on the consumer end. My concern here is that it could drive federal debt-creation even higher as more people move to social welfare programs (thus simply walking away from private debt -through bankruptcy- while simultaneously creating more federal debt).

quote:

But I notice you didn't mention GDP anywhere in your analysis. I think we're north of $25T now. You should at least mention that when quoting nominal debt levels.

I can do that, but Real GDP growth continues to be far outpaced by consumer debt growth (starting in Q4 2021 and still today, 3.1% vs 9.8% in Q4 2023). That combined with the increasing rate of federal debt accrual underscores the belief that the brunt of GDP growth has been through unsustainable levels of debt creation in both public and private sectors. In other words (if I'm correct), the strong growth of GDP in a high-debt-creation environment is indicative of the quickly growing problem I see (thus underscoring my point).

quote:

My argument is that the easy part is predicting doomsday. Your "obvious math" could take many decades to in theory play out - and clearly none of us has any predictive ability around tech/productivity in those out years.

It could take many decades to play out, unfortunately the data doesn't make me think it will. At our current rate, we may be lucky to get beyond one decade before the USD starts edging toward hyperinflation.

Outside of something large and unforeseen (like WW3 breaking out), the speed with which federal debt is accumulating will only continue to snowball. Twenty years ago it took ~2 years to add an extra trillion to the debt. Ten years ago it took ~1 year to add an extra trillion to the debt. Today it takes roughly a single quarter of a year to add an extra trillion (meaning we'll likely add $3-$4 trillion to the debt this year alone). At such a pace, within the next five-six years we'll likely be at (or near) the point of adding a trillion dollars to the debt each month. With so much debt creation, inflation will have nowhere else to go but up.

At some point (if this continues), buyers of US debt will turn away (we're almost at that point now if the auction last Fall is any indication) regardless of returns because they'll see the USD as an investment on the brink of failure (which will make that turning away a self-fulfilling prophecy). If they aren't willing to buy US debt, why continue to back the USD as the primary reserve currency? If they are driven to start asking that question often and loudly enough, game over.

I can agree that none of us have a magic ball. None of us knows for certain what surprises the future holds, but that doesn't negate the ability to make some reasonable, educated guesses by looking at available data and the trends it shows.

If you are seeing data showing things differently, please share it (because I don't like the picture I see).

This post was edited on 3/29/24 at 2:04 pm

Posted on 3/29/24 at 2:12 pm to Bard

quote:Again, you are smart and knowledgeable enough not to just give nominal stats in a vacuum. Why not use %s of GDP instead of the nominal trillion? Yes, it's worse, but you overstate it here.

Outside of something large and unforeseen (like WW3 breaking out), the speed with which federal debt is accumulating will only continue to snowball. Twenty years ago it took ~2 years to add an extra trillion to the debt. Ten years ago it took ~1 year to add an extra trillion to the debt. Today it takes roughly a single quarter of a year to add an extra trillion (meaning we'll likely add $3-$4 trillion to the debt this year alone). At such a pace, within the next five-six years we'll likely be at (or near) the point of adding a trillion dollars to the debt each month. With so much debt creation, inflation will have nowhere else to go but up.

quote:Hyperinflation? Can you define that? Even the inflation of the past 3 years I view mostly as just catching up on the disinflation of the previous 2 decades.

It could take many decades to play out, unfortunately the data doesn't make me think it will. At our current rate, we may be lucky to get beyond one decade before the USD starts edging toward hyperinflation.

quote:I think you underestimate the US economy in the long run. And also underestimate the "shortest midget" aspect. We might be the shortest midget, but we are just radically more well-placed than the rest of the world who you are projecting to in theory boycott our debt.

I can agree that none of us have a magic ball. None of us knows for certain what surprises the future holds, but that doesn't negate the ability to make some reasonable, educated guesses by looking at available data and the trends it shows.

If you are seeing data showing things differently, please share it (because I don't like the picture I see).

Posted on 3/29/24 at 2:13 pm to Civildawg

As a side note, the Fed is not being transparent regarding its assets.

As other foreign countries rehypothicate their physical bullion reserves, the amount of physical bullion assets becomes a relevant concern for Treasury.

quote:

"The Fed doesn't want anyone to know that foreign governments and other central banks are yanking their gold from America's shores because it would reveal the folly of U.S. monetary and foreign policy."

As other foreign countries rehypothicate their physical bullion reserves, the amount of physical bullion assets becomes a relevant concern for Treasury.

quote:

Weeks after Federal Reserve Chairman Jerome Powell evaded a sitting congressman’s questions about the central bank’s foreign gold holdings, the Fed has also declined to comply with a Freedom of Information Act request for records about such holdings.

