- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Diving deeper on Standard Lithium?

Posted on 12/12/23 at 12:01 pm to UFownstSECsince1950

Posted on 12/12/23 at 12:01 pm to UFownstSECsince1950

So the charcuterie and wine mixer is now government cheese and municipal hose water mixer?

Posted on 12/12/23 at 12:46 pm to Fe_Mike

So you really think this heavy selllng pressure is for tax losses? Is there any momentum changing news dropping in January?

Posted on 12/12/23 at 1:00 pm to Breesus

quote:

government cheese

Big, stinking, government cheese. I couldn’t take a dump for 2 weeks.

Now cause of this big stinking SLI stock, we can’t have anything nice. I wanna eat some of them chitlins. I love pig feet.

Posted on 12/12/23 at 1:59 pm to Fe_Mike

quote:

Have some concerns that an offtake agreement that may or may not have been a 'done deal' a few months ago is now in limbo because of the plunging lithium prices. Could be slowing down the capital raise.

Yeah this sounds like the most logical explanation. SLI sounded super confident that a deal with a "household name" was almost a given, once Lanxess backed out.

Posted on 12/12/23 at 2:52 pm to gautamj

Yup, I have no inside info but I’m pretty confident they had everything but the signatures in place prior to Lanx opting out. It was essentially the football equivalent of waiting to fire your coach til after the season and buyouts expired, but already having the new coach lined up and ready to announce.

But then lithium prices just kept tanking so now everyone is back at the negotiating table.

Honestly, from my perspective, I’d give some lucky buyer a stupid deal for 100% offtake at these prices with a true up index formula that always gives them discount to market but doesn’t sink the plant’s EBITDA. Make them give a huge prepay to help with capital but make sure they always have a massively advantageous price position with Phase 1 lithium.

Phase 1 is not the money maker. It is a glorified pilot plant. Just get the damn thing built as proof of concept and try not to lose too much money before SWA comes online.

Get that revenue line pumped up. That will bring investors even if you’re not turning a profit. People are all about the top line these days.

But then lithium prices just kept tanking so now everyone is back at the negotiating table.

Honestly, from my perspective, I’d give some lucky buyer a stupid deal for 100% offtake at these prices with a true up index formula that always gives them discount to market but doesn’t sink the plant’s EBITDA. Make them give a huge prepay to help with capital but make sure they always have a massively advantageous price position with Phase 1 lithium.

Phase 1 is not the money maker. It is a glorified pilot plant. Just get the damn thing built as proof of concept and try not to lose too much money before SWA comes online.

Get that revenue line pumped up. That will bring investors even if you’re not turning a profit. People are all about the top line these days.

This post was edited on 12/12/23 at 3:20 pm

Posted on 12/12/23 at 3:19 pm to Fe_Mike

quote:

Honestly, from my perspective, I’d give some lucky buyer a stupid deal for 100% offtake at these prices with a true up index formula that always gives them discount to market but doesn’t sink the plant’s EBITDA.

Amen to that !!

Posted on 12/12/23 at 5:34 pm to gautamj

Just listened to Joe Lowry's podcast with Patrick Howarth (head of low-carbon dept with Exxon). Might Exxon really not be using their own DLE? Also, no royalty decision until 2024...

Lowry: Do you have a DLE technology picked or is it still in process?

Howarth: [Looking at each of the process steps, what's the right technology?] [Parts need to be integrated into a whole] Down to your question, we're in the process of selecting a DLE vendor. We've done some pretty extensive pilots at our facilities over the last months and years and so we're rapidly approaching that selection choice.

Lowry: Do they have a royalty structure in place for lithium yet?

Howarth: Good question. It's under development. There was a recent hearing that got delayed. I know Standard Lithium, they're looking to line up the royalty on their first project. The can got kicked into 2024. We're watching that with bated breath and we'll obviously look to get ours locked up at the appropriate time.

Lowry: Do you have a DLE technology picked or is it still in process?

