- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Coaching Changes

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Someone Please Explain How Jerome Powell Is Any Different Than Previous Fed Chairmen?

Posted on 10/8/18 at 10:57 am

Posted on 10/8/18 at 10:57 am

quote:

The death knell for the "last bastions of safety" in equities has finally arrived for analysts at Morgan Stanley. The violent move up in U.S. Treasury yields has put investors on the threshold of casting out growth stocks -- the last act of a rolling bear market Morgan Stanley sees playing out. According to the strategists, strength in the broader index has been masking bear market-like pain for different groups of shares. Growth companies, which consistently post high earnings multiples, are especially vulnerable to rate risk, according to strategists at the bank. If they’re right, it would mark the demise of the biggest winners of America’s bull market in equities that’s battered cheap value stocks.

LINK

quote:

Ron Paul believes the bond trading pits are giving investors a dire message about the state of the nation's economy.

According to the former Republican congressman from Texas, the recent jump in Treasury bond yields suggest the U.S. is barreling toward a potential recession and market meltdown at a faster and faster pace.

quote:

We're getting awfully close. I'd be surprised if you don't have everybody agreeing with what I'm saying next year some time," he said Thursday on CNBC's "Futures Now." His remarks came as the benchmark 10-Year Treasury yield, which moves inversely to its price, rallied to seven year highs, intensifying fears over rising inflation. It may be beneficial for personal savings accounts, but it could deliver irrevocable damage to those in adjustable mortgages, or for auto buyers looking to finance a new vehicle. "It can be pretty well validated by looking at monetary history that when you inflate the currency, distort interest rates and live beyond your means and spend too much, there has to be an adjustment," he said. "We have the biggest bubble in the history of mankind."

LINK

Powell is sending this country straight into a stock market crash for the sake of normalizing rates. He’s a Keynesian moron like his predecessors.

Posted on 10/8/18 at 11:01 am to Trump_Gump

quote:

He’s a Keynesian moron

Looks like you answered your question

Posted on 10/8/18 at 11:04 am to Pdubntrub

Trump really does himself no favors when he appoints people like this. Very short sighted of him. It may prove to be one of the biggest blunders of his presidency.

Posted on 10/8/18 at 11:05 am to Trump_Gump

This board has predicted 28 out of the last 3 market corrections.....

Posted on 10/8/18 at 11:07 am to Trump_Gump

quote:

Trump really does himself no favors when he appoints people like this.

Trump appears to be a Keynesian also.

Posted on 10/8/18 at 11:15 am to Trump_Gump

quote:Do you understand the rationale for normalizing rates?

Powell is sending this country straight into a stock market crash for the sake of normalizing rates.

Do you understand the danger of not normalizing them?

Do you understand the assumed US economic fragility if a fed funds rate of 2.25% actually might crash our stockmarkets?

Posted on 10/8/18 at 11:16 am to Trump_Gump

quote:

He’s a Keynesian moron like his predecessors.

You'll not find someone at that level of banking who isn't.

Posted on 10/8/18 at 11:20 am to Trump_Gump

How many years now has Ron Paul been making money predicting economic collapse that hasn't happened yet?

Posted on 10/8/18 at 11:21 am to NC_Tigah

quote:

Do you understand the rationale for normalizing rates?

Yes

quote:

Do you understand the danger of not normalizing them?

Yes

quote:

Do you understand the assumed US economic fragility if a fed funds rate of 2.25% actually might crash our stockmarkets?

Go look at the stock market right now

Posted on 10/8/18 at 11:30 am to Trump_Gump

quote:I've been looking at it all morning. The bond market is closed.

Go look at the stock market right now

You say you understand the danger of not normalizing rates?

That is simply is not evident.

Posted on 10/8/18 at 11:39 am to Trump_Gump

quote:

Trump_Gump

You again, and your bullshite, libertarian fantasies. When are you crackpots going to realize that you're nothing but a peon, anti-semitic, pothead driven shite show.

Posted on 10/8/18 at 11:45 am to Trump_Gump

You're complaining about his Keynesianism as he continues to hike rates?

Posted on 10/8/18 at 11:50 am to Trump_Gump

quote:

Powell is sending this country straight into a stock market crash for the sake of normalizing rates. He’s a Keynesian moron like his predecessors.

Holy frick you are dumb. It doesn't matter who's on the chair. The damage has been done over almost two decades. Blame Powell like the sheep you sound like you are. If raising rates .25 bps every quarter tanks the market, you never had a strong market in the first place.

Posted on 10/8/18 at 11:52 am to NC_Tigah

quote:

You say you understand the danger of not normalizing rates? That is simply is not evident.

Show me an instance where the US economy tanked because of low rates. I’ll wait.

Posted on 10/8/18 at 11:52 am to wutangfinancial

quote:

If raising rates .25 bps every quarter tanks the market, you should never raise rates in the first place.

Fixed your post

Posted on 10/8/18 at 11:54 am to Lou Pai

quote:

You're complaining about his Keynesianism as he continues to hike rates?

That’s a Keynesian policy Lou

Posted on 10/8/18 at 11:55 am to Trump_Gump

quote:Can you please explain his Keynesian philosophy and what philosophy you’re advocating for? It seems you would prefer Keynesian economic policies on steroids.

Show me an instance where the US economy tanked because of low rates. I’ll wait.

This post was edited on 10/8/18 at 11:58 am

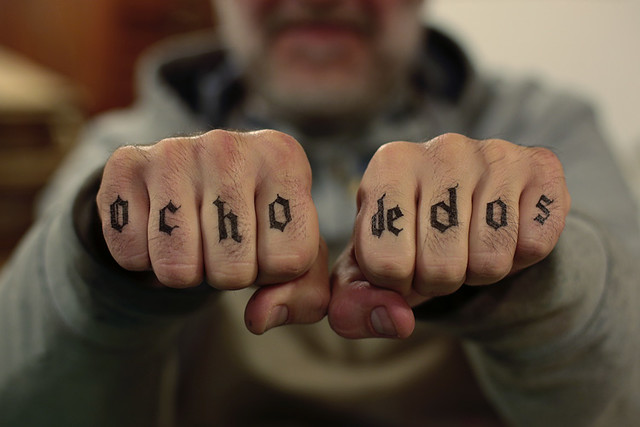

Posted on 10/8/18 at 11:56 am to OchoDedos

quote:

When are you crackpots going to realize that you're nothing but a peon, anti-semitic, pothead driven shite show.

Republicans hate identity politics until it’s conducive to their talking point.

I kinda lol’d at anti semitism. You’ve been listening to too much Ben Shapiro.

Posted on 10/8/18 at 11:58 am to Trump_Gump

quote:I ask if you understand the danger of not normalizing rates? You said you do. When you make that evident, I'll be happy to have an intelligent conversation with you.

Show me an instance where the US economy tanked

Back to top

10

10

/https%3A%2F%2Fblueprint-api-production.s3.amazonaws.com%2Fuploads%2Fcard%2Fimage%2F101822%2F0f3814ec7652433594beaa68f8be329d.png)