- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Amazon beats on revenue, top line rises 7%

Posted on 7/28/22 at 3:06 pm

Posted on 7/28/22 at 3:06 pm

Posted on 7/28/22 at 3:31 pm to FLObserver

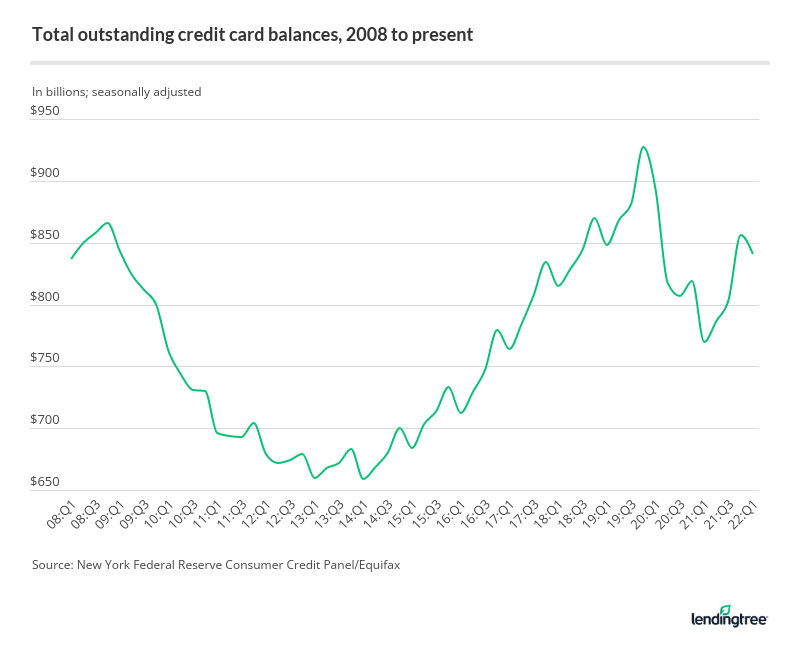

Credit card debt goes vroooom

Posted on 7/28/22 at 3:58 pm to Lsut81

quote:

Credit card debt goes vroooom

Americans have less CC debt today than they did before the pandemic.

Posted on 7/28/22 at 4:25 pm to TigerDeBaiter

Posted on 7/28/22 at 4:27 pm to FLObserver

Drag ETSY up even more with you big boi (AMZN)! Thank you!

Posted on 7/28/22 at 5:17 pm to FLObserver

My wife is doing her part.

Posted on 7/28/22 at 5:20 pm to Turf Taint

quote:

My wife is doing her part.

Just moved houses and holy shite I feel like bezos owes me a night on the yacht.

Posted on 7/28/22 at 5:26 pm to JohnnyKilroy

quote:

Just moved houses and holy shite I feel like bezos owes me a night on the yacht.

Get in line brother. The various Amazon drivers just automatically stop daily in my neighborhood because they already know something's been ordered at my location.

Posted on 7/28/22 at 5:51 pm to slackster

quote:

Americans have less CC debt today than they did before the pandemic.

All thanks to govt stimulus checks and enhanced unemployment from the pandemic.

Posted on 7/28/22 at 6:29 pm to JohnnyKilroy

quote:

Just moved houses and holy shite I feel like bezos owes me a night on the yacht.

If no order for Amazon in 3 days in a row, Amazon does wellness check on us.

Posted on 7/28/22 at 6:55 pm to Lsut81

quote:I mean you implied this was due to credit card debt, and the data he provided, refutes that. Why the credit card debt is lower is completely unrelated to whether this was due to credit card debt.

All thanks to govt stimulus checks and enhanced unemployment from the pandemic.

Furthermore, his chart shows credit card debt decreasing in Q1 2022, long after the majority of the checks were distributed and benefits were provided (I guess it could have been due to some getting benefits when filing taxes, but much of that would have been in Q2).

In addition, if adjusted for inflation (and inflation was already quite high in Q1), the levels are actually look even better (and delinquency rates show similar). Regardless, if stimulus checks and UE benefits go towards paying down high interest debt, that’s a good thing overall, and shows that some portion of demand-side stimulus doesn’t necessarily increase demand/inflation, and with fewer supply-side constraints (like current, post-pandemic supply-issues) and/or supply-side stimulus (that specifically targets usual constraints), then we could craft ideal stimulus policies that increase growth (more demand and supply) and decrease bad debt, while keeping inflation in check (supply increasing with demand).

Posted on 7/28/22 at 8:00 pm to buckeye_vol

quote:

Although balances fell slightly from where they stood at the end of 2021 following the peak holiday shopping season, they are expected to keep going up from here, according to researchers at the New York Fed.

“There’s a good chance that Americans’ total credit card balances will soon reach a new record high, marking a sharp reversal from the precipitous drop that occurred in 2020 and early 2021,” said Ted Rossman, a senior industry analyst at CreditCards.com.

After consumers paid off $83 billion in credit card debt during the pandemic, helped by government stimulus checks and fewer opportunities for discretionary purchases, credit card balances have steadily ticked back up amid higher prices for gas, groceries and housing, among other necessities.

“A lot of this is being driven by robust consumer spending, of course, but credit and debit cards have both been aided by the growth of e-commerce and the ongoing migration away from cash,” Rossman said. “This is great if you can pay in full, avoid interest and earn rewards, but potentially very costly if you’re paying interest every month.”

LINK

Posted on 7/28/22 at 8:15 pm to Lsut81

CC debt goes up routinely until we have a recession and it’s effectively charged off. Rinse and repeat. I’m not sure why 2Q is due to CC debt but the previous 14 years weren’t.

Posted on 7/28/22 at 8:27 pm to Lsut81

Maybe they will, and maybe they’ve risen since Q1, but Amazon is beating revenue with their highest Q2 on record (by 7.2%) and their highest non Q4 holiday on record, solely/mostly because credit card spending like your post implied.

Also, although you haven’t argued this, credit card debt levels could reach record levels but still he less concerning based on those levels relative to income, assets, other debt levels, and/or just population size (and rates). So at least compared to record highs in 2019, population has grown (albeit not a lot), income is up, and assets are up significantly (real estate, although that’s not inherently good overall, and stocks are still up >25%, despite significant decrease off high). Although I’m sure rates are up, so that would work the other direction (but effective rate is important).

And as slackster said, credit card debt increased in a good economy, but I’m not sure if that’s a good thing or a bad thing (pay down debt when things are good) or neither and just a reality of markets.

Also, although you haven’t argued this, credit card debt levels could reach record levels but still he less concerning based on those levels relative to income, assets, other debt levels, and/or just population size (and rates). So at least compared to record highs in 2019, population has grown (albeit not a lot), income is up, and assets are up significantly (real estate, although that’s not inherently good overall, and stocks are still up >25%, despite significant decrease off high). Although I’m sure rates are up, so that would work the other direction (but effective rate is important).

And as slackster said, credit card debt increased in a good economy, but I’m not sure if that’s a good thing or a bad thing (pay down debt when things are good) or neither and just a reality of markets.

Posted on 7/29/22 at 10:30 am to slackster

I guess it’s a little less, but obviously increasing rapidly. Seems like a bogus talking point where the data is old anyway

Popular

Back to top

5

5