Howarth: [Looking at each of the process steps, what's the right technology?] [Parts need to be integrated into a whole] Down to your question, we're in the process of selecting a DLE vendor. We've done some pretty extensive pilots at our facilities over the last months and years and so we're rapidly approaching that selection choice.

Lowry: Do they have a royalty structure in place for lithium yet?

Howarth: Good question. It's under development. There was a recent hearing that got delayed. I know Standard Lithium, they're looking to line up the royalty on their first project. The can got kicked into 2024. We're watching that with bated breath and we'll obviously look to get ours locked up at the appropriate time.

Posted on 12/12/23 at 6:37 pm to Fe_Mike

Any plans to talk to them again, friend?

Posted on 12/12/23 at 7:43 pm to ev247

Thanks for the Lowry excerpt. Always interesting to hear just how aware of SLI the big players are. Slight note of interest, Standard told me that they (SLI, XOM, ALB, all the local players) were in the royalty hearings together. Odd that Exxon is making it sound like it is separate designations. I admittedly don’t know too much about how these matters are handled so it’s likely just a misunderstanding on my part.

I emailed the generic SLI IR account today with quite a few questions. If they don’t respond this week I’ll reach out more directly and try to set up a call. Outside of the lithium market dropping, nothing has changed or been delayed from my last timeline so I don’t want to press or stress too much right now. Hard not to do with the stock price though.

I thought we’d get sell side pressure until the lanxess decision mid December, at which point we’d get even more sell-off. Then I estimated January for the “new partnership” (even though SLI said they anticipated December). Just didn’t count on the lithium market dropping quite this fast to add to the hurt.

I’m still bullish here especially at these prices but I am close to the point of demanding some additional strategy guidance from management if the market stays depressed. Going to give it until mid-January, my original timeline, before throwing a tantrum.

I emailed the generic SLI IR account today with quite a few questions. If they don’t respond this week I’ll reach out more directly and try to set up a call. Outside of the lithium market dropping, nothing has changed or been delayed from my last timeline so I don’t want to press or stress too much right now. Hard not to do with the stock price though.

I thought we’d get sell side pressure until the lanxess decision mid December, at which point we’d get even more sell-off. Then I estimated January for the “new partnership” (even though SLI said they anticipated December). Just didn’t count on the lithium market dropping quite this fast to add to the hurt.

I’m still bullish here especially at these prices but I am close to the point of demanding some additional strategy guidance from management if the market stays depressed. Going to give it until mid-January, my original timeline, before throwing a tantrum.

Posted on 12/12/23 at 8:54 pm to Fe_Mike

I'm with you-added 8% today since they haven't actually fallen short in some way (that we know of) since you last shared with us what they told you.

My only two gripes lately have been the hollow PR talking about SLI's positioning in the Smackover and the PR to tell us about the two Dec conferences that we can't access.

All in all, it seems to me that they're still on track. Hopeful that they'll respond to your email.

My only two gripes lately have been the hollow PR talking about SLI's positioning in the Smackover and the PR to tell us about the two Dec conferences that we can't access.

All in all, it seems to me that they're still on track. Hopeful that they'll respond to your email.

Posted on 12/13/23 at 7:21 am to Wraytex

quote:

Oof @ 1.65

Set my buy order at $1.00

This post was edited on 12/13/23 at 7:22 am

Posted on 12/13/23 at 10:28 am to Wraytex

We're down 5% when LAC and ALB are up 3-4%. Not sure why we're getting punished by the market.

Posted on 12/13/23 at 11:27 am to gautamj

If this gets to a dollar I’ll buy a frickton of shares

Posted on 12/13/23 at 11:59 am to gautamj

I'll try to make the least charitable pessimistic case, contrary to my current conviction.

-Lanxess, who knows more about Standard's operation than you or I do, has chosen not to partner on it

-$50M dilution locked and loaded

-Why still attending secret investor conferences if partnership demand is so fervent?

