- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Posted on 1/27/21 at 9:52 am to boosiebadazz

quote:

I just read where Steve Cohen is pumping $2 billion or so into the shorting hedge fund to prop them up.

The elites are rallying together.

Keep buying and driving it up and frick every one of the elites over.

Posted on 1/27/21 at 9:58 am to moneyg

A lot of hedge funds are glorified robber-barons along the likes of Jay Gould and Jim Fisk.

Those two in particular were key players in a failed attempt to corner the gold market in 1869 called “Black Friday”.

Those two in particular were key players in a failed attempt to corner the gold market in 1869 called “Black Friday”.

Posted on 1/27/21 at 10:00 am to Jyrdis

quote:

Robin Hood traders started buying GameStop stock like crazy because it was heavily shorted.

This sounds like something Mark Cuban would do. I do not know if he is involved but he has inserted himself into deals where other elites have looked to make out big and Cuban jumped in to muddy the deals and the only results have been the original investors paid a higher price.

Posted on 1/27/21 at 10:04 am to cwill

quote:

Now is the time to short. Whoever holds it now is going to take it in the shorts.

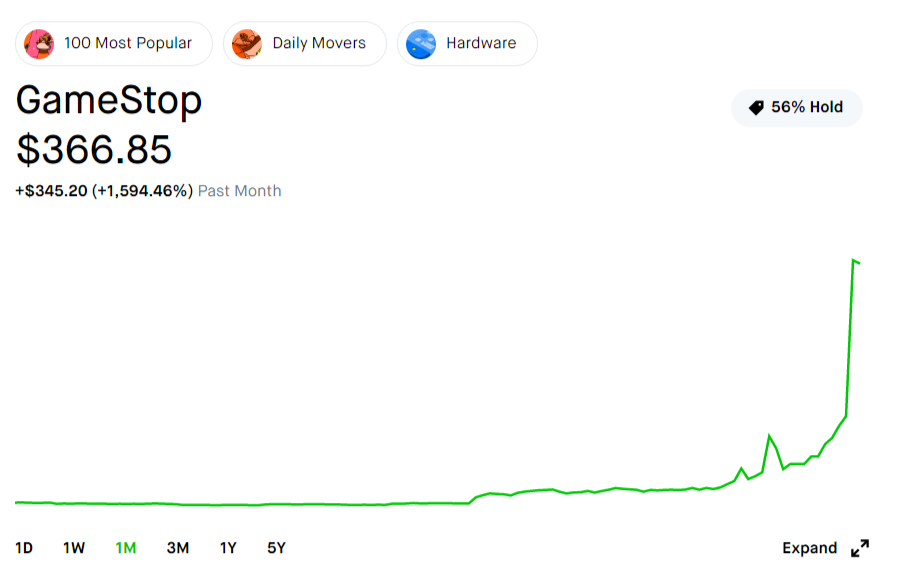

Bad advice at the time of this recommendation trading at $150.

It's trading at $370 now. You would have been squeezed with a big time loss.

Classic short squeeze.

Posted on 1/27/21 at 10:04 am to cwill

quote:

But it is going to crash at some point. It is a no questions asked, plain as day bubble...it isn't like the tech bubble or the O&G bubble that maybe a few saw coming, but most only saw after it popped. As soon as a few significant hodlers decide to cash in, it's going off a fricking cliff.

Relevant if your play is to make money. The play here isn't economic in that way. It is to crush the squeezers. Those participating are obviously willing to take a small loss to impose a large loss on the squeezers.

Posted on 1/27/21 at 10:06 am to fwtex

quote:

This sounds like something Mark Cuban would do.

I doubt it's one big player. It's several small players with one goal in mind. If it were one big player he wouldn't be able to unload and the shorts would win.

This post was edited on 1/27/21 at 10:16 am

Posted on 1/27/21 at 10:07 am to GumboPot

Musk is pushing the buys in part as revenge for one of the hedge funds previously fricking with Tesla.

