- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Earnings on 529 plans are not taxable

Posted on 11/5/25 at 11:55 am

Posted on 11/5/25 at 11:55 am

So why do I constantly see posters dismiss them as non-worthy savings and investment options? Not as advantageous as HSA, but still a useful tool to consider if you have children of any age.

Posted on 11/5/25 at 12:05 pm to Black n Gold

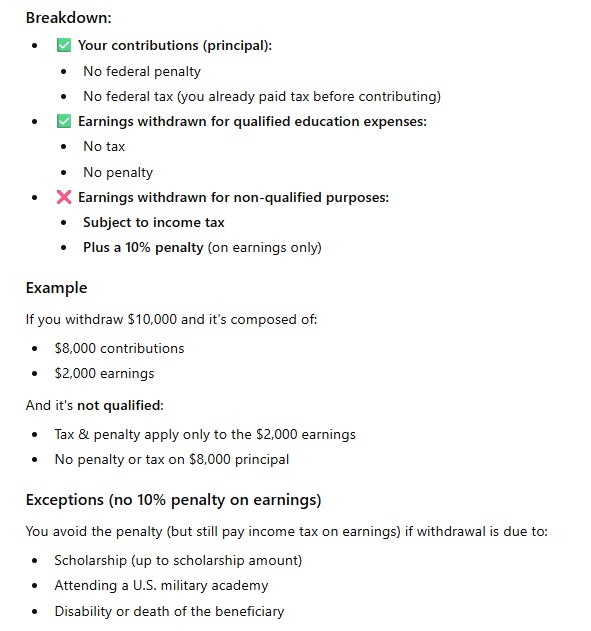

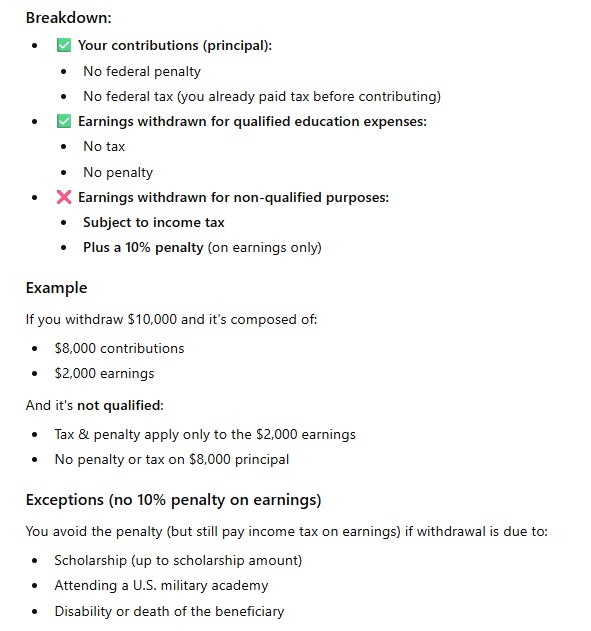

Not taxable on education use only.

Kind of sucks if you have $100,000 in one and your kid gets school covered by scholarship

You can roll $35,000 into Roth for kid.

Kind of sucks if you have $100,000 in one and your kid gets school covered by scholarship

You can roll $35,000 into Roth for kid.

This post was edited on 11/5/25 at 12:07 pm

Posted on 11/5/25 at 12:11 pm to DarthRebel

quote:

Kind of sucks if you have $100,000 in one and your kid gets school covered by scholarship

Some discretion is necessary when contributing. Pointing of that I see many posters dismissing it as simply a 3% savings on state income taxes.

Posted on 11/5/25 at 12:19 pm to Black n Gold

Not taxable only on LA state tax return. Earnings are taxable on the 1040.

Posted on 11/5/25 at 12:58 pm to Black n Gold

The biggest complaint as noted by others is what if junior gets a full ride some where.

I don’t know how many kids get full rides to college but odds aren’t in juniors favor

529 is still a pretty good bet.

You can make another child the beneficiary , use it for graduate school, study aboard, roll it to a Roth , school supplies like laptops and tech which most schlorships don’t cover

Also you could keep the unused funds in 529 and set it up for a future grandchild…what a gift and legacy that would be!

I don’t know how many kids get full rides to college but odds aren’t in juniors favor

529 is still a pretty good bet.

You can make another child the beneficiary , use it for graduate school, study aboard, roll it to a Roth , school supplies like laptops and tech which most schlorships don’t cover

Also you could keep the unused funds in 529 and set it up for a future grandchild…what a gift and legacy that would be!

Posted on 11/5/25 at 1:38 pm to masoncj

quote:

The biggest complaint as noted by others is what if junior gets a full ride some where.

I don’t know how many kids get full rides to college but odds aren’t in juniors favor

The ones that should actually be in school after HS get scholarships

quote:

529 is still a pretty good bet.

I agree, parents need to accept the money you put in there is not coming back to you easily. Once they wrap their brains around that, there is lot of good things that can be done.

The ability to roll over $35,000 into Roth is great thing. If your kid never touched it or added to it, they have $500,000 tax free dollars in 40 years.

There are some ways technically a parent can benefit from leftover money

- Make themselves a beneficiary and go back to school

- If your kid gets a scholarships, you can take out that amount without paying 10% penatly. You will be taxed like it is income though.

- Repay the dumb kid's student loans.

This post was edited on 11/5/25 at 1:39 pm

Posted on 11/5/25 at 2:05 pm to DarthRebel

So if I contribute to a 529 with taxed income, I will have to pay taxes again on it if the 529 is not needed?

Posted on 11/5/25 at 2:11 pm to Black n Gold

After rolling 35k into a ROTH account for them, sit on it and gift to grandkid(s).

Help your kids save for their kids education.

Help your kids save for their kids education.

