- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

SVB Listed As “Best Banks” Immediately Prior To Collapse….

Posted on 3/17/23 at 11:18 am

Posted on 3/17/23 at 11:18 am

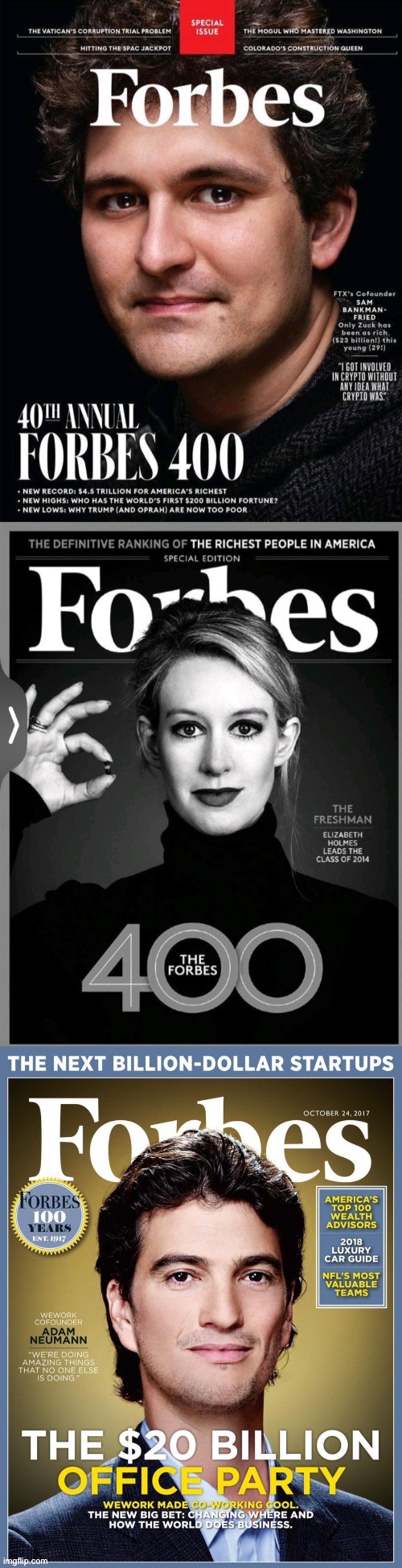

Silicon Valley Bank was named on Forbes' America's Best Banks list for 2023 days before collapse….

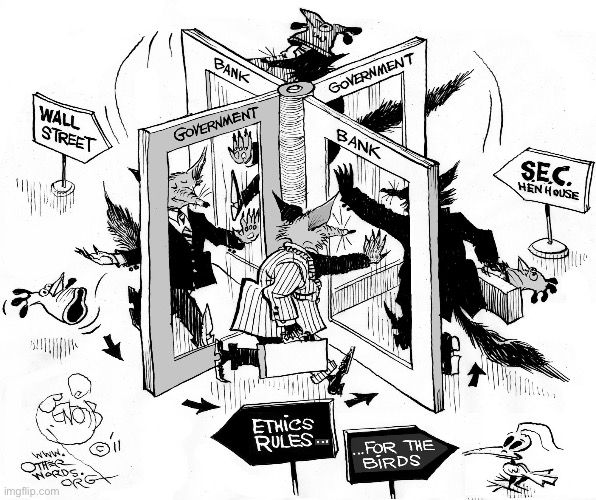

Our nation’s entire financial industry — one of the most heavily regulated sectors in the economy — is little more than a house of cards.

Our nation’s entire financial industry — one of the most heavily regulated sectors in the economy — is little more than a house of cards.

Posted on 3/17/23 at 11:22 am to Toomer Deplorable

They could have used that money they paid Forbes.

And BLM

And BLM

Posted on 3/17/23 at 11:45 am to Toomer Deplorable

Forbes will suffer nothing for not being worth a shite.

Posted on 3/17/23 at 12:24 pm to rhar61

quote:

Forbes will suffer nothing for not being worth a shite.

Posted on 3/17/23 at 12:26 pm to Toomer Deplorable

quote:Cramer in February ...

SVB Listed As “Best Banks” Immediately Prior To Collapse….

Posted on 3/17/23 at 12:28 pm to Toomer Deplorable

No one puts any stock in Forbes listings. That shite is basically pay for play. 30 under 30, 40 under 40, who’s who. All of that crap is bought. It’s a joke.

