- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Crypto hedge fund Three Arrows Capital (3AC) now in liquidation

Posted on 6/29/22 at 10:56 am

Posted on 6/29/22 at 10:56 am

Teneo Restructuring has been brought on board to deal with the liquidation

LINK

Anyone on here have funds with them?

LINK

Anyone on here have funds with them?

Posted on 6/29/22 at 12:47 pm to RobbBobb

shooters shoot

quote:

How did 3AC get here?

Three Arrows Capital was established in 2012 by Zhu Su and Kyle Davies.

Zhu is known for his incredibly bullish view of bitcoin. He said last year the world’s largest cryptocurrency could be worth $2.5 million per coin.

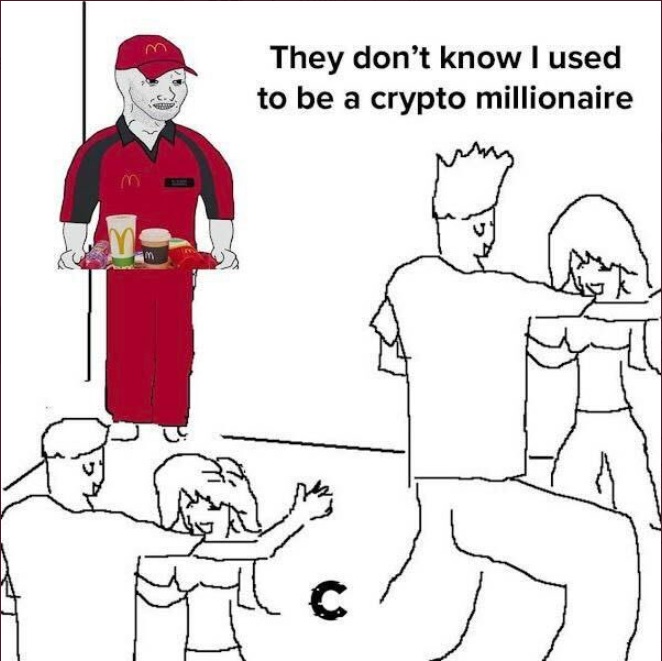

But in May this year, as the crypto market began its meltdown, Zhu said on Twitter that his “supercycle price thesis was regrettably wrong.”

Posted on 6/29/22 at 1:42 pm to RobbBobb

That absolutely sucks for people who have funds with them.

Posted on 6/29/22 at 7:40 pm to RobbBobb

Does anybody have a feel for what might happen with/to CoinFlex?

quote:

Mark Lamb, the CEO of embattled cryptocurrency exchange CoinFlex, said that withdrawals will probably not restart on Thursday as the company initially hoped.

To fix the $47 million hole in CoinFlex's balance sheet, the company is issuing a token called Recovery Value USD, or rvUSD, and enticing investors with a 20% interest rate. Lamb said the ability to pay that interest rate would come from recouping the funds from Roger Ver plus a "financing charge" that has been imposed on him.

CoinFlex claimed that Ver's account went into "negative equity." Normally, the exchange would liquidate an investor's position in this situation. But Ver had a particular agreement that meant this did not happen, the exchange said.

The agreement between CoinFlex and Roger Ver, aka “Bitcoin Jesus”, meant that if the investor failed to meet a margin call, then his positions would not be automatically liquidated as would normally be the case.

A margin call is a situation in which an investor must commit more funds to avoid losses on a trade made with borrowed cash.

Lamb said that CoinFlex felt comfortable to go into such an agreement because of the "data we'd seen around his capitalization."

But CoinFlex will now be eliminating such agreements, Lamb said.

"In hindsight, having no non-liquidation agreements would have definitely been better," Lamb said.

Popular

Back to top

7

7