- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

All About OPTIONS - THREAD

Posted on 12/6/21 at 1:44 pm

Posted on 12/6/21 at 1:44 pm

I've been wanting to start a thread for my advanced options traders to talk overall strategies, trade ideas and answer questions.

Also to serve as a learning opportunity for folks new to options. I will include links to resources that people use or find helpful.

Options are a very powerful tool that even beginner investors can use to grow their portfolios, and no I'm not talking about Yoloing Calls

Resources:

What is an Option

Options Trading for Beginners (The ULTIMATE In-Depth Guide)

Tastytrade Youtube

Options Greeks: 4 Factors for Measuring Risk

Tastytrade.com Learning Center - Free to Join

Best Brokers for Options Trading (I personally use and am partial to Tastyworks)

List of Common Acronyms:

C - Call

P - Put

DTE - Days to Expiration

ITM - In the Money

OTM - Out of the Money

ATM - At the Money

IC - Iron Condor

IV - Implied Volatility

PMCC - Poor Man's Covered Call

SL - Stop Loss

BTO - Buy to Open

STO - Sell to Open

BTC - Buy to Close

STC - Sell to Close

Also to serve as a learning opportunity for folks new to options. I will include links to resources that people use or find helpful.

Options are a very powerful tool that even beginner investors can use to grow their portfolios, and no I'm not talking about Yoloing Calls

Resources:

What is an Option

Options Trading for Beginners (The ULTIMATE In-Depth Guide)

Tastytrade Youtube

Options Greeks: 4 Factors for Measuring Risk

Tastytrade.com Learning Center - Free to Join

Best Brokers for Options Trading (I personally use and am partial to Tastyworks)

List of Common Acronyms:

C - Call

P - Put

DTE - Days to Expiration

ITM - In the Money

OTM - Out of the Money

ATM - At the Money

IC - Iron Condor

IV - Implied Volatility

PMCC - Poor Man's Covered Call

SL - Stop Loss

BTO - Buy to Open

STO - Sell to Open

BTC - Buy to Close

STC - Sell to Close

This post was edited on 12/7/21 at 8:54 pm

Posted on 12/6/21 at 9:49 pm to Brobocop

Weeklies are cheaper for a reason, ok to use for momentum scalping but be wary.

Easiest way to make money with options is play the opposite side of huge momentum swings. Something drops 15%, buy longer dated calls 5-10% OTM. Puts for the opposite.

Dump them while they are hot. If something goes up 5% then pulls back, it will need to go up 7% the next time for the option to reach the same price sometimes even in the same day.

Pay attention to IV. An IV drop can cause you to lose many even if the stock moves in your favor.

Poor Man Covered Call and Collars are the 2 best advanced strats in my opinion but everyone’s opinion will differ. PMCC is a great way to use leverage with options.

Easiest way to make money with options is play the opposite side of huge momentum swings. Something drops 15%, buy longer dated calls 5-10% OTM. Puts for the opposite.

Dump them while they are hot. If something goes up 5% then pulls back, it will need to go up 7% the next time for the option to reach the same price sometimes even in the same day.

Pay attention to IV. An IV drop can cause you to lose many even if the stock moves in your favor.

Poor Man Covered Call and Collars are the 2 best advanced strats in my opinion but everyone’s opinion will differ. PMCC is a great way to use leverage with options.