Big money on both sides are playing chicken here.

Big money on both sides are playing chicken here.

Posted on 1/27/21 at 10:10 am to O P Walker

I just checked the options because I was considering buying some puts and join the sort side because this is going to crash like a motherfricker, just got to get the timing right. The premiums are outrageous due to the beta. However there is zero volume. No one is selling options.

Posted on 1/27/21 at 10:11 am to GumboPot

No one wants to be left with their arse hanging out.

The stock is going to rise until one side breaks, at which point it will rapidly fall. Which is what happened in other major runs on stocks and commodities in US history.

The stock is going to rise until one side breaks, at which point it will rapidly fall. Which is what happened in other major runs on stocks and commodities in US history.

Posted on 1/27/21 at 10:12 am to teke184

quote:

Musk is pushing the buys in part as revenge for one of the hedge funds previously fricking with Tesla.

Big money on both sides are playing chicken here.

They are making the hedge funds algorithms either squeeze out (thereby losing money) or the hedge fund managers override their algorithms.

Posted on 1/27/21 at 10:12 am to O P Walker

Doesn't this just make it more lucrative to short now?

Posted on 1/27/21 at 10:14 am to O P Walker

quote:

Who else is tuned into gamestop?

You have to laugh, at this point.

Posted on 1/27/21 at 10:15 am to GumboPot

Win win IMHO.

If those funds all went bust, I would be fine with that. Let their investors come to take their pound of flesh out of those assholes.

If those funds all went bust, I would be fine with that. Let their investors come to take their pound of flesh out of those assholes.

Posted on 1/27/21 at 10:15 am to WildManGoose

quote:

Doesn't this just make it more lucrative to short now?

IDK if it's even possible now. There is probably no one that is going to loan you shares. It's going to crash right after enough shorts buy back the shares and take their losses.

Posted on 1/27/21 at 10:16 am to WildManGoose

quote:

Doesn't this just make it more lucrative to short now?

Who is going to make your market with this going on right now? The short price is going to be astronomical.

Posted on 1/27/21 at 10:17 am to GumboPot

The controls are better these days but in at least one of these prior runs, a lot of people thought they had bought stock from people who never owned it.

Which meant when the price spiked, the people who made those sales lost their shite metaphorically, and somewhat literally in some cases.

Which meant when the price spiked, the people who made those sales lost their shite metaphorically, and somewhat literally in some cases.

Posted on 1/27/21 at 10:20 am to Strannix

quote:

This is actual effective economic warfare

Until the new regulations on investing come. Which is bound to come out of this because it shows how easily stocks can be hijacked and manipulated.

Posted on 1/27/21 at 10:21 am to teke184

Coming from someone that is not tuned into stock trading I am curious on something here.

Is there a point where this type of "revenge war" of big money can become a criminal stock manipulation? If there are several traders working in sync to manipulate a stock price, up or down, wouldn't that be a major SEC violation? It seems similar to insider trading but by outsiders.

Is there a point where this type of "revenge war" of big money can become a criminal stock manipulation? If there are several traders working in sync to manipulate a stock price, up or down, wouldn't that be a major SEC violation? It seems similar to insider trading but by outsiders.

Posted on 1/27/21 at 10:33 am to fwtex

Good question.

I think that would apply is patently false information were put out for the purposes of manipulating the stock price.

Problem is that this was people identifying a potential target due to looking at publicly available numbers and determining that a run would heavily boost the stock because shorters were in such a poor position.

If you can make your decision based on what the SEC is putting out there for public consumption, it shouldn’t be considered manipulation.

I think that would apply is patently false information were put out for the purposes of manipulating the stock price.

Problem is that this was people identifying a potential target due to looking at publicly available numbers and determining that a run would heavily boost the stock because shorters were in such a poor position.

If you can make your decision based on what the SEC is putting out there for public consumption, it shouldn’t be considered manipulation.

Popular

Back to top

2

2