Posted on 3/17/23 at 12:37 pm to Toomer Deplorable

I thought depositors were supposed to do their own detailed risk analysis on bank assets, and they don’t deserve a bail out because they didn’t check into the risk…

Or… believe a Forbes Top ____ list.

Or… believe a Forbes Top ____ list.

Posted on 3/17/23 at 12:41 pm to NC_Tigah

quote:

Cramer

Buyer’s Remorse…

Posted on 3/17/23 at 12:49 pm to cwill

quote:

That shite is basically pay for play.

That is equally an apt description of the SEC.

Posted on 3/17/23 at 1:19 pm to Toomer Deplorable

You or ghost need to post the money printer gif to complete the poliboard financial post trifecta.

Posted on 3/17/23 at 2:23 pm to Toomer Deplorable

SVB probably feels pretty slighted. They played the game. They greased the right palms. They did all the right things.

The Fed is just that incompetent.

If people think it's over, they're sorely mistaken. Things are going to get worse before they get better. There will be a reckoning for the trillions printed in the last few years. It's just a matter of time before the whole system collapses. Will it be Saudi Arabia moving away from the petro-dollar? Will it be a world war? Will it be both and more? Who knows? I just know that the world is aligning against the US and our media is doing its best to hide that from you.

The Fed is just that incompetent.

If people think it's over, they're sorely mistaken. Things are going to get worse before they get better. There will be a reckoning for the trillions printed in the last few years. It's just a matter of time before the whole system collapses. Will it be Saudi Arabia moving away from the petro-dollar? Will it be a world war? Will it be both and more? Who knows? I just know that the world is aligning against the US and our media is doing its best to hide that from you.

Posted on 3/17/23 at 3:00 pm to Toomer Deplorable

Not sure if this has been mentioned but I heard that SBV thought they were in such a good spot they committed to not taking a bailout if this were to happen but to get private money to help out, but the Biden admin stepped in instead. With the BAILOUT quickness

Posted on 3/17/23 at 3:28 pm to cwill

quote:

You or ghost need to post the money printer gif to complete the poliboard financial post trifecta.

Posted on 3/17/23 at 3:32 pm to KAGTASTIC

quote:

KAGTASTIC

CEO of collapsed Silicon Valley Bank successfully lobbied Congress to avoid imposing extra scrutiny….

The president of Silicon Valley Bank appeared before in 2015 to argue that his bank should not be subject to scrutiny - insisting that 'enhanced prudential standards' should be lifted 'given the low risk profile of our activities'.

Greg Becker, president of SVB, on Friday watched as his bank collapsed and was placed under government control — becoming the second largest bank to fold after Washington Mutual in 2008.

Yet hours later it emerged Becker had convinced Congress to lessen the scrutiny of businesses like his. But anyone with deposits over a quarter of a million dollars with Silicon Valley Bank now faces losing all their money above the $250,000 protected by a federal law.

Becker had also sold $3.57m of stock in a pre-planned, automated sell-off two weeks before the bank collapsed — and the CFO ditched $575,000 the same day.

Becker sold 12,451 shares at an average price of $287.42 each on February 27.

The price plunged to just $39.49 in premarket on Friday before the Federal Deposit Insurance Corporation (FDIC) seized the bank's assets. It closed at $15.

Federal records obtained by The Lever showed that Becker had spent more than half a million dollars on federal lobbying in 2015-18.

The money was well spent: SVB obtained the light-touch regulation it wanted.

Becker told Congress about 'SVB's deep understanding of the markets it serves, our strong risk management practices.'

He argued that his bank would soon reach $50 billion in assets, which under the law would trigger 'enhanced prudential standards,' including more stringent regulations, stress tests, and capital requirements for his and other similarly sized banks.

The financier, who joined the company three decades ago as a loan officer, told Congress that $250 billion was a more appropriate threshold.

'Without such changes, SVB likely will need to divert significant resources from providing financing to job-creating companies in the innovation economy to complying with enhanced prudential standards and other requirements,' said Becker.

'Given the low risk profile of our activities and business model, such a result would stifle our ability to provide credit to our clients without any meaningful corresponding reduction in risk.'

The lobbying paid off in 2019.

The Federal Reserve proposed regulations implementing the deregulatory law - despite warnings from financial watchdogs that its regulations on Category IV institutions — as SVB was later classified due to its size and other risk factors — were far too weak…

Popular

Back to top

7

7