Posted on 12/7/21 at 12:31 am to Brobocop

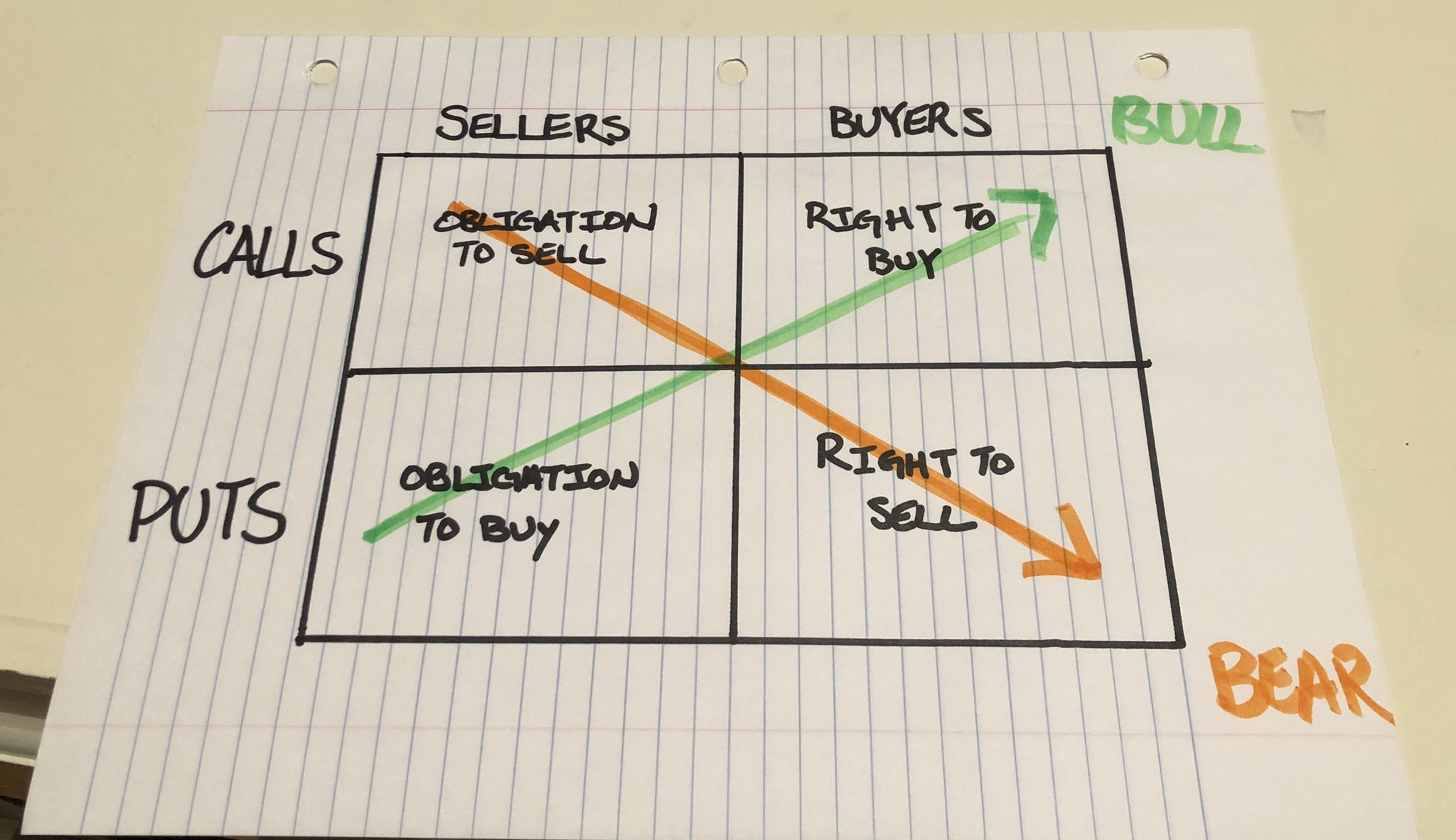

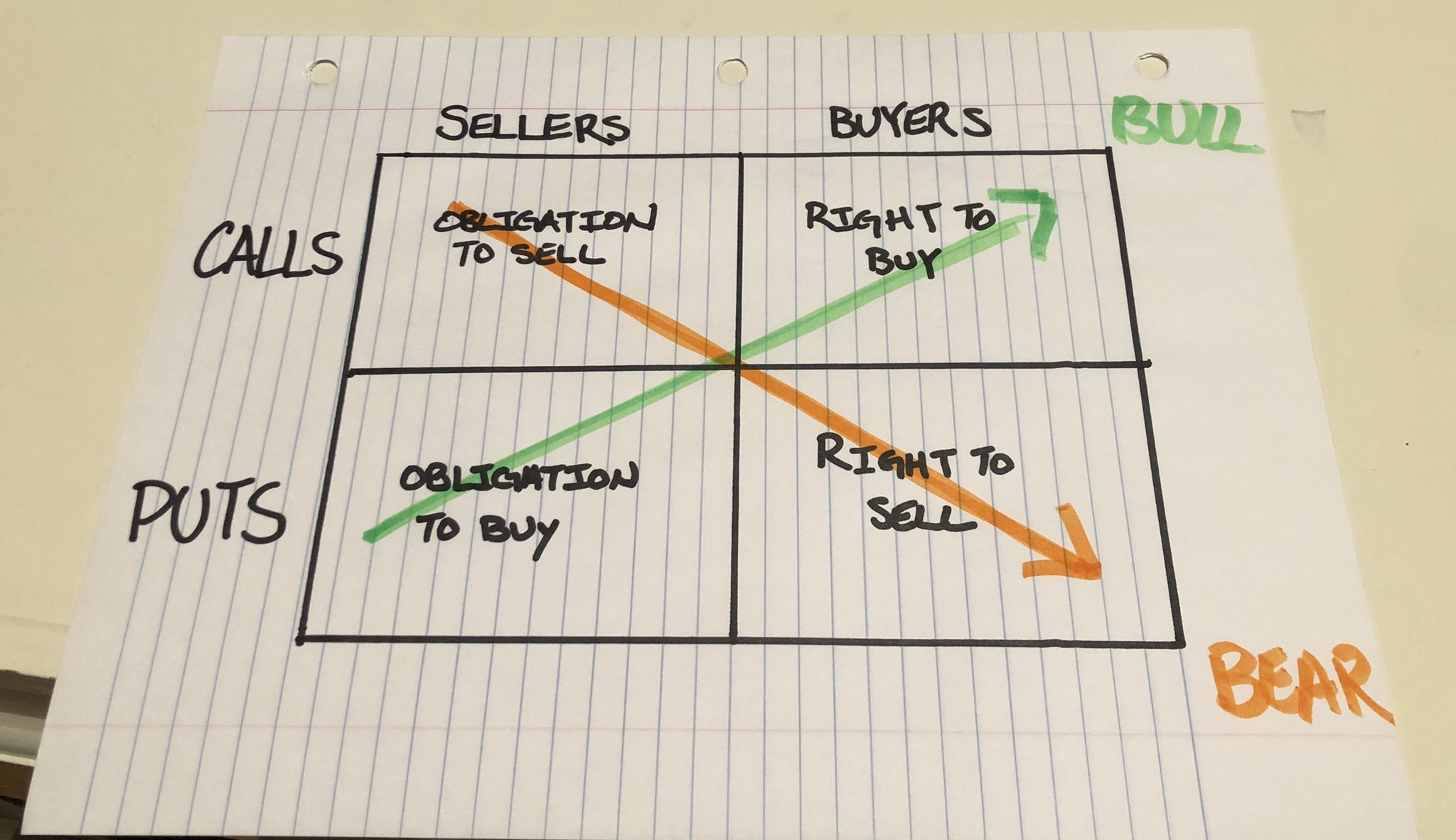

I’m looking forward to this thread. Majority - 95% of what I trade are options. The options market is now the same size as the stock market and will soon eclipse it. If you’re just starting to explore options, I have no doubt that this will be a great place to do so. So, for those who will be learning by reading through this thread, here is a great, visual way to begin to understand the terminology.

Posted on 12/7/21 at 1:04 am to TchoupitoulasTiger

quote:

TchoupitoulasTiger

What are your main strategies? Are you long premium or short?

Posted on 12/7/21 at 1:25 am to Brobocop

I write weekly OTM calls where the strike is around 10% above market price. If I don’t close or it exercises I’ll write short term puts just below market price to get back in. I’m a big fan of put writing. Why buy at current market price when you can get back in lower while collecting a premium? Assuming you’re trading a round lot.

For big intraday swings I like to buy short term ITM options depending which way the market is going.

And as you mentioned, if there’s a big sell off,I’ll buy slightly OTM calls. I paid for my kitchen renovation by getting lucky on timing the bottom after the covid crash.

I’ll say with speculative options trading, you have to have an exit point in mind as you can lose a lot of money in a flash.

For big intraday swings I like to buy short term ITM options depending which way the market is going.

And as you mentioned, if there’s a big sell off,I’ll buy slightly OTM calls. I paid for my kitchen renovation by getting lucky on timing the bottom after the covid crash.

I’ll say with speculative options trading, you have to have an exit point in mind as you can lose a lot of money in a flash.

Posted on 12/7/21 at 7:14 am to Brobocop

quote:Thanks for the thread.

All About OPTIONS

I'm studying the basics of options, but I'll be advanced one day.

Posted on 12/7/21 at 10:38 am to gatorsimz

quote:

For big intraday swings I like to buy short term ITM options depending which way the market is going.

And as you mentioned, if there’s a big sell off,I’ll buy slightly OTM calls. I paid for my kitchen renovation by getting lucky on timing the bottom after the covid crash.

I’ll say with speculative options trading, you have to have an exit point in mind as you can lose a lot of money in a flash.

I like all of this. Especially buying ITM when buying short term to scalp intraday. For the beginners, ITM (In The Money) has mostly intrinsic value remaining as most of the extrinsic value (Time and Volatility) has bled off so the option will move more in-line with the stock movement.

