- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 12/18/23 at 12:59 pm to ev247

Posted on 12/18/23 at 12:59 pm to ev247

Not sure how relevant this is, but hey it's a dead PR season so I'll share.

Telescope Innovations Develops New IP for the Production of Battery Materials

"[Telescope] announces it has filed a provisional patent application (65/584,062) on the production of lithium sulfide, a key precursor for next-generation solid-state batteries.

As an outcome of work with Standard Lithium Ltd., Telescope has invented a low-temperature method of generating lithium sulfide from brine-sourced lithium chemicals. This method could reduce the current high costs of lithium sulfide production, and so facilitate the widespread deployment of solid-state batteries."

"This accelerated discovery has fueled the growth of Telescope’s IP portfolio..."

So Telescope owns the IP, but Mintak and Robinson sit on Telescope's board and Telescope's CEO Jason Hein is part of Standard's management team.

From Standard's most recent MD&A:

Telescope Innovations Develops New IP for the Production of Battery Materials

"[Telescope] announces it has filed a provisional patent application (65/584,062) on the production of lithium sulfide, a key precursor for next-generation solid-state batteries.

As an outcome of work with Standard Lithium Ltd., Telescope has invented a low-temperature method of generating lithium sulfide from brine-sourced lithium chemicals. This method could reduce the current high costs of lithium sulfide production, and so facilitate the widespread deployment of solid-state batteries."

"This accelerated discovery has fueled the growth of Telescope’s IP portfolio..."

So Telescope owns the IP, but Mintak and Robinson sit on Telescope's board and Telescope's CEO Jason Hein is part of Standard's management team.

From Standard's most recent MD&A:

Posted on 12/18/23 at 2:18 pm to Auburn1968

quote:

In the case of Lanxess, are they paying royalties on the raw brine or for the bromine that they extract?

Yes.

Posted on 12/18/23 at 2:32 pm to SmackoverHawg

well looks like we're back to being punished.. 7% drop today

Posted on 12/18/23 at 2:48 pm to ev247

quote:

"I would like to see both parties make an effort to canvas the abstract plants at the courthouses and the landmen that are working in South Arkansas and bring before the commission a copy of a lease, paid-up, for the develop of lithium, that includes the highest and best terms available within the region."

Good answer. Landowners are going to be disappointed.

Posted on 12/18/23 at 5:08 pm to Auburn1968

I guess they hired a company called Water Tower Research to analyze the company.

Anyway, this section of their initial report pertains to your question about brine royalties

This analyst firm's disclosure says they receive up to $14k/month, for at least 1 year, and client cannot cancel for the content of its reports.

Looks like they're still using(how?) LHA IR as well.

Anyway, this section of their initial report pertains to your question about brine royalties

This analyst firm's disclosure says they receive up to $14k/month, for at least 1 year, and client cannot cancel for the content of its reports.

Looks like they're still using(how?) LHA IR as well.

This post was edited on 12/18/23 at 5:36 pm

Posted on 12/19/23 at 8:54 am to ev247

Up 9% on 250k vol in first 20 minutes, hm

Eta the January hearing is scheduled for the 23rd

Eta the January hearing is scheduled for the 23rd

This post was edited on 12/19/23 at 11:27 am

Posted on 12/19/23 at 2:18 pm to ev247

Schwab just returned 100% of the shares I had loaned out.

This downturn in price has allowed me to get my DCA down to less than 50% of Koch’s entry price of $7.42 so I’m ready for this thing to lift off now!

This downturn in price has allowed me to get my DCA down to less than 50% of Koch’s entry price of $7.42 so I’m ready for this thing to lift off now!

Posted on 12/19/23 at 2:28 pm to Beerinthepocket

I just got the same email from Schwab.

Posted on 12/20/23 at 3:12 pm to Fe_Mike

Mike, did you end up deciding to reach out to Allysa this week? I did a general inquiry last week and have been serenaded by crickets since.

