- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 6/4/24 at 5:18 pm to Ballstein32

Posted on 6/4/24 at 5:18 pm to Ballstein32

I was reading about the envisioned process earlier today. One drawback is that those geothermal or gas wells have a limited period of time when they produce brine.

It's our SLI anniversary since this thread started 6/4/20. That's a lot of conferences!

It's our SLI anniversary since this thread started 6/4/20. That's a lot of conferences!

This post was edited on 6/4/24 at 5:20 pm

Posted on 6/4/24 at 5:58 pm to Auburn1968

This one sure has been a turd.

Posted on 6/5/24 at 12:27 am to FnTigers

I think it'll still come around, and they'll actually start producing and we'll start making money off our shares.

I am just starting to think SLI will end up not being the first to do so, and our profits will suffer because of it.....meaning instead of (eventually) $30-40+ a share, it'll be $10-20 a share, which will still be nice, but since they continue to sleepwalk we won't get the Vueve mixers, only the boones farms, maybe korbel

I am just starting to think SLI will end up not being the first to do so, and our profits will suffer because of it.....meaning instead of (eventually) $30-40+ a share, it'll be $10-20 a share, which will still be nice, but since they continue to sleepwalk we won't get the Vueve mixers, only the boones farms, maybe korbel

This post was edited on 6/5/24 at 12:29 am

Posted on 6/5/24 at 12:29 am to Auburn1968

And happy anniversary. Glad to be one page 1 as well!

Posted on 6/5/24 at 1:01 am to Ballstein32

Been holding for 3 years now, since early in the thread.

Page 900 on our anniversary!

Page 900 on our anniversary!

Posted on 6/5/24 at 1:18 am to KCRoyalBlue

I was lucky to sell at just under $11. I only had a few thousand shares, but with my profits, I was able to pay off all of my credit cards, and my truck and become debt free. I love TD because of this.....

But I did buy back in for 1k shares at just over $7/share, and have been holding that ever since......

But I did buy back in for 1k shares at just over $7/share, and have been holding that ever since......

