- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Increasing Credit Score / Debt Use

Posted on 6/13/22 at 1:46 pm

Posted on 6/13/22 at 1:46 pm

Credit / debt is not an area where I have a lot of personal experience, so I'm hoping some of you can offer some thoughts.

My credit score is 755 currently with Experian, within 1-3 points with the other two bureaus, and has for the last three or so years, been in the range of 750-759 (occasionally goes up or down a point or two at a time).

My credit report is pretty thin. I have the mortgage, a paid off car loan that is still showing, my student loans (less than 2 percent interest rate so I'm taking as long as I can to pay them), a Home Depot credit card that I use for projects that give me 0 percent interest (always paid off before the interest hits), and a Capital One card that I use mainly for personal travel. In months I don't have any travel, I'll charge a tank or two of gas to it. I always pay this card in full every month so no interest, but a balance is reported each month.

There are no late payments, or other negative items on my credit report.

I've never had much desire to play the credit card rewards game.

In the next two years or so, I will likely be getting a new car. I am planning on giving my daughter my current car when she gets her license in a couple of years. I don't think I want to pay cash for this car especially if a very low interest rate is an option.

So my questions for the MT are as follows:

1) Is a 755-ish credit score enough to qualify for the best car loan interest rates?

2) If it's not... what score is?

3) What are some ways I can get my credit score to move from that 755 range to whatever level is needed to get to the score needed in question 2?

I did try to get a higher CL on the Cap One card, thinking that would improve my utilization, and I got a response that said my current card use did not justify a higher CL.

I'm not opposed to using a CC for more everyday spending and paying in full each month, if that would give a big boost to my credit score (if that's even needed).

Thanks.

Edit to add: I get 3-4 credit card solicitations in the US mail on a weekly basis from Chase, Wells Fargo, Citi, BoA, etc. So I presume I'm eligible for additional credit cards to some extent.

My credit score is 755 currently with Experian, within 1-3 points with the other two bureaus, and has for the last three or so years, been in the range of 750-759 (occasionally goes up or down a point or two at a time).

My credit report is pretty thin. I have the mortgage, a paid off car loan that is still showing, my student loans (less than 2 percent interest rate so I'm taking as long as I can to pay them), a Home Depot credit card that I use for projects that give me 0 percent interest (always paid off before the interest hits), and a Capital One card that I use mainly for personal travel. In months I don't have any travel, I'll charge a tank or two of gas to it. I always pay this card in full every month so no interest, but a balance is reported each month.

There are no late payments, or other negative items on my credit report.

I've never had much desire to play the credit card rewards game.

In the next two years or so, I will likely be getting a new car. I am planning on giving my daughter my current car when she gets her license in a couple of years. I don't think I want to pay cash for this car especially if a very low interest rate is an option.

So my questions for the MT are as follows:

1) Is a 755-ish credit score enough to qualify for the best car loan interest rates?

2) If it's not... what score is?

3) What are some ways I can get my credit score to move from that 755 range to whatever level is needed to get to the score needed in question 2?

I did try to get a higher CL on the Cap One card, thinking that would improve my utilization, and I got a response that said my current card use did not justify a higher CL.

I'm not opposed to using a CC for more everyday spending and paying in full each month, if that would give a big boost to my credit score (if that's even needed).

Thanks.

Edit to add: I get 3-4 credit card solicitations in the US mail on a weekly basis from Chase, Wells Fargo, Citi, BoA, etc. So I presume I'm eligible for additional credit cards to some extent.

This post was edited on 6/13/22 at 1:48 pm

Posted on 6/13/22 at 1:50 pm to LSUFanHouston

Credit scores are only useful if you are borrowing money. I have one note and that is for the house. 2.25% for a 15 year. I do have a credit card but I pay it off every month. There is no harm if you can do that.

Posted on 6/13/22 at 3:14 pm to sawtooth

quote:

Credit scores are only useful if you are borrowing money.

Right. Which I think I will do in a couple of years for a car.

Posted on 6/13/22 at 3:20 pm to LSUFanHouston

1. Yes

2. Typically anything 740+

3. If you are responsible with it (which from your post it seems you would be), getting a CC to use for everyday spending is the way to go. Will prop your utilization and available credit, along with adding more payment history. Plus the added benefit of rewards.