-We haven't had a meaningful PR since Oct 25 (potash and bromine found in East TX brine)

Every PR since has been absolute filler/review of things we know.

-The November 14 PR has bothered me more than anything else since the short report on Mintak's history. It couldn't have been less necessary or more desperate.

-Headlines of lithium spot price and EV demand tanking (valid or not)

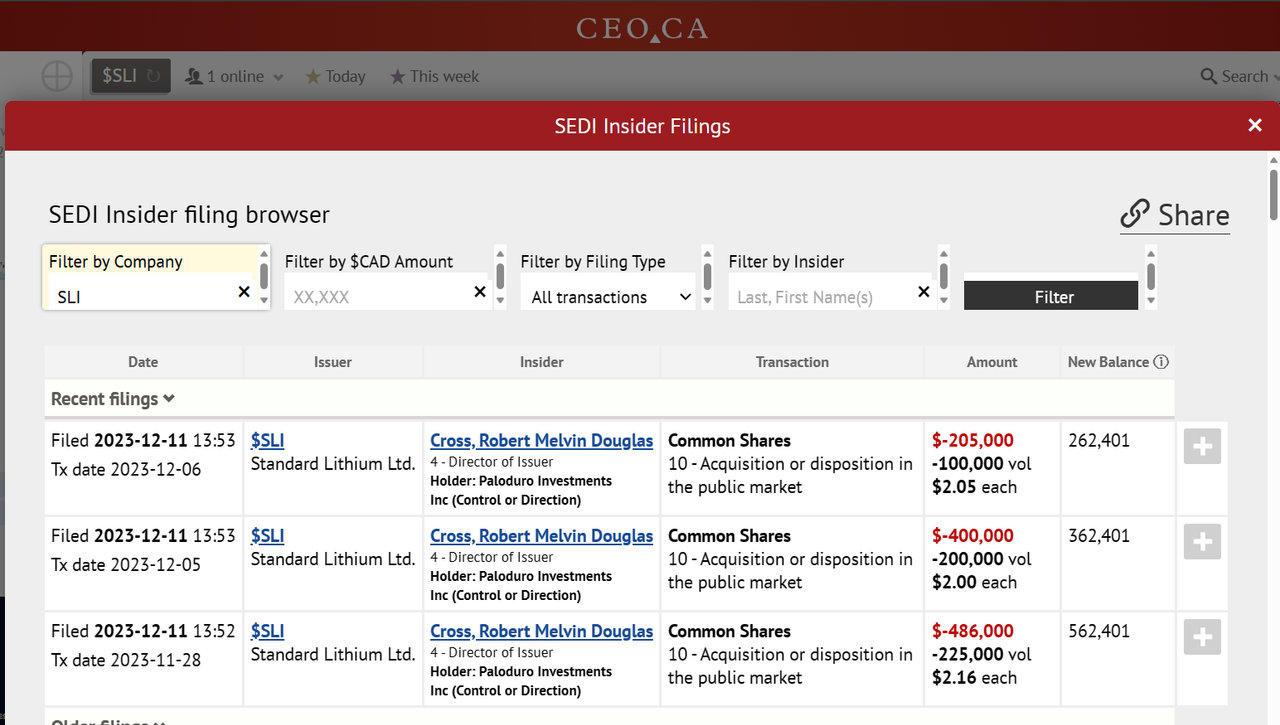

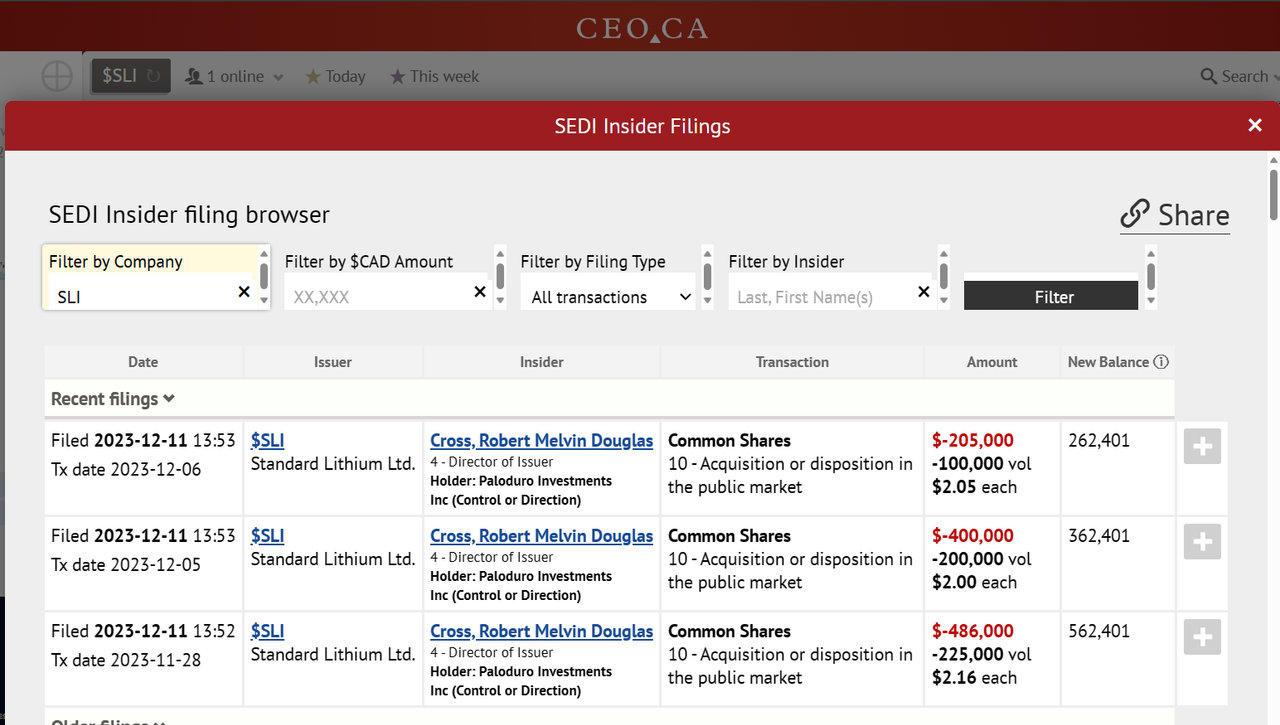

-I haven't seen an insider buy since Alvaro in July, but insider Robert Cross has sold over 500k shares in the last 2 weeks. Reason?

-Lanxess, who knows more about Standard's operation than you or I do, has chosen not to partner on it

-$50M dilution locked and loaded

-Why still attending secret investor conferences if partnership demand is so fervent?

-We haven't had a meaningful PR since Oct 25 (potash and bromine found in East TX brine)

Every PR since has been absolute filler/review of things we know.

-The November 14 PR has bothered me more than anything else since the short report on Mintak's history. It couldn't have been less necessary or more desperate.

-Headlines of lithium spot price and EV demand tanking (valid or not)

-I haven't seen an insider buy since Alvaro in July, but insider Robert Cross has sold over 500k shares in the last 2 weeks. Reason?

This post was edited on 12/13/23 at 12:48 pm

Posted on 12/13/23 at 12:32 pm to ev247

I believe in Koch and the process, mintak however reeks of Fake it until you make it.

Posted on 12/13/23 at 12:41 pm to Wraytex

theres a thread on the OT about Ford slashing F-150 Lightning production bc the demand isnt there. This has been one of my biggest fears...that nobody actually wants EVs

Posted on 12/13/23 at 1:07 pm to jamiegla1

Tesla and Rivian have both raised their production demand. I commented in that thread too but I wouldn’t chalk up Fords failure to the demand as a whole.

Posted on 12/13/23 at 1:19 pm to jamiegla1

quote:

that nobody actually wants EVs

I see the need for battery production beyond EVs. Such as batteries for solar power etc.

Popular

Back to top

1

1