- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

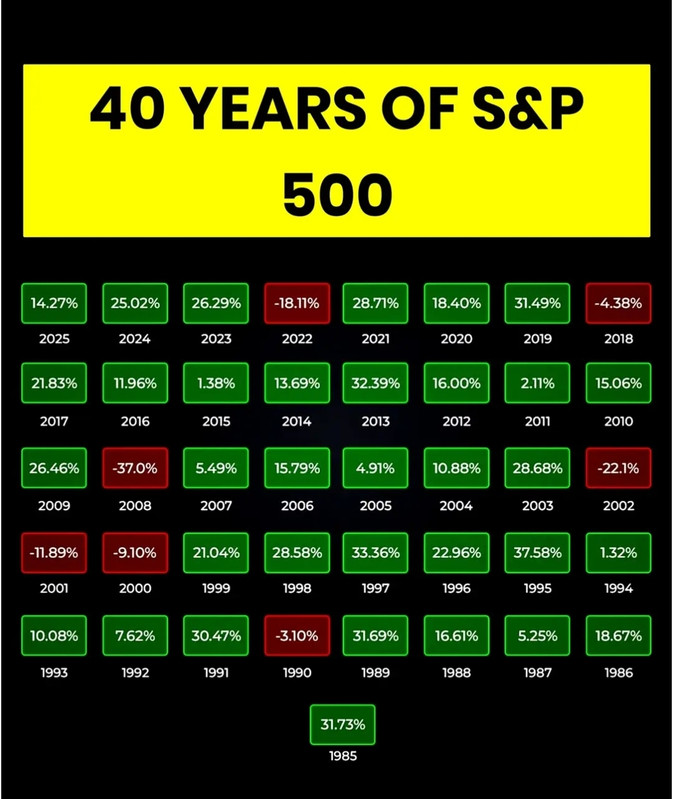

S&P 500 - only 7 red years out of 40.

Posted on 11/10/25 at 1:17 pm

Posted on 11/10/25 at 1:17 pm

No cheat code required.

Posted on 11/10/25 at 1:25 pm to DarthRebel

I have been told by many on this board that investing in broad index funds such as those that track the S&P500 is for old people, and has poor returns.

Its no wonder that most "traders" lose money

Its no wonder that most "traders" lose money

Posted on 11/10/25 at 1:33 pm to DarthRebel

Yes, but within those calendar years, there have been countless substantial corrections of between 10% and 25%, or up to 40%. These corrections cause many people to panic and sell their investments, thus causing them to miss out on the eventual rebound, and the full calendar year gains.

This is why some of the most sound investment advise is to routinely invest in the S&P 500 and do not try to time the market or panic and sell. This is why so many people do well with a 401K (don't take 401K Loans).

Thirty years of this and everyone can be a successful investor.

This is why some of the most sound investment advise is to routinely invest in the S&P 500 and do not try to time the market or panic and sell. This is why so many people do well with a 401K (don't take 401K Loans).

Thirty years of this and everyone can be a successful investor.

Posted on 11/10/25 at 1:38 pm to UltimaParadox

quote:Citing only annual returns masks markedly more severe price action in between.

have been told by many on this board that investing in broad index funds such as those that track the S&P500 is for old people, and has poor returns.

People are not robots. They have anxieties and emotions. They also aren't all the same age.

The shape of your equity curve matters.

It's true that if you could put all your $ in the S&P and then have the luxury of only looking 50 years later, it's likely the single best investment you can make.

But that's not real life. Real people with real dependents can't just casually be down 50 or 60% and think "it's OK, it always comes back". That just isn't how people work.

Posted on 11/10/25 at 1:46 pm to Big Scrub TX

quote:why not? funds that are "invested" should be above and beyond current/future cost of living needs

Real people with real dependents can't just casually be down 50 or 60% and think "it's OK, it always comes back"

Posted on 11/10/25 at 1:54 pm to Big Scrub TX

quote:I agree that emotions are always there and you absolutely need a way to manage it, but it is possible. One way is to always have dry powder available for those moments. You're still down because the stock is down, but now you're buying cheap and that can provide some solace. How can you afford to keep cash on the side to do that and still get decent returns? Leveraged index funds. You're welcome.

But that's not real life. Real people with real dependents can't just casually be down 50 or 60% and think "it's OK, it always comes back". That just isn't how people work.

Posted on 11/10/25 at 1:59 pm to RoyalWe

quote:

How can you afford to keep cash on the side to do that and still get decent returns? Leveraged index funds. You're welcome.

Posted on 11/10/25 at 2:00 pm to UltimaParadox

I was too young to ride that 90s money printing machine, but old enough to experience to the 2000-2002 crash. That is basically when I hit a point to start investing and was scared as hell to. Started diving in mid 2000s to panic my arse off in 2008 and take some hefty losses.

