- My Forums

- Tiger Rant

- LSU Recruiting

- SEC Rant

- Saints Talk

- Pelicans Talk

- More Sports Board

- Fantasy Sports

- Golf Board

- Soccer Board

- O-T Lounge

- Tech Board

- Home/Garden Board

- Outdoor Board

- Health/Fitness Board

- Movie/TV Board

- Book Board

- Music Board

- Political Talk

- Money Talk

- Fark Board

- Gaming Board

- Travel Board

- Food/Drink Board

- Ticket Exchange

- TD Help Board

Customize My Forums- View All Forums

- Show Left Links

- Topic Sort Options

- Trending Topics

- Recent Topics

- Active Topics

Started By

Message

re: Feds Collect Record Individual Income Taxes Through August; Still Run $898B Deficit

Posted on 9/14/18 at 11:49 am to Trump_Gump

Posted on 9/14/18 at 11:49 am to Trump_Gump

Disappointing. I know Trump didnt campaign on being a deficit hawk but I wish this was more of a priority for his administration considering how worthlessly inept the GOP congress is

Posted on 9/14/18 at 11:50 am to troyt37

quote:

Reagan had a country, and a military to rebuild. He did exactly that, while cutting taxes and winning the Cold War. None of that fixes the legislature's spending problem.

First the spending problem is on Congress (we agree there) but Reagan signed his name to it; he could have vetoed it and make Congress own it.

Posted on 9/14/18 at 12:00 pm to bamafan1001

quote:

I know Trump didnt campaign on being a deficit hawk

he did say he'd get rid of the entire $19 tril debt in eight years though

(update: it's just shy of $21.5 tril)

Posted on 9/14/18 at 12:21 pm to 90proofprofessional

quote:

huh? all they show on net so far is a deceleration, despite an ostensible economic acceleration. just like the totals. but this is enough to show that the tax cuts aren't increasing revenues, which is what articles and threads like the OP's are clearly intended to convey.

What percentage of total revenues is represented by withholding and corporate receipts?

This post was edited on 9/14/18 at 12:22 pm

Posted on 9/14/18 at 12:22 pm to Trump_Gump

quote:Clearly not enough.

collected a record $1,521,589,000,000 in individual income taxes through the first eleven months of fiscal 2018

Your pal,

—Democrats.

Posted on 9/14/18 at 12:23 pm to AggieHank86

quote:

It is silly for either “side” to be crowing at this point.

Truer words have never been spoken, but that won't stop anyone.

Posted on 9/14/18 at 12:33 pm to 90proofprofessional

quote:Youre a short term thinker.

huh? all they show on net so far is a deceleration, despite an ostensible economic acceleration. just like the totals. but this is enough to show that the tax cuts aren't increasing revenues

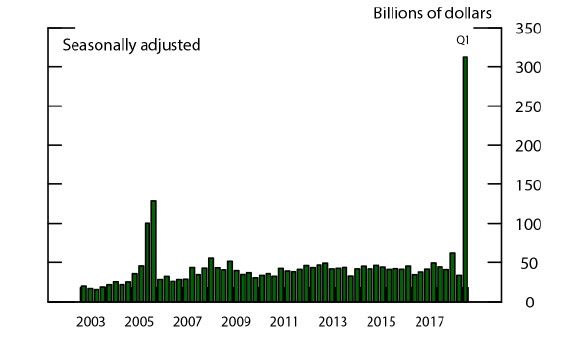

Almost $300 billion repatriated in the first quarter after the repatriation tax law change.

Almost $300 billion repatriated in the first quarter after the repatriation tax law change. Posted on 9/14/18 at 12:34 pm to Trump_Gump

quote:

The federal government collected a record $1,521,589,000,000 in individual income taxes

Color me skeptical, but I find it hard to believe they collected exactly $1,521,589,000,000.

I'd be okay with reporting "the federal government collected a record $1.52 trillion in individual income taxes. But reporting that many significant digits. C'mon, man!

Posted on 9/14/18 at 12:41 pm to BBONDS25

quote:

What percentage of total revenues is represented by withholding and corporate receipts?

looks like withholdings are about 70% of individual income this year (which is what the OP and article cite)

withholdings + corporate are something like 47% of overall

non-withholdings for that month of april are up huge though, like 25%.

biggest other chunk is payroll tax stuff, and they look to be up less than 1% over this time last year (compared to a 5% Y/Y jump at this time last year)

Posted on 9/14/18 at 12:44 pm to Taxing Authority

quote:

Youre a short term thinker.

i'm not the one acting like tax revenues have been increased by the tax cut

Posted on 9/14/18 at 12:47 pm to 90proofprofessional

quote:No, but you are judging the entire economy as a 1 DOF system.

i'm not the one acting like tax revenues have been increased by the tax cut

Posted on 9/14/18 at 12:51 pm to Taxing Authority

quote:

No, but you are judging the entire economy as a 1 DOF system.

no i'm not. i'm explaining why it looks like revenues to date haven't actually increased following the tax cut

This post was edited on 9/14/18 at 12:52 pm

Posted on 9/14/18 at 12:56 pm to 90proofprofessional

quote:...with a facile “analysis”. And doing a poor job of it at that.

i'm explaining why it looks like revenues to date haven't actually increased following the tax cut

Posted on 9/14/18 at 12:59 pm to Taxing Authority

quote:

...with a facile “analysis”. And doing a poor job of it at that.

feel free to offer a better one

so far both you and bonds have taken issue with my breakdown and not the one in the OP, which is easily more "facile". at least you offered a nugget with your unsourced repatriation chart. the thing is, corporate revenues are down like 40% as of August

This post was edited on 9/14/18 at 1:05 pm

Posted on 9/14/18 at 1:03 pm to 90proofprofessional

So when you show corporate and withholding, you are showing less than half of total revenue sources. Yet don’t like it when I say that is an incomplete analysis? Have I summed up the dance we do in every tax thread appropriately?

This post was edited on 9/14/18 at 1:06 pm

Posted on 9/14/18 at 1:06 pm to BBONDS25

quote:

So when you show corporate and withholding, you are showing less than half of total revenue sources. Yet don’t like it when I say that is an incomplete analysis?

bro i've told you before that payrolls are the biggest other chunk and they're flat

Posted on 9/14/18 at 1:08 pm to Nguyener

quote:

I fail to see how Trump signing a tax bill makes congress above criticism for a terrible budget and spending problem?

They think they're going to win the House, so they're trying to be consistent by blaming the spending issue on Trump now. It's a pre-made excuse for their overlords.

Posted on 9/14/18 at 1:09 pm to 90proofprofessional

quote:Payrolls are back to flat? In a day?

bro i've told you before that payrolls are the biggest other chunk and they're flat

Posted on 9/14/18 at 1:09 pm to NC_Tigah

quote:

Payrolls are back to flat? In a day?

excuse me. revenues of payroll taxes

Posted on 9/14/18 at 1:10 pm to imjustafatkid

quote:

They think they're going to win the House, so they're trying to be consistent by blaming the spending issue on Trump now. It's a pre-made excuse for their overlords.

This isn't hard to understand. If Trump isn't liable for spending, then he also can't be credited with the tax bill. All he did was sign both pieces of legislation. It's a consistency thing.

Popular

Back to top

2

2