The Federal Reserve’s lack of transparency comes amidst reports that countries are removing their gold and other assets from the U.S. in the wake of the unprecedented Western sanctions imposed on Russia over its invasion of Ukraine.

According to a 2023 Invesco survey, a “substantial percentage” of central banks expressed concern about how the U.S. and its allies froze nearly half of Russia’s $650 billion gold and forex reserves. Rep. Alex Mooney, R-W.Va., asked Powell about the matter in a December letter, only to have the Fed chair respond last month with evasive non-answers, telling him that the Federal Reserve does not own gold but holds it as a custodian for other entities—a fact that the congressman presumably already knew.

Following Powell’s evasive response, Headline USA filed a FOIA request with the Fed for records reflecting how much gold the Federal Reserve Bank of New York currently holds in its vault, as well as records reflecting the ownership stake that each of FRBNY’s central bank/government clients have in that gold. The FOIA request also sought records about the Fed’s gold holdings prior to Russia’s February 2022 invasion of Ukraine.

However, the Federal Reserve denied the FOIA request on Wednesday. “Board staff consulted with staff at the Federal Reserve Bank of New York (‘Reserve Bank’) and have been advised that such records, if they exist, would be Reserve Bank records, and consequently, not subject to the Board’s Rules Regarding Availability of Information,” the Fed said. The Federal Reserve said that this publication could take its request to the New York Fed. However, that institution isn’t subject to FOIA.

This post was edited on 3/29/24 at 2:15 pm

Posted on 3/29/24 at 6:19 pm to Big Scrub TX

quote:

Again, you are smart and knowledgeable enough not to just give nominal stats in a vacuum. Why not use %s of GDP instead of the nominal trillion?

I don't think I'm giving them in a vacuum. A lot of GDP growth over the last year or two has been due to excessive debt creation so to me, looking at the economy or inflation through GDP is to muddy the waters.

If I'm seeing GDP growth as a function of excessive debt creation, why would I want to look at currency strength through a lens of GDP?

quote:

Hyperinflation? Can you define that?

I'm using the standard 50% (or more) within a month. If ongoing debt creation (read: currency creation) reaches $1T per month (which was my stipulation), there's absolutely no way it doesn't start devaluing the currency at a double-digit pace.

quote:

Even the inflation of the past 3 years I view mostly as just catching up on the disinflation of the previous 2 decades.

I think this is where we see things differently. I mean, I see the boiler-pressure analogy but I don't think it extends to two decades (especially with 9/11 and the Great Recession happening within the same decade). What I see is that starting in 2013 there should have been a slow trickle of rate increases, maybe just a quarter-point per year. So if there's disinflation, I would point it as being only from that much closer period.

Still, looking at what was going on at the time I think the economy was strong enough that rates could have continued increasing after a pause in 2019 (maaaaaybe 2020 as well, but we'll never know). Instead, we got a massive liquidity injection (from massive debt creation) directly to the consumers while simultaneously hampering production. If 2013-2019 was kindling, the stimulus checks, PPP, rent forbearance, etc was jet fuel and a match. I not only believe it's sped the debt problem up by decades but has done so in a manner that can't be "soft landing"'d out of.

quote:

I think you underestimate the US economy in the long run. And also underestimate the "shortest midget" aspect. We might be the shortest midget, but we are just radically more well-placed than the rest of the world who you are projecting to in theory boycott our debt.

It's not a matter of underestimating a plucky competitor who just has to reach down deep to find that extra will to win the fight -it's a matter of math, basic economics and politics. More and more of the economy is being run on massive debt creation and there's nothing in place to change that (nor the will to do so) for neither the private nor public side, this means that massive debt creation is begetting only more massive debt creation which begets only more massive debt creation until the debt crushes us. The politicians aren't going to cut spending because that will hurt their re-election changes. Consumers aren't cutting back on spending while they have lines of credit because... lifestyle.

Unless something radically changes (Congress cutting total spending enough to start paying the debt down, for example), there is no other possible outcome.

I hope you're right, I really do. Show me the data you're basing your optimism on and I'll gladly give it an objective look. Until then, I have to go with what's plainly in front of my eyes.

This post was edited on 3/29/24 at 6:21 pm

Posted on 3/30/24 at 1:37 pm to Bard

quote:

Unless something radically changes (Congress cutting total spending enough to start paying the debt down, for example), there is no other possible outcome.

This is the way ……

Posted on 3/30/24 at 6:09 pm to Big Scrub TX

I feel like you have been saying in layman's terms that the debt the USA has doesn't matter and will continue to not matter. I just don't believe that. There have been multiple revolutions throughout history because a country became "broke". At some point our debt has to matter. I don't know if that's now, next year, or 50 years from now but at some point it has to.

