- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 7/10/24 at 12:23 pm to jamiegla1

LIthium has huge violent swings up and down right. When lithium rebounds this rebounds? Also with the lease percentage agreements coming at such low lithium values the % may go to the miner and not the property owner? What are y'all thoughts?

Edited: My shares haven't been loaned out in a few months now? Anyone else? I got moved from TD Ameritrade to Schawb back in Jan or Feb and they haven't been loaned since. Just checked with Schawb and they said that the stock is in the lending program just no demand for it.

Edited: My shares haven't been loaned out in a few months now? Anyone else? I got moved from TD Ameritrade to Schawb back in Jan or Feb and they haven't been loaned since. Just checked with Schawb and they said that the stock is in the lending program just no demand for it.

This post was edited on 7/10/24 at 12:55 pm

Posted on 7/10/24 at 1:49 pm to Pierre

Lithium sentiment aside, SLI has explicitly given potential investors every reason to wait and watch from the sidelines for the moment:

1. Phase 1A: CFO Salah Gamoudi has clearly said in the last earnings call that nothing will happen with Phase 1A until the royalty is decided and Lanxess brine supply agreement is finalized. (New investors should wait until the royalty is decided.)

2. SWA: CFO and COO have both recently said that SWA is working on FEED and DFS and they expect those to be complete in CALENDAR YEAR 2025. Until then, biggest hope is another "Drilled a new hole. Great lithium levels!" (New investors should wait until 2025.)

3. East Texas: Between May and June, CFO and COO have each said that the goal is to define the East Texas resource "within the next 12 months." Until then, biggest hope is another "Drilled a new hole. Great lithium, bromine, and potash levels!" (New investors should wait until closer to May 2025.)

Upcoming items to look for:

1. Royalty decision

2. Lanxess brine supply deal finalized

3. Phase 1A partnership

4. Phase 1A offtake announcement

5. Phase 1A funding (prioritized by CFO: $ from partner>prepaid offtakes>[DoE] loans>grants>dilution)

6. East Texas resource announcement

7. East Texas offtake announcement

8 SWA DFS

(Correct me anywhere I'm wrong)

1. Phase 1A: CFO Salah Gamoudi has clearly said in the last earnings call that nothing will happen with Phase 1A until the royalty is decided and Lanxess brine supply agreement is finalized. (New investors should wait until the royalty is decided.)

2. SWA: CFO and COO have both recently said that SWA is working on FEED and DFS and they expect those to be complete in CALENDAR YEAR 2025. Until then, biggest hope is another "Drilled a new hole. Great lithium levels!" (New investors should wait until 2025.)

3. East Texas: Between May and June, CFO and COO have each said that the goal is to define the East Texas resource "within the next 12 months." Until then, biggest hope is another "Drilled a new hole. Great lithium, bromine, and potash levels!" (New investors should wait until closer to May 2025.)

Upcoming items to look for:

1. Royalty decision

2. Lanxess brine supply deal finalized

3. Phase 1A partnership

4. Phase 1A offtake announcement

5. Phase 1A funding (prioritized by CFO: $ from partner>prepaid offtakes>[DoE] loans>grants>dilution)

6. East Texas resource announcement

7. East Texas offtake announcement

8 SWA DFS

(Correct me anywhere I'm wrong)

This post was edited on 7/10/24 at 2:25 pm

Posted on 7/10/24 at 2:04 pm to ev247

That's very helpful. Thank you!

Posted on 7/10/24 at 2:08 pm to ev247

New investors should wait for insiders to actually accumulate on their own, outside of compensation.

Existing share, I mean bag holders, should flip the pancake when the opportunity arises.

Existing share, I mean bag holders, should flip the pancake when the opportunity arises.

Posted on 7/11/24 at 8:32 am to Pierre

You’re welcome

12 days left for them to submit a new royalty application or we’re onto yet another month

12 days left for them to submit a new royalty application or we’re onto yet another month

Posted on 7/11/24 at 9:43 am to ev247

IBAT has officially won the race being first to market with commercial DLE

LINK

LINK

quote:

International Battery Metals (OTCPK:IBATF) +16.3% in Thursday's trading after Reuters reported it has become the first company to commercially produce lithium with a unique type of filtration technology, a step expected to usher in cheaper and faster supplies of the metal. At a site in rural Utah controlled by privately-held U.S. Magnesium, IBAT (OTCPK:IBATF) this week started producing commercial volumes of lithium at a rate of nearly 5K metric tons/year using its version of a direct lithium extraction technology, according to the report. IBAT (OTCPK:IBATF), which developed its DLE plant to be portable, essentially has beaten Standard Lithium (SLI), Rio Tinto (RIO), Eramet (OTCPK:ERMAF) (OTCPK:ERMAY) and others as the first to hit that mark, the report said.

This post was edited on 7/11/24 at 9:44 am

Posted on 7/11/24 at 9:48 am to Shepherd88

While it’d be nice if SLI was first, this may be a rising tide that lifts all DLE boats. If the news is true, DLE has been proven to work at commercial scale.

Posted on 7/11/24 at 12:16 pm to Beerinthepocket

quote:

While it’d be nice if SLI was first, this may be a rising tide that lifts all DLE boats. If the news is true, DLE has been proven to work at commercial scale.

First is the worst, second is the best...

