- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Winter Olympics

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

New LA State Sales Tax

Posted on 1/3/25 at 4:40 pm

Posted on 1/3/25 at 4:40 pm

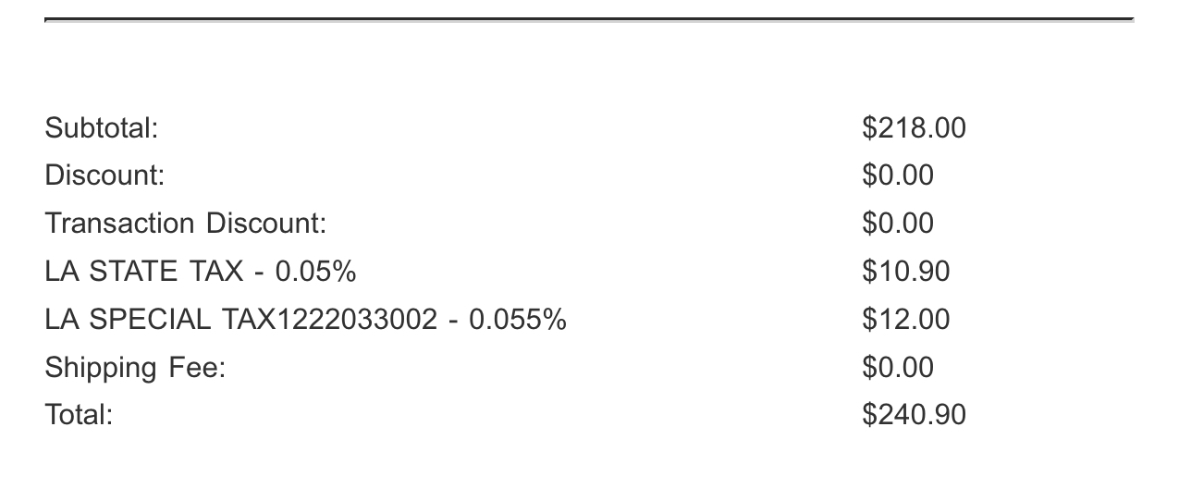

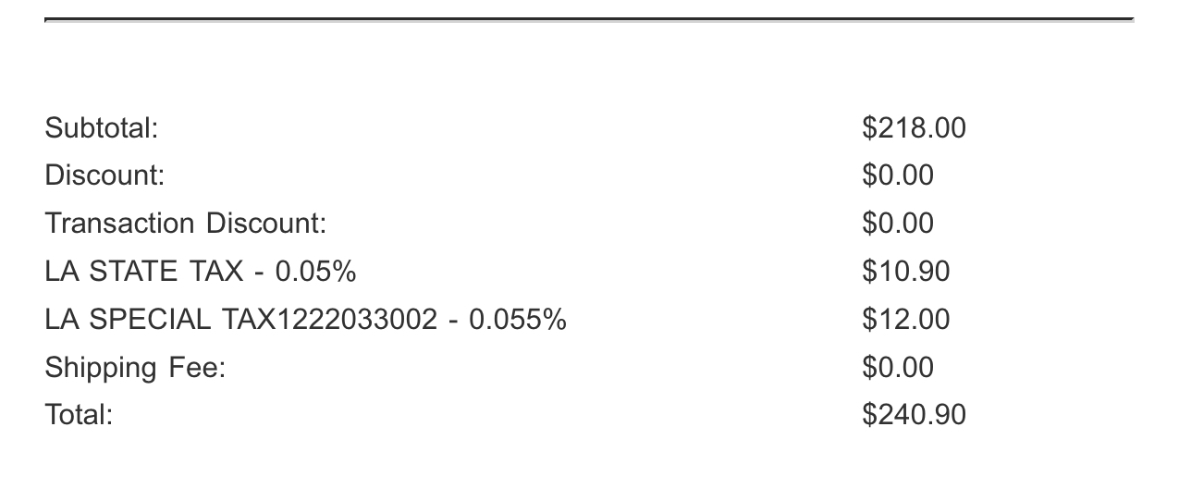

Did this new law these frickers managed to pass really double the sales tax for online purchases? I purchased this stuff from a local brick and mortar shop and they insisted on drop shipping to my house because it wasn't in stock. If I would have picked up the order in house would the LA special tax not apply?

Posted on 1/3/25 at 4:43 pm to Whatafrekinchessiebr

That seems incorrect. I don't think the state sales tax doubled

Posted on 1/3/25 at 4:45 pm to Whatafrekinchessiebr

I thought the new combined tax was 10.5%. State and Parish so that looks correct.

Posted on 1/3/25 at 4:46 pm to Rize

Yea one of those should be labeled parish tax and the other state tax

Total sales tax went up half a percent

Total sales tax went up half a percent

This post was edited on 1/3/25 at 4:47 pm

Posted on 1/3/25 at 4:47 pm to Whatafrekinchessiebr

I thought he said he was going to cut/lower taxes?

