- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

July US corporate bankruptcy filings hit highest monthly total in 5 years

Posted on 8/22/25 at 12:49 pm

Posted on 8/22/25 at 12:49 pm

Anyone else read this and see nothing of concern? Is tracking just the numerical count of bankruptcies each year and month an important data element, or should we be talking about bankruptcy rates?

Yet here's S&P Global still appearing to make a big deal about these numbers: LINK

What am I missing?

Yet here's S&P Global still appearing to make a big deal about these numbers: LINK

What am I missing?

Posted on 8/22/25 at 1:02 pm to EatnCreaux

Are they really making a big deal about it? Sounds like they are trying to grab your attention with something notable and then giving a pretty straightforward summary.

Posted on 8/22/25 at 1:34 pm to TigersHuskers

Higher but not out of range. Unhealthy can hang around longer than they should with low interest rates. Higher borrowing costs should mean more unhealthy companies file for bankruptcy at some point when loans/balloon payments are due and they can't afford the debt service at the higher rates to refi.

Posted on 8/22/25 at 1:55 pm to EatnCreaux

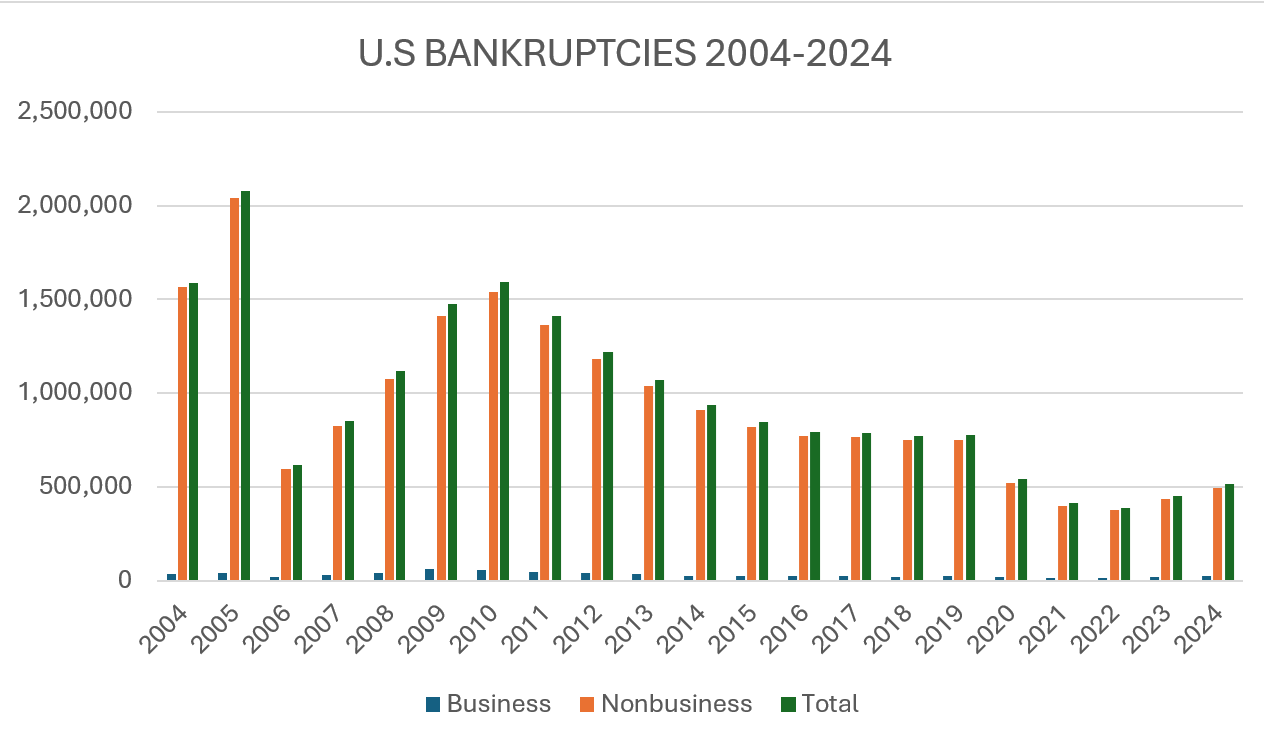

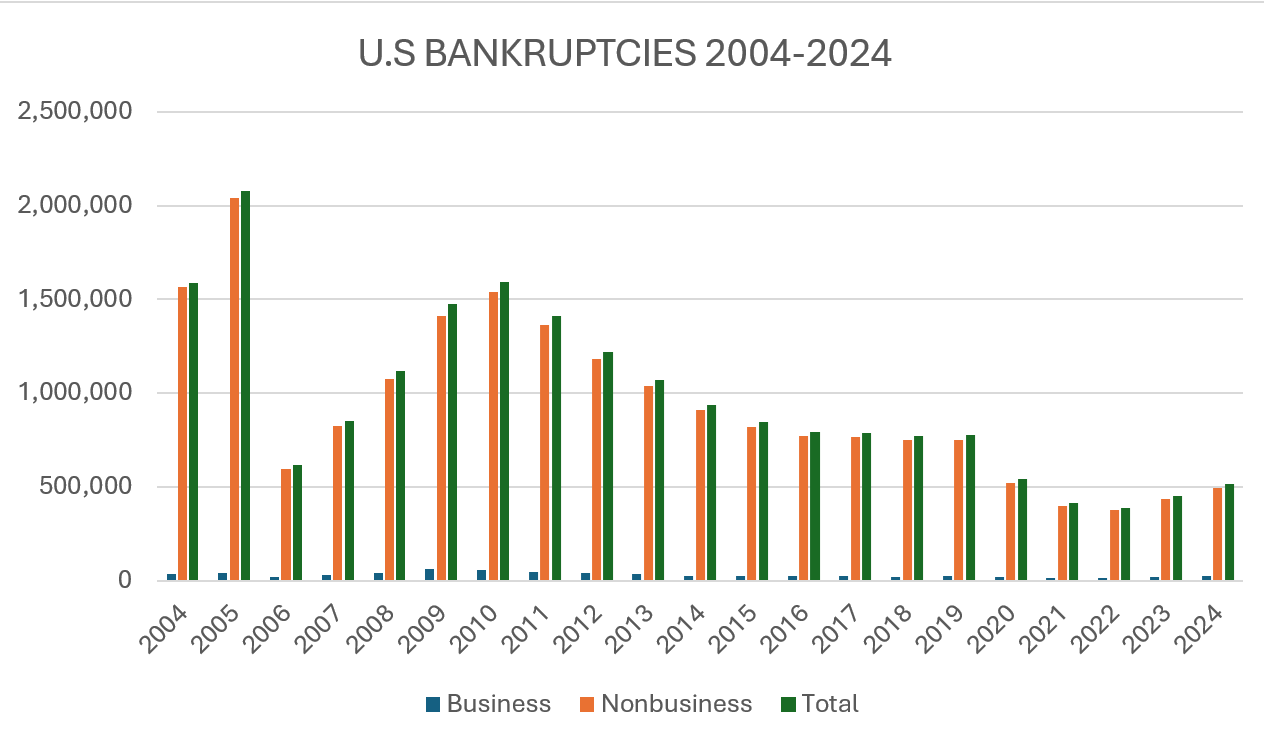

2008 and 2009 make you really appreciate where we've been since then regardless of the slight upticks in some years vs. other around it

Posted on 8/22/25 at 2:37 pm to EatnCreaux

I would be more concerned about personal bankruptcies because of high consumer debts.

Thus far Q1 2025 is ~13% higher and Q2 is about 11% higher (both YoY).

That said, although they are trending upward we are still below the 20-year average.

Thus far Q1 2025 is ~13% higher and Q2 is about 11% higher (both YoY).

That said, although they are trending upward we are still below the 20-year average.

