- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

Lets talk about the housing bubble

Posted on 3/1/18 at 11:06 am

Posted on 3/1/18 at 11:06 am

We're in a housing bubble that's been created for 20 years, and shite's going to get really bad before it gets better.

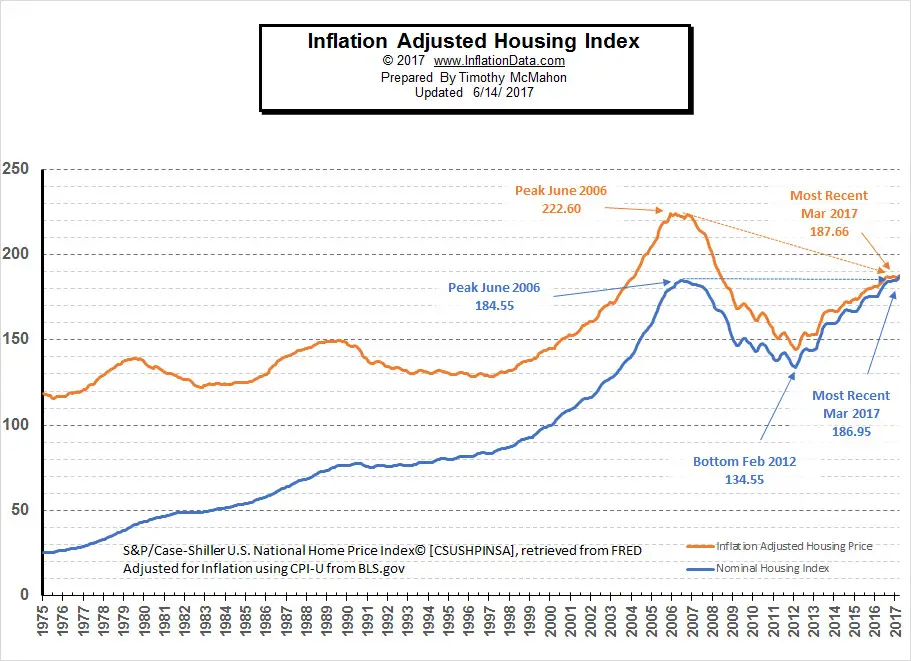

So first, housing prices adjusted for inflation (if you believe the stupidity that your home is an asset, I'm so sorry)

So, clearly, outside of 2008, home prices stay roughly constant when adjusted for inflation. This makes sense: cement, wood, brick, and glass cost the same now (adjusted for inflation) as they did in 1970.

So where's the bubble, cokebottle? Sure, 2017 is clearly at the top of one of these gentle cycles.

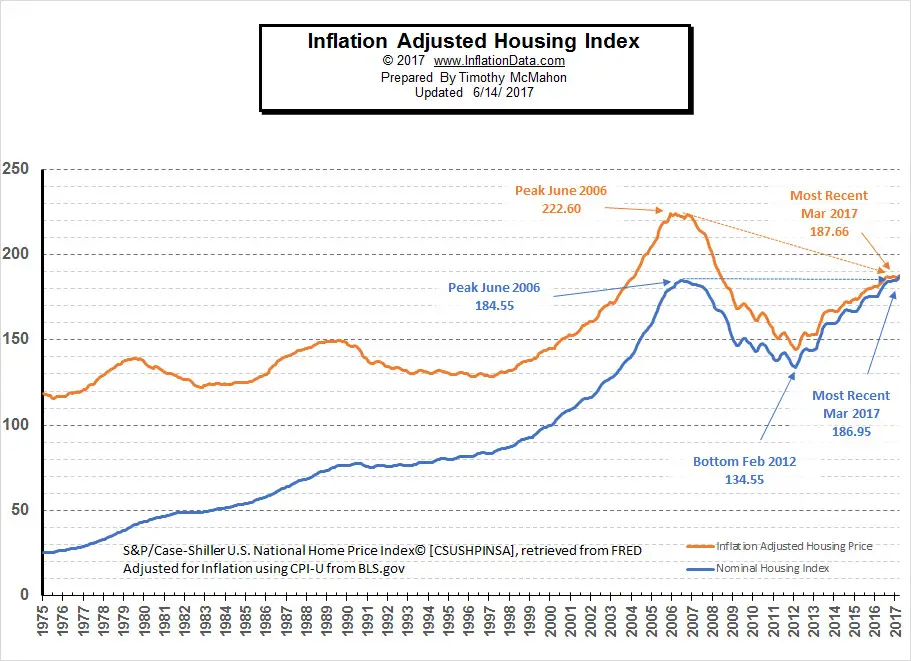

The bubble is two fold: one, the top of our current cycle is considerably higher than all previous ones. Two, the reason for this is the bottom basement interest rates of the last 20 years that has fed this over inflated housing bubble.