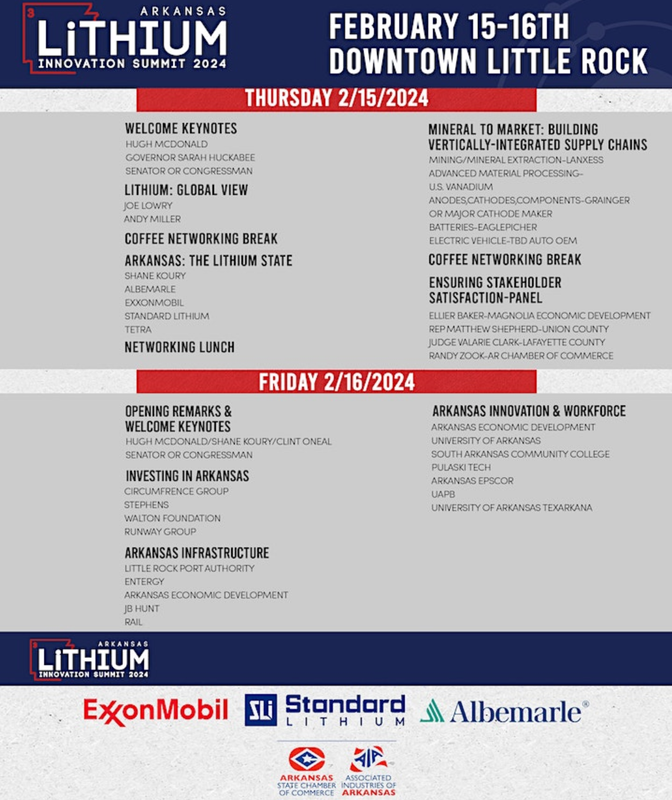

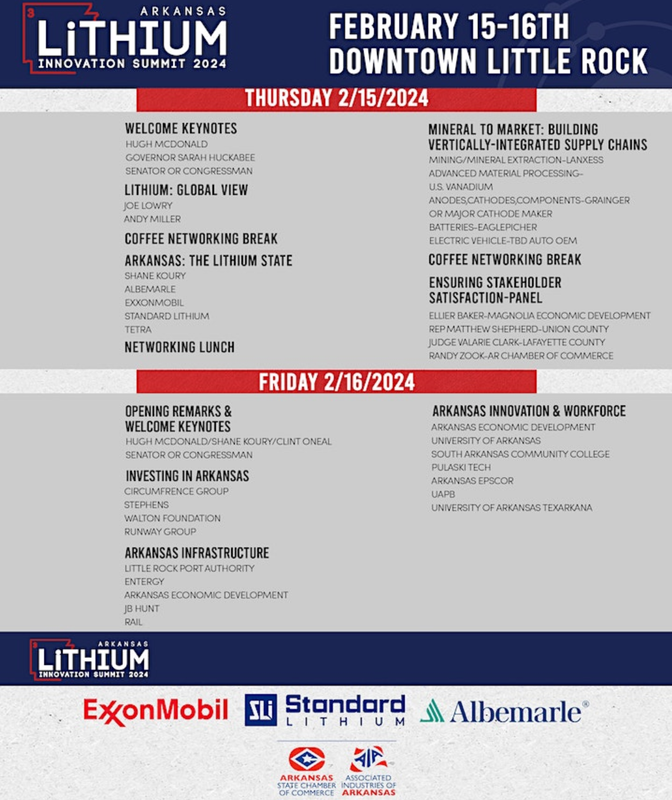

PSA for our Arkansas folks, there's a lithium summit planned for Feb 15-16. Hopefully the presentations are streamed but not counting on it

PSA for our Arkansas folks, there's a lithium summit planned for Feb 15-16. Hopefully the presentations are streamed but not counting on it

Posted on 12/20/23 at 5:02 pm to SmackoverHawg

quote:

"I would like to see both parties make an effort to canvas the abstract plants at the courthouses and the landmen that are working in South Arkansas and bring before the commission a copy of a lease, paid-up, for the develop of lithium, that includes the highest and best terms available within the region."

Good answer. Landowners are going to be disappointed.

Or not. Was told by one of the commissioners that Exxon was offering 10% lithium royalties or whatever the commission set, whichever is higher. He did not see that in writing was just told that.

Hence the request for a copy of a lease, paid-up, for the develop of lithium. Not promised...Paid. Albermarle had no input.

Posted on 12/20/23 at 5:41 pm to SmackoverHawg

Woah. I wonder if 10% also "results in a project that does not work" for Standard Lithium like 12.5% supposedly does.

