- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

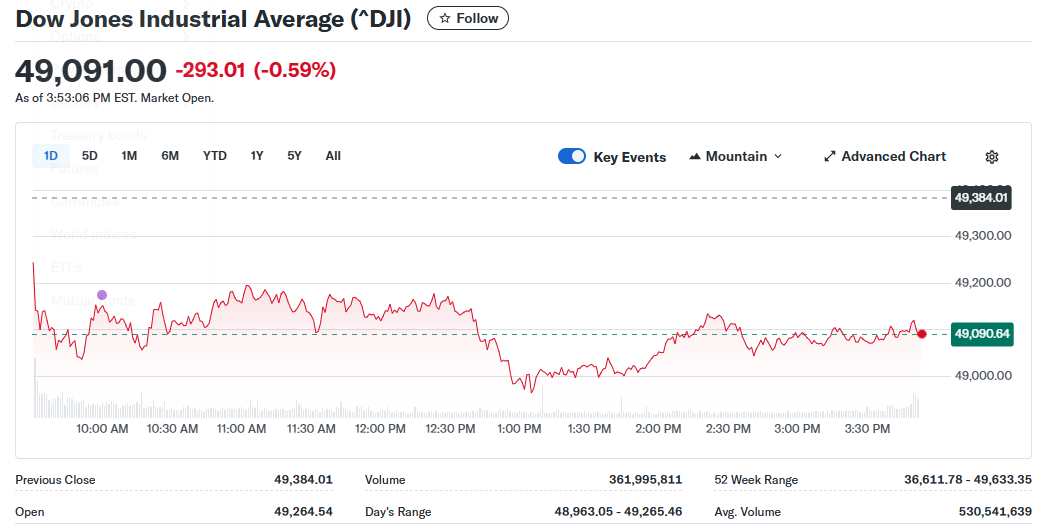

Today is one of those weird days where the DJI is down big (-300 points) &...

Posted on 1/23/26 at 2:08 pm

Posted on 1/23/26 at 2:08 pm

...both the SPX & NASDAQ are UP.

Fun With Numbers:

A quick peek at the individual stocks in the DJI shows that Goldman Sachs (GS), down $34/share, and Caterpillar (CAT), down $22.40/share as I post this, are what's causing the DJI to be down so much.

In fact, if those two stocks were magically removed from the DJI Index, the Dow would be UP on the day.

Fun With Numbers:

A quick peek at the individual stocks in the DJI shows that Goldman Sachs (GS), down $34/share, and Caterpillar (CAT), down $22.40/share as I post this, are what's causing the DJI to be down so much.

In fact, if those two stocks were magically removed from the DJI Index, the Dow would be UP on the day.

This post was edited on 1/23/26 at 3:23 pm

Posted on 1/23/26 at 2:20 pm to LSURussian

Yep, another reason to ignore the Dow. It’s a price weighted index meaning the higher the share price the more it matters. Market cap indexes aren’t perfect but they make more sense than just the price of a stock, which is completely meaningless.

Posted on 1/23/26 at 2:20 pm to LSURussian

Dow is pretty stable, but narrow gauge of performance. One year returns.

Dow +10%

S&P +13%

NSDQ +17%

Dow +10%

S&P +13%

NSDQ +17%

Posted on 1/23/26 at 2:30 pm to TX_Tiger23

quote:

Yep, another reason to ignore the Dow. It’s a price weighted index meaning the higher the share price the more it matters. Market cap indexes aren’t perfect but they make more sense than just the price of a stock, which is completely meaningless.

So is the S&P.

Difference is the Dow has only 30 stonks which means one outlier can skew the whole index.

Posted on 1/23/26 at 2:35 pm to Bestbank Tiger

The S&P is market cap weighted. The Dow is not. The Dow is weighted based on the share price. The market cap of a company is the share price X the number of shares outstanding. $40 share X 1,000,000 shares = $40 million market cap. $100 share X 100,000 shares = $10,000,000 market cap.

In the Dow the $100 share company affects the index more even though it’s a smaller company. In the S&P the $40 share company will move the index more.

That’s the difference in a market cap weighted index vs a price weighted index.

In the Dow the $100 share company affects the index more even though it’s a smaller company. In the S&P the $40 share company will move the index more.

That’s the difference in a market cap weighted index vs a price weighted index.

Posted on 1/23/26 at 2:56 pm to LSURussian

quote:

the DJI is down big

We really need to work on what "big" is.

This is what I was talking about Mr. Negative

Posted on 1/23/26 at 3:41 pm to Bestbank Tiger

quote:I don't ignore the Dow because a significant number of my long-term holdings in my portfolio are Dow 30 stocks.

another reason to ignore the Dow.

And at one time the S&P500 was a better indicator of the market as a whole but those days are over, at least for now.

The "Magnificent 7" mega cap stocks (Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA)) control the SPX because their combined market cap is almost 40% of the total market cap of the SPX's 500 stocks.

One analyst early last year on CNBC had a graphic showing if those 7 stocks are up or down big for the day, the SPX will also be up or down that day regardless how the other 493 stocks perform that day.

That was proof to me that the SPX no longer represents the broad market like it once did.

Posted on 1/23/26 at 4:10 pm to LSURussian

You’re absolutely correct and I agree on the top 7-10 stocks in the S&P being overly weighted now due to their run up the past few years. However, it corrects itself over time by newer companies growing and replacing others. Meaning look at the past and some of the heavier weighted companies for the S&P vs now. Lilly, Nvidia, Tesla are all relatively newer companies that have grown and surpassed others to become more heavily weighted.

I still think 500+ companies with market cap weight makes more sense for an index vs weighting based on stock price. And it gives a broader/better representation of the business environment. But I would agree the Dow has done a better job of selecting new companies that better represent the US than they have in the past.

