- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: U.S. credit card debt stands at a record of nearly $1 trillion

Posted on 5/15/23 at 11:41 am to Bard

Posted on 5/15/23 at 11:41 am to Bard

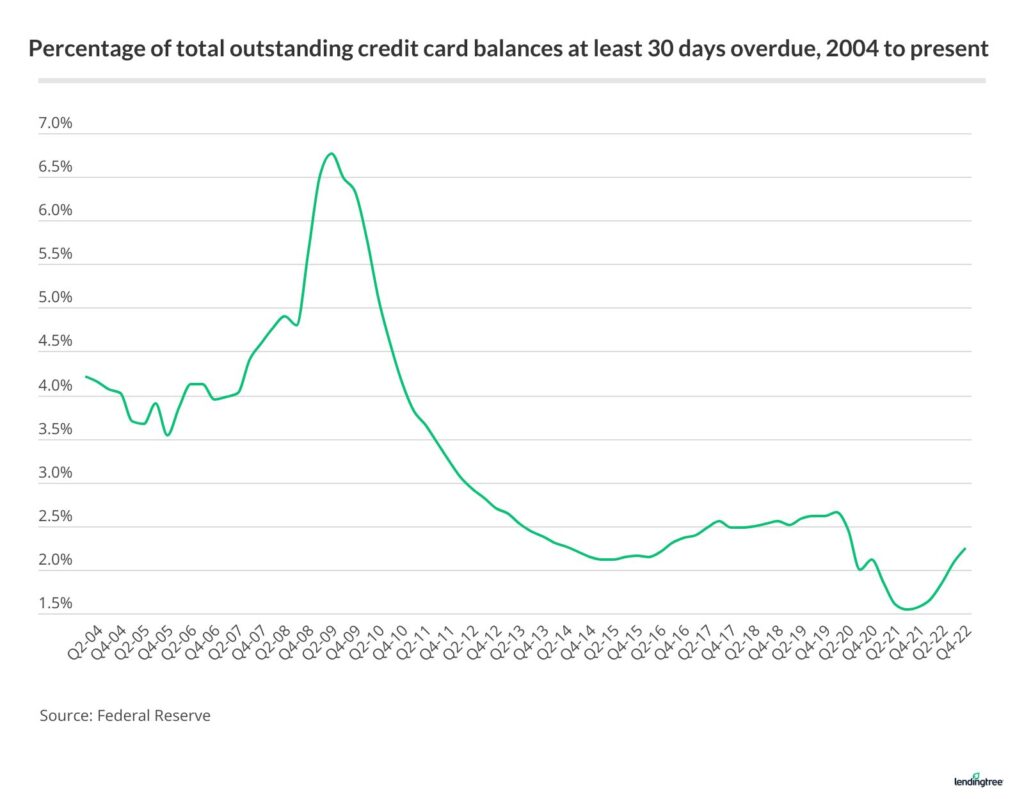

What the hell happened in 2010 that caused that jump?

Any idea if this is carrying balance, or does it also factor in those that run up a couple grand on credit cards every month, then pay them off on the statement due date?

quote:

The average balance rose to $5,733 over that same period, TransUnion found.

Any idea if this is carrying balance, or does it also factor in those that run up a couple grand on credit cards every month, then pay them off on the statement due date?

Posted on 5/15/23 at 11:43 am to Weekend Warrior79

quote:

What the hell happened in 2010 that caused that jump?

Probably hangover from 2008 collapse

Posted on 5/15/23 at 11:46 am to Weekend Warrior79

quote:

Any idea if this is carrying balance, or does it also factor in those that run up a couple grand on credit cards every month, then pay them off on the statement due date?

Was curious and found another article:

quote:

Overall, the national average card debt among cardholders with unpaid balances in December 2022 was $7,279. That includes debt from bank cards and retail credit cards.

Posted on 5/15/23 at 12:54 pm to Weekend Warrior79

quote:

What the hell happened in 2010 that caused that jump?

No idea. Normally a spike like that is due to a change in how they compute the outcome. When that happens though they'll often end that series and start a whole new one (see: the old M1).

quote:

Any idea if this is carrying balance, or does it also factor in those that run up a couple grand on credit cards every month, then pay them off on the statement due date?

I think it's total balance (ie: both of your categories). Just from a quick glance at a few sites, it seems slightly over half of credit cards used carry a balance (thus, slightly less than half pay off their balance every month). That averaged carried balance (for FY2022) was ~$7,200.

Full disclosure: we're still below the historical average on past dues and defaults.

Posted on 5/17/23 at 6:53 pm to Weekend Warrior79

quote:

What the hell happened in 2010 that caused that jump?

I looked into this and it’s because of a change in the financial reporting requirements. Actual debt didn’t spike, just the way it was reported.

This also makes it pretty difficult to really compare the long term growth rates before and after the methodology change. You can’t simply subtract (or add) the delta from the spike since you don’t know how that additional data would have impacted the numbers years before or years after they changed the reporting.

That being said, if you look at the period from 2000-2007 (trying to remove the 2008 impacts from the equation since the methodology changes right in the aftermath) credit card debt increased at a 5.518% compound annual growth rate. If you look at the period from 2014-2023, credit card debt increased at a 5.430% CAGR.

So over the long term, revolving debt has been growing at about the same rate. However, if you only look at the period from 2021-2023 it increases to 14.997% CAGR. This is of course after a huge drop in revolving debt from 2020-2021, which appears to have been a result of the stimulus packages.

The question will be whether the growth rate falls back in line with the average now that debt has effectively caught back up to pre-stimulus levels.

Popular

Back to top

4

4