Let me show you. Behold, your historic interest rates:

Here's the bottom line on housing: People buy based on what monthly payment they can afford, not the sticker price. So naturally, a low interest rate makes sellers able to charge more for homes.

Let's say you bought a $500,000 home, with 20% down (so a loan of $400000). You got a 4% interest rate. Your monthly payment (assuming Houston level taxes) is $2,826.

You got a new job and you need to sell your home. Well, due to inflation (a natural cycle and partly caused by extremely low interest rates, sometimes) the fed has raised the national interest rate. Not even a lot. Just back up to the historical average, around 9%. Now, your potential buyers can't get a loan for less than that. That means, for you to find a buyer who can purchase your home for the exact amount you paid (not any appreciation) they will have a payment of $4,135 a month. For them to be able to make the same payment you did, they would have to offer you only $300,000 for the house, a $200,000 loss on your part.

Is this clear enough for everyone? The huge pool of homes that are being bought and sold for ever higher prices right now is going to devalue in a big way once interest rates become reasonable again.

So first, housing prices adjusted for inflation (if you believe the stupidity that your home is an asset, I'm so sorry)

quote:

The rich buy assets, the poor buy liabilities, and the middle class buys liabilities that they think are assets.

So, clearly, outside of 2008, home prices stay roughly constant when adjusted for inflation. This makes sense: cement, wood, brick, and glass cost the same now (adjusted for inflation) as they did in 1970.

So where's the bubble, cokebottle? Sure, 2017 is clearly at the top of one of these gentle cycles.

The bubble is two fold: one, the top of our current cycle is considerably higher than all previous ones. Two, the reason for this is the bottom basement interest rates of the last 20 years that has fed this over inflated housing bubble.

Let me show you. Behold, your historic interest rates:

Here's the bottom line on housing: People buy based on what monthly payment they can afford, not the sticker price. So naturally, a low interest rate makes sellers able to charge more for homes.

Let's say you bought a $500,000 home, with 20% down (so a loan of $400000). You got a 4% interest rate. Your monthly payment (assuming Houston level taxes) is $2,826.

You got a new job and you need to sell your home. Well, due to inflation (a natural cycle and partly caused by extremely low interest rates, sometimes) the fed has raised the national interest rate. Not even a lot. Just back up to the historical average, around 9%. Now, your potential buyers can't get a loan for less than that. That means, for you to find a buyer who can purchase your home for the exact amount you paid (not any appreciation) they will have a payment of $4,135 a month. For them to be able to make the same payment you did, they would have to offer you only $300,000 for the house, a $200,000 loss on your part.

Is this clear enough for everyone? The huge pool of homes that are being bought and sold for ever higher prices right now is going to devalue in a big way once interest rates become reasonable again.

Posted on 3/1/18 at 11:10 am to cokebottleag

Houses are also expensive to maintain over the long term. I agree that they aren't the long term investment people think they are unless you just happen to buy low in a really hot market.

Posted on 3/1/18 at 11:12 am to fallguy_1978

Posted on 3/1/18 at 11:13 am to fallguy_1978

Land is a much better investment, as far as being able to buy something that physically exists. It may take longer to realize gains, but only fools invest large sums of money for the short-term, unless they have some inside information.

Posted on 3/1/18 at 11:14 am to fallguy_1978

quote:

I agree that they aren't the long term investment people think they are unless you just happen to buy low in a really hot market.

This is true. They're still an "asset", though.

Posted on 3/1/18 at 11:14 am to HempHead

Land is the only thing god don't make more of.

Posted on 3/1/18 at 11:14 am to cokebottleag

quote:

Not even a lot. Just back up to the historical average, around 9%.

An overnight jump of 5% to interest rates isn't a lot?

This post was edited on 3/1/18 at 11:19 am

Posted on 3/1/18 at 11:15 am to cokebottleag

DFW market doesnt show any signs of cooling off anytime soon.

To buy anything relatively in this century and less than 350k requires the ghetto or close to 380.

To buy anything relatively in this century and less than 350k requires the ghetto or close to 380.

Posted on 3/1/18 at 11:15 am to Tiguar

quote:

Land is the only thing god don't make more of.

I mean, we could do speculations of Pacific Island volcanic growth, but I don't care enough about my 15x grandchildren to do that.

