- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

What’s the downside of 15 year mortgage?

Posted on 8/16/24 at 10:27 am

Posted on 8/16/24 at 10:27 am

If I plan on paying it off in 10? I noticed we are making a lot of principal payments on top of our mortgage, is there a downside to a 15 year to save some on rates?

Posted on 8/16/24 at 10:29 am to fareplay

You're rich, just pay cash.

Posted on 8/16/24 at 10:35 am to fareplay

A higher minimum payment?

Depending on your rate, from a mathematic perspective, your money may be earning more interest in investments than you're paying in a mortgage.

But if financial freedom is more important to you, then there's nothing wrong with paying off the house.

Depending on your rate, from a mathematic perspective, your money may be earning more interest in investments than you're paying in a mortgage.

But if financial freedom is more important to you, then there's nothing wrong with paying off the house.

Posted on 8/16/24 at 10:41 am to WhiskeyThrottle

Seeing as our current rate is 6.625 and refi is available low 6 I’m thinking the payment numbers will only go up 1k or so if forced 15

Posted on 8/16/24 at 10:43 am to fareplay

quote:

Seeing as our current rate is 6.625 and refi is available low 6 I’m thinking the payment numbers will only go up 1k or so if forced 15

You're gonna pay closing costs to refi when you plan to pay off in 10 regardless?

Shut up, stupid

ETA: Do you just sit around all day to think up what stupid threads you can start? What do you get out of this?

This post was edited on 8/16/24 at 10:44 am

Posted on 8/16/24 at 10:45 am to fareplay

Unless there is an early pay off penalty, which is extremely rare these days, refinancing to get a marginally better rate wouldn’t come close to being worth the trade off of associated fees and less monetary flexibility.

Posted on 8/16/24 at 10:48 am to fareplay

Downside is your minimum payment would be higher.

Getting a 30 year note and paying as it were a 15 year note, would enable you to make a lower payment than normal in the event of income loss without having to go through a refi, which is difficult since income changed.

Getting a 30 year note and paying as it were a 15 year note, would enable you to make a lower payment than normal in the event of income loss without having to go through a refi, which is difficult since income changed.

Posted on 8/16/24 at 10:57 am to LNCHBOX

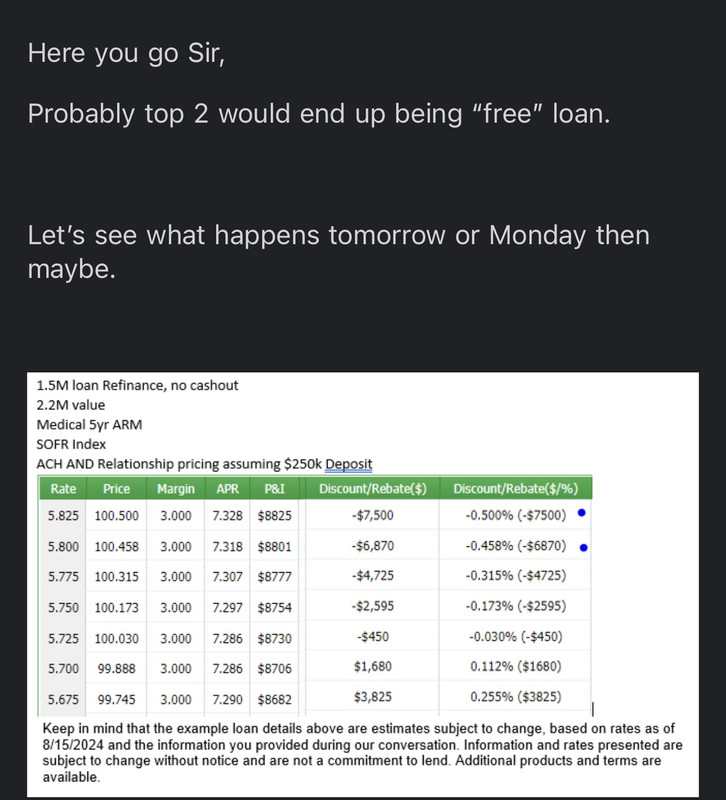

Brother I know you jealous but the refi quotes I received is me receiving points

Posted on 8/16/24 at 10:57 am to fareplay

If you get pressed for cash and can't make the higher payments (vs 30 year loan), the bank takes your home.

Posted on 8/16/24 at 10:58 am to Joshjrn

The quotes I received actually do not have fees. The only issue is time and I guess if both of us lose our jobs

This post was edited on 8/16/24 at 11:00 am

Posted on 8/16/24 at 11:00 am to fareplay

We just did a 20 year. Plan on paying it off much earlier.

Posted on 8/16/24 at 11:01 am to fareplay

quote:

Brother I know you jealous but the refi quotes I received is me receiving points

Could yo make that pic smaller and blurry so that I might be able to see what it shows?

Posted on 8/16/24 at 11:08 am to LNCHBOX

This post was edited on 8/16/24 at 11:09 am

Posted on 8/16/24 at 11:08 am to fareplay

Hilarious, almost as funny as all your amazing threads.

ETA: Ah, you figured out how to post with the edit. What possible questions could you have with an aggy education and all the money in teh world from you and your doctor wife's super high incomes? What could you possibly learn from us plebs here? Your new loan is free, may as well save teh couple bucks on interest be refinancing to a 15 that you pay off 5 years early. Surely someone with teh assets yall clearly have wouldn't benefit from investing that money elsewhere.

ETA: Ah, you figured out how to post with the edit. What possible questions could you have with an aggy education and all the money in teh world from you and your doctor wife's super high incomes? What could you possibly learn from us plebs here? Your new loan is free, may as well save teh couple bucks on interest be refinancing to a 15 that you pay off 5 years early. Surely someone with teh assets yall clearly have wouldn't benefit from investing that money elsewhere.

This post was edited on 8/16/24 at 11:13 am

Posted on 8/16/24 at 11:11 am to LNCHBOX

Sorry you can’t relate with your shack

Posted on 8/16/24 at 11:13 am to fareplay

quote:

Sorry you can’t relate with your shack

Even funnier

Posted on 8/16/24 at 11:22 am to LNCHBOX

Because you dummy I don’t spend my time focused on financials when I have a stressful job to work. I’d rather get answers from people who focus a lot more on how to manage money than me who only looks at ai gpus and my wife who only looks at stomach cancers

Posted on 8/16/24 at 11:26 am to fareplay

quote:

Because you dummy I don’t spend my time focused on financials when I have a stressful job to work. I’d rather get answers from people who focus a lot more on how to manage money than me who only looks at ai gpus and my wife who only looks at stomach cancers

I'd be more interested in how you're being quoted under $9k P&I on a $1.5 million loan since that is basically an interest free loan

Posted on 8/16/24 at 11:26 am to LNCHBOX

250 liquid cash in their 5.15 hysa

Medical loan

And we need to set up direct deposit. That’s another 50k a month injection

Medical loan

And we need to set up direct deposit. That’s another 50k a month injection

This post was edited on 8/16/24 at 11:28 am

Posted on 8/16/24 at 11:31 am to fareplay

quote:

250 liquid cash in their 5.15 hysa

What does that have to do with the refi?

quote:

Medical loan

Does it being a medical loan somehow make the interest go away entirely?

quote:

And we need to set up direct deposit. That’s another 50k a month injection

And?

Popular

Back to top

15

15