- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 12/5/23 at 11:16 am to gautamj

Yeah, there are some general lithium head winds going on. EV's are piling up at dealerships as car companies jump with both feet into a soft market in part due to government pressure.

Then too EV's themselves are having their teething pains with too many being totaled by insurance because the battery is damaged and too expensive to replace. This causes insurance rates to go up.

EV resale value is not so good either.

Gov put a lot of money into chargers, but haven't installed any.

Then too current gov is pushing EV's and thus electric demand, but also cutting power generation at coal fired plants. No new power plants are being pushed. That's not going to work.

Then too EV's themselves are having their teething pains with too many being totaled by insurance because the battery is damaged and too expensive to replace. This causes insurance rates to go up.

EV resale value is not so good either.

Gov put a lot of money into chargers, but haven't installed any.

Then too current gov is pushing EV's and thus electric demand, but also cutting power generation at coal fired plants. No new power plants are being pushed. That's not going to work.

This post was edited on 12/5/23 at 11:33 am

Posted on 12/5/23 at 11:38 am to Auburn1968

I would think that lithium would be very beneficial as power storage during periods where supply is interrupted. Big power banks would need a lot of lithium for that application.

Posted on 12/5/23 at 11:46 am to TigerHornII

quote:

Citi or a Goldman-Sachs only comes in as either a mezzanine prior to IPO (which SLI has already done obviously) or if they believe they can broker a strategic investor into the deal for a public or private company.

The art for us is in the terms of whatever deal they broker. They make money on the transaction, not the actual deal. Should be interesting.

Could be leading debt syndication too. It's certainly transaction related - either equity, debt or some type of mezzanine/preferred equity arrangement.

Posted on 12/5/23 at 12:30 pm to ThermoDynamicTiger

1.975 now. I think my toes can touch the bottom.

This post was edited on 12/6/23 at 4:09 pm

Posted on 12/5/23 at 1:08 pm to Auburn1968

quote:

EV's are piling up at dealerships

Meh.. this is kinda a misleading headline being pushed by the media. Teslas are selling like hot cakes right now. A lot of car dealerships are filling back up as it is anyway bc of supply chain issues finally resolving themselves, demand is softening, higher interest rates. There’s brand new 2022 jeeps all over the lot.

Posted on 12/5/23 at 2:27 pm to Shepherd88

As depressing as the current price is, anyone here willing to share the price at which you'll sell your SLI holdings?

Personally, I'd like to hold this until it runs to around 15 CAD, but mostly I'll crack and take a small profit by selling at 9 CAD.. I haven't seen my portfolio to be green since Oct 2021.

Personally, I'd like to hold this until it runs to around 15 CAD, but mostly I'll crack and take a small profit by selling at 9 CAD.. I haven't seen my portfolio to be green since Oct 2021.

This post was edited on 12/5/23 at 2:28 pm

Posted on 12/5/23 at 4:01 pm to gautamj

Is this still a good buy at sub $2?

Posted on 12/5/23 at 4:26 pm to Jack Ruby

If you want to lose money, its an excellent opportunity

Posted on 12/5/23 at 5:21 pm to gautamj

quote:

anyone here willing to share the price at which you'll sell your SLI holdings?

$0.94/share, it’s looking like…

Posted on 12/5/23 at 5:41 pm to GeauxldMember

All Lithium stocks at 52 week lows! Nothing has changed with Standard Lithium!

Posted on 12/5/23 at 6:43 pm to gautamj

I asked AI to help me make a DCFA model for projects Phase 1A and SWA. I came out with value of .76/share for Phase 1A and 12.44/share for SWA, totaling 13.20/share. If we get a PFS for East Texas I will include it.

I will throw this all away if I totally lose trust in the company, but until then I won't sell until it breaks $13.20.

I will throw this all away if I totally lose trust in the company, but until then I won't sell until it breaks $13.20.

Posted on 12/5/23 at 7:02 pm to ev247

quote:

I asked AI to help me make a DCFA model for projects Phase 1A and SWA. I came out with value of .76/share for Phase 1A and 12.44/share for SWA, totaling 13.20/share. If we get a PFS for East Texas I will include it.

I will throw this all away if I totally lose trust in the company, but until then I won't sell until it breaks $13.20.

That at current lithium prices I suppose?