Posted on 6/5/24 at 4:59 pm to Ballstein32

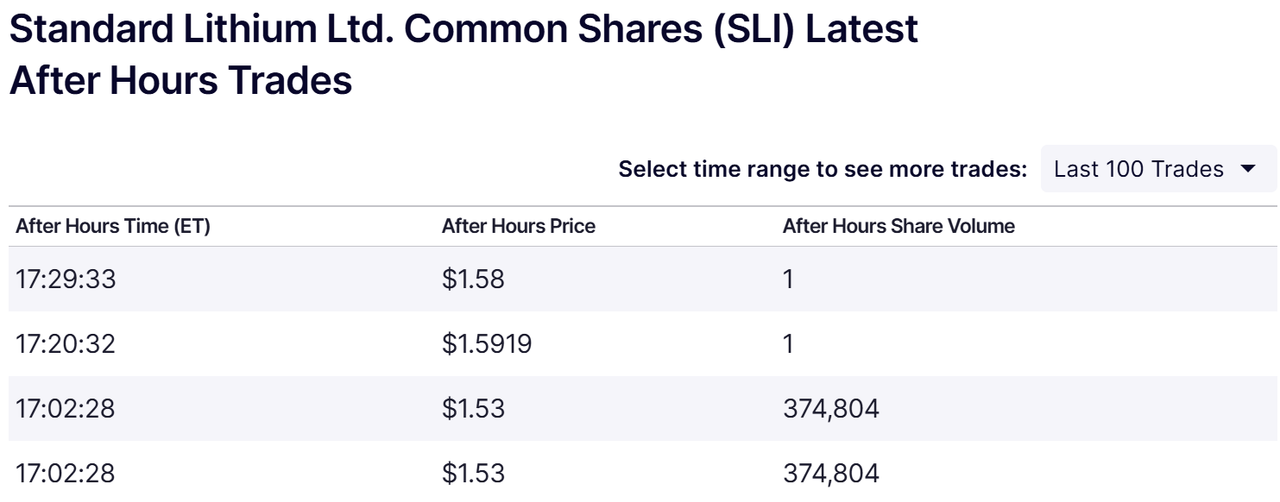

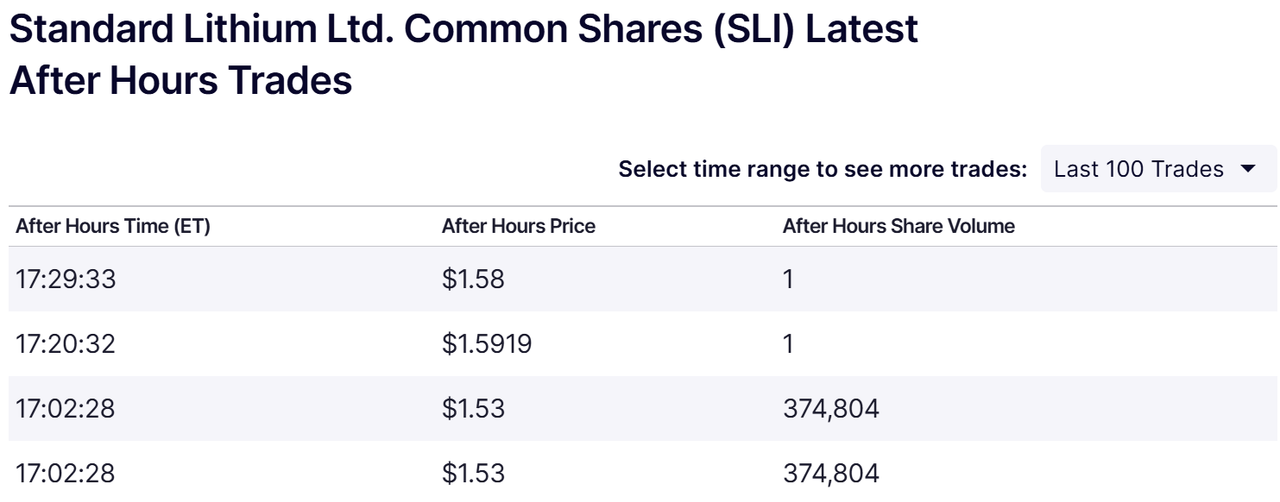

750k volume after hours

Btw congrats on the good sell Ballstein

Btw congrats on the good sell Ballstein

This post was edited on 6/5/24 at 5:03 pm

Posted on 6/5/24 at 5:57 pm to Ballstein32

quote:

I am just starting to think SLI will end up not being the first to do so, and our profits will suffer because of it.....meaning instead of (eventually) $30-40+ a share, it'll be $10-20 a share, which will still be nice, but since they continue to sleepwalk we won't get the Vueve mixers, only the boones farms, maybe korbel

By the time they start producing they will have removed "near term commercial" but will also unfortunately have to drop "leading" from their overblown investor conference puff piece announcements.

Posted on 6/6/24 at 12:18 am to ev247

I was lucky when I sold it. I think I was still spooked by my losses in WKHS earlier in the year that I vowed to never do that again.

I figured that once I sold it that it would moon.....fortunately for me (atleast at this time) I still have made the right call on that....

I figured that once I sold it that it would moon.....fortunately for me (atleast at this time) I still have made the right call on that....

This post was edited on 6/6/24 at 12:20 am

Posted on 6/6/24 at 8:32 am to Ballstein32

1st page to the 900th page

ETA: Haven't sold a single share in between, only added.

ETA: Haven't sold a single share in between, only added.

This post was edited on 6/6/24 at 8:33 am

Posted on 6/8/24 at 2:12 pm to ColoradoAg03

Not sure if anyone has seen this, but it's a good article on the challenges facing SLI and others in South Arkansas.

This is from Arkansas Farm Bureau's "Front Porch" magazine that I received in the mail a couple of months ago for policyholders. Luckily, I stumbled across the digital version.

LINK

This is from Arkansas Farm Bureau's "Front Porch" magazine that I received in the mail a couple of months ago for policyholders. Luckily, I stumbled across the digital version.

LINK

Posted on 6/9/24 at 5:26 pm to KCRoyalBlue

quote:

Not sure if anyone has seen this, but it's a good article on the challenges facing SLI and others in South Arkansas.

Reading this article, I'm going to double my holdings tomorrow morning. I don't think it's any coincidence that these companies are congregating and coalescing around where SLI has set up their test plant.

That, the investments of Koch, and the Equinor partnership almost makes this more than a speculative play.

There is still some serious risk, but Koch thought $7 a share was a fair price and Equinor dropped 30 million in a partnership. I find it hard to believe that what they saw behind closed doors was "unproven" or "potential."

One last comment, there are a lot of mentions of SLI outside of their own press releases now. What they are doing is starting to catch everyone's attention.

Posted on 6/9/24 at 6:19 pm to Boss13

I would be a happy camper if the value ticked up just enough to trigger share lending

Posted on 6/9/24 at 6:42 pm to Boss13

quote:

Equinor dropped 30 million in a partnership.

While not inconsequential, to help frame the amount - Equinor was sitting on 9.6 billion in cash at the end of March and Koch has somewhere north of $125+ billion in annual revenues. Big companies with an indication of interest in the space.

At the same time, both companies make smart decisions with strong success rates and growth

Posted on 6/9/24 at 7:32 pm to ApexHunterNetcode

quote:

While not inconsequential, to help frame the amount - Equinor was sitting on 9.6 billion in cash at the end of March and Koch has somewhere north of $125+ billion in annual revenues. Big companies with an indication of interest in the space.

At the same time, both companies make smart decisions with strong success rates and growth

A very valid point, and reasons to remember this is still a speculative play. This stock is going to make or break when it's time to start forecasting revenue.

