- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

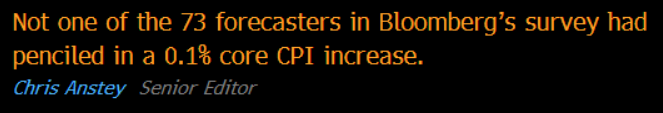

CPI comes in below expectations across the board

Posted on 6/11/25 at 8:10 am

Posted on 6/11/25 at 8:10 am

Loading Twitter/X Embed...

If tweet fails to load, click here.

This post was edited on 6/11/25 at 8:11 am

Posted on 6/11/25 at 8:29 am to HailHailtoMichigan!

Methinks they consider themselves influencers and not researchers.

Posted on 6/11/25 at 8:37 am to HailHailtoMichigan!

The Umich economists who run their inflation survey need to offer a public apology and announce they are going to look into why their data was showing 6.6% annual inflation

It’s obvious at this point that that isn’t happening.

We may see inflation tick back up to 3%, but 6.6%?

My goodness

It’s obvious at this point that that isn’t happening.

We may see inflation tick back up to 3%, but 6.6%?

My goodness

Posted on 6/11/25 at 8:38 am to HailHailtoMichigan!

While economics is a very soft science, in spite of what economists would have you think, do we know when the survey was conducted? The variables they would be taking into account were changing rapidly a month ago.

With that said, while a 0.1% increase is nothing to be concerned about, it does speak against the push to lower rates.

With that said, while a 0.1% increase is nothing to be concerned about, it does speak against the push to lower rates.

Posted on 6/11/25 at 8:39 am to HailHailtoMichigan!

Cut the rates and stop playing politics Jerome

At least shelter dipped below 4%

Still way off

At least shelter dipped below 4%

Still way off

Posted on 6/11/25 at 8:43 am to HailHailtoMichigan!

Slightly off topic, but Weisenthal's podcast with Tracey Galloway, Odd Lots, is a pretty good listen.

Posted on 6/11/25 at 8:47 am to Joshjrn

quote:

With that said, while a 0.1% increase is nothing to be concerned about, it does speak against the push to lower rates.

A 0.1% monthly increase is the target the fed wants to see when deciding to lower rates.

It translates into a yearly inflation rate right in line with the target.

Posted on 6/11/25 at 8:54 am to HailHailtoMichigan!

quote:

A 0.1% monthly increase is the target the fed wants to see when deciding to lower rates. It translates into a yearly inflation rate right in line with the target.

You’re right; I didn’t read closely enough. I saw MoM and thought they meant rate increase in May of this year versus last year, which would indicate a worsening of inflation. Was my mistake

Posted on 6/11/25 at 9:00 am to SDVTiger

This shite is always a lagging indicator. It’s been past time to cut rates. The economy is like a tug boat- you have to start turning early.

Maybe with the “deal to make a deal” with China, they can stop worrying about “uncertainty”

Maybe with the “deal to make a deal” with China, they can stop worrying about “uncertainty”

Posted on 6/11/25 at 9:01 am to Joshjrn

You are good

I still think too early to lower rates

Consumers are buying things from inventories purchased before tariffs went into effect

In the later months of this year, the goods on the market will be from inventories purchased during tariff mania.

I still think too early to lower rates

Consumers are buying things from inventories purchased before tariffs went into effect

In the later months of this year, the goods on the market will be from inventories purchased during tariff mania.

Posted on 6/11/25 at 9:09 am to HailHailtoMichigan!

quote:Why? They are a political hack, that is why

The Umich economists who run their inflation survey need to offer a public apology and announce they are going to look into why their data was showing 6.6% annual inflation

Posted on 6/11/25 at 9:10 am to HailHailtoMichigan!

quote:

In the later months of this year, the goods on the market will be from inventories purchased during tariff mania.

Even then it will still be too early to determine the impact of tariffs. I think most companies are trying to absorb them by cutting costs everywhere else, which is what most of my customers are doing. I think the strategy is a wait and see if these tariffs are a negotiating strategy, if they can get exemptions, or determine if they are a permanent fixture. Once companies determine that it is a permanent fixture they will have no choice but to raise their prices.

Popular

Back to top

6

6