Posted on 7/15/24 at 8:38 pm to ev247

quote:

Proof of life, we got a new drilling permit

I was doing some digging, the drilling permit looks like it's on land that SLI purchased in Arkansas about 10 months ago. I think the coordinates on the permit match the parcel.

Will they have to pay royalties on this production? I would also imagine they purchased the land with the intent of building a DLE system around any production they get.

Article about the land purchase

Posted on 7/15/24 at 9:52 pm to Boss13

SLI? Production?

Pardon my gallows humor on SLI as I fill in for Gaucho, who's been sluffing off lately.

Pardon my gallows humor on SLI as I fill in for Gaucho, who's been sluffing off lately.

This post was edited on 7/16/24 at 7:54 am

Posted on 7/15/24 at 10:00 pm to Boss13

(Edited because I misunderstood your question)

I can't tell from the article you shared if SLI owns the mineral rights or just the land. Either way, it matters very, very little in the grand scheme of things. If SLI owns the minerals, they'd save royalties on 118 acres out of 30,000 acres that make up the SWA project territory.

For perspective, under Standard's previous royalty proposal, mineral owners stood to be paid about $80/acre/year in royalties under worst case (low lithium prices). That would have meant that the total royalty to be paid to mineral owners in the SWA project would have been $2.4M per year. And if Standard owned the minerals to go with their 118-acre parcel, they would have saved a grand total of $9,440 per year in royalties. That's how small of a deal this is.

I can't tell from the article you shared if SLI owns the mineral rights or just the land. Either way, it matters very, very little in the grand scheme of things. If SLI owns the minerals, they'd save royalties on 118 acres out of 30,000 acres that make up the SWA project territory.

For perspective, under Standard's previous royalty proposal, mineral owners stood to be paid about $80/acre/year in royalties under worst case (low lithium prices). That would have meant that the total royalty to be paid to mineral owners in the SWA project would have been $2.4M per year. And if Standard owned the minerals to go with their 118-acre parcel, they would have saved a grand total of $9,440 per year in royalties. That's how small of a deal this is.

This post was edited on 7/15/24 at 11:25 pm

Posted on 7/17/24 at 4:15 pm to ev247

Losing confidence that the royalty will be decided this month, still no application posted. Only 3 business days for one to show up before the hearing

Posted on 7/17/24 at 4:38 pm to ev247

Yeh I don't think it's this month.

No royalty items on the docket for the final meeting agenda posted on AOGC website.

No royalty items on the docket for the final meeting agenda posted on AOGC website.

Posted on 7/17/24 at 5:07 pm to Fe_Mike

Ah I forgot to check for the agenda. Thanks, you just saved me 3 more days of checking the applications

Odds they skip Phase 1A at this point?

Odds they skip Phase 1A at this point?

This post was edited on 7/17/24 at 9:37 pm

Posted on 7/18/24 at 8:46 am to ev247

quote:

Odds they skip Phase 1A at this point?

Definitely think it's looking more and more likely.

I just hope skipping 1A will allow them to put more resources into SWA and expedite it.

Posted on 7/19/24 at 8:34 am to Fe_Mike

What are the pros and cons of skipping phase 1a?

Posted on 7/19/24 at 8:39 am to Pierre

Pros: quick to build and to production

Cons. Lower output and revenue

Lower efficiency compared to E Tx concentrations

Cons. Lower output and revenue

Lower efficiency compared to E Tx concentrations

Posted on 7/19/24 at 9:21 am to Wraytex

Lot of cost wasted that went into the engineering study of Phase 1 not to mention the time value. I get it though.

I think you gotta just chalk that as another strike against Mintak ultimately.

I think you gotta just chalk that as another strike against Mintak ultimately.

Posted on 7/19/24 at 9:57 am to ev247

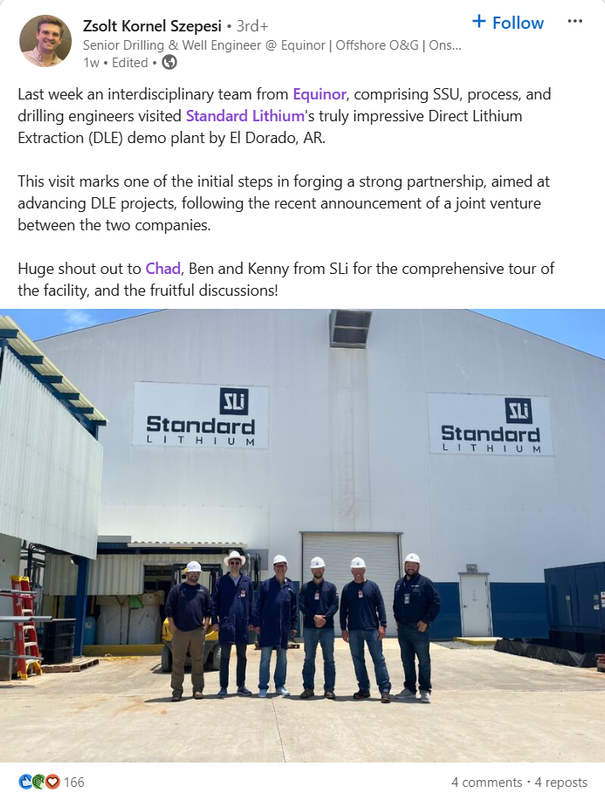

Thought I'd pass along this LinkedIn post from an Equinor engineer since things are pretty slow

Popular

Back to top

1

1