2. Typically anything 740+

3. If you are responsible with it (which from your post it seems you would be), getting a CC to use for everyday spending is the way to go. Will prop your utilization and available credit, along with adding more payment history. Plus the added benefit of rewards.

Posted on 6/13/22 at 3:31 pm to LSUFanHouston

Make sure your credit cards report 1% balance of your total credit limit. That’s the sweet spot to get maximum credit score. Find out when your card reports either on the statement date or the last business day of the month. Try not to use that credit card between your payment date and statement date.

Example:

Credit Card Limit: $1000.00

Credit Balance You Want To Report: $10

$10= 1% of your limit. This will boost your score tremendously

Example:

Credit Card Limit: $1000.00

Credit Balance You Want To Report: $10

$10= 1% of your limit. This will boost your score tremendously

Posted on 6/13/22 at 3:39 pm to LSUFanHouston

I have no idea why you wouldn't run all your purchases through a credit card. Better fraud protection, helps your credit score, and I thank myself during my free flights and/or vacations.

Posted on 6/13/22 at 3:59 pm to Catchfalaya

quote:

Make sure your credit cards report 1% balance of your total credit limit.

Thanks. This is something I can work on. I haven't paid attention to that as much because I just spend whatever and pay it off before the due date.

No reason I could not make early payments before due date to get it down at least on the Cap One. That might not make as much sense when I use the 0 percent financing at Home Depot.

Posted on 6/13/22 at 4:01 pm to Mingo Was His NameO

quote:

I have no idea why you wouldn't run all your purchases through a credit card. Better fraud protection, helps your credit score, and I thank myself during my free flights and/or vacations.

I've always been debt averse. I saw my parents get into a lot of trouble with debt / credit cards when I was young.

I've also seen clients get into trouble here as well. Nothing like seeing someone with 500K/yr in income paying late fees and running huge CC balances and huge interest charges.

Posted on 6/14/22 at 6:57 am to LSUFanHouston

Here is how to improve your good score and make it excellent. It takes time though.

1. Keep your utilization low like the other poster mentioned. There are two things that will help with that.

A. Get your credit limit higher by requesting credit limit increases on your cards every 6 months. This will help your score cause available credit is a factor and it will also help keep utilization low. With only two cards though, you may want to open some others cause they will usually give you a pretty high limit if you already have a pretty good score. But be picky and Pick ones that will help you. I like the citi 2% cash back everywhere card. You'll have to use the cards and charge decent amounts to them to get increases though.

B. Pay all your cards off weekly or make sure they are fully paid 21 days I believe it is before your statement date for each card. That's when it is checked. I just pay mine off weekly, it's simpler.

This combined with a high credit limit will keep you utilization around 1-2%.

So if you have 1,000 limit... you can only put 10 dollars on your cards to keep 1% utilization. But if you get those limits increased over time to 20,000 dollars across your cards and pay it off weekly and never let it get over 400 dollars... you'll carry a 2% utilization at most.

2. Don't cancel cards unless you just really need to. You want to build old credit history. Credit cards are great for that cause you can keep them forever unlike a car loan or even a mortgage. Your credit history age is a big factor in your score qnd is the average age of all accounts.

Another reason to be picky with the cards you choose cause you want to pick ones you'll keep for q long time.

If you have the capital one card you can request it be upgraded to the quicksilver version if you haven't already. This will give you 1.5% cash back.