Posted on 3/31/24 at 1:20 pm to Civildawg

quote:I'm not saying it doesn't matter. But I am saying it might not matter very much for a really long time - by which time who knows what technology has done for productivity. At the very least, I don't see any reason to be afraid of anything "imminent".

I feel like you have been saying in layman's terms that the debt the USA has doesn't matter and will continue to not matter. I just don't believe that. There have been multiple revolutions throughout history because a country became "broke". At some point our debt has to matter. I don't know if that's now, next year, or 50 years from now but at some point it has to.

Posted on 3/31/24 at 1:24 pm to Bard

quote:I'm saying when you say "it now only takes x days for $1T to be added", the denominator of GDP is relevant. It doesn't make your concerns go away, but it does provide valuable context.

I don't think I'm giving them in a vacuum. A lot of GDP growth over the last year or two has been due to excessive debt creation so to me, looking at the economy or inflation through GDP is to muddy the waters.

If I'm seeing GDP growth as a function of excessive debt creation, why would I want to look at currency strength through a lens of GDP?

quote:This is an extreme claim. But also - to make an extreme response - if GDP were $100T, then would you still be making the same claim?

I'm using the standard 50% (or more) within a month. If ongoing debt creation (read: currency creation) reaches $1T per month (which was my stipulation), there's absolutely no way it doesn't start devaluing the currency at a double-digit pace.

quote:I think 2013 was too early, as aggregate demand was just not there. That's why all the "hyperfinlation" claims rooted in the QE in response to the GFC never came to pass - there just was no demand. IMO, the mistake was not understanding this dynamic when the pandemic hit.

I think this is where we see things differently. I mean, I see the boiler-pressure analogy but I don't think it extends to two decades (especially with 9/11 and the Great Recession happening within the same decade). What I see is that starting in 2013 there should have been a slow trickle of rate increases, maybe just a quarter-point per year. So if there's disinflation, I would point it as being only from that much closer period.

Posted on 3/31/24 at 4:30 pm to Big Scrub TX

quote:

I'm saying when you say "it now only takes x days for $1T to be added", the denominator of GDP is relevant. It doesn't make your concerns go away, but it does provide valuable context.

I'm saying GDP has become irrelevant (for purposes of this conversation) because so much of its growth has become absolutely dependent on continued high debt creation. In other words, when further debt creation becomes impossible GDP growth will come to a such a screeching halt that we will likely see deflation.

Showing debt as a % of GDP doesn't parse out the dependency aspect. By not taking it into account, that part gets downplayed (if not outright ignored). That's fine in a normal economic scenario where debt is actually being managed as leverage instead of only serviced in the hopes that some miracle will come along and magically fix things. We're not in a normal scenario and haven't been since at least COVID.

quote:

This is an extreme claim. But also - to make an extreme response - if GDP were $100T, then would you still be making the same claim?

That's a tough question because I believe that in our current scenario we can't get to $100T without collapsing the USD. GDP is currently ~$25T, meaning your scenario would mean 4x current GDP. Keeping all things equal, yes I would be making the same claim if GDP were $100T and our debt was $136T and each year Congress was adding ~$6.8T more debt. Too much liquidity is too much liquidity.

While the federal government is servicing the debt, it's really technically not as it needs to keep borrowing more and more as the amount needed to service the debt continues to grow.

Posted on 3/31/24 at 10:07 pm to Bard

quote:I guess at the end of the day, I believe debt is just accounting. It's why I expect Japan at some point to be like "we're haircutting everything to 65 cents on the dollar". And people will be pissed that day, but it'll be ok. I can imagine similar scenarios here - especially around entitlements. I'm personally 100% prepared to have SS and Medicare cut to 0 for me.

That's a tough question because I believe that in our current scenario we can't get to $100T without collapsing the USD. GDP is currently ~$25T, meaning your scenario would mean 4x current GDP. Keeping all things equal, yes I would be making the same claim if GDP were $100T and our debt was $136T and each year Congress was adding ~$6.8T more debt. Too much liquidity is too much liquidity.

While the federal government is servicing the debt, it's really technically not as it needs to keep borrowing more and more as the amount needed to service the debt continues to grow.

Also, at some point, infrastructure matters. Like, China is in a really desperate position - WAY worse than the US. But whenever their reckoning comes, it's not like it will take away all they've built. Even if these mega railroads and bridges et al were rife with graft an corruption - at the end, they still have those physical assets. Same here. The physical reality of the US is just too crushing to write off.

Posted on 4/1/24 at 7:55 am to Civildawg

I lean towards Slackster for once. I do not think we need to raise rates and we don;t need to lower them yet.

But April 10th will tell us more.

But April 10th will tell us more.

Popular

Back to top

0

0