Posted on 12/5/23 at 7:11 pm to ev247

Now you are speaking my language, if we get to $8 I will be thanking my lucky stars. I wouldn't be lying if I said my confidence is waning.

This post was edited on 12/5/23 at 7:12 pm

Posted on 12/5/23 at 7:15 pm to SmackoverHawg

Sorry, it's using our most current reports- DFS for Phase 1A and PFS for SWA. So $30k/ton base case selling prices

This post was edited on 12/5/23 at 7:17 pm

Posted on 12/5/23 at 8:08 pm to ev247

Was the royalty hearing today?

Posted on 12/5/23 at 9:04 pm to CarbonAce

AOGC's agenda says it was. Not expecting the order for 3 weeks like last time, but maybe the local papers will leak something before then?

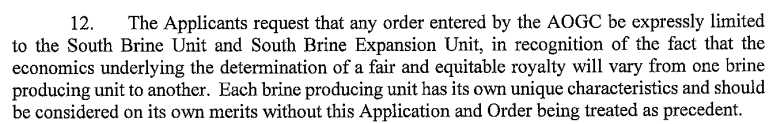

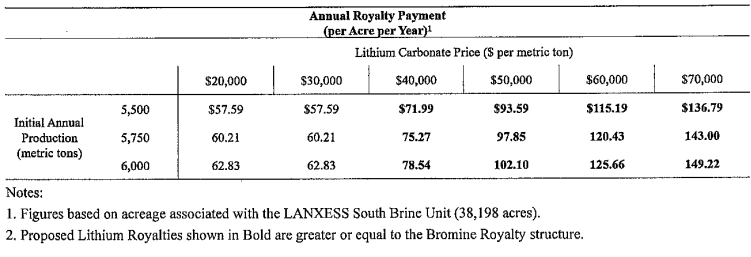

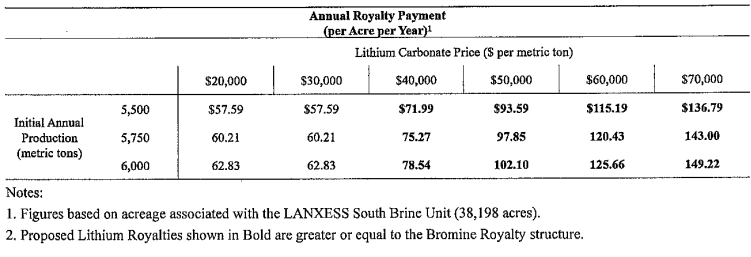

Also, I tend to forget this so I thought I'd share a reminder here... SLI has specifically asked in their royalty proposal that this royalty decision only apply to Lanxess projects and not be used as precedent for future projects, so we may have to do this dance again.

This is old but I'm just seeing it. Probably what's taking the royalty decision so long is that Lanxess (SLI) is proposing to pay $57.59/acre per year for lithium royalties. I can't imagine these two ideas being at peace in the mind of Arkansans:

1. This lithium rush is gonna be bigger than the oil booms was!

2. We'll give you $57.59/acre/year for your lithium brine.

Also, I tend to forget this so I thought I'd share a reminder here... SLI has specifically asked in their royalty proposal that this royalty decision only apply to Lanxess projects and not be used as precedent for future projects, so we may have to do this dance again.

This is old but I'm just seeing it. Probably what's taking the royalty decision so long is that Lanxess (SLI) is proposing to pay $57.59/acre per year for lithium royalties. I can't imagine these two ideas being at peace in the mind of Arkansans:

1. This lithium rush is gonna be bigger than the oil booms was!

2. We'll give you $57.59/acre/year for your lithium brine.

Posted on 12/6/23 at 12:03 pm to ev247

That's close to a 1.5% royalty rate. I'm not involved in the O&G industry so can't speak to comparability. If I have time later today I'll look up current Arkansas rates for other resources.

Posted on 12/6/23 at 12:48 pm to ApexHunterNetcode

A land man in Arkansas recently told me that this is about the same as bromine royalties. And it may be fair, it just wouldn’t surprise me if landowners are holding up the decision by trying to push for more.

Posted on 12/6/23 at 1:59 pm to ev247

Anyone here have access to attend either of the two investor conferences? Would be interesting to see if the presentations reflect Lanxess' decision to opt out.

Popular

Back to top

1

1