This post was edited on 8/22/25 at 2:38 pm

Posted on 8/22/25 at 4:45 pm to EatnCreaux

quote:

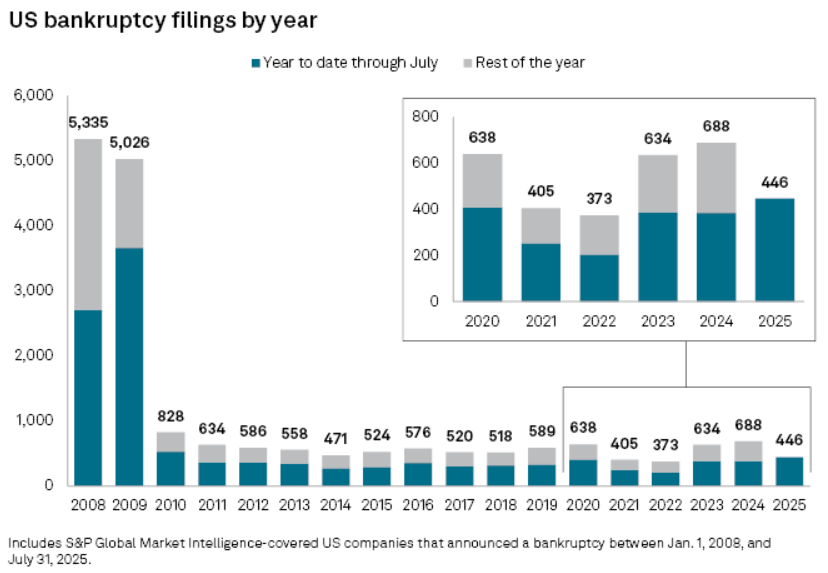

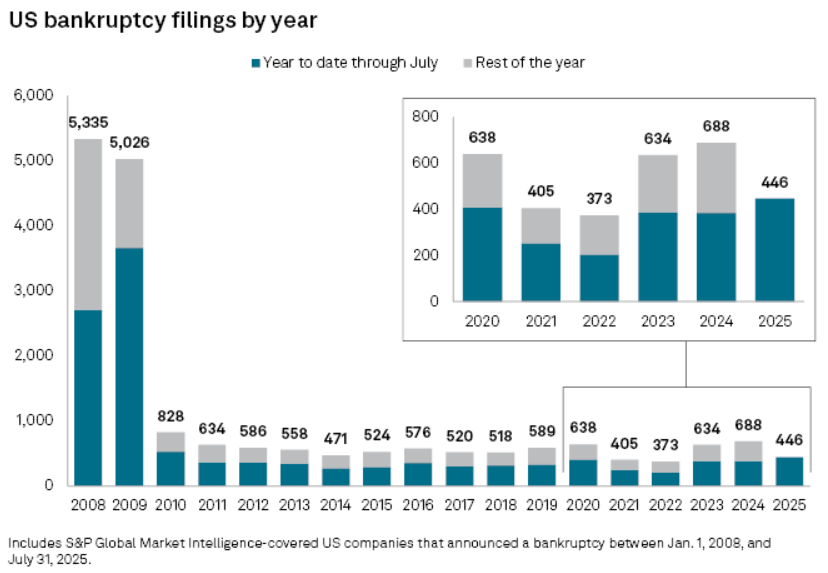

Year-to-date bankruptcy filings totaled 446 through the end of July, the most for this seven-month period since 2010.

The data includes companies with public debt and assets or liabilities of at least $2 million or private companies with assets or liabilities of at least $10 million at the time of filing.

This feels like something that should have an eye kept on it at the very least

Posted on 8/22/25 at 5:45 pm to TigersHuskers

quote:an annoying slander used by buffoons

panican

Posted on 8/23/25 at 4:52 pm to deltaland

Ending all the hand me outs to the DEI crowd starting businesses and using our tax dollars to keep their businesses afloat. Not any longer. I voted for this

Posted on 8/23/25 at 6:15 pm to EatnCreaux

Probably zombie companies that can’t survive at a reasonable interest rate. Thinning the herd.

Posted on 8/24/25 at 9:20 am to AuburnTigers

quote:

an annoying slander used by buffoons

A low IQ response to anything that could just even be perceived as not all berries and roses for the Trump Administration, even if it's not even their doing.

When someone is in charge for four years, much less eight, not everything is going to be peachy all the time, but that doesn't stop the snowflakes from getting all defensive.

Popular

Back to top

7

7