Posted on 11/5/25 at 2:18 pm to Civildawg

No tax on contribution, just the growth/earnings. Similar to short term capital gains it is taxed at income tax rates rather than more favorable LTCG rates.

Room and board expenses are qualified as well including off campus up to schools COA estimate.

Room and board expenses are qualified as well including off campus up to schools COA estimate.

Posted on 11/5/25 at 3:20 pm to TorchtheFlyingTiger

Yes, what TorchtheFlyingTiger said.

The one I have going into college next year will be close to 100% covered with academic merit and scholarship. Part of their 529 might be paying for a new car for them.

The one I have going into college next year will be close to 100% covered with academic merit and scholarship. Part of their 529 might be paying for a new car for them.

Posted on 11/5/25 at 3:31 pm to Black n Gold

damn site is down again after all that drama from a month ago.

Posted on 11/5/25 at 3:41 pm to DarthRebel

quote:

parents need to accept the money you put in there is not coming back to you easily. Once they wrap their brains around that, there is lot of good things that can be done.

This is just wrong. It’s easy to access, you just pay a 10% penalty on the gains to do so and lose the favorable tax treatment.

We’ve super funded 529s…they will coast into being whatever value they are when it’s time for higher ed. Roth conversion is also going to be a priority as it is a cheat code for setting up a legacy.

The “Dynasty 529” that plans to roll these over for grandchildren is something I’ve only recently begun to think about. Who knows what tax code looks like in 50 years…

Posted on 11/5/25 at 4:23 pm to lynxcat

quote:

This is just wrong. It’s easy to access, you just pay a 10% penalty on the gains to do so and lose the favorable tax treatment.

Maybe easy was wrong word, 10% penalty is just that though. Yeah you can get it, but you are paying 10% on top of tax as well.

My point was besides principal, you are going to lose money unless it is used for education purposes. Like a 401K, it is not just a simple ("easy") account to run stuff through, unless you are cool with the 10% donation.

Posted on 11/6/25 at 6:53 am to Black n Gold

If your child gets a scholarship, convert $35,000 of it to a Roth the first few years when they start working (that’s huge) and eventually change the beneficiary for the rest of it to grandchild. The Roth conversion from a 529 plan would have been a major game changer for 18 year old version of me, but it only became a thing in the last couple of years.

Kind of what we are trying to do.

My kids are 15 months old and 5 years old. We put about $500/month into each of their accounts but we are going to cut that back soon to about $300/month or so pretty soon. They both got a solid lump sum start of about $3,000 when they first got their social security number.

I kind of stress about both of them having similar amounts in their accounts when they turn 18, adjusted for inflation. Going to be challenging.

BTW they can use the 529 funds for room and board. I happen to have a rental house near LSU’s south gates off Highland that they’ll probably inherit one day. .

Kind of what we are trying to do.

My kids are 15 months old and 5 years old. We put about $500/month into each of their accounts but we are going to cut that back soon to about $300/month or so pretty soon. They both got a solid lump sum start of about $3,000 when they first got their social security number.

I kind of stress about both of them having similar amounts in their accounts when they turn 18, adjusted for inflation. Going to be challenging.

BTW they can use the 529 funds for room and board. I happen to have a rental house near LSU’s south gates off Highland that they’ll probably inherit one day. .

This post was edited on 11/6/25 at 6:59 am

Posted on 11/6/25 at 6:56 am to dewster

Edit - I misread - earnings are taxable but penalty is waived based on scholarships

This post was edited on 11/6/25 at 6:58 am

Posted on 11/6/25 at 7:26 am to Chris4x4gill2

So what 529 plans is everyone using. I've been putting off on opening one for my kid but I guess I need to try to start funding one a little bit

Posted on 11/6/25 at 8:42 am to Civildawg

I did two…LA and RI. I don’t remember why I picked RI as one it was a long time ago. Resources available now to compare plans are exponentially better than they were in 1995 though so do your research and pick what looks like a good plan for you

LAs plan is very highly regarded despite the recent tech glitches

LAs plan is very highly regarded despite the recent tech glitches

Posted on 11/6/25 at 2:54 pm to DarthRebel

quote:

Kind of sucks if you have $100,000 in one and your kid gets school covered by scholarship

Roll it over to grad school.

Posted on 11/6/25 at 3:09 pm to cgrand

We have an Illinois and Louisiana plans (because of where we were at the time). Impressed with both, although the Illinois Bright Start online tools are so much easier to use.

The Louisiana system has an array of Vanguard funds. No complaints other than the remarkably clunky website. Like blank error messages, links to emails and phone numbers that are not active, etc. As good as the Louisiana system is…the website is horrendous.

The Louisiana system has an array of Vanguard funds. No complaints other than the remarkably clunky website. Like blank error messages, links to emails and phone numbers that are not active, etc. As good as the Louisiana system is…the website is horrendous.

quote:

LAs plan is very highly regarded despite the recent tech glitches

Posted on 11/6/25 at 3:11 pm to Civildawg

quote:

So what 529 plans is everyone using. I've been putting off on opening one for my kid but I guess I need to try to start funding one a little bit

Louisiana START. What state are you in now?

Also - I think you can use this for room and board and pay your own company market rent if you own a home near a campus and your kid stays there. Since my RE investment company will probably be inherited by my kids, I wonder if this is a method of returning that cash to them without restrictions so they can have spending money for whatever they want while I take a little haircut on rent.

I don’t know anyone who has tried this before though.

Many ways to skin this cat if you have rental properties near a campus your kids go toI think. I have 13 years to figure it out. But if you think your kids are going to school in Starkville- maybe look there for a rental house and get ready to pay yourself rent.

This post was edited on 11/6/25 at 3:17 pm

Popular

Back to top

7

7