Been smooth sailing then, and did not touch a thing during the 2018 and 2022 blips. Just keep on investing and do not panic.

I took around $60,000 of actual losses in 2008, because I was stupid. Now my portfolio can drop $100,000+ in a week, and I am like it is ok, I will check on it next week maybe

Been smooth sailing then, and did not touch a thing during the 2018 and 2022 blips. Just keep on investing and do not panic.

I took around $60,000 of actual losses in 2008, because I was stupid. Now my portfolio can drop $100,000+ in a week, and I am like it is ok, I will check on it next week maybe

Posted on 11/10/25 at 2:01 pm to Big Scrub TX

quote:

It's true that if you could put all your $ in the S&P and then have the luxury of only looking 50 years later, it's likely the single best investment you can make. But that's not real life. Real people with real dependents can't just casually be down 50 or 60% and think "it's OK, it always comes back". That just isn't how people work.

Really? That’s pretty much exactly what I do.

Posted on 11/10/25 at 2:08 pm to DarthRebel

quote:

S&P 500

"It's hard to beat the S&P 500 because it's a systematic rules-based approach. Not the best rules or the most robust rules and not the most consistent approach but rules nonetheless."

-Jerry Parker

Posted on 11/10/25 at 2:10 pm to cgrand

quote:And that's why I retired at 52. How long have you been a financial advisor?

thats not a viable investment strategy for 99/100 normal working folk

Posted on 11/10/25 at 2:12 pm to RoyalWe

you beat me by 4 years, congrats.

day trading leveraged ETF's is still not a viable investment strategy for 99/100 people. you being an outlier doesnt change that

day trading leveraged ETF's is still not a viable investment strategy for 99/100 people. you being an outlier doesnt change that

Posted on 11/10/25 at 2:20 pm to DarthRebel

quote:

S&P 500 - only 7 red years out of 40.

That's not as impressive as it sounds.

When the market drops 50% it has to go up 100% just to get back to break even.

The S&P was 1,500 in the year 2000 & was 667 in 2009, a 50% drop.

It finally got back to 1,500 in 2013.

So people that bought & held in 2000 had to wait 13 years to get back to break even.

Posted on 11/10/25 at 2:22 pm to Bubble Trouble

quote:and in those intervening 13 years they bought cheaper shares of SPY or of the index and thus have a lot more money than they did prior

So people that bought & held in 2000 had to wait 13 years to get back to break even.

Posted on 11/10/25 at 2:33 pm to Bubble Trouble

quote:

That's not as impressive as it sounds.

When the market drops 50% it has to go up 100% just to get back to break even.

The S&P was 1,500 in the year 2000 & was 667 in 2009, a 50% drop.

It finally got back to 1,500 in 2013.

So people that bought & held in 2000 had to wait 13 years to get back to break even.

This math ain't mathing

Posted on 11/10/25 at 2:40 pm to Bubble Trouble

quote:Yes. Now imagine you were 63 when that started and you needed to take substantial distributions to pay for a family medical emergency. You would probably have sold at the bottom.

The S&P was 1,500 in the year 2000 & was 667 in 2009, a 50% drop.

It finally got back to 1,500 in 2013.

So people that bought & held in 2000 had to wait 13 years to get back to break even.

Again, the shape of your equity curve matters. A portion of your money should be in true buy and hold, long-term equities. But not all - or maybe not even nearly all - of it.

Posted on 11/10/25 at 2:45 pm to Bubble Trouble

Well, well, well, what do we have here? I see a new poster who has a familiar posting style. Very stable use of embed feature across similar boards of another poster that has disappeared. Very interesting

The amount of new posters that make their way to the least visited money board is staggering. Welcome

The amount of new posters that make their way to the least visited money board is staggering. Welcome

Posted on 11/10/25 at 2:55 pm to Big Scrub TX

quote:

Now imagine you were 63 when that started

Well, using the percentages from the chart, the type of person you're describing would be up over 1200% since 1985 even with the 9.1% loss in 2000. The worst case based on these rates of return would be pulling everything out after 2002 and that person would still be up over 830%.

That 63 year old should also have their investments in much more risk averse holdings at that point, but that's for a different thread.

Posted on 11/10/25 at 2:58 pm to Big Scrub TX

quote:

Now imagine you were 63 when that started and you needed to take substantial distributions to pay for a family medical emergency.

At 63, how much of your portfolio is sitting in stocks? What are you even trying to say? Did this person have 0% gains through their working years? Were they given some money right before the bust and invested it?

Posted on 11/10/25 at 3:16 pm to cgrand

Who said anything about day trading? Why would you assume that?

Popular

Back to top

7

7