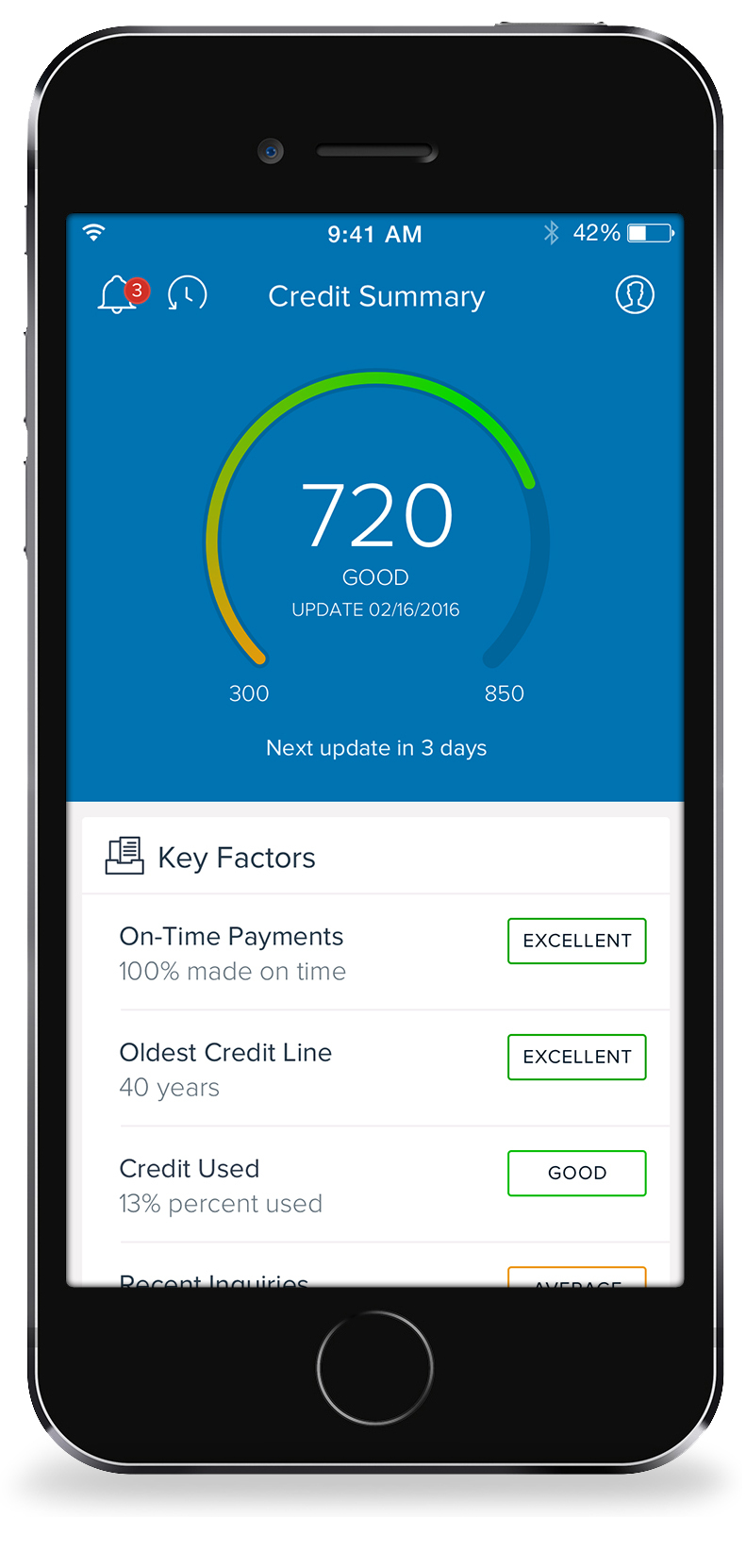

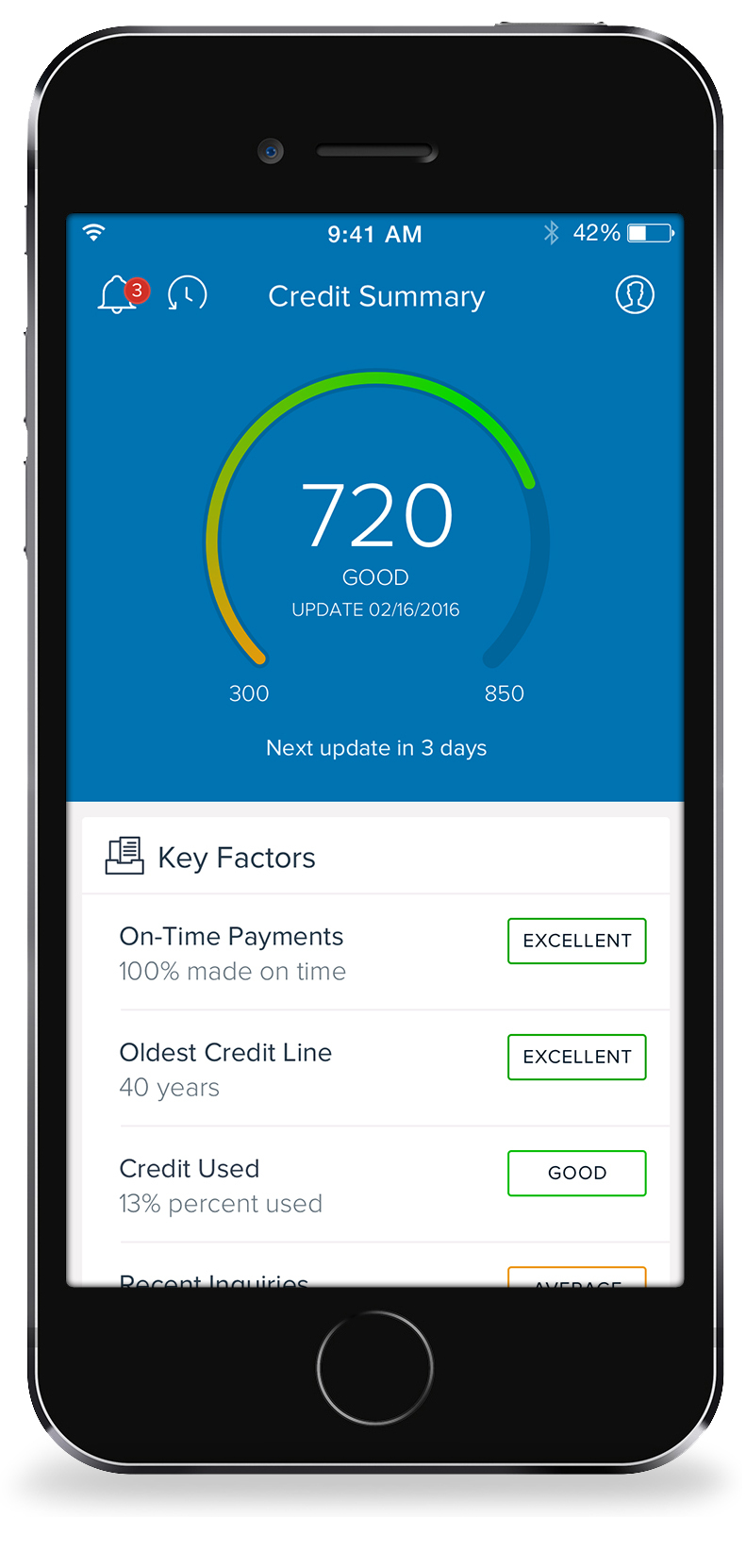

Also it should give you access to creditwise through the app which will show you how your doing in things that effect your score like utilization, limit, history, ontime payments, etc. If you click on each one it will tell you what you need to be excellent in each category.

Hope that makes sense, let me know if you have more questions. But you definitely want to charge more so you can get your limit up with increases and pay off often to keep utilization down.

1. Keep your utilization low like the other poster mentioned. There are two things that will help with that.

A. Get your credit limit higher by requesting credit limit increases on your cards every 6 months. This will help your score cause available credit is a factor and it will also help keep utilization low. With only two cards though, you may want to open some others cause they will usually give you a pretty high limit if you already have a pretty good score. But be picky and Pick ones that will help you. I like the citi 2% cash back everywhere card. You'll have to use the cards and charge decent amounts to them to get increases though.

B. Pay all your cards off weekly or make sure they are fully paid 21 days I believe it is before your statement date for each card. That's when it is checked. I just pay mine off weekly, it's simpler.

This combined with a high credit limit will keep you utilization around 1-2%.

So if you have 1,000 limit... you can only put 10 dollars on your cards to keep 1% utilization. But if you get those limits increased over time to 20,000 dollars across your cards and pay it off weekly and never let it get over 400 dollars... you'll carry a 2% utilization at most.

2. Don't cancel cards unless you just really need to. You want to build old credit history. Credit cards are great for that cause you can keep them forever unlike a car loan or even a mortgage. Your credit history age is a big factor in your score qnd is the average age of all accounts.