A few other things, if you buy a stock and it plummets, you can hold long term if necessary to regain your investment, not true with options. Exit plan is key here.

Also stop losses are wonky with options because the spreads can be wide at times. Depending on your broker depends on how they work. Fidelity uses the bid side of the spread which means you can trigger your SL way before you should if the spread is wide.

Posted on 12/7/21 at 10:46 am to LSUStjames

Forgot to post another adv strategy I use sometimes is Converting a covered call to a spread. I use this strategy when I think the stock will rebound.

When selling CC's most people's target profit is ~50%, they will BTC the CC when they get there. Instead of closing it out, I will instead buy a call closer to ATM for 50% of what I've sold the CC for. I've now locked in my 50% profit but still also get exposure to the upside as the underlying rebounds. When the stock rebounds, simply close the entire spread. This is basically legging into a debit spread for "free". Once you are in a spread, it's generally a very bad idea to leg out by closing one of the calls, you are better to keep the spread intact.

I'll try to do an example.

MSFT is currently trading at 300

I sell a covered call with a strike of 350 for .50.

MSFT drops to 285, the call I sold is now worth .25, I could BTC for 50% profit. Instead, I buy the call with the strike of 345 for .30. I've still pocketed $20 on my CC and have now legged into a debit spread so if the stock rebounds to 300 or even better splits the strike prices, I can close the entire spread for a much bigger profit. If it continues to drop, I keep the $20 and let the spread expire.

When selling CC's most people's target profit is ~50%, they will BTC the CC when they get there. Instead of closing it out, I will instead buy a call closer to ATM for 50% of what I've sold the CC for. I've now locked in my 50% profit but still also get exposure to the upside as the underlying rebounds. When the stock rebounds, simply close the entire spread. This is basically legging into a debit spread for "free". Once you are in a spread, it's generally a very bad idea to leg out by closing one of the calls, you are better to keep the spread intact.

I'll try to do an example.

MSFT is currently trading at 300

I sell a covered call with a strike of 350 for .50.

MSFT drops to 285, the call I sold is now worth .25, I could BTC for 50% profit. Instead, I buy the call with the strike of 345 for .30. I've still pocketed $20 on my CC and have now legged into a debit spread so if the stock rebounds to 300 or even better splits the strike prices, I can close the entire spread for a much bigger profit. If it continues to drop, I keep the $20 and let the spread expire.

This post was edited on 12/7/21 at 11:03 am

Posted on 12/7/21 at 11:19 am to gatorsimz

quote:

I’m a big fan of put writing. Why buy at current market price when you can get back in lower while collecting a premium?

This is how I enter a stock.

It could still go lower, but I get some premium to offset loss.

Most of the time, I end up just getting the premium, and then writing another put.

Posted on 12/7/21 at 11:23 am to makersmark1

quote:bingo

Dump them while they are hot.

Posted on 12/7/21 at 1:30 pm to LSUStjames

quote:

Easiest way to make money with options is play the opposite side of huge momentum swings. Something drops 15%, buy longer dated calls 5-10% OTM. Puts for the opposite

Do you buy the same day of the momentum swing or wait a few days? Seems like you would still be paying on the inflated volatility for the larger than normal move - whether up or down -- when buying the same day.

Volatility is a real thing and sometimes it can help you out. Two examples.

GME Back in Jan of 2020, Gamestop was making a huge move late in the day. I think it was closing in on $200 at the end of the day. I figured it was crazy reaction so I bot the Feb 60 puts with less than 5 minutes to go.

In the after hours, GME got to $249 and figured - well that was a major screwup. The stock opened higher the next morning, but my puts INCREASED in value due to the higher volatility even though I was further away from the strike price than the prior day. I closed for a small gain.

This is one of those outliers that almost never happens. If you buy to open a call, then your option goes up as the price goes up and if you bto a put then your option should go up in price as the stock price falls.

COUP I tried to get in the Coupa Software weekly 120 & 140 puts yesterday morning. I figured recent tech names like CRM and DOCU didn't fare too well, so it could be an indicator on how COUP might perform post ER. The plan was to get some where hopefully I could make a profit on some before the close and hold just enough so that it wouldn't cost me anything to hold - a free look. Worse case, if there isn't a profit close most and hold a few to see how things play out.

I tried getting some but I didn't want to overpay and the 120 puts tripled in price in half an hour. I took the orders down when I had to leave.

