- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 11/22/24 at 1:37 pm to Beerinthepocket

Posted on 11/22/24 at 1:37 pm to Beerinthepocket

We have so many catalysts. Dozens.

Posted on 11/22/24 at 1:48 pm to ev247

quote:

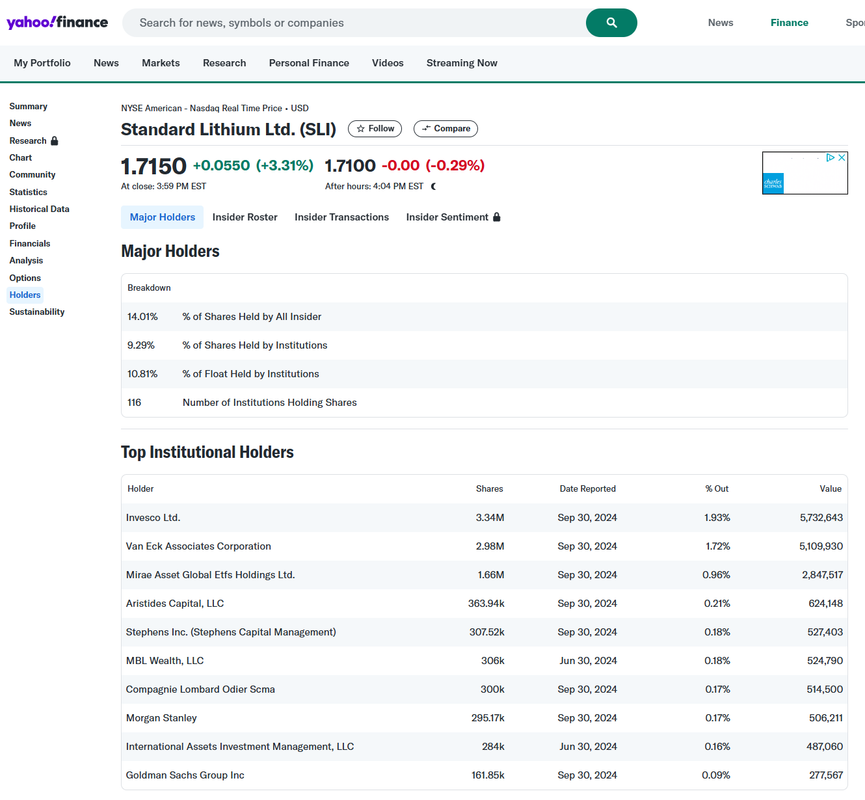

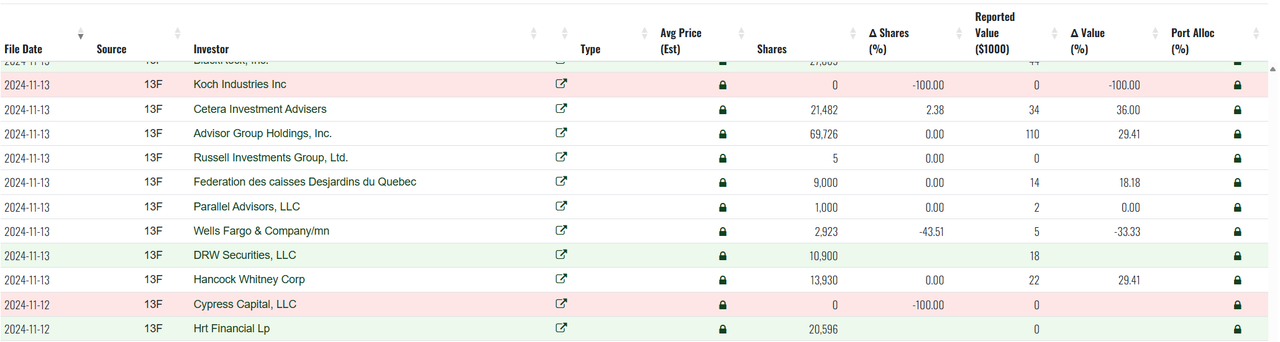

Koch sold 100% of theirs

Interesting.

Wonder if putting their guy in as CEO & licensing their tech to SLI created conflicts of intersest?

Posted on 11/22/24 at 3:24 pm to Houstiger

A few months ago they were hoping to announce East Texas resource definition by the end of this year, now in yesterday's call they said they hope they can have it by the end of 2025.

They said yesterday that they've started to have more formal offtake talks at a conference last week. Said not to expect announcement of non-binding offtake agreements, so that tells us that offtake will not be announced before the royalty is decided (since a binding offtake cannot happen before the royalty). Again, they're now hopeful that a royalty can be reached by mid next year. (This was in response to "~At which point does the royalty stalemate start affecting project timelines?" suggesting to expect a project delay if the royalty isn't reached by mid next year)

Also said yesterday that they're optimistic about finalizing the $225M grant by the end of this year, but that if they don't get that done by inauguration day then expect it to take "quarters."