Posted on 6/9/24 at 9:03 pm to ApexHunterNetcode

According to SA their balance sheet (EQNR) shows they currently have $37b in cash with $29b in debt. Nonetheless they’re flush with cash

Morningstar has it further broken down as $8B in actual cash and $29B in st investments (cash equivalents).

Thats strong

Morningstar has it further broken down as $8B in actual cash and $29B in st investments (cash equivalents).

Thats strong

This post was edited on 6/10/24 at 10:45 am

Posted on 6/10/24 at 9:51 am to Boss13

Does potential of extracting thousands of tons of lithium from wastewater generated by fracking in the Marcellus Shale have any impact on SLI? Seems like it would have potential for a rather large impact, but I do not pretend to have any level of sophistication when it comes to any technology in this field.

This post was edited on 6/10/24 at 9:52 am

Posted on 6/10/24 at 10:06 am to go ta hell ole miss

Generally, I don’t tend to worry when a new potential project pops up for two reasons.

1. Most lithium demand forecasts I’ve seen into the 2030’s show room for much more supply to come online than what’s already planned.

2. For one reason or several, new lithium projects are notorious for coming online later than planned.

On top of those, I’d want to know the new project’s lithium concentrations. If those are low, they’ll have to process more brine for each part of lithium they want to recover. This would give someone like Standard a significant advantage on pricing/margins.

(I’m no expert or advice giver)

1. Most lithium demand forecasts I’ve seen into the 2030’s show room for much more supply to come online than what’s already planned.

2. For one reason or several, new lithium projects are notorious for coming online later than planned.

On top of those, I’d want to know the new project’s lithium concentrations. If those are low, they’ll have to process more brine for each part of lithium they want to recover. This would give someone like Standard a significant advantage on pricing/margins.

(I’m no expert or advice giver)

This post was edited on 6/10/24 at 10:13 am

Posted on 6/10/24 at 10:13 am to ev247

Any update on when they are releasing the mineral rights royalties?

Posted on 6/10/24 at 10:42 am to KCRoyalBlue

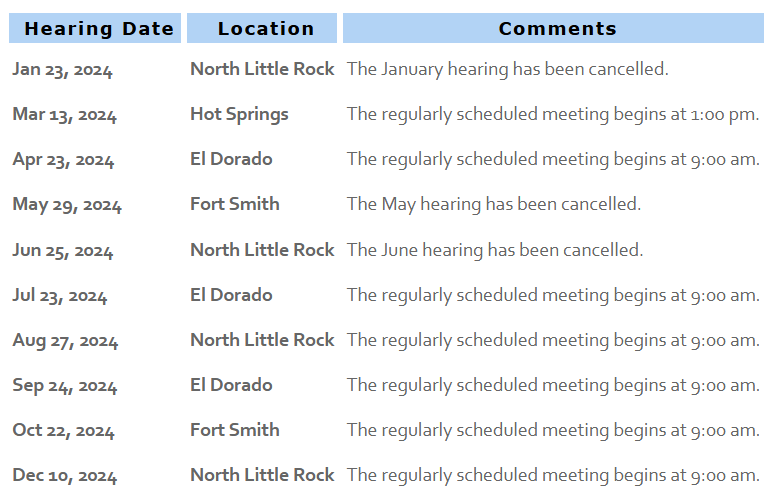

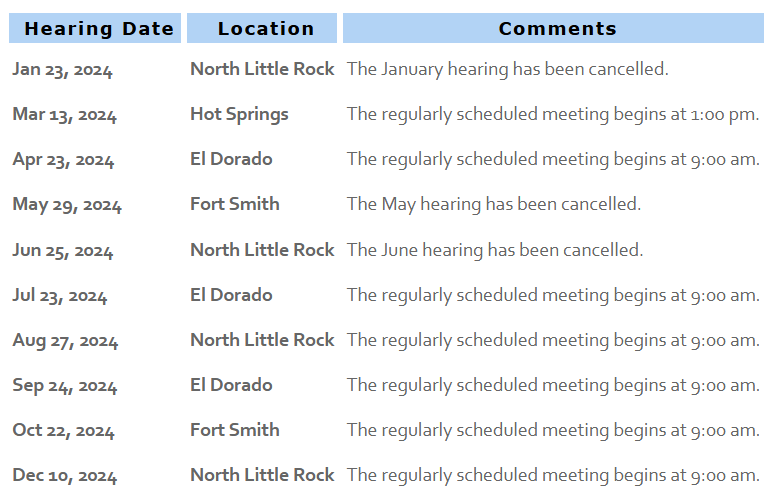

Without holding my breath I'm guessing July or September. Those two will be in El Dorado, which is where the last two royalty hearings were scheduled (Dec and Apr). Maybe they'll have had enough time for Equinor to get involved by July/Sep? Just noticed the June hearing has been cancelled, so at least we can firmly rule it out.

Popular

Back to top

2

2