Posted on 1/3/25 at 4:48 pm to Whatafrekinchessiebr

quote:

The minimum combined 2025 sales tax rate for East Baton Rouge Parish, Louisiana is 11.0%. This is the total of state, county, and city sales tax rates. The Louisiana sales tax rate is currently 5.0%.

Save on taxes by shopping out of the parish

quote:

The minimum combined 2025 sales tax rate for Ascension Parish, Louisiana is 9.5%. This is the total of state, county, and city sales tax rates.

quote:

The minimum combined 2025 sales tax rate for Livingston Parish, Louisiana is 9.0%. This is the total of state, county, and city sales tax rates.

Posted on 1/3/25 at 4:48 pm to LegendInMyMind

quote:

I thought he said he was going to cut/lower taxes?

Well we now have a tax on streaming services

Posted on 1/3/25 at 4:49 pm to LegendInMyMind

quote:

I thought he said he was going to cut/lower taxes?

he did, for corporations. now we are covering their % of taxes with our sales taxes.

The state’s new corporate income tax rate will be a flat 5.5%, reducing the highest tier from 7.5%. Landry had wanted a 3.5% flat rate.

Lawmakers repealed the 0.275% corporate franchise tax, a levy on businesses operating on the state worth more than $500 million in annual revenue that went to a state savings account. Republican lawmakers had decried the tax as an arbitrary penalty on business.

Gov. Jeff Landry’s recent tax overhaul will erase Louisiana’s budget deficit that was expected to be just shy of $600 million and threatened funding for health care services and higher education.

This post was edited on 1/3/25 at 4:52 pm

Posted on 1/3/25 at 4:51 pm to Whatafrekinchessiebr

It went from 4.45% to 5%.

The “special tax” might be a parish/city combo component as a lot of tax software calculators in accounting systems don’t handle the multi-jurisdictional BS Louisiana has. They probably charge that rate and let the state figure out how to disburse the 5.5%.

5+5.5 is 10.5 which is about right.

The “special tax” might be a parish/city combo component as a lot of tax software calculators in accounting systems don’t handle the multi-jurisdictional BS Louisiana has. They probably charge that rate and let the state figure out how to disburse the 5.5%.

5+5.5 is 10.5 which is about right.

Posted on 1/3/25 at 4:52 pm to TigerTatorTots

quote:

Yea one of those should be labeled parish tax and the other state tax

That's kind of what I was thinking. I knew EBR has been over 10% combined for a while but this just looked fricky.

This post was edited on 1/3/25 at 4:53 pm

Posted on 1/3/25 at 4:52 pm to LegendInMyMind

quote:

I thought he said he was going to cut/lower taxes?

Income tax was lowered, your take-home pay should go up. Consumption tax is the fairest tax

Posted on 1/3/25 at 4:55 pm to Whatafrekinchessiebr

Sales tax in BR went from 9.95 to 10.5.

Posted on 1/3/25 at 4:59 pm to Rize

quote:

I thought the new combined tax was 10.5%. State and Parish so that looks correct.

It is. If you look at the purchase then the two tax amounts equal 10.5% of the purchase price.

Posted on 1/3/25 at 5:01 pm to TigerGM

Yeah, I just checked the receipt for the items I bought in store. It wasn't broken out like that but matched up. I still think our sales tax is out of control but this looks right. It was the wording of the taxes of stuff that is drop shipping that through me off.

Posted on 1/3/25 at 5:28 pm to Corinthians420

quote:

he did, for corporations. now we are covering their % of taxes with our sales taxes

Hilarious that this is being downvoted.

They cut the corporate tax $500 million dollars and tax revenue is still gonna go up. Who do you think is gonna pay the burden of that extra $500 million? Poor people? Food stamps? Who pays for those?

This post was edited on 1/3/25 at 5:29 pm

Posted on 1/3/25 at 5:29 pm to Corinthians420

Hey man stop complaining about taxes you like being free right

Posted on 1/3/25 at 6:54 pm to Corinthians420

quote:

Hilarious that this is being downvoted.

They’re downvoting you because you’re wrong. You’re correct on the corporate tax but they also cut individual income tax rates and increased the standard deduction.

Posted on 1/3/25 at 7:02 pm to LegendInMyMind

The jackass wanted to lower income tax but raise other taxes to make up for it. This state is run by morons. One thing is certain, our politicians will frick us to help their own causes.

Posted on 1/3/25 at 7:12 pm to lgtiger

quote:

Income tax was lowered, your take-home pay should go up. Consumption tax is the fairest tax

It's a net tax RAISE. How can anyone trumpet this as a good thing?

Posted on 1/3/25 at 7:46 pm to armsdealer

quote:

It's a net tax RAISE. How can anyone trumpet this as a good thing?

because they are stupid. they think they extra money is just gonna magically appear rather than coming from our pockets. it's a $1.1 billion dollar tax increase on civilians, there was a $600 million deficit and they reduced corporate taxes by $500 million and now they are projecting a surplus

Popular

Back to top

15

15