I still think 500+ companies with market cap weight makes more sense for an index vs weighting based on stock price. And it gives a broader/better representation of the business environment. But I would agree the Dow has done a better job of selecting new companies that better represent the US than they have in the past.

Posted on 1/23/26 at 4:59 pm to LSURussian

quote:Owning GS was a drag today.

Today is one of those weird days where the DJI is down big (-300 points) &...

Then again, -300 points on the DJIA isn't what it once was.

Portfolio was down 0.02% at this end.

Posted on 1/23/26 at 5:26 pm to TX_Tiger23

If you don’t like the weighting of the SP500 and don’t like the dollar weighting of the DJIA, try EQWL or RSP. The former is the SP100 equal weight and the latter is the SP500 equal weight.

I realize these aren’t traditional indexes and are instead ETFs, just thought I’d throw them out there for discussion of a better barometer.

I realize these aren’t traditional indexes and are instead ETFs, just thought I’d throw them out there for discussion of a better barometer.

Posted on 1/23/26 at 5:27 pm to LSURussian

quote:

DJI is down big

300 pts is not big. It’s statistical noise

Posted on 1/23/26 at 5:32 pm to slackster

Absolutely and thanks. I do know about RSP and agree it’s a good alternative or can use tactically with the market cap weighted indexes. Thanks for heads up on the other.

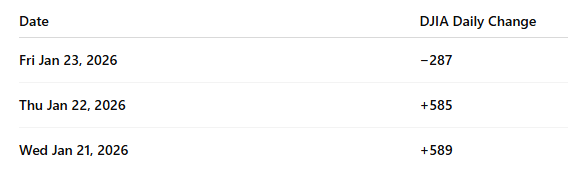

Posted on 1/26/26 at 2:14 pm to LSURussian

quote:

DJI is down big (-300 points)

How come you did not make a thread about the DJI being up 500 points each day the two days before this post

or today being up +300?

Posted on 1/26/26 at 3:23 pm to DarthRebel

quote:Are you really that stupid to not understand the point of my thread wasn't about the Dow's loss that day but was about the divergent direction of the Dow loss compared with the NASDAQ's and SPX's positive day?

How come you did not make a thread about the DJI being up 500 points each day the two days before this post

Posted on 1/26/26 at 3:39 pm to LSURussian

quote:

Are you really that stupid to not understand the point of my thread wasn't about the Dow's loss that day but was about the divergent direction of the Dow loss compared with the NASDAQ's and SPX's positive day?

Nah, it’s intentional. There’s very little interest in truth in discourse, and particularly online discourse, anymore. No rational person can take this:

quote:

Today is one of those weird days where the DJI is down big (-300 points) & both the SPX & NASDAQ are UP.

And turn it into this:

quote:

DJI is down big (-300 points)

Unless they are intentionally doing so to create a strawman. People used to ignorantly run with quotes out of context; now, they intentionally remove the context so they can try to score political gotchas. fricking sucks.

Posted on 1/26/26 at 3:52 pm to Joshjrn

ETA: If you've followed his posts over the years you'd see that he is the stereotypical Ole Miss fan. He lacks intelligence.

This post was edited on 1/26/26 at 3:54 pm

Posted on 1/26/26 at 4:15 pm to LSURussian

quote:

ETA: If you've followed his posts over the years you'd see that he is the stereotypical Ole Miss fan. He lacks intelligence.

Honestly, the worst for it, at least in my experience, is Roger. Though how much of it is intentional versus what goes on in that head of his is up for debate

Posted on 1/26/26 at 5:12 pm to LSURussian

This thread you created was days later after you starting one about the Dow futures begin down, because of "Trump's tariffs". However you want to spin it, please do. You just need to have a moment to understand "down big" is not -300. You could have easily phrased this thread title better, however you have an agenda.

We must have also missed the ones you posted of the Dow being up.

You and Josh can have fun backing each other up, however you would be better off leaving your emotional negativity for other places. The school affiliation attacks are a little suspect as well, as this is not the place for that. We tend to leave that on the SECRant side of this place.

We must have also missed the ones you posted of the Dow being up.

You and Josh can have fun backing each other up, however you would be better off leaving your emotional negativity for other places. The school affiliation attacks are a little suspect as well, as this is not the place for that. We tend to leave that on the SECRant side of this place.

Posted on 1/26/26 at 6:59 pm to DarthRebel

quote:What I posted was "Financial websites believe it's because of Trump's latest tariff threats against Europe over Greenland."

after you starting one about the Dow futures begin down, because of "Trump's tariffs".

And then I said, "another buying opportunity..." Which I took advantage of and made a little over $1,000 on a round trip day trade as soon as the market opened.

LINK

quote:What is my agenda?

however you have an agenda.

Your agenda is to believe anything anyone says when the stock market pulls back even a little is an attack on President Trump. Your brain is mush.

quote:I agree you must have missed those posts. I've made numerous posts about good days in the market. But you are so brainwashed you only remember posts that you believe disagree with your uber-biased opinion.

We must have also missed the ones you posted of the Dow being up.

Here is a thread I started just 15 days ago. "New all-time high closings on the S&P500 Index and Dow Jones 30"

And here's a thread I started last April...

quote:

What just happened? DJ30 went from -250 to +1,750 within 10 minutes. EDIT: Now +2,000.

(Edited) Here it is:

"Trump announces 90-day tariff pause for at least some countries."

EDIT2: DJ30 now up +2,560.

LINK

If you're so sissified that you don't want to discuss financial news, bad news as well as good news, maybe you shouldn't read nor post on this board.

And while you're at it, get your head out of your arse...

Popular

Back to top

7

7