Another reason to be picky with the cards you choose cause you want to pick ones you'll keep for q long time.

If you have the capital one card you can request it be upgraded to the quicksilver version if you haven't already. This will give you 1.5% cash back.

Also it should give you access to creditwise through the app which will show you how your doing in things that effect your score like utilization, limit, history, ontime payments, etc. If you click on each one it will tell you what you need to be excellent in each category.

Hope that makes sense, let me know if you have more questions. But you definitely want to charge more so you can get your limit up with increases and pay off often to keep utilization down.

This post was edited on 6/14/22 at 7:24 am

Posted on 6/14/22 at 9:13 am to NATidefan

quote:

If you have the capital one card you can request it be upgraded to the quicksilver version if you haven't already. This will give you 1.5% cash back.

Also it should give you access to creditwise through the app which will show you how your doing in things that effect your score like utilization, limit, history, ontime payments, etc. If you click on each one it will tell you what you need to be excellent in each category.

That's the card I have... Quicksilver with 1.5% cash back.

Yes, I have creditwise.

Sounds like I just need to get another card or two with decently high limits and use it and pay it to drive up CL.

Thanks for your thoughts.

Posted on 6/14/22 at 9:31 am to LSUFanHouston

Your welcome, that second credit wise is mine. As you can see I don't have the oldest history by any means, but by getting my limit up and keeping utilization down along with paying everything on time I've gained a great score in a fairly short amount of time.

Cap one also offers a 5% walmart card if you do online order/store pickup. Another good cash back card I like.

Also, don't forget to request limit increases every six months.

Cap one also offers a 5% walmart card if you do online order/store pickup. Another good cash back card I like.

Also, don't forget to request limit increases every six months.

This post was edited on 6/14/22 at 9:32 am

Posted on 6/14/22 at 9:35 am to NATidefan

quote:

Also, don't forget to request limit increases every six months.

On the Capital One, I requested one on Jan 28 and that's when I was told my use wasn't high enough to justify one. So I should try again on July 28? I've been using it more since then.

Posted on 6/14/22 at 9:46 am to LSUFanHouston

quote:

I did try to get a higher CL on the Cap One card, thinking that would improve my utilization, and I got a response that said my current card use did not justify a higher CL.

LOL, same. I said screw it and got an apple card with 20k limit. My score went down to 79x for about 3 months, now it's back over 800.

Posted on 6/14/22 at 10:05 am to LSUFanHouston

quote:

On the Capital One, I requested one on Jan 28 and that's when I was told my use wasn't high enough to justify one. So I should try again on July 28? I've been using it more since then.

You can keep trying, doesn't hurt.

But my first card was a cap one when I basically had no credit history and they gave me a 300 limit. Then they upped to like 700... etc. It's been the hardest to up.

Next I got my citi 2% card and they gave me like a 3000 dollar limit and after 6 months upped it to 7500. Etc.

It's easy to up other cards that start with a higher limit.

With your 750 score now you'll probably get some pretty good limits on new cards, so I'd definitely try one at least.

This post was edited on 6/14/22 at 10:12 am

Posted on 6/14/22 at 10:16 am to LSUFanHouston

Definitely sounds like % of credit limit might be holding you back from increasing your score to high 700s which would qualify you for the best of anything rate wise. A 755 almost gets you there and most things it will, but for some things it might hold you back from getting the very best rate. I think 780 is the highest anyone cares about to get the best rate for any 1 particular thing. Obviously a lot only require a lower score for their best rate, but I've seen a few things where a 780 would get you slightly better in some cases.

If you're having issues getting a CL increase on your 1 card, just open up another. You score might decrease slightly due to a new open account for the short-term but long term the extra credit will lower your utilization which is a bigger impact overall.

Ex. if you routinely put $5k of expenses a month on credit and your limit it $20k, that's 25% utilization which dings you a bit. Doesnt matter if you pay it all off or not, your utilization looks high due to having just the 1 card with a $20k limit. If you open another card and even just say a $10k limit there, but still only put $5k/mo of expenses on the cards. Now your utilization is only 16.7% which is a decent bit better and helps your credit score. Get another $20k limit and it's now only 12.5% utilization, etc etc...you see how it helps to have extra credit available to you...even if you dont need to use it. It simply helps pump up your credit score. Among all my cards, I have about $80k-$90k total credit available but we only put about $5k/mo or so on the cards so utilization always looks very low.