Posted on 12/7/21 at 1:47 pm to tigerfan4444

Best thing to do when volatility is high is sell options, or buy spreads, whether puts or calls. basic long calls or puts when IV is high is a recipe for disaster

This post was edited on 12/7/21 at 1:48 pm

Posted on 12/7/21 at 1:55 pm to gatorsimz

Yep! Sell calls most every week and some monthly.

Writing the Puts to get back in is really a good way to get back in it stock. The wheel is always turning!

I personally don't buy a lot of options. If I do, it's a depressed stock and I buy it far out. That's just my personal preferences.

An example here was this past week, I purchase IVR options for Jan 2023 at the current price.

Intraday swings are fun!

Writing the Puts to get back in is really a good way to get back in it stock. The wheel is always turning!

I personally don't buy a lot of options. If I do, it's a depressed stock and I buy it far out. That's just my personal preferences.

An example here was this past week, I purchase IVR options for Jan 2023 at the current price.

Intraday swings are fun!

Posted on 12/7/21 at 4:51 pm to tigerfan4444

quote:

Do you buy the same day of the momentum swing or wait a few days? Seems like you would still be paying on the inflated volatility for the larger than normal move - whether up or down -- when buying the same day.

Depends on the ticker, IV, how expensive the options are in general. For instance, TSLA options are ridiculously expensive so I'd probably not play a momentum swing there. GME/AMC IV is typically too high, though I will play GME Puts on earnings and calls when the quarterly run up is about to happen. However if i'm playing puts on earnings, I typically wait until the day after to try to limit IV crush.

A better example is something that is a good bit below its normal trading range and IV/prices are still relatively low. I did this recently on CCL. It went down to $16 last week, it normally trades between 20-30. I waited till the next morning and picked up 10 1/21/22 C20s for .61 each. They are 1.05 as of close today.

I'm also sitting on some NVDA C330s I bought yesterday morning which are already up 235%. I almost dumped them at close but think it will hit 330 again by EOW.

This post was edited on 12/7/21 at 4:53 pm

Posted on 12/7/21 at 6:59 pm to thatguy777

quote:

thatguy777

I saw the thread title and hoped that it might bring you back. I don’t post here as much either since the other options traders had basically gone away. I was lonely.

Yep. The majority of my options activity is on the short side. I screen for situations where the IV percentile is above 50%, or at least historically high. I generally don’t short iron butterflys or straddles, but I do quite a few short iron condors, strangles and occasional jade lizards. Of course, my bread and butter is short puts and short verticals.

Posted on 12/7/21 at 7:04 pm to Brobocop

Buy calls on a down day. Sell calls on an up day. Don’t chase. Get out at 20% instead of holding thinking that things going to 2x. You’ll be left holding a worthless expiry.

Posted on 12/7/21 at 7:46 pm to Jag_Warrior

Ha. Things are great. Still going hard with trading options, net buyer still. Starting to mix in more strategies though. The last two years have done me very well, hoping to close 2021 out right.

With the amount of time I put into researching stocks, my real job, and family it was too difficult to keep up with the other thread. I am going to try and contribute here as much as possible.

Hope all is well!

With the amount of time I put into researching stocks, my real job, and family it was too difficult to keep up with the other thread. I am going to try and contribute here as much as possible.

Hope all is well!

Posted on 12/7/21 at 7:47 pm to thatguy777

Yep, just doing’ the do here in VA. I’ll try to check in and contribute more often too.

Posted on 12/7/21 at 7:59 pm to Jag_Warrior

Buy VXX puts 60 days out any time it closes up 7% for a day. Back tested returns doing this are phenomenal. Anything 40-60 delta.

Posted on 12/7/21 at 8:16 pm to Jag_Warrior

Glad to see I have another short seller in the house!

Unless IV is crazy low, I’ll always be a seller. I may not sell the indexes in that situation, but I’ll always Target stocks with high IV or upcoming events.

Big fan of credit spreads, ICs and 10-16 delta strangles, etc. all 30-45 DTE.

I’m a firm believer in the “tasty way”. Lol.

There is some great ideas and discussion in here already! Look forward to keeping this going.

Unless IV is crazy low, I’ll always be a seller. I may not sell the indexes in that situation, but I’ll always Target stocks with high IV or upcoming events.

Big fan of credit spreads, ICs and 10-16 delta strangles, etc. all 30-45 DTE.

I’m a firm believer in the “tasty way”. Lol.

There is some great ideas and discussion in here already! Look forward to keeping this going.

This post was edited on 12/7/21 at 8:33 pm

Popular

Back to top

17

17