Happy for the mineral owners if the 10% is true, but I hope Standard will have a path forward. Guess we'll find out end of January

Happy for the mineral owners if the 10% is true, but I hope Standard will have a path forward. Guess we'll find out end of January

This post was edited on 12/20/23 at 5:45 pm

Posted on 12/20/23 at 8:01 pm to ev247

I'm curious to see if it's in writing and been paid or just a ploy to stall proceedings.

Posted on 12/20/23 at 8:18 pm to SmackoverHawg

Wouldn't surprise me if Exxon is stalling. If you listen to Mintak describe SLI's advantages, it might as well be a commercial for any of the regional players. "Tier-1 lithium resource, mature brine production/regulation, social license to operate, skilled workforce, access to water/roadways/rail." Exxon/Albemarle/Tetra all enjoy those things. Tech-Exxon can afford it. All SLI is left with is its dwindling head start, which Exxon might be able to slash with this royalty dance.

Still don't think being first in production is vital, but it would make me feel better along the way.

Still don't think being first in production is vital, but it would make me feel better along the way.

Posted on 12/21/23 at 6:36 pm to ev247

The co that started covering SLI this week has a podcast episode out today with Mintak. It's called The Water Tower Hour on Apple Podcasts.

(If you've been up to speed I wouldn't recommend it, as it's mostly a recap.)

One good Mintak quote to bring from it

"1.8M tons of lithium carbonate equivalent on the Southwest Arkansas Project. And what we're hoping to deliver in East Texas is something, subject to the securing of the leases, equal to or a multiple of that. And that's what we're hoping to be able to push out in 2024 for investors."

ETA I take "securing of the leases" to mean "exercising the options that we already have on the leases." Because they have at least 25k acres of lease options filed in Cass County Tx.

(If you've been up to speed I wouldn't recommend it, as it's mostly a recap.)

One good Mintak quote to bring from it

"1.8M tons of lithium carbonate equivalent on the Southwest Arkansas Project. And what we're hoping to deliver in East Texas is something, subject to the securing of the leases, equal to or a multiple of that. And that's what we're hoping to be able to push out in 2024 for investors."

ETA I take "securing of the leases" to mean "exercising the options that we already have on the leases." Because they have at least 25k acres of lease options filed in Cass County Tx.

This post was edited on 12/21/23 at 6:39 pm

Posted on 12/22/23 at 9:31 pm to ev247

Link

This article from an accounting/advisory firm sheds some light on the two grants (tax credits) that SLI has been referencing.

Review

48C is up to 30% towards Capex

45X is 10% per year towards qualifying Opex (indefinitely for critical minerals producers)

New

Turns out a facility that claims 48C cannot also claim 45X.

The DFS for Phase 1A assumes 45X credit in its Opex.

Which would rule out 48C Capex grant for Phase 1A. (no exciting Phase 1A grant announcement)

Makes more sense that Mintak is saying majority debt financing for 1A

Which would they choose for SWA project? Up to $400M upfront for the build or 10% Opex/year

Article makes a good point that if you're posturing to be bought out you'd probably choose 45X (Opex) since the value is greater over the life of the project than an initial 48C Capex injection.

This article from an accounting/advisory firm sheds some light on the two grants (tax credits) that SLI has been referencing.

Review

48C is up to 30% towards Capex

45X is 10% per year towards qualifying Opex (indefinitely for critical minerals producers)

New

Turns out a facility that claims 48C cannot also claim 45X.

The DFS for Phase 1A assumes 45X credit in its Opex.

Which would rule out 48C Capex grant for Phase 1A. (no exciting Phase 1A grant announcement)

Makes more sense that Mintak is saying majority debt financing for 1A

Which would they choose for SWA project? Up to $400M upfront for the build or 10% Opex/year

Article makes a good point that if you're posturing to be bought out you'd probably choose 45X (Opex) since the value is greater over the life of the project than an initial 48C Capex injection.

This post was edited on 12/22/23 at 9:39 pm

Posted on 12/23/23 at 4:38 pm to ev247

Ausenco posted on Facebook 5 days ago that they are working on the FEED study for Standard Lithium’s Southwest Arkansas project.

Posted on 12/25/23 at 8:04 am to Beerinthepocket

Merry Christmas to all my fellow suckers who check this thread more than 2x per day looking for hopeful news!

Enjoy this day of no news!!

Enjoy this day of no news!!

Posted on 12/25/23 at 7:04 pm to KCRoyalBlue

Had to go to Salvation Army to get family gifts due to this stock

Popular

Back to top

0

0