Also when asking for a CL increase, make sure your income is up to date, can even fudge it some if that helps. If they are giving you a $10k line, but are basing it on an income you told them 10 years ago that is say half what your income is now, you might understand where they are coming from not giving you an increase as well. Basically give them good reasons to increase it. My income is now "X", I'm looking to make a large purchase soon (Even if you arent), etc...

If you're having issues getting a CL increase on your 1 card, just open up another. You score might decrease slightly due to a new open account for the short-term but long term the extra credit will lower your utilization which is a bigger impact overall.

Ex. if you routinely put $5k of expenses a month on credit and your limit it $20k, that's 25% utilization which dings you a bit. Doesnt matter if you pay it all off or not, your utilization looks high due to having just the 1 card with a $20k limit. If you open another card and even just say a $10k limit there, but still only put $5k/mo of expenses on the cards. Now your utilization is only 16.7% which is a decent bit better and helps your credit score. Get another $20k limit and it's now only 12.5% utilization, etc etc...you see how it helps to have extra credit available to you...even if you dont need to use it. It simply helps pump up your credit score. Among all my cards, I have about $80k-$90k total credit available but we only put about $5k/mo or so on the cards so utilization always looks very low.

Also when asking for a CL increase, make sure your income is up to date, can even fudge it some if that helps. If they are giving you a $10k line, but are basing it on an income you told them 10 years ago that is say half what your income is now, you might understand where they are coming from not giving you an increase as well. Basically give them good reasons to increase it. My income is now "X", I'm looking to make a large purchase soon (Even if you arent), etc...

This post was edited on 6/14/22 at 10:20 am

Posted on 6/14/22 at 10:46 am to LSUFanHouston

Also, since you are responsible and have good credit you may want to add your daughter as a authorized user.

You don't have to give her a card or even tell her about it if you don't want to right now... but by doing so your history and score will reflect on her when she turns 18. And she will start off with a great score from the start and already have several years of credit history.

You don't have to give her a card or even tell her about it if you don't want to right now... but by doing so your history and score will reflect on her when she turns 18. And she will start off with a great score from the start and already have several years of credit history.

Posted on 6/15/22 at 12:02 pm to LSUFanHouston

It's been a very long time since I worked in lending, but anything over 750 was considered the top tier. There was no difference between a 750 and an 800 when it came to our underwriting and pricing of the loans.

Posted on 6/15/22 at 12:29 pm to deeprig9

Yep, I'm going to be the contrarian and say that at 755 there is simply no need to fret over getting the score higher. Unless the OP wants a higher score for a dick measuring contest but I've never viewed the OP as that type of person.

Posted on 6/15/22 at 12:38 pm to LSUFanHouston

As mentioned probably increasing your overall credit limit with more cards will have the most effect, but as already mentioned, I doubt they'll be much difference in your rate with your current score.

As an aside, I've found it helpful to secure financing from an outside source(lightstream, local credit union etc) prior to going to the dealer. Many times they'll match, offer incentives or offer a lower rate when in that situation.

As an aside, I've found it helpful to secure financing from an outside source(lightstream, local credit union etc) prior to going to the dealer. Many times they'll match, offer incentives or offer a lower rate when in that situation.

Posted on 6/15/22 at 12:54 pm to VABuckeye

quote:

Unless the OP wants a higher score for a dick measuring contest but I've never viewed the OP as that type of person.

Nope, definitely not that kind of guy. I wasn’t joking when I told him long ago that I’d have him as my CPA if he lived closer to me. Easily one of the most solid and knowledgeable posters that’s been on this board since I arrived.

I agree with others who’ve said that his current score is good enough for what he’s seeking to do. Other than always paying statement balances on time, keeping credit utilization well under 30% is very important. A couple of the supposed “tricks” that a couple of people have mentioned are just that… (unproven) “tricks”. My 94 year old mother’s FICO score is still over 800. She has one card (a Discover that she’s had for 30+ years). I use her card maybe once a year ($20-$50 purchase) just to keep the account open for her.

Popular

Back to top

10

10