I kept my core position but sold all of the "short term excitement" shares from the top. I'm willing to miss whatever bump might come from finalizing the grant this year if they manage to do so. Don't see any other catalysts in the near term myself

They said yesterday that they've started to have more formal offtake talks at a conference last week. Said not to expect announcement of non-binding offtake agreements, so that tells us that offtake will not be announced before the royalty is decided (since a binding offtake cannot happen before the royalty). Again, they're now hopeful that a royalty can be reached by mid next year. (This was in response to "~At which point does the royalty stalemate start affecting project timelines?" suggesting to expect a project delay if the royalty isn't reached by mid next year)

Also said yesterday that they're optimistic about finalizing the $225M grant by the end of this year, but that if they don't get that done by inauguration day then expect it to take "quarters."

I kept my core position but sold all of the "short term excitement" shares from the top. I'm willing to miss whatever bump might come from finalizing the grant this year if they manage to do so. Don't see any other catalysts in the near term myself

Posted on 11/23/24 at 4:00 pm to ev247

I just read through a bunch of this thread.

What are the odds this company goes bankrupt in the next two years vs makes some headway?

I'm giving a little thought into putting some play money into this.

What are the odds this company goes bankrupt in the next two years vs makes some headway?

I'm giving a little thought into putting some play money into this.

Posted on 11/24/24 at 8:33 am to SwampCollie

Koch selling might be the canary test for me.... If we get back into the 2's for whatever reason I'm going to lighten up.

Posted on 11/24/24 at 8:49 pm to Wraytex

I saw that Koch did some restructuring this year and went from Koch Industries Inc to Koch Industries LLC. Not sure if this explains the apparent closing of Koch's SLI position or not, but I can't make sense of what I've seen on the subject other than no version of Koch shows up under Institutional Holders anymore. Anyone else?

Posted on 11/25/24 at 10:29 am to ev247

Well I bit the bullet and bought some of this garbage. First time ever buying a penny stock

This post was edited on 11/26/24 at 9:14 am

Posted on 11/25/24 at 11:01 am to notiger1997

quote:

Well I bit the bullet and bought some of this garbage. First time every buying a penny stock

Well, you fricked up.

Posted on 11/25/24 at 11:08 am to GrizzlyAlloy

LOL

Thanks for the kind words.

Thanks for the kind words.

Posted on 11/25/24 at 12:28 pm to ev247

quote:

I saw that Koch did some restructuring this year and went from Koch Industries Inc to Koch Industries LLC. Not sure if this explains the apparent closing of Koch's SLI position or not, but I can't make sense of what I've seen on the subject other than no version of Koch shows up under Institutional Holders anymore. Anyone else?

Good question. I've heard nothing of Koch closing their position. It's been plenty of time for the news to become public.

Posted on 11/25/24 at 9:44 pm to SmackoverHawg

Oxy has entered the chat…..

LINK

LINK

quote:

Occidental Petroleum has become the latest oil and gas player to stake out acreage in the emerging lithium play in the US state of Arkansas, joining rivals such as Exxon Mobil and Equinor in the pursuit of extracting the valuable battery metal from brines.

“All we’ve done is get some leases right now,” Oxy CEO Vicki Hollub told Energy Intelligence on the sidelines of the Energy Intelligence Forum in London.

This post was edited on 11/25/24 at 9:46 pm

Posted on 11/25/24 at 9:46 pm to ColoradoAg03

IOW, right race, wrong horse.

Posted on 11/25/24 at 9:51 pm to Wraytex

I don’t know, the delay in royalty decision isn’t just holding up the SLI partnership. They're further along than new players in the game.

Posted on 11/26/24 at 9:11 am to SmackoverHawg

quote:

I've heard nothing of Koch closing their position. It's been plenty of time for the news to become public.

They surely aren't listed on institutional holders.... that amount would be #1 by $'s.

Here's my theory:

-Koch came in, loved the brine leases and concept, invested $100M.

-After looking under the hood they decide to develop their own tech, which outperforms SLI's.

-Koch licenses SLI their "Li-ProTM Lithium Selective Sorption" tech and exits their investment at a loss

This sequence accomplishes a number of things from Koch POV:

1) Taking Capital Loss on their initial investment to perhaps offset gains elsewhere

2) Licensing is mailbox money and scales to and through growing number of projects and licensee's. Don't need to own the brine or leases if you own the process.

3) Koch bean counters see Capital investment losses as cost of entry into this tech/space ($80M hit is peanuts) and as favorable CAPEX vs co-funding and amortizing a $1B build out.

This sceario captures most if not more upside w/ minimal risk/exposure/complexity vs putting all their eggs and $ in SLI's basket.

Alternative theory:

-After developing their own tech and licensing plans an ownership stake in one licensee creates potential conflict of interst - or perception of one

Posted on 11/26/24 at 2:01 pm to notiger1997

quote:

Well I bit the bullet and bought some of this garbage. First time ever buying a penny stock

Enjoy this bag. While the rest of the market has rocketed this has done nothing.

Posted on 12/3/24 at 10:16 am to CarbonAce

Next hearing is December 10 but the royalty isn’t on the agenda as of now.

They’re hopeful to have it resolved by mid 2025, which is when the project would start getting pushed back because of it.

They’re hopeful to have it resolved by mid 2025, which is when the project would start getting pushed back because of it.

Popular

Back to top

1

1