Posted on 3/1/18 at 11:15 am to cajunangelle

Exactly.

shite is only going to get worse once the interest rate gets back to the average.

quote:

Half the homes are overvalued The largest metropolitan areas are seeing the biggest gains. In the nation's top 50 markets, half of the housing stock is now considered overvalued, based on market fundamentals, like income and employment.

CoreLogic defines an overvalued housing market as one in which home prices are at least 10 percent higher than the long-term, sustainable level. Las Vegas led the November report as not only being overvalued, but showing a double-digit annual price gain of 11 percent.

quote:

Of the nation's 10 major markets with the biggest price gains, seven are overvalued. These include Washington, D.C., Houston and Miami. Boston and Chicago are still seeing price gains but are considered at value.

shite is only going to get worse once the interest rate gets back to the average.

Posted on 3/1/18 at 11:15 am to fallguy_1978

$1.5 Mil for an 80yr old 2 bedroom Sears cottage in LA....ridiculous

Posted on 3/1/18 at 11:16 am to 50_Tiger

quote:

DFW market doesnt show any signs of cooling off anytime soon.

That is precisely the mindset that can lead to over investment.

Posted on 3/1/18 at 11:17 am to cokebottleag

your making a giant assumption that interest rates will climb to 9%. after the crisis of 2008 the Feb cooked the books. They kept rates down to keep the housing market from a total failure. If the Fed lets rate's go above 6% it will start a massive housing problem. Our economy is humming and the current 30yr rate is 4.375% . We might see 4.5% or 4.75% by the end of the year but i doubt it. We have entered a brave new world in the housing market where market corrections are dangerous and the FED knows that. Our economy will determine the rate and i can't picture an economy were 9% housing rates are possible.

FYI i have been in the mortgage industry for the last 15yrs so i am not talking out my arse.

FYI i have been in the mortgage industry for the last 15yrs so i am not talking out my arse.

Posted on 3/1/18 at 11:17 am to HempHead

quote:

Land is a much better investment, as far as being able to buy something that physically exists. It may take longer to realize gains, but only fools invest large sums of money for the short-term, unless they have some inside information.

There have been several land booms and busts over the past 200 years too. No one's making more land, but it would be more accurate to say 'no one's making more land in places that want it.'

Of course, the assumption that land will always be a good investment is predicated (in my mind) on the assumption that population will always go up. Land in Detroit is certainly cheap.

Posted on 3/1/18 at 11:18 am to Tiguar

The taxes on land and or land and a home are ridic. In most cities towns the wanna be and yuppies have THE BEST school. Then housing prices soar because Mary and Jack learn algebra (joking but kids are learning two languages in daycares) in the first grade and about mother earth.

I think you only pay school taxes if you have kids in school. But that is asking too much.

I think you only pay school taxes if you have kids in school. But that is asking too much.

This post was edited on 3/1/18 at 11:19 am

Posted on 3/1/18 at 11:20 am to cokebottleag

quote:

Of course, the assumption that land will always be a good investment is predicated (in my mind) on the assumption that population will always go up. Land in Detroit is certainly cheap.

That's fair.

Still, the potential productive capacity for 'barren' land exceeds that of a house or commercial property (maybe not industiral), even in the event of a population decline.

Posted on 3/1/18 at 11:20 am to hawkeye007

quote:

your making a giant assumption that interest rates will climb to 9%. after the crisis of 2008 the Feb cooked the books. They kept rates down to keep the housing market from a total failure. If the Fed lets rate's go above 6% it will start a massive housing problem. Our economy is humming and the current 30yr rate is 4.375% . We might see 4.5% or 4.75% by the end of the year but i doubt it. We have entered a brave new world in the housing market where market corrections are dangerous and the FED knows that. Our economy will determine the rate and i can't picture an economy were 9% housing rates are possible.

FYI i have been in the mortgage industry for the last 15yrs so i am not talking out my arse.

I don't disagree, but I'm looking at interest rates and how the fed has used them before: to combat inflation. If the Fed determines that inflation is a real concern, they'll raise rates, and the housing market will be a casualty.

I'm not saying this is going to pop this year, or even next year. I'm saying that if inflation takes off (and who knows if that will be soon) that the housing market is going to get squished.

Posted on 3/1/18 at 11:21 am to HempHead

Probably why I'm not buying a house right now. Options are pretty shitty and way overpriced for what I'd be getting.

Posted on 3/1/18 at 11:23 am to cokebottleag

This is why I am going to be renting for the foreseeable future.

Popular

Back to top

24

24